In the corporate finance and strategy world, your next career move can be a launchpad, or a dead end. Pick the wrong role, and you may spend years building skills that don’t move you toward the job you really want. Whether you’re eyeing corp dev, biz dev, private equity, FP&A, or corp strategy, understanding the differences is key to shaping your corporate finance career comparison.

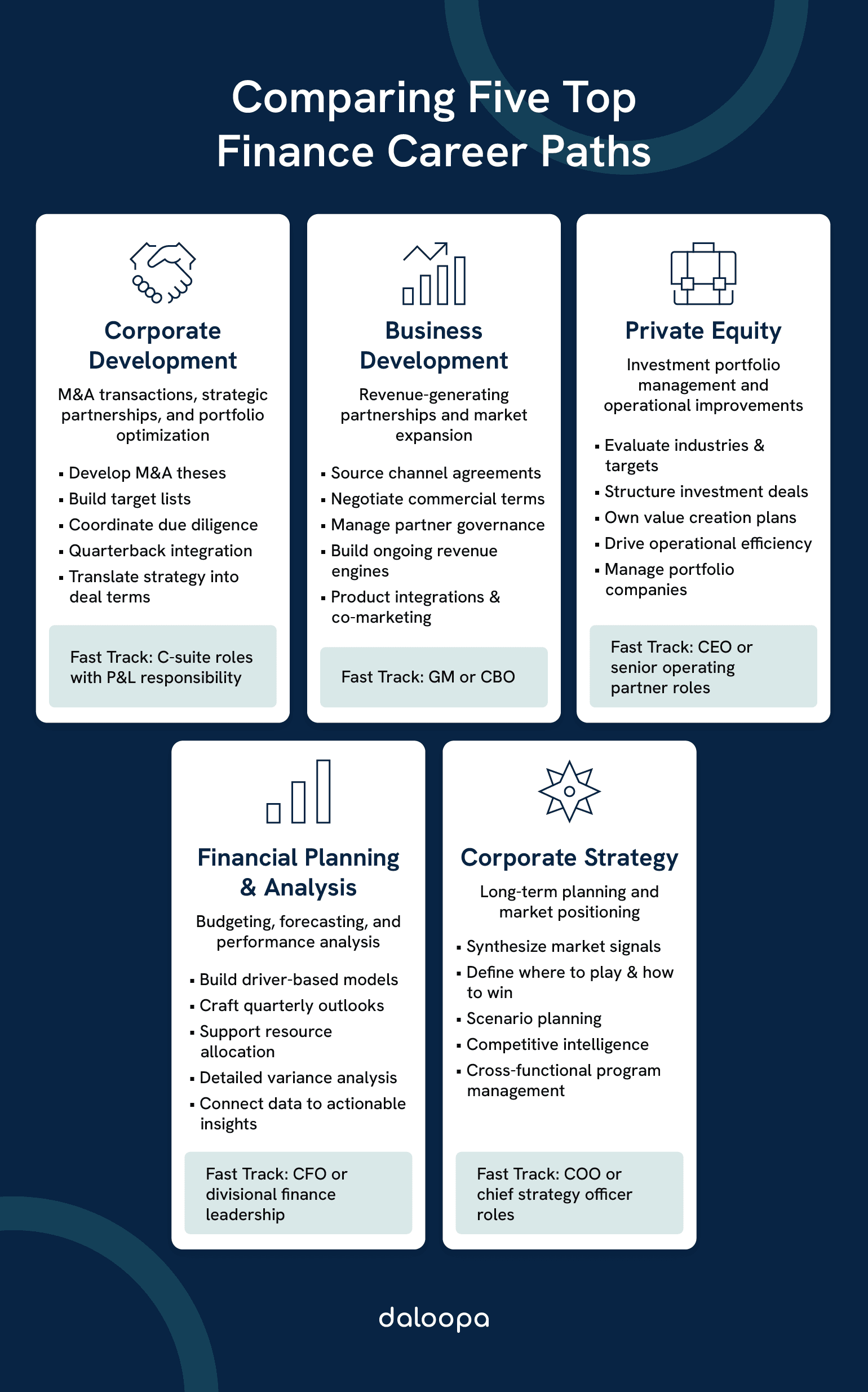

Each role creates value differently: corporate development through M&A execution, business development through partnership and revenue growth, private equity through strategic decisions that affect performance, financial planning and analysis through data-driven financial strategies, and corporate strategy through long-term planning and resource allocation.

