How many hours have you wasted wrestling with endless spreadsheets—only to find that your financial model still doesn’t capture the insights you need? If you’ve ever felt overwhelmed by the manual effort of building a reliable financial model from scratch, you’re not alone.

In today’s fast-paced business landscape, efficient financial planning is crucial. Pre-built templates offer a smart, time-saving alternative that eliminates repetitive manual work and ensures accuracy, consistency, and a deeper understanding of your business metrics.

Free financial model templates empower entrepreneurs and finance professionals to hit the ground running. They come pre-loaded with sophisticated formulas, automated calculations, and clear documentation, so you can focus on what matters most: making informed decisions that drive growth.

Key Takeaways

- Pre-built financial model templates eliminate hours of manual spreadsheet setup, ensuring that your models are accurate and efficient.

- Excel financial model templates are flexible and can be tailored to your unique business requirements—from budgeting and forecasting to complex valuation.

- With step-by-step guides and integrated metrics, these best free financial modeling templates help you identify trends, set targets, and plan for the future.

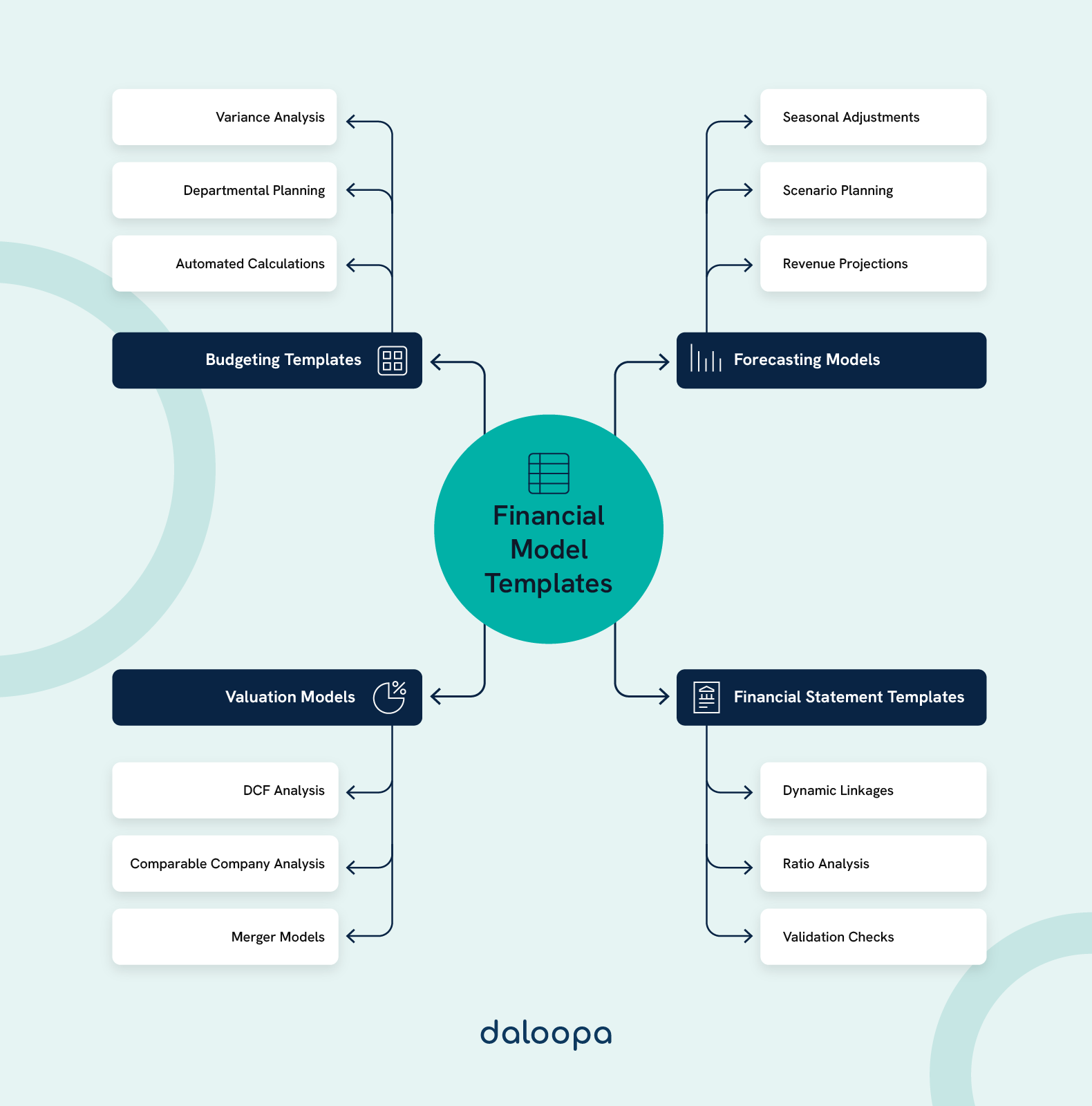

Top Categories of Financial Model Templates

Top financial model templates for free download transform complex business planning into a structured process, all neatly organized in Excel workbooks. They automate calculations, standardize reporting, and empower you to take charge of your financial future.

