By the time your spreadsheet is updated, the deal has already moved on.

In corporate development, timing decides whether you land the deal or lose it. But teams still burn hours gathering and cleaning financial data for M&A analysis, board updates, and competitor tracking. While they wait, opportunities vanish and leadership is left waiting on numbers that should have been ready yesterday.

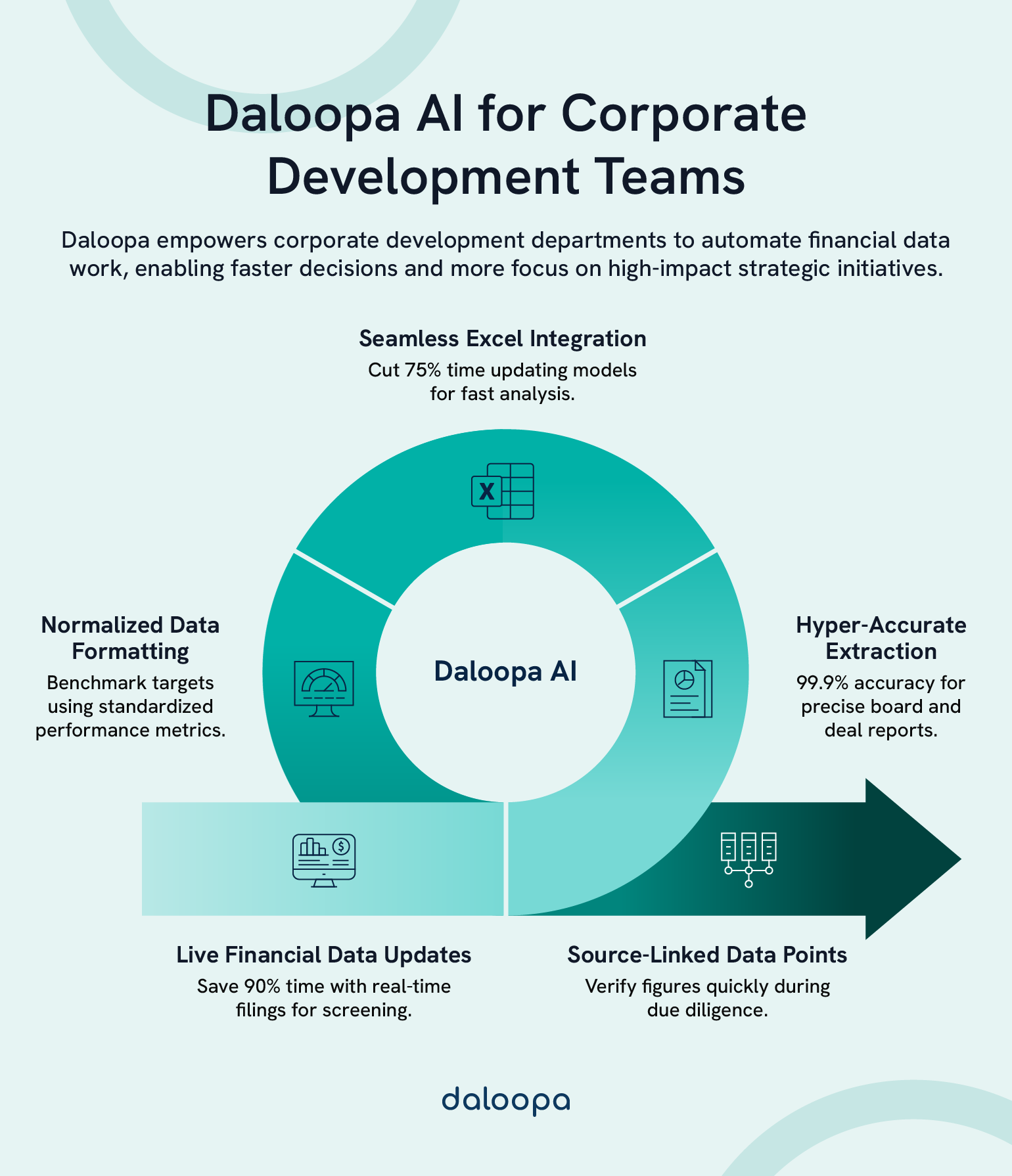

Corporate development departments can use Daloopa to fix that. Our AI-powered financial analysis software pulls and updates key metrics from earnings reports, SEC filings, and other structured sources, slashing manual work by up to 90%. The result? Faster analysis, fewer errors, and more time to focus on strategy and deal flow. Good decisions depend on fast, accurate data. Daloopa gives your team the tools to act with speed and confidence, before the window closes.