To choose well, you need to understand how each path differs in scope of responsibility, decision-making authority, visibility with executives, and the career paths it positions you for.

Key Takeaways

- Corporate development handles M&A execution; business development drives partnerships and revenue growth.

- Private equity evaluates investments and improves portfolio performance; FP&A provides financial planning; corporate strategy sets long-term direction.

- Each path demands different skills, offers unique career trajectories, and varies in pay and advancement potential.

Role Definitions and Core Functions

These five functions all contribute to growth, but they pull different levers and work to different clocks. Mapping the core responsibilities clarifies fit.

Corporate Development: Focuses on M&A transactions, strategic partnerships, and portfolio optimization. Practitioners develop theses, build target lists, coordinate diligence, and quarterback integration.

They translate high-level direction into deal terms, synergy cases, and operating plans, then work hand-in-glove with business leaders to deliver post-close results. The work blends market scanning with rigorous analysis and heavy cross-functional coordination. Financial modeling skills for finance roles are essential here.

Fast Track: Fastest jump to C-suite roles with P&L responsibility.

Business Development: Concentrates on revenue-generating partnerships and market expansion. The team sources channel agreements, product integrations, and co-marketing deals; negotiates commercial terms; and manages governance with partners.

Unlike corp dev, which tends to focus on one-time step-changes, biz dev builds ongoing revenue engines. The pace is steady, the pipeline never sleeps, and success depends on both commercial creativity and consistent execution.

Fast Track: Best route to GM, market expansion leadership roles, or to the Chief Business Officer.

Private Equity (PE): Professionals manage investment portfolios and drive operational improvements in portfolio companies. They evaluate industries and targets, structure deals, and own value creation plans that may include pricing, procurement, sales motions, leadership upgrades, and capital structure changes.

Private equity firms actively pursue strategies for cost enhancement and operational efficiency, but the best funds pair discipline on costs with practical growth plays.

Fast Track: Clearest path to portfolio CEO or senior operating partner roles.

Financial Planning & Analysis (FP&A): Handles budgeting, forecasting, and performance analysis. Teams build driver-based models, craft quarterly outlooks, and support resource allocation across the business. Financial Planning and Analysis requires detailed financial modeling and variance analysis to inform decisions. The function shines when it connects granular data to simple, actionable narratives for operators.

Fast Track: Strong springboard to CFO or divisional finance leadership.

Corporate Strategy: Develops long-term plans and market positioning. Strategy teams synthesize external signals and internal realities into coherent choices—where to play, how to win, and which bets deserve funding. Tools for financial professionals often overlap here, as strategy teams rely on quantitative analysis to guide decisions.

The remit spans scenario planning, competitive intelligence, organic growth paths, and sometimes incubation of new ventures or cross-functional programs.

Fast Track: Ideal launchpad for COO or chief strategy officer roles.

Organizational Positioning and Reporting Structures

Titles tell part of the story; reporting lines reveal decision rights and access. Where a team sits affects the scope of problems it can solve and the speed at which it can move.

Corporate Development: Typically reports to the CEO or Chief Strategy Officer, reflecting its role in company-shaping transactions. That proximity to leadership ensures quick alignment on themes, but also raises the bar on judgment and communication.

A corp dev leader must calibrate not only deal quality but also timing, board dynamics, and integration capacity. Missteps here can cost both the deal and your credibility at the top.

Business Development: Often sits under Sales, Marketing, or Strategy, depending on the company’s model. Reporting determines focus: biz dev under Sales leans toward revenue targets and partner-sourced pipeline; under Strategy, it may drive platform plays and ecosystem design.

