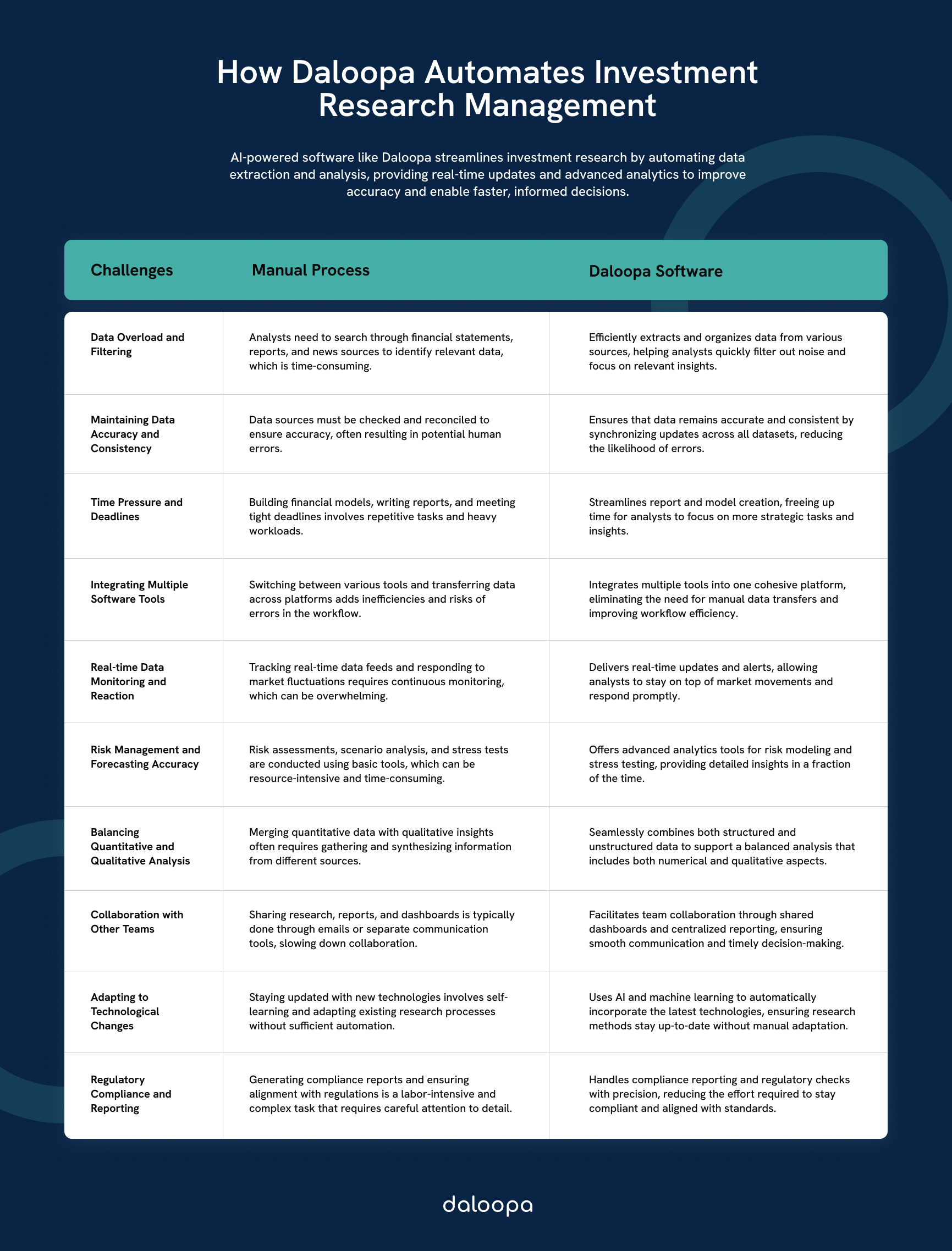

Investment research management requires precise and efficient tools to navigate the complexities of financial markets. The right software streamlines the process by offering comprehensive data analysis, risk management, and dynamic reporting. By using these digital tools, we can improve our financial planning and investment management strategies, ensuring informed decision-making and better outcomes.

Quality investment research management software also helps create accurate risk assessments, reducing potential losses and identifying profit opportunities. It saves time by automating data tasks, allowing more focus on strategy and thereby increasing productivity.

