Why do two analysts using DCF end up with two wildly different valuations? More often than not, it comes down to how they handle WACC.

It’s a common headache in valuation and analysis techniques: the method looks solid on paper, the assumptions seem reasonable, and yet the output veers off course. That’s because Discounted Cash Flow (DCF) and Weighted Average Cost of Capital (WACC) are deeply connected. But they are not always clearly understood in practice. DCF is the full valuation framework. WACC is both a vital input within it and, in some cases, the primary discount rate used when capital structure is stable. When used thoughtfully, the two together can highlight the full economic potential of a business. Confusing their roles, or treating them as interchangeable, can quietly derail an otherwise sound valuation.

Key Takeaways

- DCF is the overarching valuation system; WACC acts both as an input and, sometimes, the key discount rate.

- The ideal DCF model varies depending on capital structure dynamics.

- Reliable results require fluency in how each model works and where its limits are.

Understanding the Fundamentals

At the heart of modern valuation sit two indispensable tools: Discounted Cash Flow (DCF) analysis and the Weighted Average Cost of Capital (WACC). Together, they estimate what future cash is worth today.

DCF Valuation Framework

The DCF approach calculates value by forecasting cash generation over time and then adjusting for the time value of money. The focus is on Free Cash Flow to the Firm (FCFF) or Free Cash Flow to Equity (FCFE), depending on context.

Any good Discounted Cash Flow model includes:

- Cash flow forecasts across relevant years

- A terminal value that accounts for residual performance

- A rate to discount all future flows into today’s dollars

Cash flows need to reflect operational improvements, working capital shifts, and capex needs.

WACC as a Discount Rate

WACC summarizes the cost of financing a firm, considering both debt and equity components.

In most traditional equity research valuation methods, it’s the default discount rate, though not always the correct one. The typical WACC calculation includes:

- Cost of equity (often via CAPM)

- Post-tax cost of debt

- Weightings based on target capital structure

Always rely on market values, not accounting figures, for structure weights.

Macro factors and sector-specific risks influence each piece of the WACC equation.