Key Takeaways

- Daloopa’s AI-powered automation replaces manual data entry and normalizes reporting across sources.

- Corporate development departments can use Daloopa to redirect up to 90% of data collection time into meaningful strategic work.

- Daloopa’s standardized, real-time updates support confident, consistent financial decision-making.

Daloopa’s Value Proposition for Corporate Development Teams

Daloopa offers a new standard for how corporate development teams collect and use financial data. Our AI extracts and organizes numbers from SEC filings, earnings documents, and similar sources, removing the bottleneck of manual entry.

The return on time is immediate. Users regularly reclaim up to 75% of hours once spent on compiling and validating data, opening the door to more thorough deal reviews and higher-quality analysis. Less grunt work. More green lights.

Daloopa delivers several core advantages:

- Live financial updates

- Uniform formatting across reporting entities

- Built-in validation tools

- Seamless Excel integration

- Preservation of historical context

Accuracy remains central to the platform’s value. Daloopa’s verification methods and human oversight ensure data reliability at 99.9%, so teams can move quickly without second-guessing the numbers. Confidence? Guaranteed.

The system aligns results across different quarters and company types, which simplifies cross-company benchmarking. When public companies update their numbers, your data reflects it automatically. No manual refresh required. No more delays.

Teams can use the Excel add-in to populate models instantly, keeping analysis consistent and reducing friction in preparing materials like board decks or internal deal reviews. What used to take days now takes minutes.

Reducing data entry also brings cost benefits. Teams often reclaim 15–20 hours per week, allowing more time to focus on corporate financial modeling, scenario planning, or identifying strategic opportunities. That’s 20 hours back, enough to close a deal instead of formatting one.

Key Challenges Addressed by Daloopa in Corporate Development

Corporate development analysts often face tight timelines and a steady stream of data to process. Manually collecting details from filings, earnings reports, and statements can eat up nearly half of their weekly capacity. That’s half the week gone before strategy even starts. Corporate development departments can use Daloopa to overcome common hurdles like tight timelines and overwhelming data streams.

Errors from manual input and inconsistent source formats can distort valuations or derail side-by-side comparisons. These small issues can snowball, affecting decisions at the highest level. When that happens, it’s not just numbers on the line, it’s reputation too. According to Gartner, poor data quality costs businesses over $12.9 million a year on average.

Another common hurdle is data freshness. Because it’s time-intensive to update models, they often contain lagging or incomplete numbers, which delays action and affects precision. In fast-moving markets, old numbers mean lost chances.

Corporate development teams benefit from Daloopa by automating financial data extraction and getting real-time updates, helping them stay on the front foot when timing matters most.

Daloopa tackles these recurring problems with a direct approach:

- Automatically pulls metrics from source documents

- Normalizes formatting across diverse entities

- Updates in real time when filings go public

- Checks for errors and inconsistencies by default

- Integrates cleanly with existing modeling tools

Fewer clicks. Faster deals. This removes the drag of repetitive work, letting teams reallocate time toward sourcing opportunities and evaluating deals in real terms.

Previously, aligning data between companies with different accounting structures took hours. Corporate development departments can rely on Daloopa to remove repetitive work and reallocate time toward real strategy and deal evaluations. Daloopa’s system handles this cleanup in the background, making side-by-side analysis easier and more dependable.

With up to 75% of validation and collection time reduced, corporate development teams gain speed without compromising accuracy. This puts them in a better position to act when opportunities appear.

Integration With Existing Corporate Development Workflows

One reason corporate development teams benefit from Daloopa is its smooth integration. Our AI-powered financial analysis software supports familiar workflows while removing the need for manual data management. No reinvention required. Just plug in and go.

Corporate development departments can use Daloopa with the tools they already rely on—especially Excel—through built-in connectors that automate financial data refreshes and eliminate redundant tasks.

It connects directly with widely used tools like Excel and other enterprise systems. This allows teams to continue using their preferred templates and databases while benefiting from automated data updates. Your models. Your flow. Just faster.

Notable integration features include:

- Excel plugin for real-time financial refresh

- REST API for flexible system connectivity

- Multi-format bulk exports

- Template mapping to fit current model designs

Templates can be linked directly to Daloopa’s data structure, so there’s no need to rebuild or reformat—just swap in live data in place of the static entries. Typical implementation takes just one to two weeks. Dedicated support is included to make sure the switch goes smoothly across teams and workflows. It’s a quick setup with a long-term payoff.

