Preparing for a hedge fund analyst interview can feel overwhelming, but it’s also an opportunity to showcase your potential. The questions you ask during the interview can set you apart and highlight your readiness to contribute meaningfully.

Insightful questions reflect your understanding of the hedge fund’s operations, investment strategies, and broader market dynamics. They also show genuine interest in the fund’s goals and challenges. By framing your inquiries carefully, you engage the hedge fund manager in thoughtful dialogue, showcasing your value as a candidate.

Remember, the interview works both ways. While the manager assesses your fit, you determine if the fund aligns with your career ambitions. In this guide, we share hedge fund analyst interview tips to help you prepare the best questions to ask hedge fund managers during your analyst interview. These questions provide a window into the fund’s culture, team dynamics, and future direction, empowering you to make an informed decision about the opportunity.

Key Takeaways

- Asking meaningful questions demonstrates your industry acumen and analytical mindset.

- Thoughtful inquiries engage managers in productive conversations, reflecting your value.

- The right questions help evaluate the fund’s culture and potential alignment with your goals.

Preparing for the Interview

You can achieve success in hedge fund analyst interviews through preparation.

Researching the Hedge Fund

- Delve into the hedge fund’s background, investment strategy, and performance history.

- Review their website, SEC filings, and industry analysis to understand their assets under management, organizational structure, and leadership.

- Explore their recent trades and investment positions through financial databases or news outlets.

- Analyze their performance metrics—returns, volatility, and other risk-adjusted indicators. Study their financial health and operational strategy by examining public statements and reports.

- Pay attention to how their investment philosophy aligns with the current economic landscape.

- Craft questions around their decision-making process, risk management frameworks, and future direction.

- Prepare to discuss your own investment ideas that resonate with the fund’s strategy.

Additionally, consider researching the backgrounds of the interviewers. Understanding their experience and prior roles can help you craft insightful and personalized questions. Creating a concise summary of your research to reference during the interview builds confidence and facilitates meaningful conversations with hedge fund managers.

Example Question:

“How does your team adjust strategies in response to macroeconomic shifts, such as changes in monetary policy?”

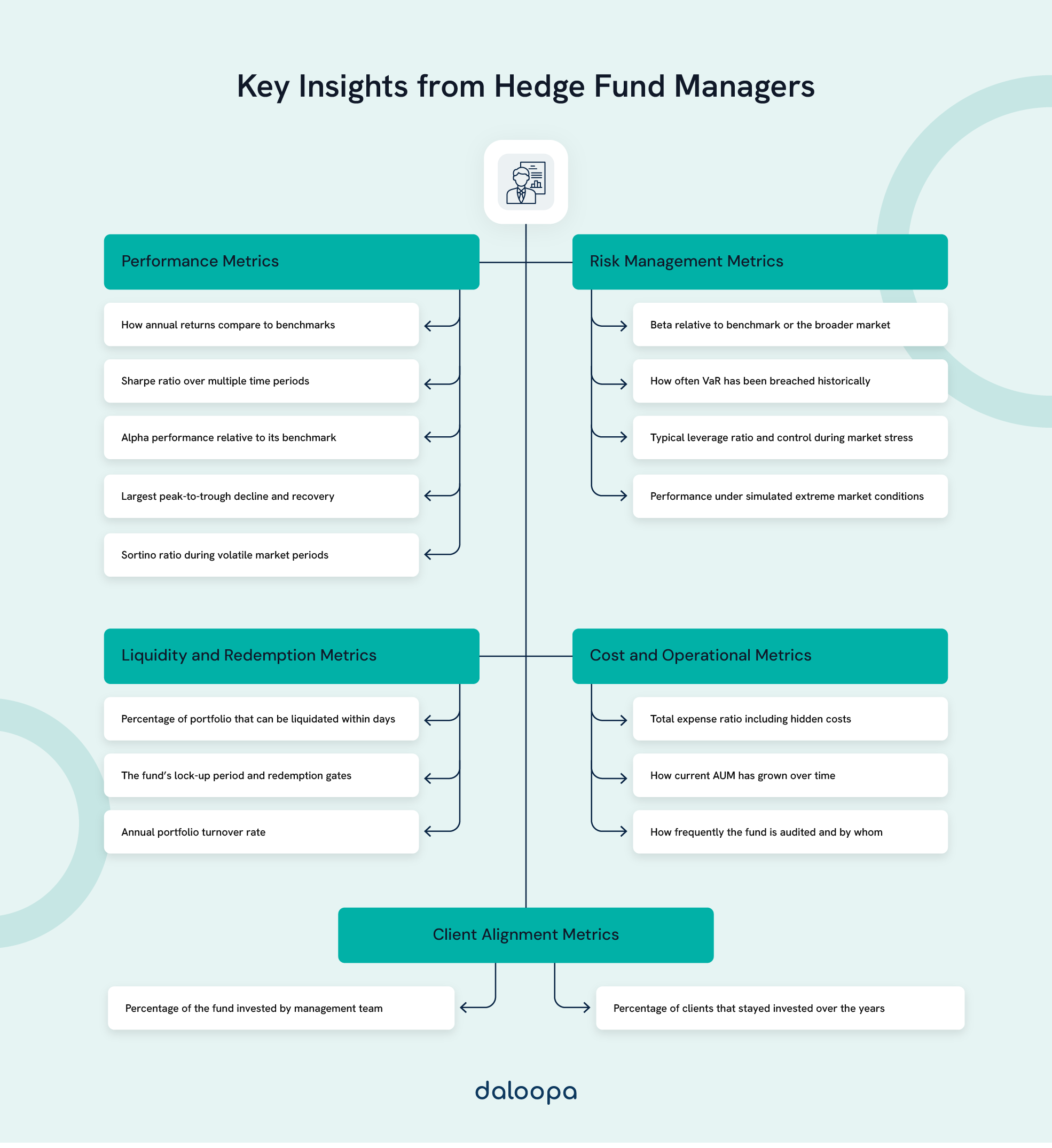

Key Questions to Ask Hedge Fund Managers

Thoughtful questions demonstrate your initiative and help you assess whether the firm aligns with your long-term aspirations. Here are questions to ask hedge fund managers during your analyst interview that can showcase your strategic thinking and help you determine if the firm’s values align with your career goals.

