Preparing for hedge fund case study interviews is a multifaceted process requiring proficiency in financial modeling and understanding hedge fund-specific strategies. These interviews challenge candidates to analyze investments, craft robust models, and articulate compelling investment ideas. Mastering hedge fund case study interview prep makes you a strong contender for top hedge fund roles.

Hedge funds utilize proprietary models and sophisticated analyses to stay ahead. This hedge fund case study interview guide provides insights into meeting hedge fund managers’ expectations and aligning your approach with their philosophies.

Key Takeaways

- Case studies evaluate analytical, modeling, and investment decision-making skills.

- Strong pitches are backed by detailed research and a unique thesis.

- Tailoring your approach to the fund’s philosophy is critical to success.

The Role of Hedge Fund Case Study Interviews

Hedge fund case study interviews evaluate candidates’ ability to make informed investment decisions.

Typically, candidates analyze an investment opportunity and recommend buying, selling, or holding. Interviewers look for:

- Advanced financial analysis

- Problem-solving skills

- Industry expertise

- Clear communication

Interviews often involve strict time limits and incomplete information, replicating the fast-paced hedge fund environment. Candidates excel by:

- Identifying key value drivers swiftly

- Formulating creative investment theses

- Constructing concise, accurate models

- Presenting ideas confidently

Case studies are customized to align with the fund’s strategy, covering scenarios like long/short equity, derivatives, or distressed assets. Ultimately, they assess your ability to generate alpha and contribute to the fund’s success.

Why Hedge Fund Case Studies Matter

Case studies are more than technical evaluations; they also provide insights into your thoughts. Hedge funds look for candidates who bring unique perspectives, challenge conventional ideas, and identify opportunities others may overlook.

Strong performance in these interviews reflects technical ability and an aptitude for independent thought and creative problem-solving. By excelling in a case study, you demonstrate your potential to thrive in high-pressure, dynamic environments that require swift yet strategic decision-making.

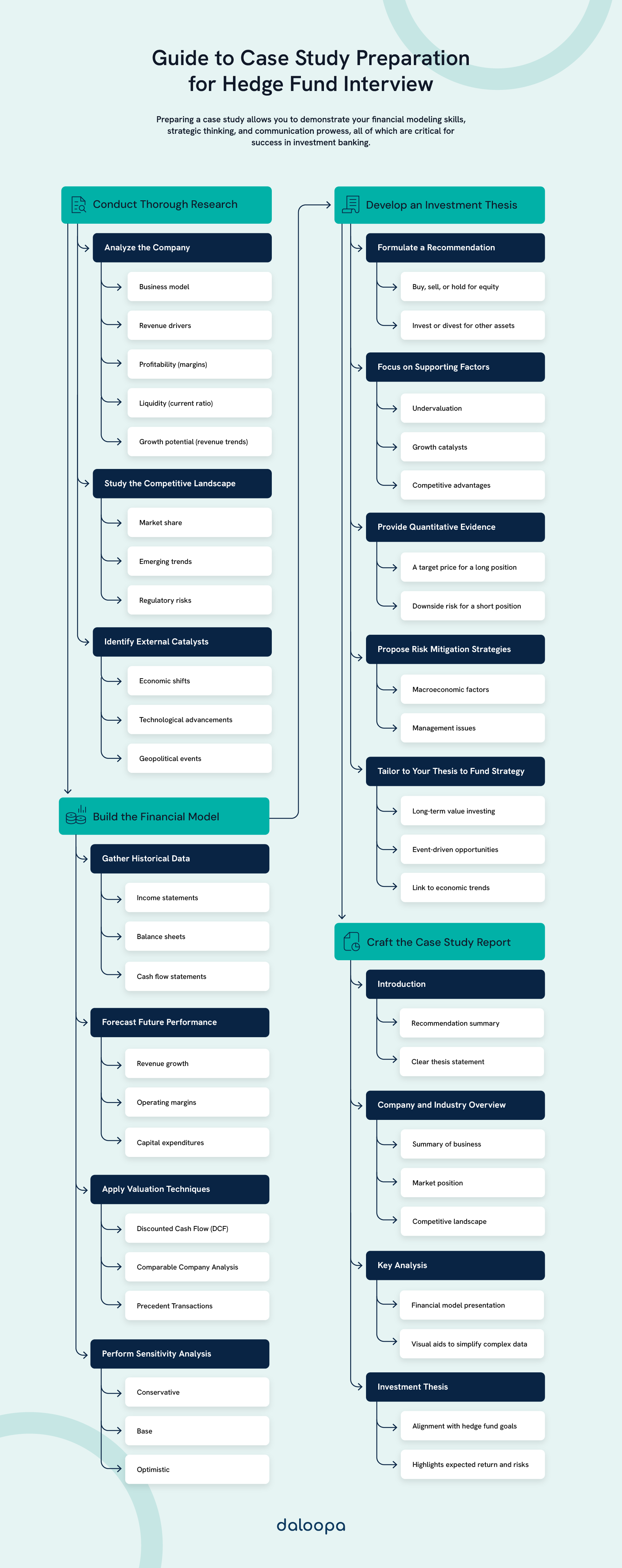

Structuring a Long or Short Investment Pitch

An effective investment pitch requires strategic structuring and alignment with the fund’s focus. Let’s break down the essential components.

Key Elements of a Pitch

Start with a sharp thesis statement summarizing your idea in 1-2 sentences. Add a brief company overview outlining metrics and market position.

Your investment rationale should include 3-5 arguments backed by quantitative data and qualitative analysis. Address risks and mitigation strategies.

Incorporate a valuation section featuring multiple methodologies, such as DCF and comparables. Include price targets and expected returns. For short positions, focus on catalysts likely to reduce the stock’s value, like competitive threats or financial irregularities.

Aligning with Fund Strategies

Research the fund’s style—value, growth, event-driven, etc.—and adapt your pitch accordingly. For long-term strategies, emphasize durable advantages; for short-term, highlight near-term catalysts.

Explain how your idea fits within the fund’s risk and sector focus. Prepare for potential questions on industry dynamics and what could challenge your thesis.

Pro Tips for Structuring Pitches

- Make Your Arguments Bulletproof: Use data and examples to back every claim. For example, if your pitch hinges on a company’s expansion potential, include market size projections, competitor analysis, and evidence of prior execution capability.

- Keep Visual Aids Clear and Concise: Charts, tables, or models are powerful but must be self-explanatory. Review your visuals for clarity, ensuring they add value without cluttering the presentation.

- Create Multiple Exit Scenarios: Articulate your primary thesis and alternative scenarios. For instance, how might the investment perform under adverse market conditions? This demonstrates flexibility and foresight.

Conducting Rigorous Research

Thorough research is the cornerstone of a compelling investment thesis. Here’s how to dive deep into companies and industries.

Analyzing Companies and Industries

Examining the company’s business model, market positioning, and growth strategy. Use investor presentations, industry reports, and regulatory filings to uncover insights. Study competitors to understand relative advantages.

Stay updated on news and trends that could impact the company or sector. Uncover customer sentiment and market perception through social media or niche forums.

Leveraging Financial Reports

Analyze financial statements—income, balance sheet, and cash flow—focusing on profitability, liquidity, and stability. Dig into SEC filings for detailed disclosures.

Use databases to benchmark performance and review equity research reports for industry insights. