What if the opportunity to join your dream hedge fund hinges on your ability to deliver a single standout investment pitch? The hedge fund interview process functions as a proving ground for the sharpest minds in finance. Are you ready to rise to the challenge?

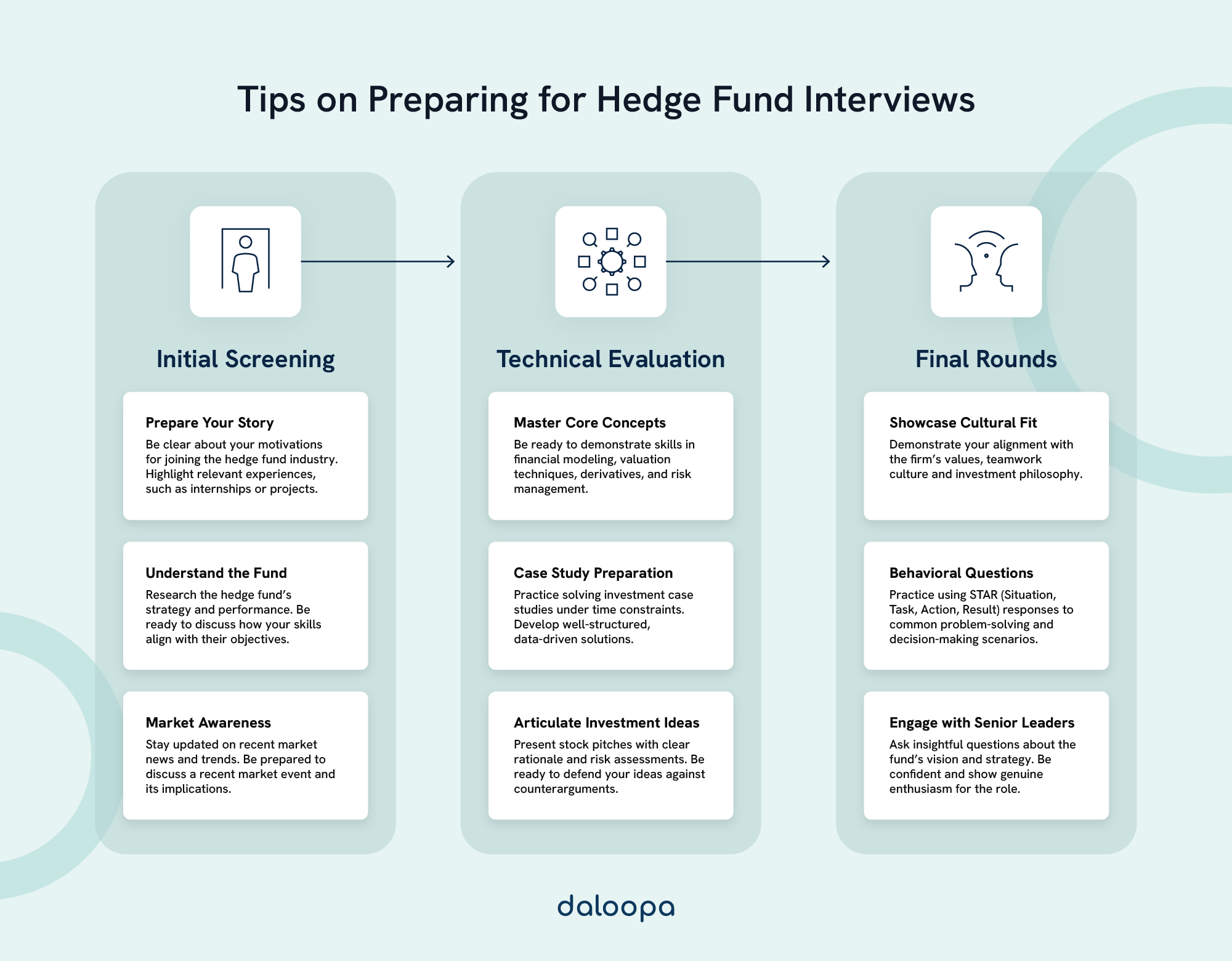

Breaking into the hedge fund industry demands rigorous preparation. Candidates must demonstrate their market insight, analytical prowess, and investment acumen across multiple demanding rounds. So, what is the hedge fund interview process: how should one prepare for hedge fund interviews & how many rounds are there in a hedge fund interview? Typically, hedge fund interviews involve 3-5 stages, including initial screenings, technical evaluations, case studies, and final interviews with senior decision-makers.

Success requires mastering financial modeling, staying ahead of market trends, and crafting persuasive investment pitches. Many aspirants dedicate months to honing their skills and building industry connections.