Relationship Between DCF and WACC

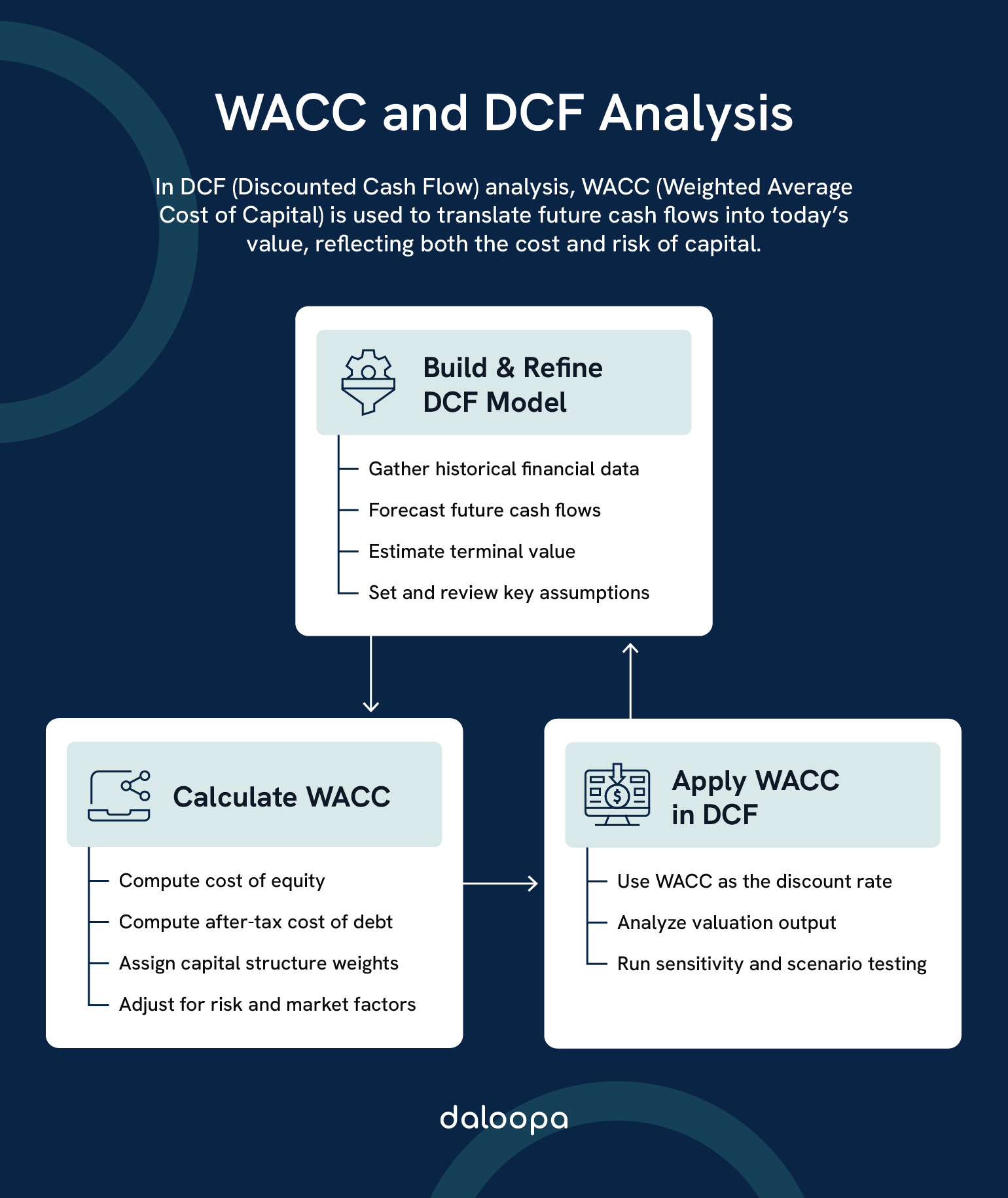

So how do DCF and WACC fit together? In most enterprise-level DCFs, WACC is used to discount FCFF. But when a firm’s leverage changes over time, the relationship needs extra care.

Key modeling points:

- Adjust WACC when capital structure shifts.

- Reflect changes in interest obligations and tax impacts.

- Align growth, debt, and risk assumptions throughout.

The most robust models maintain harmony between assumptions and valuation math. Every number has a purpose and precision counts.

Methodological Approaches and Variations

Each DCF method has its own strengths and works best under specific assumptions. Matching the right model to the right capital structure matters more than many realize. If you pick the wrong model you could end up with a flawed framework.

DCF Valuation Methods

With FCFF, you’re valuing the firm as a whole by discounting operations at WACC. It’s ideal for companies that keep their debt ratios stable. If the business maintains a predictable capital mix, FCFF keeps things streamlined and accurate.

The FCFE model looks solely at shareholder-level cash flows, discounted at the cost of equity, suited to companies where debt is changing or uncertain. That’s especially important when leverage is in flux. Using FCFF in that context masks real risk.

APV takes a more modular path: it values the company as if it were fully equity-financed, then adds value from interest tax shields separately. It’s helpful when financing adds value independently. Think leveraged buyouts or major restructurings.

Alternative Discount Rate Approaches

CAPM remains a go-to for cost of equity, using the market risk premium and beta. But don’t blindly trust beta if you’re working with small caps or illiquid stocks. It can be wildly misleading.

The build-up method adds firm-specific risks onto a baseline rate, which is especially useful for private businesses with no public comps. This is where judgment matters. If you’re pulling numbers from outdated studies or misjudged risk premiums, you’ll anchor your valuation to bad assumptions.

When a firm evolves dramatically over time, using dynamic discount rates that adjust for different risk phases can improve the precision of your model. A tech startup with volatile growth, for instance, shouldn’t use the same rate across the board. Yet people do it. And they get burned when the valuation doesn’t match reality.

Practical Implementation Challenges

WACC’s accuracy depends heavily on the quality of market data. If comps are illiquid or beta is unreliable, discount rate errors compound quickly. It’s not just about getting the inputs. It’s about knowing which ones to trust.

Handling structural shifts matters:

- Fixed WACC assumptions fail if debt changes.

- Target leverage often diverges from actual levels.

- Interest deductions (tax shields) must be factored in consistently.

Risk adjustments need both hard numbers and business sense. Sector trends, management, and financial disclosures all play a part. This is where the real-world mess kicks in. One misread footnote or a sector you don’t fully grasp and your ‘clean’ model starts cracking under pressure.

So don’t just build models. Stress-test them. Ask where your assumptions could fail. That’s where strong valuation and analysis techniques separate seasoned analysts from amateurs.

Critical Analysis and Decision Factors

Choosing the correct method isn’t just a numbers game. It’s about evaluating where a business stands and how likely its capital and risk structure is to hold over time. Knowing when to adjust WACC, or when to shift to APV, is part of mastering advanced equity research valuation methods. Overlooking this context often leads to mismatched models and unreliable outputs.

When WACC-Based DCF Works Best

A WACC-based DCF is often the right tool for companies with steady leverage and a clear operating profile. These tend to be mature businesses with minimal balance sheet drama. In such environments, consistency in capital structure supports the assumption of a constant weighted average cost of capital.

WACC works well when debt levels are consistent, typically when leverage sits between 20% and 60%. Think of stalwart industries like power utilities, consumer packaged goods, or traditional manufacturing.

Take, for example, a regional power utility with stable margins, regulated pricing, and predictable infrastructure investments. A WACC-based DCF keeps the model straightforward without compromising accuracy.

Ideal candidates for this method usually have:

- Reliable operating margins

- Predictable investment needs

- Few financial restructuring events

In such cases, introducing more complex valuation methods often adds more risk than insight.

When Alternative DCF Approaches Are Preferable

In what scenarios does a WACC-based approach fall short?

