A single error in your Excel model can cost millions in private equity. Yet, the best analysts don’t simply crunch numbers—they anticipate risks, structure deals strategically, and use Excel as a precision instrument to drive decision-making. This guide explains building and using private equity models in Excel, helping you construct robust models that not only forecast returns but also empower you to confidently evaluate investment opportunities, all while saving time and reducing manual errors.

By mastering these private equity modeling techniques, you sharpen your competitive edge and increase your influence as a decision-maker in high-stakes finance.

Key Takeaways

- Precision and Efficiency: Excel-based models are essential tools for evaluating private equity investments and structuring transactions.

- Decision-Centric Approach: Strong Excel financial models help spot overpriced deals, mitigate risks, and optimize capital allocation.

- Career Catalyst: Advanced modeling skills unlock new career opportunities in investment banking, private equity, and corporate finance.

Fundamentals of Financial Modeling

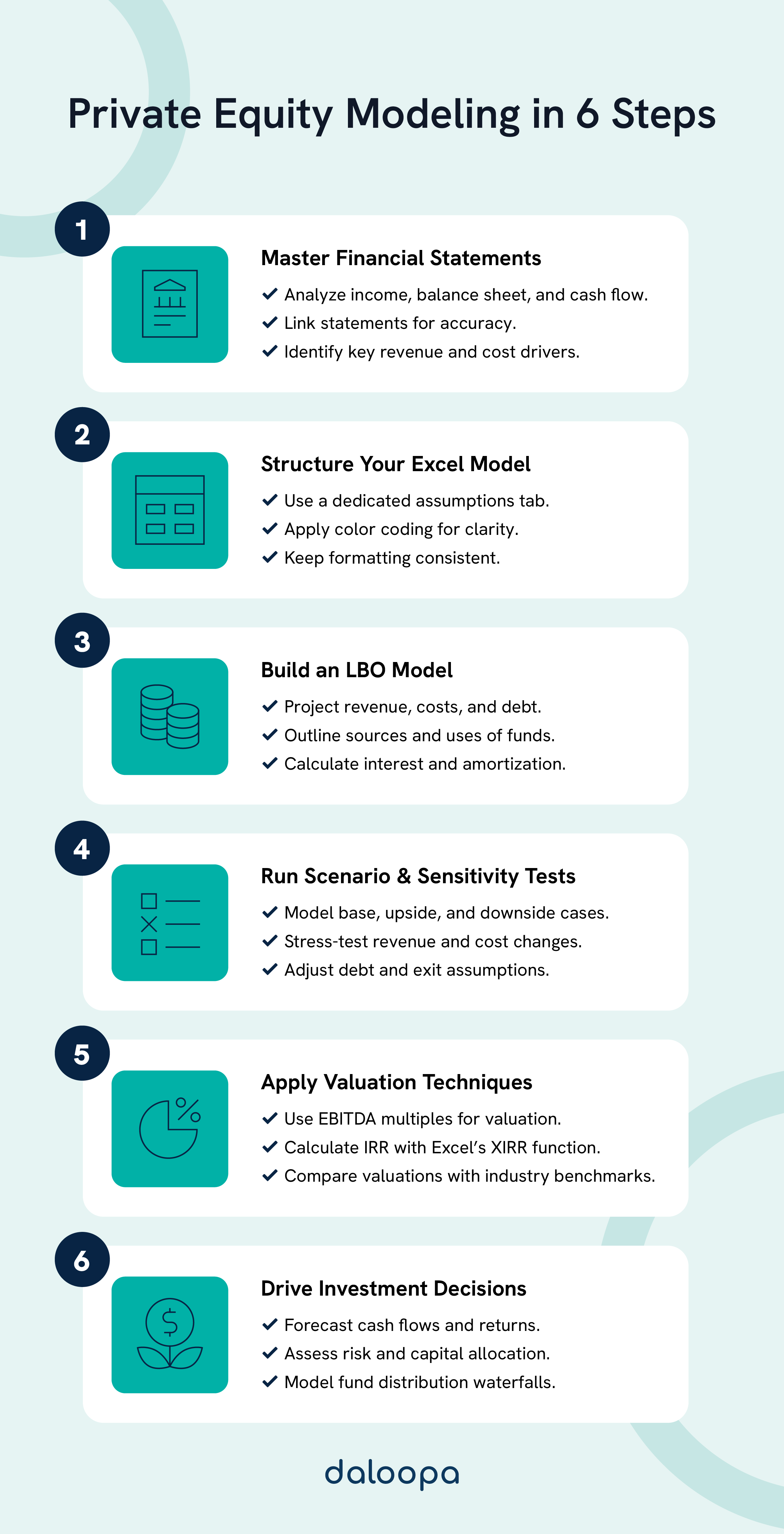

A well-built financial model provides a structured approach to analyzing a company’s performance through its key financial statements. These foundational elements serve as the backbone for complex private equity analysis and investment decision-making. Building and using private equity models in Excel is essential for accurately forecasting financial performance and assessing investment opportunities.

Income Statement Analysis

The income statement is a primary tool for evaluating revenue trends, cost structures, and profitability. Understanding key financial drivers helps analysts determine a company’s efficiency and potential growth trajectory.

Essential elements to model include:

- Revenue Breakdown: Segment revenues by product line, region, or customer type. For example, if a company generates $10 million in EBITDA with an 8x multiple, its estimated enterprise value is $80 million.

- Cost Structure: Model the cost of goods sold (COGS) and operating expenses accurately. Differentiate between fixed and variable costs to gauge operational leverage.

- Profitability Metrics: Include EBITDA calculations, operating margins, and net income to assess performance trends.

Projecting future performance requires precise modeling of each revenue and cost component. Analysts also factor in cyclical industry trends, competitive positioning, and market conditions to enhance forecast accuracy.

Balance Sheet and Cash Flow Statements

The balance sheet provides a snapshot of a company’s assets, liabilities, and equity structure. Investors and analysts assess financial stability, working capital efficiency, and capital investment needs.

Key components include:

- Asset and Liability Dynamics: Model current assets (like receivables and inventory) and liabilities (such as payables and debt) to assess working capital efficiency.

- Capital Structure: Document debt schedules, equity balances, and other financing components that impact future cash flows.