Choosing the right software is key to working efficiently and promoting accuracy in investment research. We need robust platforms that offer real-time data, advanced analytics, and seamless integration with our existing systems to remain competitive.

Key Takeaways

- Research management software boosts accuracy and efficiency.

- Digital tools improve financial planning and risk management.

- Selecting the right software is essential for optimal results.

Key Features of Investment Research Management Software

Investment research management software offers a range of powerful features designed to streamline the investment process, from data analysis to decision-making. Below are some of the key features that make these platforms a necessity for investment professionals.

Advanced Analytics and Decision-Making Tools

Advanced analytics and decision-making tools use algorithms and machine learning to enhance our investment strategies. Important features include scenario analysis, predictive modeling, and portfolio optimization tools.

Bloomberg Terminal, for instance, offers the Black-Scholes options pricing model which allows investors to estimate the fair market value of options contracts based on factors such as volatility, time to expiration, and interest rates.

These tools help us to identify patterns, evaluate the potential impact of various investment decisions, and simulate different market conditions. By using these sophisticated analytics, we can make more nuanced and data-driven decisions, leading to better investment outcomes.

For instance, asset management firms are using data analytics to fine-tune their clients’ information and characteristics resulting in a 5 to 30% increase in revenues.

Real-Time Data Access

Real-time data access is important in investment research management. It allows us to make informed decisions quickly based on the most current information available. Features such as live market feeds, real-time updates on stock prices, and instant data synchronization ensure that our analysis is always based on up-to-the-minute information.

This ability to react promptly to market changes can lead to significant advantages in executing timely trades and adjusting investment strategies.

Risk Management Features

Risk management features help mitigate potential losses in investment portfolios. Software solutions often include tools for stress testing, assessing value at risk (VaR), and scenario analysis.

Blackrock’s Aladdin, for instance, combines risk assessment with portfolio management. Investment banking analysts can perform scenario analyses by simulating how their portfolios would perform under different market conditions, such as a sudden interest rate increase or a market shock.

These features help us understand the potential risks associated with different investment strategies and market conditions. Regular risk assessment and alerts about potential vulnerabilities enable us to take proactive measures to protect our investments.

Historical Data Analysis

Historical data analysis offers the context needed to understand market trends and investment performance over time. We can analyze past market behaviors to predict future trends by accessing comprehensive historical data.

Integrating historical data sets into research workflows allows analysts to evaluate and optimize investment strategies by simulating how they would have performed in the past. Historical market data, such as stock prices, trading volumes, and economic indicators, can be used to back-test strategies and identify patterns or anomalies. This helps us refine models for predicting future performance. For instance, datasets like CRSP (Center for Research in Security Prices) provide essential inputs, allowing us to assess the viability of strategies in various market conditions before deploying them in real-world scenarios.

Tools that allow us to create detailed reports, visualize data using graphs and charts, and compare historical performance against benchmarks are invaluable. This feature enables us to back-test investment strategies and more accurately forecast future performance.

Team Collaboration Tools

Effective team collaboration tools within investment research management software facilitate communication and coordination among team members. Features such as shared dashboards, real-time chat, and document sharing enable us to work together seamlessly.

These collaboration tools enhance efficiency and ensure that everyone is on the same page. By consolidating information and communication within a unified platform, we can make collective decisions quickly and accurately.

In 2016, FactSet partnered with Symphony, a communication platform, to enable secure real-time messaging and file sharing among team members. Analysts can share research reports, datasets, and market insights in a secure, compliant environment. FactSet itself also offers shared dashboards, where team members can view, annotate, and collaborate on financial data and analytics in real time.

Mobile Accessibility

Mobile accessibility ensures that we can manage our investments anytime and anywhere. Investment research management software with reliable mobile applications allows us to access data, perform analysis, and make decisions on the go.

Key features typically include mobile-optimized dashboards, real-time alerts, and secure access protocols. This flexibility ensures that we never miss critical information or opportunities, even when away from our desks.

A platform like Bloomberg Anywhere ensures that financial professionals can securely access real-time market data, execute trades, and analyze portfolios from their smartphones or tablets. Analysts can remain connected to critical information even when away from their offices.

Factors to Consider When Choosing the Right Software for Research Management

The right software for research management can streamline data analysis, provide customizable reporting tools, integrate seamlessly with existing systems, and ensure data accuracy.