Key Takeaways

- Hedge fund interviews generally include 3-5 stages of escalating difficulty.

- Successful candidates display exceptional technical skills, strategic thinking, and market insights.

- Comprehensive preparation, from investment pitches to networking, is essential for standing out.

Typical Structure of Hedge Fund Interviews

Before we discuss the hedge fund interview process: how should one prepare for hedge fund interviews & how many rounds are there in a hedge fund interview, let’s take a look at the general structure. Hedge fund interviews are renowned for their intensity and rigor. Designed to simulate real-world challenges, these interviews push candidates to showcase their financial acumen, strategic thinking, and cultural fit.

Most hedge funds evaluate candidates based on three dimensions:

- Technical Proficiency – Mastery of financial modeling, valuation techniques, and portfolio management metrics.

- Strategic Thinking – Ability to identify market inefficiencies and capitalize on emerging trends.

- Interpersonal Skills – Clarity, confidence, and the ability to defend complex ideas under scrutiny.

Increasingly, firms prioritize cultural fit, seeking professionals who align with their values and work style. Each interview round is carefully crafted to assess specific attributes, ensuring only the best candidates make it through. In the next section, we’ll share key hedge fund job interview tips to help you prepare and feel confident throughout the process.

How to Prepare for Hedge Fund Interviews

Preparation can be the deciding factor in landing a hedge fund role. To stand out, follow a systematic approach, and understand the essential steps on how to prepare for hedge fund interviews.

- Research the Firm

Understand the hedge fund’s strategy, recent investments, and leadership. Familiarity with the firm’s philosophy enables tailored, thoughtful responses during interviews. - Master Financial Fundamentals

- Valuation Techniques: Study discounted cash flow (DCF) models, comparable company analysis, and sector-specific metrics.

- Financial Statement Analysis: Focus on understanding balance sheets, income statements, and cash flow reports.

- Derivatives Pricing: Be prepared to explain concepts like Black-Scholes or merger arbitrage.

- Develop Investment Ideas

Prepare 2-3 robust stock pitches, including a thesis, valuation rationale, key catalysts, and risk mitigants. A successful pitch demonstrates originality and in-depth analysis. - Mock Interviews and Case Studies

Practice with mentors or industry peers to refine your technical and behavioral responses. Case studies help simulate real-world scenarios, honing your decision-making skills. - Build a Professional Network

Leverage alumni connections, LinkedIn, and industry events to gather insights and referrals. For example, one candidate secured their dream role by leveraging their network to schedule mock interviews with hedge fund alumni.

Use these insights on how to prepare for hedge fund interviews to approach the process with confidence and maximize your chances of success.

Mastering Technical Skills

Candidates must analyze financial statements, assess balance sheets, and interpret cash flow dynamics effectively. A strong grasp of financial modeling showcases your ability to build models that forecast company performance or evaluate investment opportunities.

Key areas to focus on:

- Valuation Mastery: Be adept at DCF, precedent transactions, and comparable company analyses.

- Portfolio Metrics: Understand the Sharpe ratio and risk-adjusted performance benchmarks.

- Leverage and Derivatives: Demonstrate a grasp of tools used in hedge fund strategies, such as options pricing and fixed-income derivatives.

To prepare, engage in regular practice sessions, use relevant textbooks and online resources, and stay informed through financial news and analysis. Participating in online courses or certifications, such as the CFA program, can also enhance your technical knowledge and credibility in the eyes of potential employers.

Developing Strategic Thinking

Candidates must interpret global economic events, identify market inefficiencies, and formulate actionable investment strategies. Hedge funds value individuals who can take a macro view while zooming in on micro-level details that drive market opportunities.

Practice creating investment theses by analyzing industries, market trends, and potential stock price catalysts using a holistic view of both short- and long-term implications. Consider factors like competitive positioning, regulatory developments, and technological advancements that could affect the asset’s performance.

Case studies and simulations provide hands-on experience and test the ability to make decisions under pressure. Many hedge funds use these exercises during interviews to assess how candidates approach problem-solving and adapt to rapidly changing scenarios.

Following thought leaders, reading analyst reports, and engaging with market data can also sharpen strategic insights. For example, keeping up with commentaries from influential investors or economists can provide a broader perspective on market dynamics, helping you think critically about investment opportunities.

To apply these skills in practical settings, engage in activities like investment clubs or competitions. These platforms simulate real-world scenarios, offering a safe space to experiment with different strategies and refine your approach. Focus on areas like:

- Identifying risk-reward opportunities.

- Analyzing macroeconomic influences.

- Evaluating sector-specific trends.

- Anticipating potential catalysts.

Interviewers look for candidates who can connect the dots between data points and present a coherent narrative about their investment decisions.