1. Investment Strategy and Philosophy

Understanding the fund’s investment strategy is essential to evaluating your potential fit. Ask questions that clarify their approach to portfolio management and decision-making.

Examples:

- “Can you walk me through your investment philosophy and how it informs your strategies?”

- “What distinguishes your approach to balancing risk and return in portfolio construction?”

- “How do you integrate emerging trends, like AI or ESG investing, into your strategies?”

Explore their adaptability to changing market conditions. For example, ask how they incorporate alternative investments or manage long and short positions.

Consider diving deeper into their sector expertise. Are there particular industries or markets they specialize in? If so, understanding how they leverage that expertise can provide valuable insight into their approach and help you determine if it aligns with your own interests.

2. Performance and Track Record

Performance questions reveal insights into the fund’s success, resilience, and strategic decision-making. Research their historical returns and risk management practices.

Examples:

- “How has the fund performed during major market downturns, such as the COVID-19 pandemic?”

- “What lessons have you drawn from your most challenging investment decisions?”

- “How do you communicate performance metrics to stakeholders effectively?”

Additionally, inquire about their approach to stress testing and navigating volatility to understand how the fund thrives during uncertain times. Asking about specific examples of how they responded to financial crises or market downturns can further enrich the discussion.

Example Follow-up:

“What scenarios do you use for stress testing, and how have these shaped your portfolio strategies during volatile markets?”

3. Team Dynamics and Culture

Understanding the team’s structure and culture aids in assessing your compatibility with the firm.

Examples:

- “How do junior analysts contribute to the decision-making process?”

- “What opportunities exist for mentorship and professional development?”

- “Can you describe the fund’s approach to fostering innovation and inclusivity?”

Probe into their mentorship practices and how they cultivate collaboration within the team. A supportive culture often enhances professional growth. You could also ask how team dynamics have evolved as the fund has grown and whether they prioritize fostering innovation and inclusivity in their decision-making processes.

4. Technical and Quantitative Skills

Explore the technical expertise required to succeed at the fund. These questions can uncover expectations and help you highlight relevant skills.

Examples:

- “Which financial modeling techniques are most commonly used at your fund?”

- “What programming tools, such as Python or R, are essential for analysts here?”

- “How do you integrate data analytics into your investment process?”

Understanding their quantitative and fundamental analysis approach, including specific tools like discounted cash flow models or proprietary systems, helps clarify their technical requirements. You might also explore how analysts are encouraged to improve and expand their technical skill sets through training programs or internal workshops.

5. Future Outlook and Challenges

Discussing the fund’s future goals and potential challenges demonstrates your forward-thinking approach.

Examples:

- “How are you positioning the fund to adapt to emerging market trends?”

- “What impact do you foresee from evolving regulations in the hedge fund industry?”

- “How do you plan to integrate advancements in AI or blockchain into your strategies?”

These inquiries show you’re not just focused on the present but also thinking critically about the industry’s trajectory and opportunities. Additionally, asking how they integrate new technologies or innovations into their strategies can provide a clearer picture of how they remain competitive in a fast-changing financial landscape.

Making a Lasting Impression

To stand out, show strategic thinking, adaptability, and a genuine passion for investing.

Actionable Hedge Fund Analyst Interview Tips:

- Present a well-researched investment idea tailored to the fund’s philosophy. For example, suggest how a green energy strategy could capitalize on recent policy changes.

- Frame your resilience with anecdotes, such as tackling a challenging financial model or pivoting strategies during market volatility.

- Engage interviewers with specific, insightful questions that reflect thorough research.

Finally, let your enthusiasm for investing shine through. Discuss your interest in particular market trends or align your career goals with the fund’s strategy.

Example:

“I’m particularly drawn to how your team integrates ESG factors into decision-making, as I’ve researched how these align with long-term alpha generation.”

Preparing the right questions to ask hedge fund managers during your analyst interview is a powerful way to demonstrate your expertise and curiosity. Thoughtful inquiries not only showcase your understanding of the industry but also provide insights into the firm’s values and strategies.

With these hedge fund analyst interview tips, you can craft impactful questions that showcase your preparation and align with the firm’s goals. Preparing for a hedge fund analyst interview equips you to stand out, make a lasting impression, and take a confident step toward a rewarding career in finance.

Further Your Knowledge with Daloopa

If you’re ready to take your investment research to the next level, consider exploring Daloopa’s AI-powered solutions. With capabilities like real-time data updates, verifiable sourcing, and seamless integration into your workflows, Daloopa helps you stay ahead in the fast-paced world of finance.

Book a quick demo to see how Daloopa can eliminate manual work and enhance your modeling accuracy—or start with a free trial and experience the benefits firsthand. Your next breakthrough in hedge fund analysis might just begin here.