Regression analysis is a statistical tool that banking professionals use to uncover patterns and relationships within complex financial data. This method equips them with the ability to make informed, data-driven decisions in banking, forecast trends, and accurately assess potential risks.

By employing regression analysis in banking, professionals can measure the impact of different factors on key performance indicators, predict future outcomes, and identify areas ripe for improvement. Analyzing historical data enables banks to extract insights into customer behavior, market trends, and operational efficiency.

This versatile approach supports a range of banking functions, from credit risk assessment to portfolio management, ensuring institutions stay competitive in an ever-changing market environment.

Key Takeaways

- Regression analysis in banking aids in data-driven decision-making and trend forecasting.

- It quantifies relationships between variables for enhanced risk assessment.

- Banking professionals apply regression for applications like credit scoring and market forecasting.

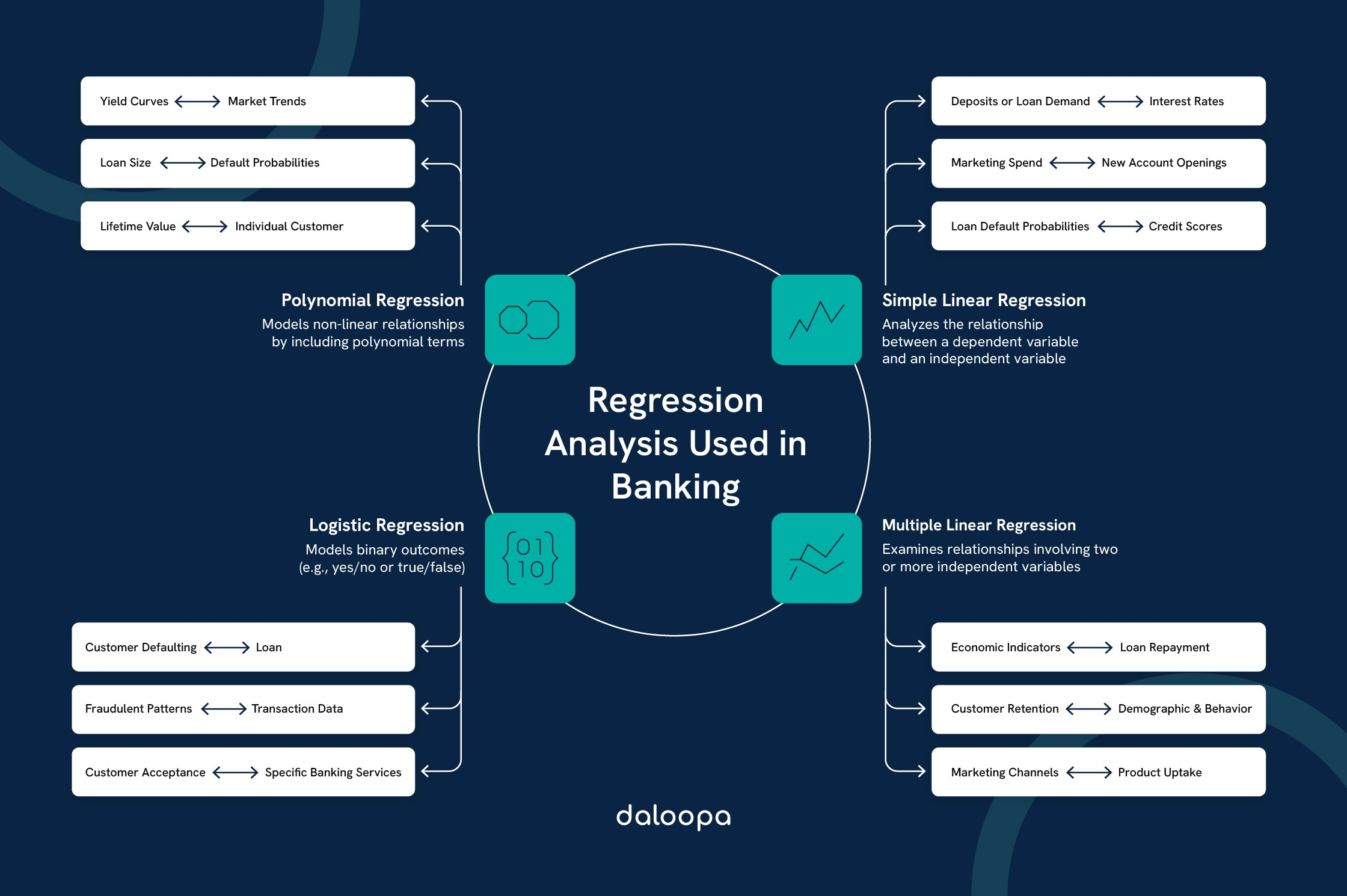

Types of Regression Analysis in Banking

Regression analysis in banking provides professionals with powerful tools for data examination and decision-making. By combining it with AI-powered tools like Daloopa, they can automate data preprocessing, model selection, and result interpretation for faster and more accurate processes. Below, we explore four main types of regression analysis in banking and their key applications.