The variety can open doors or cause turf wars, making clear mandates critical to keeping momentum and political capital.

Private Equity: Operates within investment firms where organizational structure works especially well in supporting the investment process. Analysts and Associates support VPs and Principals who, in turn, support Partners responsible for fundraising, investment decisions, and exits.

The line of sight to outcomes is clear; expectations are too. Performance is measured in deal returns, not effort, and the hierarchy keeps the pressure tight.

FP&A: Always reports directly to the CFO, alongside controllership and tax. This structure grants influence on capital allocation and performance management but tends to center on operating cadence—monthly close, quarterly guidance, annual plans—more than one-off bets.

It’s a high-trust seat in the inner finance circle, with influence that comes from consistency, precision, and a command of the company’s financial pulse.

Corporate Strategy: Typically reports to the CEO or CSO, giving them access to board-level conversations and enterprise priorities. The role’s success hinges on shaping decisions across functions, each with its own agenda, while keeping the enterprise pointed toward a unified vision.

| Function | Common Reporting | Strategic Influence |

| Corp Dev | CEO/CSO | Very High |

| Biz Dev | Sales/Strategy | Medium-High |

| Private Equity | Managing Directors | High (within portfolio) |

| FP&A | CFO | Medium |

| Corp Strategy | CEO/CSO | Very High |

Understanding these reporting structures and strategic positioning helps you pick a lane that matches your desired level of influence, your tolerance for ambiguity, and the kinds of tradeoffs you want to own.

Value Creation Approaches

Consider the primary value lever in each role and the time horizon over which it pays off. That pairing, lever and horizon, determines the style of analysis, the stakeholders involved, and the metrics that matter.

Corporate Development: Emphasizes inorganic growth. Acquisitions can buy market share, fill capability gaps, accelerate product roadmaps, or improve unit economics via scale effects. Value shows up in synergy run-rates, expansion into adjacencies, and optionality created by new assets.

The challenge is sequencing: evaluate targets, negotiate the right structure, and integrate without losing momentum in the base business.

Business Development: Builds compounding revenue through alliances. Winners build systems—partner tiers, incentives, joint planning, and shared dashboards—that make growth inevitable.

They test new routes to market, co-sell with strategic partners, and adjust commercial terms as data accumulates. Value grows quarter by quarter as more partners hit ramp and cross-sell deepens.

Private Equity: Value creation combines financial and operating moves. Capital structure decisions (debt terms, covenants, hedging) sit next to operational plays (pricing, sales efficiency, procurement, supply chain).

The active portfolio management approach produces results when people, process, and priorities align and when measurement is unflinching.

FP&A: Drives value by improving decisions with better visibility. Strong Financial Planning and Analysis functions bring clarity to tradeoffs; investment versus efficiency, growth versus margin, risk versus return. They connect leading indicators to lagging results, and push leaders toward unambiguous accountability: what’s measured, who owns it, and whether it delivered.

Corporate Strategy: Creates value by setting direction and enforcing focus. It shapes a portfolio of bets, defines the tempo of change, and ensures resources match priorities.

The job is to say yes to a few things and no to many, then hold the organization to those choices as market conditions shift.

The professionals who understand how these approaches intersect—how a partnership can seed an acquisition thesis, how a strategy initiative becomes an FP&A driver, how a PE-style playbook informs integration—gain range that travels well across roles. That range is career gold: it lets you move between seats without losing relevance or momentum.

Skill Requirements and Competency Comparisons

Every path asks for analysis and communication, but the slope and shape differ. Think in terms of three stacks: technical, interpersonal, and operating.

Technical Skills Assessment

Financial modeling and analysis underpins all five paths, yet complexity varies.

- FP&A: Centers on driver-based forecasting, sensitivity analysis, and variance narratives tied to business rhythms.

- Corp Dev: Adds transaction modeling, that is, DCF, trading and transaction comps, synergy modeling, and accretion/dilution, plus deal structuring and pro forma mechanics.

