With the rapid pace and risk involved in hedge fund management, having the right tools can make all the difference. Hedge fund reporting software plays a crucial role in management by providing accurate and timely data essential for decision-making. Selecting the best software can significantly enhance performance predictability and streamline operations, leading to better fund management and increased investor confidence.

This analysis explores some features that define excellent hedge fund reporting software, the criteria to identify the most appropriate one, and the features and benefits of our hedge fund reporting software. Here are some key features to look for when choosing a hedge fund reporting software.

Key Features of The Best Hedge Fund Reporting Software

When choosing a hedge fund reporting software, certain key features stand out as quintessential. From real-time data analysis to seamless integration with accounting systems, these features ensure that the software meets the complex needs of hedge funds.

Comprehensive suite of reporting tools

A comprehensive suite of reporting tools lets us generate detailed reports on fund performance, risk metrics, and portfolio holdings. Features like customizable templates, data visualization tools, and automated processes constitute a comprehensive hedge fund management system.

Benefits:

- Aids in regulatory compliance

- Enhances transparency with stakeholders

- Advanced filters and search options provided by these tools make it easier to access specific data points for decision-making

Real-time data analysis

Real-time data analysis is crucial for capturing market movements and making informed decisions quickly. The best software offers live updates on market data, fund performance, and risk exposure.

Benefits:

- Enables high-frequency trading

- Allows quick reaction to market changes

- Optimize investment strategies against rapid market movements

- Helps gain a competitive edge in fast-paced markets

Multi-asset class support

A robust hedge fund reporting software supports multiple asset classes including equities, bonds, derivatives, and alternative investments. This capability allows us to manage diverse investment portfolios from a single platform.

Benefits:

- Ensures comprehensive performance tracking and risk assessment across different asset types

- Simplifies portfolio management by consolidating all asset data in one accessible location

Portfolio management capabilities

A hedge fund is highly reliant on statistical data and research. Effective portfolio management capabilities like rebalancing tools, performance attribution, and scenario analysis help better understand these data.

Benefits:

- Optimizes portfolio performance by letting us adjust asset allocations based on market conditions and investment goals

- Helps us understand the drivers of returns

- Helps identify the impact of different investments on overall portfolio performance

Risk management functionalities

Risk management functionalities are critical for identifying and mitigating potential risks. Popular techniques include Value at Risk (VaR) calculations, stress testing, and scenario analysis.

Benefits:

- Helps evaluate the potential impact of adverse market conditions on our portfolios

- Ensures that we can adopt proactive strategies to protect our investments

- Helps meet regulatory requirements

Cash flow analysis tools

A cash flow analysis tool tracks the inflow and outflow of cash, providing a clear picture of liquidity. This is essential for maintaining sufficient cash reserves and managing capital efficiently.

Benefits:

- Helps channel resources efficiently

- Helps ensure that funds are properly allocated and ready to meet obligations such as redemptions, margin calls, and operating expenses.

Automation and streamlined operation

Automation and streamlined operations reduce manual processes and enhance efficiency. Tasks like trade execution, data reconciliation, and report generation can be conveniently automated.

Benefits:

- Minimizes human error

- Frees up valuable time for more strategic activities

- Ensures that tasks are completed promptly and accurately, contributing to overall operational efficiency

Integration with accounting software

Maintaining accounts is a significant part of the finances involved in hedge funds. The best hedge fund reporting software is ideally compatible with popular accounting tools. This integration facilitates the automatic synchronization of transaction data, reducing the need for manual entry and minimizing errors.

Benefits:

- Improved accuracy and timeliness.

- Facilitates streamlined audits

- Simplifies regulatory compliance

- Supports efficient financial reporting and analysis.