Budgeting Templates

Budgeting is the cornerstone of sound financial planning. Excel financial model templates help you forecast revenue, track expenses, and accurately manage cash flows. For instance, imagine a startup that used the best free financial modeling template to track monthly operational costs—automatically comparing actual figures against forecasts and highlighting variances instantly.

Key features of effective budgeting templates include:

- Built-in Variance Analysis: Compare actual versus projected figures in real-time.

- Departmental Planning: Separate worksheets for different business segments, such as marketing, R&D, and operations.

- Automated Calculations: Pre-programmed formulas for percentage changes, running totals, and more.

By using these top financial modeling templates, you maintain fiscal discipline and free up time to strategize for growth.

Forecasting Models

Financial forecasting templates help businesses anticipate future performance by merging historical data with predictive assumptions. They often include features for adjusting for seasonality and trend analysis—making it easier to project sales and revenues accurately.

Consider a retail business that uses Excel financial model templates to project inventory needs during peak seasons. With built-in scenario planning, the model automatically adjusts for unexpected market trends, ensuring you are always one step ahead.

Essential aspects of forecasting models include:

- Seasonal Adjustments: Automated modifications for seasonal fluctuations.

- Scenario Planning: Tools to simulate different market conditions and plan accordingly.

- Revenue Projections: Integration of market size estimates and customer acquisition data.

These models provide the clarity needed to secure funding, avoid cash flow crises, and optimize operational performance.

For forecasting models, head over to Microsoft Office Templates. Their free Excel template downloads include robust forecasting tools with built-in seasonal and trend analysis.

Financial Statement Templates

A well-structured financial model interconnects your income, balance, and cash flow statements. Financial statement templates help you link these documents dynamically, ensuring that any change in one area automatically updates the others.

For example, adjusting the revenue growth rate in your income statement automatically recalibrates your cash flow projections and balance sheet balances—giving you a holistic view of your company’s financial health.

These top financial model templates for free download typically offer:

- Dynamic Linkages: Automated interconnections between income, balance sheet, and cash flow statements.

- Ratio Analysis Worksheets: Tools to calculate critical metrics like ROI, debt-to-equity, and working capital turnover.

- Validation Checks: Built-in error alerts to maintain accounting accuracy.

This interconnected approach strengthens your financial reporting and helps you make more data-driven decisions.

For financial statement templates, Template.net provides a selection of professionally designed, free Excel template downloads that ensure all financial statements work together seamlessly.

Valuation Models

Valuation templates are vital for assessing your business’s or potential investments’ worth. They include models such as Discounted Cash Flow (DCF), comparable company analysis, and merger models.

Imagine a SaaS startup that refined its valuation using a DCF template, enabling it to secure a $2M funding round by presenting confident financial projections. These templates often incorporate:

- Discounted Cash Flow (DCF) Analysis: Estimating company value based on future cash flows.

- Comparable Company Analysis: Evaluating valuation multiples like EV/EBITDA and P/E ratios.

- Merger Models: Analyzing potential synergies and acquisition scenarios.

Using these valuation models, you can present compelling data to investors and stakeholders, enhancing credibility and growth potential.

Download free valuation model templates from Daloopa to accurately assess your business value. By creating a free account at Daloopa, you can download templates that include DCF analysis, comparable company evaluations, and merger scenario tools.

Popular Free Financial Model Templates

The best free financial modeling templates streamline complex planning tasks while maintaining professional standards. These top financial model templates for free download come pre-built with essential formulas and are designed for instant use—saving you the headache of extensive manual setup.

Startup Financial Model Template

Explicitly designed for emerging businesses, this template helps you forecast financial performance over a 3–5 year horizon. It covers revenue projections, expense tracking, and cash flow planning. For example, a tech startup might use this template to plan its burn rate, employee headcount growth, and break-even analysis—providing a visual dashboard that summarizes key metrics and funding requirements.

Key components include:

- Monthly Revenue Projections: Capture multiple income streams.

- Detailed Expense Breakdowns: Track operational and marketing costs.

- Burn Rate Analysis: Monitor cash depletion and plan accordingly.

Three-Statement Model Template

The three-statement model template integrates your income statement, balance sheet, and cash flow statement into a single dynamic workbook. The interconnectivity ensures that any change in assumptions flows seamlessly through all statements.

Features include:

- Automated Interconnections: Updates are instantly reflected across all statements.

- Working Capital and Depreciation Schedules: Simplify complex calculations.

- Ratio Analysis Dashboard: Evaluate key performance indicators with built-in checks.

For a comprehensive three-statement model, visit Eloquens for top financial model templates for free download, and streamline your financial reporting.