- Private Equity: Demands the deepest technical stack with LBO modeling featuring layered debt tranches, working capital nuance, tax considerations, and exit math under varied scenarios.

- Business Development: Uses models for commercial cases including pricing, partner economics, and channel productivity.

- Corporate Strategy: Blends quantitative work with frameworks, market mapping, and scenario planning where models must be credible, but the art lies in framing decisions for executive commitment.

Technology proficiency keeps expanding. Automation and visualization skills shorten time-to-insight.

- FP&A: Staff need technical skills for future goals, making fluency with SQL, Python, and BI tools, and other tools for financial professionals a durable edge.

- Corp Dev and PE: Benefit from deal platforms and data rooms.

- Strategy and Biz Dev: Benefit from market intelligence and partner telemetry.

Soft Skills and Leadership Competencies

Communication and presentation skills show up differently by seat.

- Corp Dev: Must explain deal logic, integration risk, and synergy math to leadership and boards.

- Biz Dev: Negotiates externally, builds trust, and manages executive relationships on both sides.

- PE: Presents to investment committees and aligns portfolio management teams around tough choices.

- FP&A: Translates data into operating stories line leaders can act on.

- Corporate Strategy: Guides decision-making among senior stakeholders with competing priorities.

Strategic thinking is high across the board, but the altitude changes.

- Strategy: Operates at multi-year horizons and portfolio scope.

- PE: Toggles between deal-level theses and quarter-by-quarter operating plans.

- Corp Dev: Focuses on fit and integration.

- Biz Dev: Thinks in partner economics and ecosystem design.

- FP&A: Links strategy to budgets and KPIs.

Project management matters because work happens across functions.

- Corp Dev and PE: Juggle diligence, legal, financing, and operating tracks.

- Biz Dev: Coordinates product, marketing, and sales enablement.

- FP&A: Owns planning calendars and forecast cadences (companies use rotation systems with Financial Planning and Analysis staff to broaden leaders).

- Strategy: Runs cross-functional programs and steers governance.

Educational and Experience Requirements

Educational background varies.

- PE: Strongly favors top-tier MBAs and prior banking or consulting experience.

- Corp Dev: Often recruits MBAs or CFAs with investment banking, consulting, or internal finance backgrounds.

- FP&A: Draws from accounting, finance, economics, and sometimes engineering.

- Biz Dev: Values industry knowledge, product fluency, and a record of closing complex deals.

- Corporate Strategy: Often prefers MBAs plus analytics-heavy roles.

Experience progression reflects the complexity of decisions and the size of bets.

- PE Associates: Typically come in with several years of IB or consulting; advancement depends on sourcing ability and portfolio results.

- Corp Dev and Strategy: Often seek 4–6 years of relevant experience at entry levels and escalate responsibility quickly with performance.

- FP&A: Allows earlier entry and builds leadership through exposure to the full operating cycle.

- Biz Dev: Promotes those who deliver durable revenue and partner satisfaction.

Industry specialization gains importance as scope increases.

- PE: Professionals often focus on a sector.

- Corp Dev: Leaders with deep industry knowledge spot fit faster and integrate better.

- Biz Dev: Network depth and reputation in a vertical shorten sales cycles.

- Strategy: Benefits from recurring pattern recognition within a space.

- FP&A: Benefits when analysts understand unit economics and operational drivers unique to the industry.

Investment strategy consultancy uses vastly different skills than hands-on operating roles, and careers reflect that divergence over time.

Day-to-Day Responsibilities and Deliverables

Rhythm differs. Some roles sprint around transactions; others run steady marathons of planning, measurement, and iteration. Ownership and artifacts tell the tale.

Project and Process Ownership

Corporate Development: Owns the M&A lifecycle—sourcing, NDAs, diligence checklists, valuation models, investment committee memos, and integration planning. Post-close, the team monitors synergy capture, steers governance, and supports leaders on scope, timeline, and interdependencies.

When divesting, corp development manages carve-out financials and transition services agreements, keeping separation clean and customer impact low. They also codify lessons learned so the next deal moves faster with fewer surprises. They oversee integration activities and strategic execution.