If leverage is shifting or debt plays a large role in valuation, APV can offer more accurate insights. It’s a favorite for fast-growing firms, LBOs, or firms undergoing strategic financing.

Imagine a private equity firm acquiring a distressed retailer. Debt will spike early, then taper off as the business turns around. WACC assumes constant structure so it’s the wrong fit. APV lets you value the business cleanly and layer in tax shield benefits separately.

FTE shines in settings like:

- Firms with unusual debt schedules

- High-volatility countries or sectors

- Cases with layered or hybrid financial instruments

For instance, a telecom company operating in emerging markets with multi-currency loans and periodic refinancings would trip up a standard DCF. FTE can isolate equity value more precisely amid those moving parts.

We see APV as a strong match when debt’s tax benefits represent a meaningful portion of valuation, such as in buyouts or large-scale recapitalizations.

Applying WACC in such situations may underrepresent financial risk and distort valuation.

Sensitivity and Scenario Analysis

No matter how well a model is built, its usefulness hinges on how it handles uncertainty. Stress-testing key assumptions is not just a best practice, it’s how you find out whether your model can hold up when conditions change.

Important inputs worth stress-testing include:

- Revenue growth (tested at ±2%)

- Margins across cycles

- Discount rate elements

- Working capital intensity

To prepare for variation, we recommend setting up three core cases:

- A base model grounded in consensus views

- A bullish scenario with higher top-line or margin expansion

- A conservative scenario showing downside risks

Let’s say your base case puts a SaaS firm at $120M valuation. Push growth by 2%, and suddenly you’re at $150M. Tweak the discount rate upward by 1%, and you’re back down to $110M.

Play with both terminal growth assumptions and exit multiples to check how sensitive your results are and validate them with market comps.

This ensures you are prepared when someone across the table asks, “What happens if the market turns?”

Advanced Considerations and Real-World Applications

Valuation models are built on theory but succeed or fail in practice. They must account for sector-specific dynamics, regulatory frameworks, and geographic risks to remain credible in real-world applications. Failing to adjust for these variables can lead to significant mispricing and credibility issues.

Industry-Specific Adaptations

Industries with heavy infrastructure, such as utilities or telecoms, require models that reflect lumpy cash flows and regulated return structures. Here, WACC often incorporates regulated return caps.

Take a national telecom provider planning fiber rollout in phases over a decade. Cash inflows may be delayed, but capex hits immediately. A standard DCF without adjustment will misrepresent both timing and risk.

Meanwhile, in fast-moving tech or biotech, reinvestment needs dominate. These firms demand modified DCFs that reflect early losses and delayed returns. A biotech startup burning cash through clinical trials needs a multi-stage DCF to reflect the long runway to profitability. Applying a single-phase model will overstate near-term value.

WACC also moves with industry risk. Mining firms, for instance, need extra premiums due to resource price swings. By contrast, companies in food and beverage tend to offer greater predictability.

This is where applying a generic discount rate becomes dangerous. A 9% WACC might be reasonable for a food distributor, but far too low for a lithium miner exposed to volatile pricing and unstable jurisdictions.

International and Cross-Border Considerations

Global firms need to address currency shifts, political stability, and country tax differences. That means incorporating a country risk premium in WACC for foreign operations.

A logistics company operating in both Germany and the United States cannot apply the same WACC across regions without skewing the risk profile. Adjusting for local inflation, sovereign stability, and repatriation risk is essential.

Accounting treatments differ, too. IFRS vs. GAAP can change how cash flows and capex are recognized, directly affecting DCF inputs. For example, under IFRS, certain leases are capitalized that wouldn’t be under GAAP, altering EBITDA, depreciation schedules, and cash flow timing.

Each country also has its own market norms. What qualifies as “safe” debt in Japan may differ from standards in the U.S. or Germany. That influences optimal leverage and thus WACC. Assuming uniform debt capacity across borders can distort leverage assumptions. A 60/40 debt-equity structure may be normal in one market but aggressive in another.

Market-specific data also matters. U.S. Treasuries may not reflect the true risk-free rate in emerging economies. In those cases, using local government bond yields, or adjusted global benchmarks, is a more defensible choice. Ignoring this can produce under-discounted valuations that won’t stand up in due diligence.

Valuation That Holds Up in the Real World

Without a sharp understanding of when and how to apply DCF and WACC in real-world financial decision-making, your valuation can quickly become an exercise in misplaced confidence.

From capital structure assumptions to regional tax risks, every input matters. The best analysts don’t just build models that look right. They build models that hold up under scrutiny, adjust to complexity, and deliver answers that stand when questioned by stakeholders.

If your team is still spending hours pulling historicals, reconciling statements, or manually updating data, there’s a smarter way. Daloopa automates the data-gathering grind so you can focus on getting the valuation and analysis techniques right. Whether you’re refining equity research valuation methods or running scenario stress-tests, see how you can start building better models with Daloopa AI today.