Automated Data Extraction and Analysis

Automated data extraction and analysis tools are essential for managing large volumes of financial data effectively. These tools can automatically pull data from multiple sources, such as databases, APIs, and web pages, reducing the need for manual data entry.

They can streamline processes like scraping SEC filings (such as 10-K and 10-Q reports) for sentiment analysis, reducing the time spent on manual tasks. For instance, NLP algorithms can quickly analyze documents for market sentiment, while data aggregation software integrates financial information from multiple sources, improving data reliability.

By automating this process, we can dedicate more time to analyzing data trends and making informed investment decisions. Moreover, automation minimizes human error, thereby improving the reliability of the data we use.

Advanced software solutions, such as machine learning algorithms, can also identify patterns and provide actionable insights, further enhancing our research capabilities.

Customizable Dashboards and Reports

Customizable dashboards and reports allow us to visualize data in ways that best suit our needs.

With these features, we can configure dashboards to display key performance indicators (KPIs), metrics, and other critical data points. This flexibility makes it easier to monitor the performance of our investments in real time. Additionally, customizable reports can be tailored to meet specific requirements, providing summaries and detailed analyses as needed.

The ability to adapt reporting structures ensures that the software grows with us, meeting evolving business needs and analytical capabilities.

Integration with Existing Financial Planning Tools

Seamless integration with existing financial planning tools is crucial for a cohesive research management system.

Software that can sync with accounting software, portfolio management systems, and other financial tools ensures a smoother workflow. This integration reduces the need for duplicative data entry and helps maintain consistency across different platforms. When our systems are interconnected, we can achieve a unified view of our financial data, enhancing our decision-making process.

Enhanced Data Accuracy and Reliability

Ensuring data accuracy and reliability is a cornerstone of effective research management.

High-quality software solutions come with robust validation mechanisms to verify data integrity. These features help us minimize errors and maintain the accuracy of the information that we depend on for making crucial investment decisions. Regular updates and maintenance schedules provided by reputable software vendors further enhance data reliability.

This focus on accuracy allows us to trust our data, enabling more precise analyses and better-aligned investment strategies.

Digital Tools for Financial Planning and Investment Management

Leveraging digital tools in financial planning and investment management can increase efficiency and provide tailored strategies. These tools range from data aggregation platforms to AI-driven investment tools, streamlining decision-making processes and personalizing financial advice.

Financial Data Aggregation Platforms

Our financial data aggregation platforms bring all your financial information into one place. They connect to multiple accounts—banks, brokerages, and credit cards—providing a comprehensive view of your financial status.

This consolidation helps in tracking spending, managing budgets, and identifying investment opportunities. For instance, some platforms use secure APIs to pull data in real time, offering up-to-date insights.

Investment Strategy Development Tools

We utilize several investment strategy development tools to craft personalized investment plans. These tools analyze historical data, market trends, and risk indicators to provide diverse investment options.

For example, robo-advisors use algorithms to assess a client’s risk tolerance and financial goals, developing a customized investment portfolio. These tools also re-balance portfolios automatically to maintain the desired asset allocation.

Artificial Intelligence and Machine Learning

Artificial intelligence and machine learning help us to better predict market trends and identify investment opportunities. These technologies analyze vast amounts of data at high speed, finding patterns that human analysts might miss.

For instance, machine learning models can forecast stock prices based on historical data and market sentiment. AI also supports fraud detection and improves the accuracy of financial forecasts. One of the largest banks in the world, HSBC, has used Ayasdi’s Artificial Intelligence solution to prevent possible cases of fraud and money laundering. Ayasdi was able to achieve this by studying patterns and detecting anomalies.

Finding the Right Investment Research Management Software

Choosing the right investment research management software helps us remain competitive in today’s fast-paced financial landscape. From advanced analytics to real-time data access and risk management tools, the right solution will streamline your work and ensure informed decision-making. With features like mobile accessibility and team collaboration, it is easier than ever to manage complex portfolios and stay ahead of market shifts.

Learn how Daloopa can transform your investment research process by reaching out today. We offer the world’s first AI-powered fundamental and historical financial data service, specifically designed for equity analysts. With hundreds of AI algorithms, we do the heavy lifting, giving you more time to focus on insights and strategy.