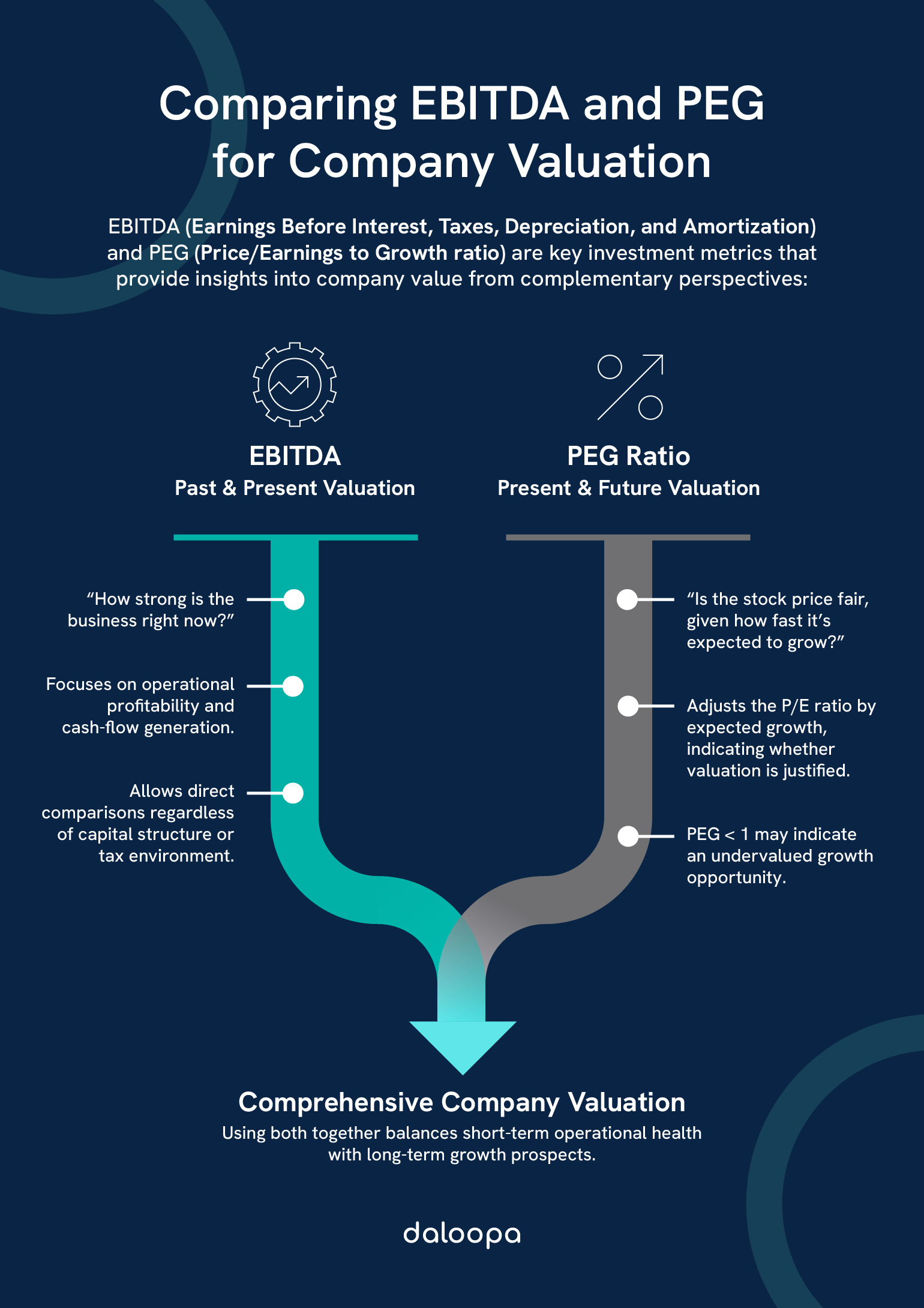

For investors aiming to sharpen their understanding of company valuations, EBITDA and PEG ratios offer a well-rounded lens. EBITDA evaluates operational efficiency without the noise of financing or tax impacts, while PEG adds depth by tying a company’s valuation to its growth expectations.

Key Takeaways

- EBITDA sheds light on core business performance, excluding financing, taxes, and accounting estimates.

- PEG highlights if a stock’s valuation makes sense based on its projected growth rate.

- Using both together allows a deeper dive into a company’s present strength and long-term outlook.

Understanding EBITDA and PEG: A Comprehensive Overview

These two metrics approach company evaluation from different angles—EBITDA focuses on how well a company runs now, while PEG looks at whether its stock price reflects expected growth.

Defining EBITDA and PEG

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measures operating profitability by stripping out financing and non-cash accounting items, giving you a cleaner view of core cash-flow generation.

It is calculated as:

EBITDA = Net Income + Interest Expense + Taxes + Depreciation + Amortization

Enterprise Value (EV) often underpins valuation multiples like EV/EBITDA, and is defined by:

EV = Market Capitalization + Total Debt – Cash and Cash Equivalents

PEG Ratio adjusts the traditional Price/Earnings multiple by expected earnings growth, showing whether a stock’s valuation reasonably reflects its growth trajectory.

It’s defined as:

- P/E Ratio = Price per Share / Earnings per Share

- PEG Ratio = P/E Ratio / Annual EPS Growth Rate (%)

When used together, you capture today’s operating strength (via EBITDA) and tomorrow’s potential (via PEG). In many private equity models, these two benchmarks are central to structuring deals.

Relying solely on growth forecasts is risky—if estimates miss, you face the fear of overpaying. By anchoring your analysis in EBITDA’s historical stability, you mitigate “buy the hype” mistakes and build confidence in growth forecasts.