Crafting Standout Investment Pitches

Investment pitches are a defining aspect of hedge fund interviews. To excel, choose an idea where you have deep knowledge and conviction, even if it’s unconventional. Unique ideas demonstrate originality, while depth showcases expertise.

Structure your pitch to include:

- A clear thesis statement.

- An overview of the asset or company.

- Key catalysts driving the investment.

- Valuation rationale to justify your thesis.

- Risks and mitigants to address potential counterarguments.

Keep it concise but compelling—whether for a brief verbal presentation or a one-page summary. Use unique insights and data-driven arguments. Be ready for follow-up questions that probe the depth of your analysis. For instance, if pitching a tech stock, highlight specific metrics like user growth, retention rates, or competitive advantages that support your recommendation.

Confidence, passion, and clarity can set your pitch apart. A well-delivered investment idea showcases your analytical skills and reflects your understanding of market dynamics and your ability to communicate effectively.

Building a Strong Network

Networking is a vital component of breaking into hedge funds. Utilize alumni networks, professional organizations, and industry events to make connections. The finance world is small, and building relationships can lead to valuable referrals and insights.

Optimize LinkedIn profiles to highlight relevant skills and experience and engage with professionals for informational interviews. Attend conferences and seminars, prepared with thoughtful questions to build rapport with industry leaders. Remember, the goal isn’t just to expand your network but to foster meaningful connections.

Tips for effective networking:

- Approach interactions with authenticity and respect.

- Follow up with personalized messages.

- Add value by sharing relevant insights or information.

Join groups like the CFA Institute to access exclusive resources and events. Informational interviews with professionals at target firms can also yield valuable advice and opportunities. These conversations often provide insights into what specific hedge funds look for in candidates and how to tailor your application accordingly.

Building meaningful relationships requires time and persistence, but the rewards—insights, mentorship, and referrals—are invaluable.

How Many Rounds Are There in a Hedge Fund Interview?

Hedge fund interviews involve several rounds, each designed to assess distinct aspects of a candidate’s qualifications and suitability for the role.

Initial Screening Rounds

The process begins with one or two screenings, often via phone or video, focusing on basic market knowledge, professional motivations, and fit. Candidates may also complete take-home assignments or online assessments to demonstrate financial and analytical skills.

Technical and Case Study Rounds

The core of the process involves two or three technical interviews or case studies led by senior analysts or portfolio managers, testing valuation methods, financial modeling expertise, and investment strategies.

Final Interview Rounds

Final rounds involve one or two meetings with senior leadership, evaluating cultural fit and decision-making under pressure. These interviews often include behavioral questions and group discussions. Highlighting unique skills and understanding the firm’s investment approach help candidates leave a lasting impression. To succeed in these rounds, make sure to apply the hedge fund job interview tips we’ve shared previously, which emphasize showcasing not only your technical expertise but also your adaptability and strong interpersonal skills.

Landing a Spot in a Hedge Fund

Now that we’ve explored the hedge fund interview process: how should one prepare for hedge fund interviews & how many rounds are there in a hedge fund interview, let’s finish by pointing out the key factors for success.

Achieving a hedge fund role requires a mix of technical expertise, strategic insight, and persistence. Candidates with robust academic backgrounds in finance or economics, strong networks, and a passion for investment strategies tend to excel.

Demonstrating technical proficiency through financial modeling or programming languages like Python is a significant advantage. Internships or relevant experience in investment banking or portfolio management can further boost a candidate’s prospects.

Consider leveraging hedge fund job interview tips to improve your preparation and approach. Practice, refine, and confidently present ideas to showcase analytical rigor and market awareness.

Persistence and preparation remain key. Candidates should approach each interview as an opportunity to grow while emphasizing genuine interest in the firm’s strategy and potential contribution to its success.

Maximize Your Efficiency with Daloopa

Daloopa offers cutting-edge financial modeling and data analysis tools, enabling you to work smarter, not harder. With Daloopa’s AI-powered platform, you can access error-free financial data and automate repetitive modeling tasks, freeing up time to focus on refining your investment theses and preparing for the tough questions.

Daloopa’s tools are designed to:

- Enhance Accuracy: Reduce errors in financial models with AI-driven data extraction.

- Save Time: Automate the manual process of updating models so you can focus on strategic insights.

- Provide Depth: Access clean and detailed financial data to confidently support your investment pitches.

Whether preparing a complex DCF model or analyzing sector-specific trends, Daloopa ensures you stay ahead of the competition.

Request a demo to see how its platform can give you a competitive edge in your hedge fund interview preparation. Pair your passion with the right tools, and take the first step toward securing your dream role!