Discounted Cash Flow (DCF) Valuation Template

A DCF template calculates your company’s value based on projected free cash flows and discount rates. It provides sensitivity analysis tools that allow you to assess different financial scenarios. For instance, a manufacturing firm might use the DCF model to evaluate investment opportunities by simulating changes in operating margins or capital expenditures.

Key elements include:

- Free Cash Flow Forecasts: Project future cash flows accurately.

- Terminal Value Estimations: Incorporate long-term growth or exit multiples.

- Sensitivity Analysis: Adjust key assumptions to see potential impacts.

Budgeting and Forecasting Template

This monthly budgeting tool facilitates detailed revenue forecasting and expense management. It features a user-friendly layout that highlights budget discrepancies and supports quick, accurate adjustments.

Highlights include:

- Revenue Forecasting by Category: Break down income streams by product or service.

- Departmental Expense Planning: Organize costs by business unit.

- Budget vs. Actual Comparisons: Monitor financial performance with ease.

For an integrated budgeting and forecasting template, explore the offerings at TemplateLab, which provides free, professionally designed Excel models.

Investment Analysis Template

Ideal for evaluating potential investments, this template employs multiple valuation methods, including IRR and NPV. It offers risk assessment metrics and portfolio tracking dashboards, ensuring that comprehensive data back every investment decision.

Key features include:

- Return Projections: Assess potential gains under different scenarios.

- Risk Metrics: Quantify uncertainties using built-in risk assessment tools.

- Interactive Dashboards: Visualize performance and adjust assumptions quickly.

For investment analysis templates, InvestExcel provides a variety of free models specifically geared toward evaluating investments and performing risk assessments.

Step-By-Step Customization Guides

Customizing your financial model templates ensures they reflect your unique business metrics and operational realities. With these step-by-step guides, you can adapt templates to fit your strategic objectives and seamlessly integrate them into your daily workflows.

Adapting Templates to Specific Needs

Begin by defining your company’s core revenue streams and cost structures. Replace generic categories with terms that match your business segments. For example, if you operate in the SaaS industry, include specific metrics like monthly recurring revenue (MRR) and customer churn rates.

Steps to customize:

- Identify Key Inputs: List your revenue, cost, and growth drivers.

- Replace Placeholders: Update generic labels with your business-specific terminology.

- Segment Data: Create separate worksheets for different product lines or regions.

- Implement Data Validation: Use Excel’s data validation tools to reduce errors.

These customizations improve accuracy and enhance the relevance of your financial projections.

Integrating Business Metrics

Incorporate critical performance indicators that drive your business decisions. Custom columns for metrics such as customer acquisition cost, lifetime value, and churn rate add significant value to your analysis. Integrate dynamic formulas that adjust as new data is entered, ensuring your model remains current and actionable.

Essential metrics to track include:

- Revenue per Customer: Monitor profitability across different segments.

- Gross Margin Analysis: Evaluate the profitability of various product lines.

- Operating Expense Ratios: Ensure cost control measures are effective.

- Working Capital Turnover: Assess efficiency in managing short-term assets.

- Cash Conversion Cycle: Understand liquidity and operational efficiency.

Integrating these metrics empowers your team to make data-driven decisions that align with strategic business goals.

Maximizing the Use of Free Financial Model Templates

Free financial model templates offer a practical starting point for all your financial planning needs. However, their true potential is unlocked when you optimize and enhance them to suit your unique business environment.

Steps for Effective Optimization

To maximize the benefits of your templates, follow these steps:

- Verify Formulas: Ensure all built-in calculations are accurate and up-to-date.

- Update Assumptions: Regularly input current data to maintain relevance.

- Enhance Readability: Adjust formatting and color coding for better clarity.

- Document Modifications: Keep a record of changes for future reference.

- Test with Scenarios: Run test calculations to validate model responsiveness.

Optimizing your templates ensures they remain reliable and useful as your business evolves.

Tips for Enhancing Templates

Implement these best practices to boost your financial modeling further:

- Automate Data Validation: Use Excel’s tools to catch input errors automatically.

- Separate Input, Calculation, and Output Sections: This structure improves usability and reduces confusion.

- Introduce Interactive Dashboards: Create visualizations that highlight key trends and insights.

- Utilize Excel’s Advanced Tools: Leverage pivot tables, named ranges, and conditional formatting for improved analysis.

- Maintain Version Control: Track changes to ensure consistency and enable rollback if needed.

These enhancements streamline your financial planning process and free up valuable time for strategic analysis.

Ready to Upgrade Your Financial Modeling Workflow?

Take control of your financial planning by integrating free financial model templates with Daloopa’s AI-driven data automation. Whether you’re a startup, a mid-sized business, or a seasoned financial professional, Daloopa offers tailored solutions to streamline your workflow and boost your analytical power.

Request a demo today or create a free account at Daloopa and discover how you can stop the monkey work and start focusing on what truly matters—driving business growth through smarter, faster financial insights.