Financial markets data is essential for informed decision-making in investments.

According to Michael Boyles from Harvard Business School Online, accurate financial forecasting, or predicting a company’s financial future by examining historical performance data such as revenue, cash flow, expenses, or sales, helps traders decide whether to buy, sell, or stay away. For example, an investment banking analyst requires accurate historical data and supplementary data to build a 3-statement model forecast. Likewise, for a currency trader looking for real-time quotes, access to up-to-date and accurate financial data is essential.

Financial markets data providers give investors the information they need to navigate complex markets, including real-time prices, historical data, and analytics. These providers also offer insights into market trends, trading volumes, and economic indicators, empowering investors to make more informed, data-driven decisions. By integrating advanced tools like AI-powered analytics and alternative data, they help investors uncover hidden opportunities and manage risks more effectively.

Key Takeaways

- Financial data providers are critical for investment decision-making.

- Providers offer diverse types of data such as real-time prices and analytics.

- Innovations enhance the quality and accessibility of financial data.

Major Financial Data Providers

In this section, we will explore some of the leading financial data providers, including their roles and contributions to the financial markets. Each provider has unique strengths and offerings that cater to diverse market needs.

Daloopa

Daloopa is at the forefront of AI-powered financial data services, offering an advanced platform that streamlines fundamental and historical data workflows for financial analysts. With Daloopa, you gain faster access to the latest and most comprehensive datasets available. A key advantage of Daloopa’s service is its ability to automatically extract financial markets data from company releases in real-time, eliminating the need to track down documents during critical earnings periods manually.

Slashdot discusses how Daloopa simplifies data management by extracting and organizing information from millions of financial reports, allowing users to quickly update data sheets with one click. During earnings season, Daloopa’s KPI Builder provides a comprehensive industry overview with automatic quarterly updates. With access to the most extensive historical data, analysts can stay competitive and make informed decisions in an increasingly efficient market.

A leading US-based mutual fund managing over $1.5 trillion in assets, significantly improved its research and decision-making processes by implementing Daloopa’s AI-powered data infrastructure. Using Daloopa, the mutual fund cut analysts’ model-building time by 50%, saving 1-2 days per analyst during earnings season, allowing analysts to spend more time on in-depth analysis and uncovering new investment opportunities. Daloopa’s seamless integration of accurate, up-to-date data reduced errors in financial models and provided faster access to comprehensive datasets, ensuring more precise and timely investment decisions. The long-term partnership with Daloopa continues to enhance the firm’s ability to stay competitive and deliver superior client outcomes.

Bloomberg

Bloomberg offers the Bloomberg Terminal, a powerful tool providing real-time data, analytics, and trading capabilities. Its extensive coverage includes equities, commodities, fixed income, and derivatives. Leland discusses how investment bankers can use the terminal’s many tools and features to manage their portfolios, monitor their investments, and make adjustments as needed to maximize returns for their clients.

The Terminal allows investment bankers to create customized watchlists, set up alerts for price changes or news events, and analyze the performance of different securities and asset classes. Bloomberg’s proprietary analytics cater to professionals in various sectors, from investment banking to asset management. In early 2022, Baader Bank improved its trade execution speed and performance by using Bloomberg’s Transaction Cost Analysis (BTCA) and Rule Builder (RBLD) tools. These solutions enhanced the bank’s trading pace, leading to a 16% performance increase against its arrival price benchmark and strengthening client relationships.

Thomson Reuters

Thomson Reuters, now under the Refinitiv brand, remains a major player in financial data provision. It offers Eikon, a platform similar to the Bloomberg Terminal, providing financial data across asset classes. Eikon’s strengths lie in its customization options and powerful search capabilities. It integrates real-time and historical data, giving users the ability to track market trends and perform in-depth research.

The platform excels in combining news, analytics, and trading functionalities. With a strong presence in global markets, Thomson Reuters supports informed decision-making with its reliable and comprehensive data solutions. Markets Media explains how Eikon integrates with iQbonds from valantic Trading Solutions to enhance fixed-income traders’ efficiency and liquidity access. This integration allows traders to seamlessly manage bond trading and pricing while leveraging Eikon’s analytical tools, enabling faster and more informed decision-making across electronic markets.

S&P Global

S&P Global is a leading provider of financial information and analytics. It is known for its credit ratings, indices, and market data services. The S&P 500, one of the most widely followed equity indices, is a flagship product that highlights its prominence.

Their services offer critical insights into market trends, risk assessment, and economic performance. Its emphasis on quality and accuracy positions S&P as a trustworthy source in the financial industry, widely respected by investors and analysts.

Types of Financial Market Data

Financial market data can be categorized into several types, each serving specific needs and purposes for participants in the financial markets. Key types include real-time data, historical data, and alternative data, which are vital for making informed trading and investment decisions.

Real-Time Data

Real-time data is essential for active traders and market participants who require up-to-the-minute information on the prices of financial instruments like stocks, bonds, and commodities. This type of data provides instantaneous updates on trades as they occur, enabling us to react swiftly to market movements. Examples include live quotes, bid-ask spreads, and real-time news feeds. Analysts often rely on real-time data to make short-term trading decisions and to manage risks effectively. Providers of this data include stock exchanges and specialized financial data firms. The accuracy and speed of real-time data are crucial, as delayed information can lead to losses.