Business Development: Owns the partner lifecycle—sourcing, business case, contract, launch, QBRs, and expansions. They maintain pipelines, track stage conversion, and keep joint marketing and enablement moving. The best biz dev leaders define repeatable onboarding motions and use partner performance data to refine incentive design.

Private Equity: Owns the portfolio plan—board decks, KPI targets, leadership changes, operating cadence, and exit readiness. They coordinate operating partners, set priorities with management, and run structured reviews. Private equity firms typically focus on strategic leadership roles, not day-to-day operations, but they push for outcomes and remove blockers.

FP&A: Owns the planning drumbeat—annual plan, quarterly re-forecasts, monthly close partnering, and ad hoc decision support. They standardize reporting, evolve drivers as products and markets change, and construct dashboards that tie activity to financial outcomes. Business leaders rely on Financial Planning and Analysis to make tradeoffs visible and to call out risks early.

Corporate Strategy: Owns enterprise choices and cross-functional programs. Deliverables include market landscapes, portfolio reviews, initiative charters, and governance routines that match resources to priorities. Strategy teams also run offsites, facilitate decision sessions, and track progress on the commitments leaders make.

Key Performance Indicators and Success Metrics

| Function | Primary KPIs | Secondary Metrics |

| Corp Dev | Deal completion rate, synergy realization | Time to close, integration milestones |

| Biz Dev | Partnership revenue, pipeline conversion | Contract renewal rates, partner satisfaction |

| Private Equity | Portfolio company EBITDA growth, IRR | Exit multiples, operational improvements |

| FP&A | Forecast accuracy, variance analysis | Report timeliness, stakeholder adoption |

| Corp Strategy | Strategic initiative progress, market share | Competitive positioning, resource allocation |

FP&A success shows up in fewer surprises, better resource alignment, and faster cycle times on decisions. The metric that matters most to operators is forecast accuracy; to executives, it’s the clarity of choices surfaced by the numbers.

Corporate Strategy cares about the progress of top initiatives and leading indicators of competitive position. It also pays attention to organizational focus. The fewer unplanned workstreams creeping in, the better the strategy is landing.

Deal experience across roles values not just volume, but quality—fit, timing, and durability of results. A smaller number of well-executed moves can beat a busy slate of deals that never realize their thesis.

Interaction With Other Business Functions

Corporate Development: Partners daily with legal and finance, and heavily with HR, product, and operations during integration. IT alignment is often the make-or-break factor in whether integrations hit their synergy targets because systems and data must converge without disrupting customers.

Business Development: Works arm-in-arm with product and marketing to stand up go-to-market motions and with sales to activate partner-sourced pipeline. Success depends on clean handoffs between external agreements and internal readiness.

FP&A: Partners with every function. It supports product on pricing and investment cases, sales on capacity planning and quota setting, and operations on cost programs. Done well, this makes Financial Planning and Analysis the quiet power center of capital allocation.

Corporate Strategy: Facilitates across the executive team, aligning timing, funding, and scope. The team uses structured workshops and governance to turn strategy into an executable portfolio.

Private Equity: Interacts with portfolio management, boards, lenders, and advisors. Relationships matter here. Credibility grows when operating reviews are precise, respectful, and consistent.

Career Trajectories and Compensation

Advancement speed, earning potential, and lifestyle vary meaningfully. Your fit depends on which tradeoffs you welcome.

Career Path Progression

Corporate Development: Often follows Analyst → Associate → Senior Associate → VP → SVP. Some enter post-MBA; others arrive via banking, consulting, or internal rotations. The climb rewards deal execution, integration results, and pattern recognition across multiple transactions.

Mobility is common: corp development alumni move into business unit leadership, strategy, or PE. Many professionals also transition the other way, lateral moves into corp dev groups, bringing sell-side discipline to in-house teams.

Business Development: Offers varied ladders: Biz Dev Associate → Manager → Director → VP → Chief Business Officer. Advancement leans on relationship capital, partner outcomes, and the ability to shape repeatable motions.