- Operating Activities: Project how daily operations generate cash.

- Investing and Financing: Model capital expenditures, debt repayments, and financing activities that affect liquidity.

- Stress-Testing: Run scenarios to determine how changes in working capital impact cash flow and debt servicing capacity.

Building and using private equity models in Excel requires seamless integration of these financial statements to ensure accurate forecasting and valuation. Effective linking of these statements ensures your model reflects the true economic value of the company.

Building Private Equity Models in Excel

Private equity models demand a structured framework and meticulous detail. Excel’s power lies in its ability to translate business realities into quantitative frameworks that guide investment decisions.

Decision-Centric Modeling

When you build a model, think of it as a decision-making tool rather than just a number-crunching exercise. A robust model helps you quickly answer critical questions:

- Is the acquisition priced right?

- What risks could erode returns?

- How does a slight change in revenue growth affect your internal rate of return (IRR)?

Excel Templates and Best Practices

A well-organized Excel template improves accuracy and efficiency. The most effective Excel financial models are structured into clearly defined sections for inputs, calculations, and outputs.

Best practices include:

- Dedicated Assumptions Tab: Consolidate key inputs like revenue growth, margins, and debt terms.

- Color-Coding: Use blue for inputs, black for formulas, and green for inter-sheet links to make the model easy to audit.

- Standardized Formatting: Keep decimal places, currency formats, and cell styles consistent throughout the model.

Using keyboard shortcuts and structured formulas enhances model-building speed while minimizing errors.

Simple LBO Model Construction

A leveraged buyout (LBO) model begins with historical financial statements and projects future performance using a combination of company-specific and industry-wide assumptions. The model typically includes:

- Historical Financials: Use past income statements, balance sheets, and cash flow statements as the foundation.

- Projection Assumptions: Estimate revenue growth, cost efficiencies, and capital expenditures based on historical trends and industry benchmarks.

- Debt Structure: Model different layers of debt—senior secured loans, mezzanine financing—and include interest and amortization schedules.

- Sources and Uses Table: Clearly outline how the acquisition is financed (e.g., debt, equity, seller financing).

Real-World Example: Blackstone’s Hilton Deal

Consider Blackstone’s $26-billion LBO of Hilton Hotels. Blackstone financed about 78% of the deal with debt. By modeling revenue, expenses, and debt repayments under various scenarios, analysts demonstrated that even minor improvements in Hilton’s operational efficiency could dramatically boost IRR—a lesson that continues to influence private equity modeling today.