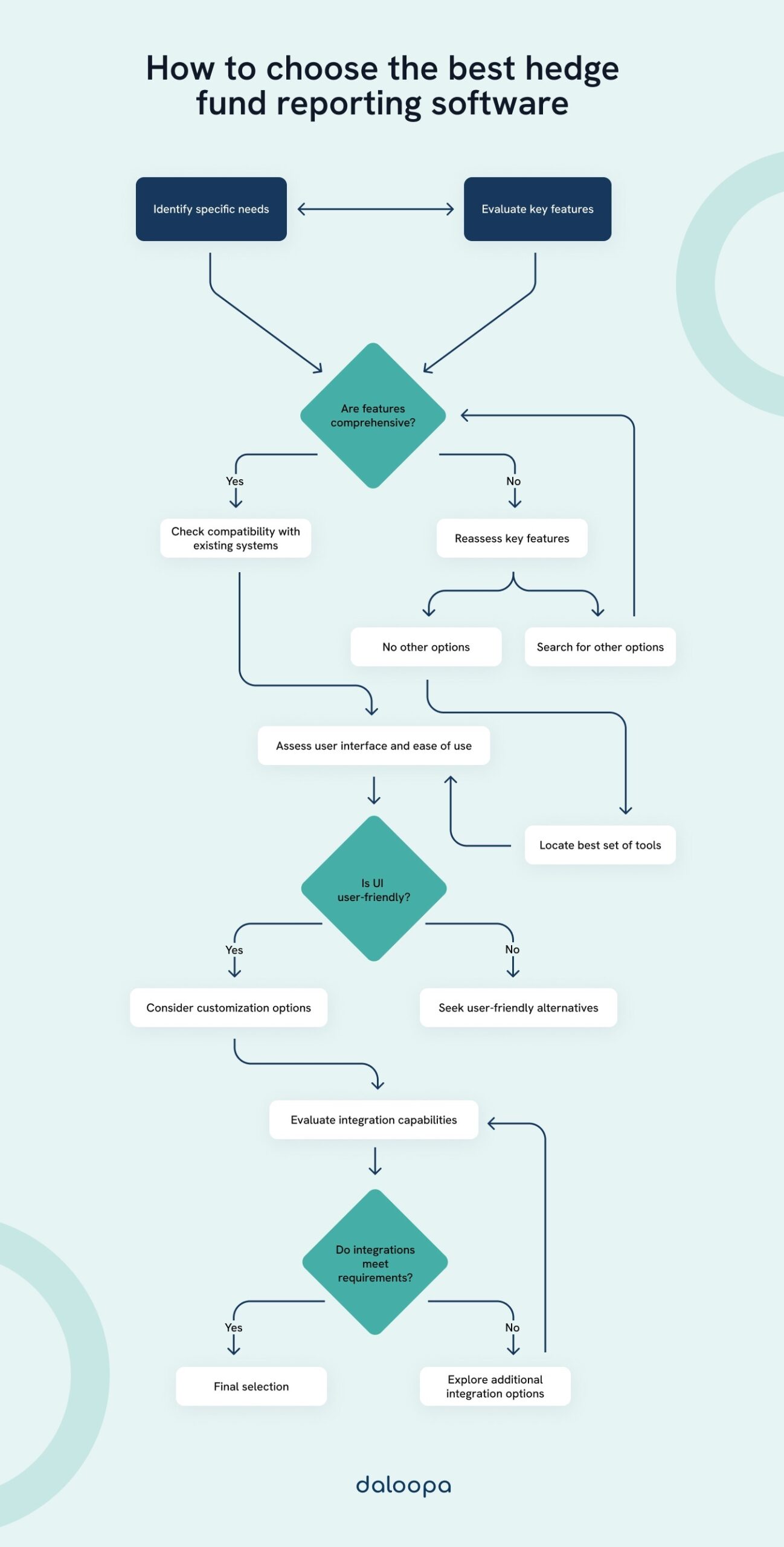

How to select the best hedge fund reporting software?

Choosing the right hedge fund reporting software involves evaluating features that meet the specific operational needs of the fund, ensuring compatibility with existing systems, and assessing factors like ease of use, customization, and integration capabilities.

Step 1: Identify the Specific Needs of the Hedge Fund

The first step in selecting hedge fund reporting software is understanding the fund’s unique requirements. An interview can be conducted to understand the specific reporting demands, whether it’s generating detailed performance reports, managing risk analysis, or facilitating compliance with regulatory standards.

It must offer features like real-time analytics, portfolio tracking, and automated report generation to enhance efficiency and decision-making. The requirements can be documented following the interview process.

Step 2: Check for Compatibility with Existing Management Software

Ensuring that new reporting software seamlessly integrates with our current management tools is crucial. Compatibility reduces the risk of data inconsistencies and minimizes the time spent transferring information between systems.

Software that offers APIs or fits within our current tech stack will save us from extensive reconfiguration. It is also important to check for any potential integration issues with third-party systems like CRM tools or accounting software.

Step 3: Test for User-friendliness and Ease of Use

A user-friendly interface is vital for ensuring that your team can quickly adapt to the new software. The learning curve should be minimal, with intuitive navigation and a clean design that aids in productivity.

Software that includes comprehensive training resources, customer support, and regular updates is beneficial.

Step 4: Customize Based on Preference

Based on the gathered requirements, we design a bespoke reporting solution. Customizability is a key factor in making reporting software versatile for various hedge fund operations. Customizability lets you tailor your reports to specific metrics and formats helping present data in the most meaningful way for stakeholders.

Software flexibility allows us to create dashboards, set KPIs, and modify workflows to align with our fund’s strategy.

Better compliance with regulatory requirements

Daloopa’s automated reporting solutions streamline the reporting process. These solutions save time and reduce errors, ensuring that analysts can focus on strategic decision-making rather than manual data entry.

For those seeking in-depth insights, our hedge fund research database is a valuable resource. It offers detailed analysis and information tailored to meet specific investment needs, aiding in more informed decision-making.

By leveraging these tools, hedge fund analysts can optimize their portfolios and enhance decision-making processes. Reliable and comprehensive reporting software is essential for achieving these goals.