Simple Linear Regression

Simple linear regression analyzes the relationship between two variables. This method of regression analysis in banking is used to observe trends and predict outcomes. For instance, banks might study how interest rates influence loan demand, assuming a linear relationship between the independent and dependent variables.

The regression equation, y = mx + b, where y represents the dependent variable, x the independent variable, m the slope, and b the intercept, helps in forecasting future values using past data. This simplicity makes it a foundational tool for initial data exploration and basic trend analysis.

Common banking applications include:

- Forecasting customer deposits.

- Evaluating the impact of marketing expenses on account openings.

- Predicting loan default rates based on credit scores.

Simple linear regression offers insights that guide strategic moves and resource allocation. By understanding these basic relationships, banks can build preliminary financial models that inform larger, more complex analytical frameworks. It enables institutions to make quick, data-backed decisions, improving operational efficiency and profitability.

Multiple Linear Regression

Multiple linear regression expands on the simple model by using two or more independent variables, allowing for the analysis of more complex relationships. The regression equation takes the form y = b0 + b1x1 + b2x2 + … + bnxn, where b0 is the intercept, and b1 to bn are the coefficients.

Applications include:

- Evaluating how various economic indicators affect loan performance.

- Predicting customer churn by analyzing multiple attributes.

- Assessing the influence of different marketing channels on product sales.

This model offers a more comprehensive understanding of how several factors impact a dependent variable, helping banks make informed decisions. It provides banking professionals with the flexibility to analyze the simultaneous effect of multiple variables, allowing them to identify the primary drivers behind financial outcomes.

With regression analysis in banking, particularly using multiple linear regression, banks can create targeted strategies to enhance profitability and customer retention. For example, by studying the combined effect of income level, employment status, and spending habits, banks can develop customer segmentation models that cater to diverse financial profiles. This approach also assists in aligning product development and marketing efforts with customer needs, leading to better customer engagement and higher satisfaction rates.

Logistic Regression

Logistic regression is invaluable for predicting binary outcomes in banking, such as determining the likelihood of a loan default or customer acceptance of a credit card offer. Unlike linear regression, it uses a sigmoid function to model relationships, enabling the estimation of probabilities rather than direct values.

Key applications include:

- Credit scoring and risk management.

- Fraud detection in financial transactions.

- Estimating customer propensity to adopt specific banking services.

This tool aids in decision-making when outcomes are categorical (yes/no or true/false), proving essential for targeted risk management. Logistic regression is particularly effective in improving the accuracy of credit approval processes by helping banks segment customers based on their likelihood of repayment.

It also plays a significant role in combating fraud by identifying transaction patterns that deviate from the norm, prompting further investigation. The insights gained from logistic regression models can enhance customer onboarding strategies by accurately predicting which individuals are more likely to use new banking products.

Polynomial Regression

When relationships between variables are non-linear, polynomial regression provides a more accurate model. The equation y = b0 + b1x + b2x^2 + … + bnx^n represents the model, with n as the polynomial’s degree. This type of regression is valuable for modeling complex financial data where changes do not follow a straight-line pattern.

In banking, it helps with:

- Analyzing interest rate yield curves.

- Modeling relationships between loan amounts and default risks.

- Predicting long-term customer lifetime value.

This approach captures more nuanced data patterns, improving forecasting where linear models are inadequate. Polynomial regression can uncover trends that might be overlooked with simpler models, adding depth to data analysis. For instance, banks analyzing loan performance over varying income levels might discover non-linear relationships that impact their risk models. This helps financial institutions better understand subtle changes in behavior or market response that could significantly affect financial outcomes.

Key Assumptions in Regression Analysis for Banking Professionals

Ensuring the validity and reliability of regression analysis depends on several assumptions.

Linearity

This assumption posits a linear relationship between dependent and independent variables. For instance, in analyzing loan amounts against income, a linear trend would show up in a scatter plot. Violating linearity leads to inaccurate predictions and misinterpretations. Detecting non-linearity early helps refine the financial models for more informed decisions and the application of suitable transformations if needed.

Independence

Independence means observations should not affect each other. This is especially relevant in time series data where autocorrelation can arise. For example, analyzing monthly loan defaults requires each month’s data to be independent to avoid underestimated errors. Tests like the Durbin-Watson statistic can confirm independence. Addressing independence issues ensures robust models that generate reliable outputs and prevent misleading conclusions in predictive analysis.

Homoscedasticity

Homoscedasticity assumes consistent error variance across all levels of independent variables. Variance inconsistency, or heteroscedasticity, is common in financial modeling, such as stock return predictions. Visual tools like residual plots or the Breusch-Pagan test help assess this assumption. When homoscedasticity holds, regression models provide consistent and unbiased parameter estimates, enhancing the reliability of financial forecasts and risk assessments.

Normality

Residuals should follow a normal distribution, crucial for hypothesis testing and creating confidence intervals. In banking, loan losses are often assumed to follow a normal distribution. However, financial data may sometimes have “fat tails,” indicating frequent extreme events. Normality can be assessed using Q-Q plots or the Shapiro-Wilk test.