Using a simple LBO model, you can calculate key metrics such as:

- IRR: The discount rate that sets the net present value (NPV) of cash flows to zero.

- MOIC (Multiple on Invested Capital): A measure of how many times the initial investment is returned.

Advanced Private Equity Modeling Techniques

As you advance, you can incorporate more sophisticated private equity modeling techniques into your Excel models to capture risk and return nuances.

Scenario Modeling and Sensitivity Analysis

Imagine you’re modeling a buyout deal where revenue growth varies significantly:

- Base Case: Revenue grows at 5% annually.

- Upside Case: Revenue grows at 10%, boosting IRR substantially.

- Downside Case: Revenue stagnates or falls, reducing returns to single digits.

Scenario modeling prepares you for every possibility. Sensitivity analysis then quantifies the impact of key variables (e.g., exit multiples, margin compression) on your model’s outputs.

Key variables stress-tested include:

- Revenue Growth Rates

- Exit Multiples

- Operating Margins

- Debt Repayment Schedules

Valuation Techniques: EBITDA Multiples and IRR

Private equity valuation often hinges on EBITDA multiples and IRR calculations.

EBITDA Multiples

By applying an industry-specific multiple to a company’s projected EBITDA, you can estimate its enterprise value. For instance, if a company’s EBITDA is $10 million and the industry multiple is 8x, its estimated enterprise value is $80 million. Even small changes in the multiple can significantly affect the valuation.

IRR Calculation

The internal rate of return (IRR) measures the profitability of an investment. Use Excel’s XIRR function to calculate IRR based on irregular cash flows. An attractive LBO deal might target an IRR between 20-25%, though real-world deals like Blackstone’s Hilton have achieved much higher returns when market conditions favor the buyer.

Using Private Equity Models for Decision-Making

Excel models are not merely academic exercises—they drive real decisions in investment banking and private equity.

Investment Analysis and Return Calculations

Your model should provide clear metrics:

- Cash Flow Forecasts: Assess capital efficiency and debt servicing capability.

- IRR and MOIC: Determine whether an investment meets your return thresholds.

- Market-Based Valuations: Compare your outputs to industry benchmarks to gauge deal attractiveness.

Distribution Waterfall and Fund Management

For fund managers, modeling how profits are distributed between general partners (GPs) and limited partners (LPs) is critical. The waterfall structure ensures that:

- LPs receive a preferred return before GPs share in the profits.

- Catch-up provisions and carried interest are accurately modeled.

Excel automates these calculations, reducing errors and ensuring that investor payouts follow the agreed structure.

Developing Expertise in Private Equity Modeling

Building private equity modeling expertise takes time and hands-on practice. Analysts should start with basic financial projections before progressing to LBO modeling and scenario analysis.

Key practice areas include:

- Income and Balance Sheet Forecasting

- Debt Structuring and Capital Allocation

- Sensitivity and Scenario Analysis

- Valuation Techniques and Exit Strategy Modeling

Peer review enhances modeling accuracy, as collaborating with colleagues helps identify gaps and refine assumptions.

Mastering building and using private equity models in Excel is essential for accurately evaluating investments, structuring deals, and optimizing returns. By consistently refining your approach, you develop the ability to anticipate risks and create more reliable Excel financial models.

With extensive practice in building and using private equity models in Excel, analysts gain a strategic advantage, improving decision-making and maximizing value in high-stakes transactions.

Ready to Elevate Your Financial Modeling?

Excel remains the cornerstone of private equity analysis—but even the best analysts can benefit from smarter data integration and automated updates. Building and using private equity models in Excel effectively requires accuracy, efficiency, and real-time data to drive better investment decisions.

Daloopa’s AI-driven platform transforms how you build and update Excel financial models. By automating data extraction and providing real-time, auditable data sheets, Daloopa enables you to focus on strategic analysis rather than manual “monkey work.”

With Daloopa, you can:

- Cut down ramp-up time: Access comprehensive historical data and KPIs from thousands of companies.

- Update models faster during earnings season: Enjoy one-click data updates that eliminate manual errors.

- Gain deeper insights: Verify every data point with direct links to original filings, ensuring complete transparency.

Visit Daloopa to request a demo and discover how you can supercharge your Excel financial models.