Historical Data

Historical data comprises past market information and includes historical prices, volumes, and volatility of securities, helping us to develop and test trading strategies. You can access this data over various time frames, from minutes to decades, making it versatile for different types of analysis. Historical data supports the backtesting of trading models and helps construct financial reports. Major data providers aggregate and disseminate this information, ensuring consistency and accuracy. Analysts and long-term investors extensively use historical data to forecast future market movements and make informed investment decisions.

Alternative Data

Alternative data refers to non-traditional data sources that can provide unique insights into market trends and company performance. This includes data like social media sentiment, satellite imagery, and foot traffic analysis. These data points can be merged with traditional financial market data to create a more comprehensive understanding of factors driving market behavior. For instance, tracking social media sentiment can help gauge public opinion and predict stock price movements. Alternative data is becoming increasingly popular as investors seek new ways to gain an edge over competitors. Specialized firms often collect and analyze this data, providing valuable information that complements traditional data sources.

Innovations in Financial Data Provisioning

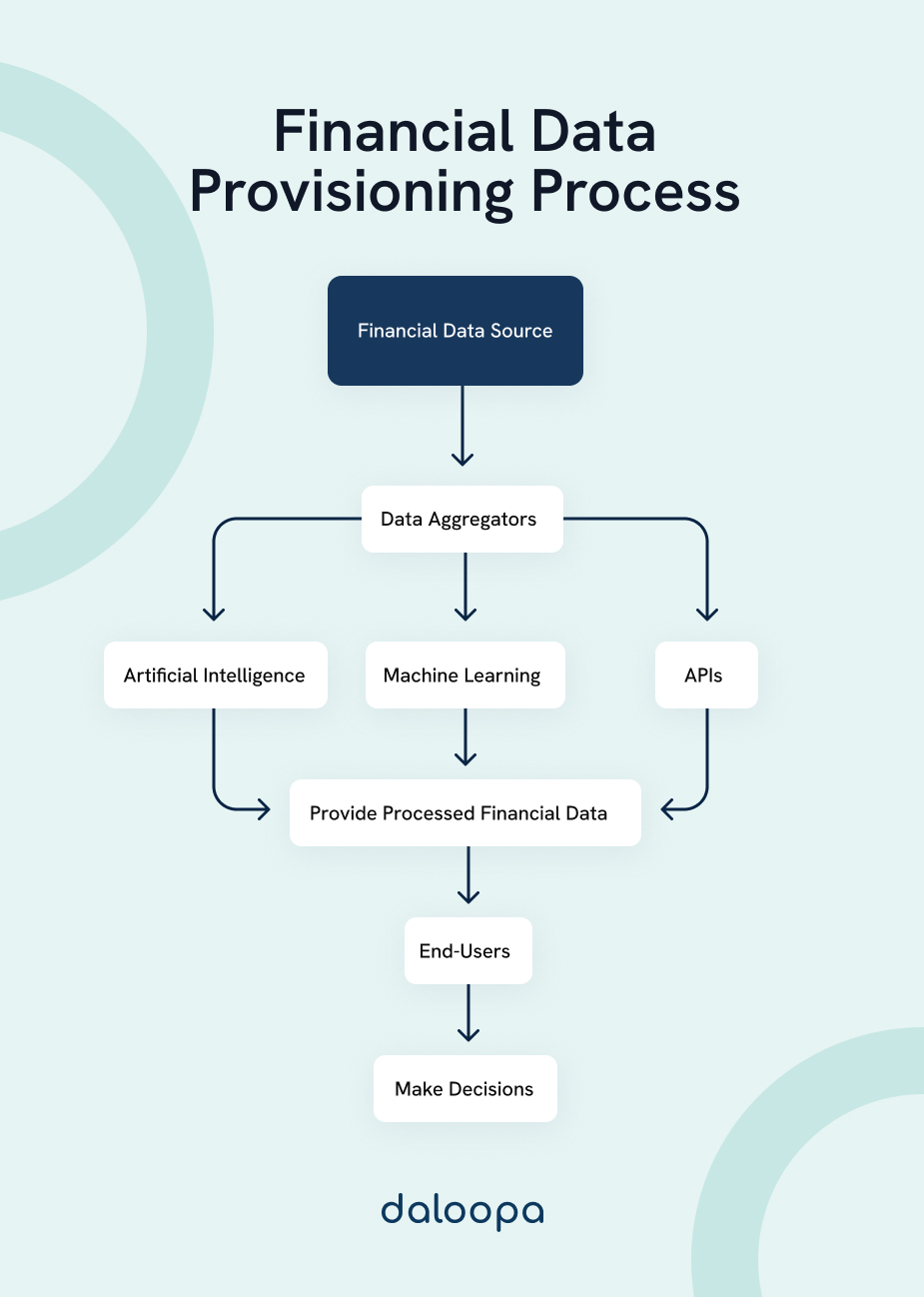

Innovations in financial data provisioning are transforming how financial markets operate. These advancements enhance accuracy, efficiency, and access to data, providing valuable insights for stakeholders across the financial sector.