Benefits include:

- Preserved model architecture

- Reduced onboarding friction

- Smooth alignment with analyst habits

- Flexibility for phased adoption

With automatic syncs and no disruption to core systems, corporate development teams can keep their preferred tools while gaining the advantage of real-time, high-quality data feeds. Zero disruption. Maximum momentum.

Practical Applications in Corporate Development Functions

Daloopa’s automation and accuracy make a difference in every stage of corporate development, from identifying acquisition targets to tracking post-deal metrics. It brings speed, depth, and consistency to tasks that used to require manual labor and vigilance.

M&A Target Identification and Screening

Finding strong acquisition targets requires comparison-ready data from a range of sources. Corporate development teams can benefit from Daloopa by analyzing large pools of companies in a fraction of the time, with standardized metrics across the board.

Key metrics for screening include:

- Revenue and margin trends

- Efficiency in working capital

- Capital structure health

- Return on invested capital

No more bouncing between PDFs, Excel files, and back-of-the-envelope calculations. Now, all the key indicators are in one place, aligned and ready to compare, whether you’re filtering through 10 companies or 100.

For instance, a corporate development analyst tasked with surfacing 20 high-potential SaaS targets can now apply uniform ROIC and margin filters across hundreds of firms, and get a clean short list in hours, not days. What once needed late nights can now happen before lunch.

The platform also provides alerts when there are changes in a target’s financials, helping teams react faster to developments in the market.

Due Diligence and Valuation Acceleration

Daloopa removes the heavy lifting from due diligence. Analysts can download complete models pre-filled with historical data and market comparisons, which speeds up the entire valuation process. From zero to analysis in record time. It’s the smart way to automate financial data collection under pressure.

Available data includes:

- Full financial statements

- Operational metrics

- Trading and transaction benchmarks

- Industry-specific ratios

The numbers are already there. The judgment is yours. This shifts the focus to analysis, rather than sourcing numbers, when timelines are tight and accuracy matters most.

With the support of AI-powered financial analysis software, teams spend less time chasing down numbers and more time refining investment theses.

Post-Merger Integration Planning

Merging financial systems is one of the harder tasks after an acquisition. Daloopa makes it easier to align differences in accounting methods or reporting formats. Clashing charts of accounts? Handled.

Audit trails help support decisions like purchase price allocations, and real-time tracking lets teams monitor how the integrated entity performs compared to the original forecasts. No more “we’ll update that next quarter.” Now you know where things stand every day.

Strategic Planning and Board Reporting

Recurring board materials and strategy documents benefit from Daloopa’s templating system. Peer benchmarking, metric tracking, and KPI dashboards update automatically—reducing prep time and increasing data consistency.

This improves the depth and quality of discussions without adding extra hours to presentation prep. And when you’re asked a follow-up question in the boardroom? You’ve got the answer, on the spot.

Advanced Analytics Applications

When the valuation landscape shifts weekly, you can’t rely on lagging reports. You need forward signals, fast. Daloopa’s capabilities stretch beyond basic reporting. As a leading example of AI in finance, our advanced system flags what’s changing before your competitors target the same companies. It helps corporate development teams spot patterns across portfolios and identify signals worth acting on.

Key use cases include:

- Clustering portfolio performance

- Surfacing emerging risk factors

- Ranking opportunities by growth readiness

- Mapping competitor positioning

- Watching trends in industry activity and deal flow

Daloopa’s API also supports integration with custom analytics stacks, making it a flexible engine for strategic intelligence. With AI-powered financial analysis software, Daloopa empowers corporate development departments to surface risk factors and spot emerging growth patterns faster than traditional methods allow.

Stay Ahead of the Deal, Not Behind the Data

In corporate finance, every delay costs more than time—it costs opportunity. Corporate development departments can use Daloopa to turn data into a competitive edge. By automating data collection, eliminating manual errors, and syncing seamlessly with your existing workflows, Daloopa frees your team to focus on the high-value work that moves deals forward.

Whether you’re screening acquisition targets, building board decks, or pressure-testing a valuation model, Daloopa delivers the clarity and speed you need to act before anyone else even sees it coming.

Stop waiting for the numbers. Start leading with them. Book a demo with Daloopa today and see how your team performs when the data finally keeps up.