Industry depth speeds trust-building and shortens negotiation cycles; commercial creativity and operational follow-through distinguish top performers.

Private Equity: Progression is structured: Analyst/Associate → VP → Principal → Managing Director. The Associate-to-VP jump is pivotal, shifting from analysis to ownership of sourcing and value creation. Not everyone climbs the full ladder; some shift to operating roles at portfolio companies, join corp development or strategy, or raise independent vehicles.

FP&A: Moves Analyst → Senior Analyst → Manager → Director → VP of FP&A, with CFO as a long-term option. Financial Planning and Analysis career paths could lead to chief financial officer roles for leaders who pair financial depth with business acumen and executive communication.

Corporate Strategy: Resembles consulting tracks: Analyst → Senior Analyst → Manager → Director → VP. Those who want P&L ownership often transition into business leadership or product roles after a tour in strategy.

Compensation Structures and Incentives

Private Equity: Leads on upside. Associates often earn $130K–$200K base with meaningful bonuses; VPs cross $500K+ total cash in strong years. Carry typically starts at VP, and co-invest options add wealth-building potential.

Outcomes vary by fund performance and vintage, but the ceiling is high. For the ambitious, it’s the closest thing to a “get rich fast” plan that isn’t a startup lottery ticket.

Corporate Development: Compensation blends base with annual bonuses tied to deal outcomes and integration milestones. VPs frequently see $200K–$350K total comp, with equity or long-term incentives at senior levels.

Pay moves in step with deal success. A big win year can feel like PE—light without the same personal risk.

Business Development: Varies widely by industry. Base salary plus commissions or partner success metrics is common. In software and platforms, equity can be substantial, especially for leaders who build ecosystems that compound over years.

FP&A: Financial Planning and Analysis offers stable pay with lower variability. Raises and bonuses align with company performance and the function’s impact on predictability and operating results.

If you value stability and clear performance signals, FP&A’s steady progression is a feature, not a bug.

Corporate Strategy: Sits between FP&A and corp dev on variability. Bonuses often tie to enterprise performance and delivery of marquee initiatives. Equity becomes more meaningful as scope increases.

Work-Life Balance and Lifestyle Considerations

Private Equity: Intense during live deals, 70–80 hour weeks can happen, with travel for diligence and board meetings. The cadence eases between transactions, but expectations remain high on throughput and quality.

The tradeoff is clear: heavier hours for higher upside and concentrated learning on ownership, governance, and value creation.

Corporate Development: Spikes around deals and integrations, but many teams run closer to sustainable rhythms than sell-side banking. Travel depends on target location and integration needs. Leaders who pace deals and sequence integrations thoughtfully protect team health and results.

Business Development: Brings flexibility in some seasons and heavy travel in others. Conferences, executive briefings, and partner summits cluster at certain times of year. Evenings may include client events; early mornings may involve joint pipeline reviews across time zones.

FP&A: Tends to keep standard hours, with busier periods around month-end, quarter-end, and annual planning. This is the lifestyle role for those who want influence without crisis calls at 11 p.m.

Corporate Strategy: Runs in waves. Planning cycles, executive offsites, and board materials create crunch periods. Implementation phases return to steady governance and measurement.

Remote and hybrid options are now common across FP&A and strategy, and increasingly feasible for corp dev and biz dev given the modern tools for financial professionals.

Setting the Course for Your Career

The right career move can speed up your path to leadership. The wrong one can leave you developing expertise that doesn’t align with your goals. Across corporate development, business development, private equity, FP&A, and corporate strategy, the winners are those who master financial modeling skills for finance roles and turn data into clear, strategic action.

Whether you’re assessing M&A targets, shaping partnerships, or building investment cases, mastering tools for financial professionals and honing skills is critical. These tools and financial modeling skills empower you to build credible analyses, influence decisions, and stand out in any finance-oriented path.

Ready to sharpen those financial modeling skills for finance roles? Discover how Daloopa’s comprehensive data platform and MCP can give you the competitive edge to excel in your chosen career path.