The Importance of EBITDA in Valuation

EBITDA lets you compare companies regardless of their debt structure or tax situations. It’s the backbone of Enterprise Value (EV)/EBITDA multiples, which typically range from 6× to 12× across industries.

EBITDA removes variables like:

- Interest linked to how a company is financed.

- Taxes influenced by location or structure.

- Depreciation and amortization shaped by accounting decisions.

The Role of PEG in Growth Valuation

PEG shines when you evaluate fast-growing firms, letting you see if high P/E ratios truly reflect robust growth expectations.

- Ideal Window: PEG works best when growth is relatively stable and analyst forecasts align with historical trends.

- Key Considerations: Vet the realism of projections, account for market cycles, and compare to industry norms.

In sectors prone to boom-and-bust, PEG can exaggerate value. For example, investors chasing cyclicals at trough earnings might see PEG spikes that reverse when earnings normalize. Always normalize earnings or use multi-year averages in your growth inputs.

Comparing EBITDA and PEG Across Private Equity Models: When to Use Each Metric

EBITDA and PEG are core components in many private equity models, each bringing different strengths—EBITDA clarifies operational output, while PEG frames future potential in light of market pricing.

Operational Performance vs. Growth Potential

- EBITDA tells you who is running a tight ship today—look for margins above 12% as a sign of strong cost management.

- PEG tells you where tomorrow’s earnings growth is priced—seek PEG < 1 to find potential under-the-radar opportunities.

In asset-heavy industries (e.g., manufacturing), EBITDA rules. In growth-focused sectors (e.g., software), PEG gains prominence.

Valuation Comparisons and Multiples

EV/EBITDA multiples usually range between 6x and 12x and provide helpful benchmarks for comparing companies with different capital structures.

Valuation tools include:

- EV/EBITDA: Captures core value

- P/E Ratio: Focuses on earnings after costs

- EV/Sales: Useful in early-stage revenue analysis

- PBV: Reflects how the market values assets

We use PEG alongside these to overlay a growth filter. A high P/E may seem expensive—until you see that future earnings could grow quickly, making it more palatable.

Addressing Valuation Problems

- Operational Blindspots: EBITDA ignores reinvestment needs and working capital demands—complement with EV/CAPEX or free cash flow analysis.

- Forecast Risks: Validate PEG inputs against past performance and adjust for macro shifts.

- Competitive Dynamics: Overlay qualitative insights on market positioning and regulatory headwinds.

By blending metrics with strategic context, you build a rounded investment thesis using leading valuation and analysis techniques.

Integrating EBITDA and PEG for Comprehensive Analysis

By blending PEG and EBITDA, investors can piece together both how well a company is operating and whether its market price accounts for realistic future growth.

Combining Metrics for Investment Decisions

EBITDA gives a read on a business’s day-to-day profit flow, while PEG brings in the element of momentum. We look at both to find companies delivering now and likely to continue delivering later.

Step-by-Step Screening

- Peer Group Definition: Assemble comparables by industry and size.

- Compute Metrics: Pull TTM EBITDA, calculate EV/EBITDA; extract P/E and consensus growth forecasts for PEG.

- Filter: Is EV/EBITDA below the sector median (6–12×)? Is PEG < 1?

- Stress-Test Forecasts: Run sensitivity checks on growth assumptions ± 2% to gauge valuation swings.

- Dividend Overlay: If income matters, check payout ratios under 75% to ensure sustainable yields.

Industry Benchmarks and Comparability

EBITDA and PEG benchmarks vary by sector. Tech firms often trade with higher PEGs because their earnings are projected to rise quickly, while traditional sectors may lean toward lower values.

Sector examples:

| Sector | Typical EBITDA Margin | Average PEG |

| Technology | 15-25% | 1.2–2.0 |

| Manufacturing | 10-15% | 0.8–1.3 |

| Retail | 5-10% | 0.7–1.1 |

These variations help us calibrate expectations, especially when comparing companies from very different sectors using modern valuation and analysis techniques.

Practical Applications in Stock Analysis

You’ll often run these routines:

- Trend Overlay: Chart EBITDA margin improvements alongside PEG shifts to see if growing efficiency is priced in.

- Scenario Analysis: Model bear/bull growth cases to gauge idiosyncratic risk.

- Dividend Screening: Combine EBITDA strength with payout discipline for income-oriented portfolios.

A firm steadily boosting margins while holding PEG < 1 is a top candidate for further diligence. These principles are often embedded in private equity models to drive investment thesis development.

Investing With Clarity and Confidence

Solid metrics help investors avoid guesswork. By combining EBITDA and PEG, we create a more grounded, data-driven view of what a stock might offer today and tomorrow.

Balancing Short-Term and Long-Term Insights

EBITDA acts as a gauge of operational strength, while PEG helps translate future expectations into something you can act on. Taken together, they help cut through valuation fog.

If dividend income matters, also check the payout ratio. Stocks paying out less than 75% of earnings tend to maintain yields over time, especially if they’re backing it up with EBITDA strength.

We spot undervalued opportunities by looking for stocks trading below industry average EV/EBITDA multiples, with PEG under 1.0. That signals solid operations priced below what future earnings might justify.

Institutional investors often use this combination—EBITDA, PEG, and dividend yields—to build durable portfolios. Stocks with strong operating returns and disciplined growth strategies tend to hold up better in the long run.

Confidence follows when a business proves it can run efficiently now and grow responsibly into the future. That’s what we look for—and why EBITDA and PEG remain a vital part of the toolkit.

Next-Level Analysis with Daloopa

Harness Daloopa’s platform to automate data collection, compute real-time EBITDA and PEG metrics, and generate interactive peer comparisons—all in one seamless interface. Tap into our demo and transform how you can uncover opportunities and act on valuation and analysis techniques.