AI and Machine Learning

Artificial Intelligence (AI) and machine learning are revolutionizing financial data provisioning. By leveraging these technologies, we can analyze vast amounts of data quickly and accurately. AI algorithms can detect patterns and trends that were previously impossible to identify.

Financial institutions are deploying AI-driven data analysis in financial compliance, where precision is critical. Here are two ways integrating AI into compliance processes ensures institutions and businesses adhere to regulations:

Mitigating the risk of errors: AI systems, driven by advanced algorithms, excel in executing repetitive tasks with precision. By automating processes such as data entry, analysis, and reporting, AI minimizes the risk of human error caused by fatigue, oversight, or the misinterpretation of complex regulatory frameworks.

Minimizing false positives: Traditional compliance systems often overwhelm teams with false positives, flagging low-risk transactions as suspicious and diverting resources from real threats. AI’s adaptive learning capabilities enable it to enhance detection accuracy over time, significantly reducing false positives and allowing compliance teams to focus on genuine risks more efficiently.

Large Language Models (LLMs)

Large Language Models (LLMs) are revolutionizing the financial industry through their ability to process and generate human-like text based on vast datasets. Their advanced natural language capabilities make them highly effective for tasks requiring nuanced understanding and contextually accurate outputs.

In financial services, LLMs are increasingly deployed for various applications, including analyzing and summarizing complex regulatory documents, enhancing customer service through AI-powered chatbots, generating automated reports (such as compliance reports), predicting potential compliance risks, and providing real-time responses to client inquiries.

Financial Data APIs

Financial Data APIs allow you to access real-time market data, historical data, and other financial information from diverse sources. They simplify the data retrieval process and ensure that you maintain up-to-date and accurate records.

APIs facilitate the integration of financial data into various platforms, including trading algorithms, portfolio management systems, and financial analysis tools, streamlining operations and enhancing the efficiency of data utilization.

For instance, APIs from platforms like Daloopa provide users with easy access to a wide range of financial datasets, enabling financial professionals to make more informed decisions by leveraging comprehensive and reliable data sources.

Alternative Data Providers

The rise of alternative data providers has introduced new dimensions to financial data provisioning. These providers offer non-traditional data sources, such as social media activity, satellite imagery, and transaction data, to complement conventional financial data.

Alternative data is valuable for gaining deeper insights into market conditions and consumer behavior. It helps you make more informed investment decisions by offering a broader perspective on economic trends.

Incorporating alternative data into our analytical frameworks can reveal hidden opportunities and risks, enhancing our ability to navigate the complexities of financial markets.

Data Quality and Integrity

In financial markets, maintaining the quality and integrity of data is paramount. Key considerations include ensuring accuracy and reliability, as well as adhering to compliance and regulatory standards.

Accuracy and Reliability

Errors and inaccuracies can significantly impact decision-making. For instance, incorrect pricing data can lead to substantial financial losses. You need to perform routine data validation and consistency checks to mitigate these risks.

Additionally, employing automated quality control systems helps in detecting anomalies and inconsistencies in real-time. Implementing standardized data formats also enhances data reliability, ensuring that data providers offer trustworthy and precise information for traders, analysts, and other stakeholders.

Compliance and Regulatory Standards

Financial data providers must adhere to regulations like GDPR in Europe, which protects personal data, and specific guidelines set by entities such as the SEC in the United States.

Regulatory filings mandate specific data quality requirements. Ensuring adherence involves regular audits, robust data governance frameworks, and maintaining detailed records of data lineage. Companies must be prepared for compliance checks and potential audits. Such compliance ensures transparency and builds trust with market participants.

Access and Integration

In the realm of financial markets, seamless integration and easy access to data facilitate accessibility and business connections.

Data Formats and Tools

Data formats and tools play a significant role in ensuring effective data integration. Utilizing standardized formats like JSON allows for streamlined data transfer and compatibility across various systems. JSON’s lightweight nature makes it ideal for real-time data updates.

Marketplace and B2B Platforms

B2B marketplaces typically see substantial user engagement. For instance, some platforms may have over 100,000 monthly buyers, underscoring their importance. They often offer subscription-based models that provide continuous access to updated financial data.

These platforms also support a range of financial instruments and services. By focusing on interconnectivity and integration, B2B market platforms enhance the efficiency of accessing and utilizing financial data, reducing the complexity of sourcing and integrating market information.

Are You Leveraging the Full Potential of Financial Data in Your Investment Strategies?

As an investment banking analyst, you know how essential high-quality financial data is for making sound decisions in today’s fast-moving markets. Are you exploring the latest advancements, such as AI-driven analytics and alternative data sources, to enhance your edge?

Daloopa offers seamless access to comprehensive financial data and insights. Sign up for a free Daloopa account or request a demo to discover how it can elevate your analysis and help you stay ahead in the market.