Violation of this assumption can lead to unreliable p-values and intervals, impacting decision-making. Advanced techniques, such as data transformations or robust regression methods, can be employed to address deviations from normality, ensuring models remain dependable and suitable for long-term strategic planning.

Practical Applications of Regression Analysis in Banking

Regression analysis is a cornerstone for data-driven decisions in banking. Here, we cover its use in sales forecasting, risk assessment, and financial performance predictions.

Sales Forecasting

Banks utilize regression models to predict future sales of products and services by analyzing historical data and variables like interest rates and economic trends. A multiple linear regression model might show how GDP changes affect mortgage demand.

Scatter plots help visualize variable relationships, while the R-squared value indicates model fit. High R-squared values suggest robust predictive capabilities, aiding banks in resource allocation and targeted marketing.

Factoring in seasonal patterns refines forecasts, optimizing staffing, inventory, and campaigns. Enhanced forecast accuracy allows banks to stay ahead of competitors by aligning their strategies with market shifts and customer needs. Additionally, forecasting can help banks identify potential slow periods, allowing them to plan promotional campaigns and improve client outreach during those times.

Asset Risk Assessment

Logistic regression is instrumental for estimating loan default probabilities using borrower data and economic conditions. This supports lending decisions and interest rate setting.

Key variables include:

- Credit scores.

- Debt-to-income ratios.

- Employment history.

For investment portfolios, regression assesses market risk, enabling data-backed strategies. Banks apply these models to balance potential returns with inherent risks, optimizing their investment approach. Robust asset risk assessment promotes a healthy financial portfolio that adapts to market fluctuations and maintains profitability. By incorporating a combination of regression outputs, financial analysts can create comprehensive risk profiles that inform decisions and fine-tune investment allocations.

Financial Performance Prediction

Multiple regression models predict financial metrics by analyzing factors like interest rates and operational efficiency. For instance, net interest margin forecasts may use data on lending rates and yield curves, offering insight into profitability.

Banks also benchmark against industry peers, identifying improvement areas through regression outputs, which informs resource allocation and strategy. These predictions help banks allocate resources effectively, ensuring they respond proactively to economic trends and competitive dynamics. With accurate models, banks can set realistic goals and take informed actions that support long-term stability. Moreover, regression insights contribute to creating financial dashboards that monitor key metrics in real-time, allowing for continuous evaluation and rapid response to changes.

Benefits of Regression Analysis for Banking Professionals

Regression analysis equips banking professionals with tools for better decision-making, risk management, and strategy. By mastering regression analysis for banking professionals, institutions can unlock deeper insights to drive growth and efficiency.

Data-driven Decisions in Banking

Regression analysis helps professionals identify key influencers on loan performance and customer behavior. Beta coefficients in regression models quantify variable impacts, enabling tailored product offerings and strategic resource use.

Statistical tests ensure reliability, supporting confident decision-making in high-stakes scenarios. Leveraging insights from regression analysis enables banking professionals to strengthen forecasting models, create targeted campaigns, and improve service offerings to attract and retain customers. This analytical advantage leads to a more customer-centric approach, as banks can better align their services with client expectations and market demands.

Enhanced Risk Management

By evaluating credit risk through income and credit history analysis, regression models guide lending strategies and interest rate adjustments. Comprehensive models provide detailed risk profiles, supporting precise risk assessments and informed interest rates. Stress testing simulates economic scenarios to assess portfolio impacts.

Effective risk management derived from regression analysis enables banks to mitigate potential losses and safeguard their financial health. This method helps in anticipating financial stress points and adjusting strategies preemptively, thus avoiding significant economic disruptions. Furthermore, by refining risk management practices through data insights, banks can maintain robust compliance with regulatory standards and improve their reputation among clients and stakeholders.

Strategic Planning

Forecasting market trends and customer demand, regression analysis informs long-term strategy. Historical data insights highlight growth opportunities and potential challenges, guiding targeted strategies. The use of advanced regression techniques facilitates comprehensive scenario planning, allowing banks to visualize potential outcomes and create agile strategies that adapt to dynamic market changes.

Regression models also help banks evaluate the effectiveness of their marketing campaigns, optimizing customer acquisition and retention. By measuring the impact of multiple variables on marketing results, banks can adjust their approaches for improved outreach and better ROI. In strategic planning, the detailed analytics provided by regression help management teams outline future objectives with precision and confidence, empowering them to make data-driven decisions in banking that bolster growth and operational success.

Leveraging Regression Analysis in Banking for Strategic Insights

Regression analysis is a key tool in modern banking, enabling professionals to navigate the complexities of financial data with precision. By analyzing historical patterns and modeling key variables, regression allows institutions to make data-driven decisions in banking, refine risk management practices, and strategize effectively for future growth. With AI automation, these models become even more efficient and accurate, allowing analysts to quickly adapt to market changes and capitalize on opportunities.

With Daloopa’s AI-driven data automation, your team can spend less time on manual data updates and more time on strategic analysis. Try Daloopa today to ensure that your foundational data remains accurate and current, providing a solid base for your advanced regression models.