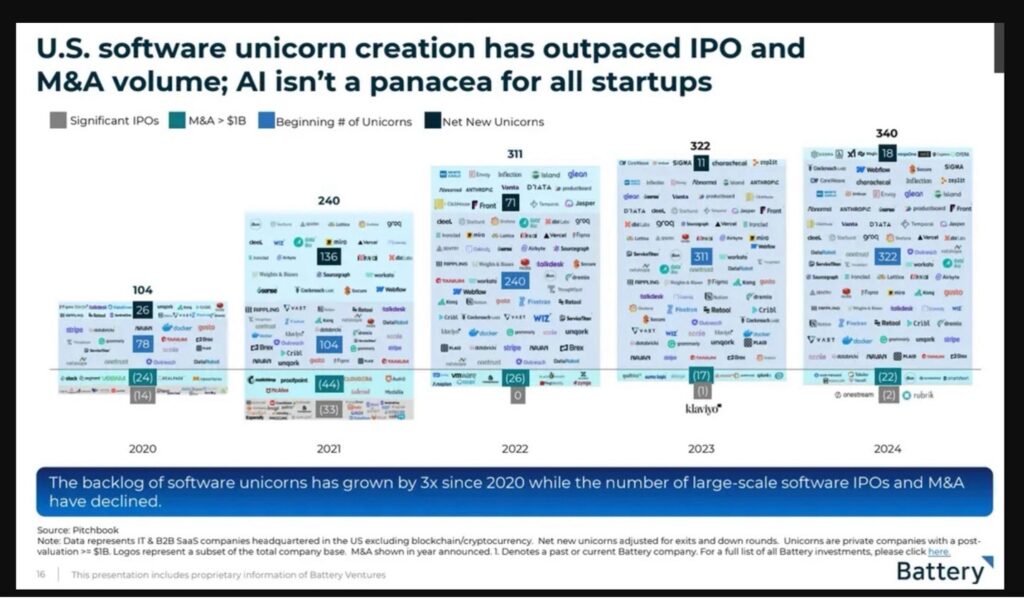

Service Titan (TTAN) raised the price range for its IPO from $52-57 to $65-67, presumably due to a strong reception from investors on the roadshow. The company will sport a market cap north of $6 billion and increase the number of software IPOs this year to only 3, following Rubrik and One Stream. Given a compounding IPO ratchet provision from their Series H in November 2022 that kicked in as of May this year at a rate of 11% annually (compounding quarterly), they could not wait any longer or risk further dilution.

All eyes will be on the performance of Service Titan to see if the spigot will open, albeit modestly, for the plethora of U.S. software unicorns.

The Good

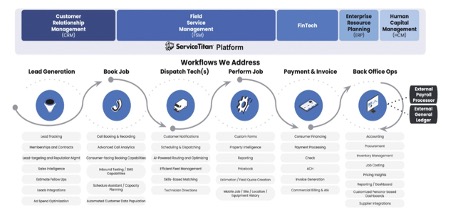

Service Titan provides a comprehensive software platform for the “trades,” including field service people such as plumbers, roofers, landscapers, HVAC technicians, etc. The platform includes CRM, FSM, ERP, and HCM, along with payments (FinTech). So, instead of a user cobbling together Quickbooks for ERP, GetJobber or HouseCall Pro for FSM, PipeDrive for CRM, and Paycor for HCM, you get one integrated platform.

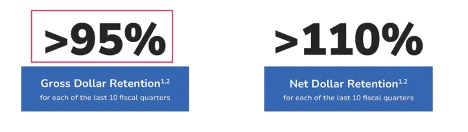

The retention numbers over the last 2-3 years show evidence of the platform’s value and stickiness. Gross Dollar Retention over 95% in each of the last 10 quarters, especially for a company with many smaller customers is exceptional. Net dollar retention over 110% shows a solid strategy of seeding their customers with the Core product, upselling to the Pro version, and/or adding payments (FinTech).

RPO growth while only disclosed on a fiscal year basis, increased 67% year over year greatly outpacing corresponding revenue growth of 31% over that same period, indicating increased customer willingness to commit to multi-year contracts.

Their customer base spans small family-owned contractors with a few employees to large franchises with national footprints of over 500 locations and over $1 billion in annual Gross Transaction Value (GTV). Their GTV has grown impressively, albeit slower than revenue, to $62 billion, trailing twelve months through the July quarter end. They monetize GTV through revenue-sharing agreements with payment processing and end-customer financing partners, netting out at 25 bps of GTV. The payments portion is in their usage revenue segment, accounting for roughly 25% of total revenue with the majority derived from their subscription line (70%/revenue).

The Concerning

While Professional Services accounts for 5% of revenue, it operates at a significant loss with non-GAAP Gross Margins of -87% over the last six months. Professional Services is comprised of customer onboarding and implementation suggesting either pricing is too low and/or implementations are too challenging, possibly due to the customers’ lack of IT expertise and bandwidth. As a result, overall Gross Margins improved to 68-71% in the last 5 quarters from the low to mid 60’s the prior year, it serves as an albatross.

Service Titan’s growth has slowed from the mid-high 30% range to the mid-twenty range. Coupled with a very modest low single-digit FCF margin (2% in FQ1 and 7% in FQ2), the company falls short of the ideal rule 40.

View our Analyst deep dive below:

To download the Service Titan datasheet Set up a Free Account Today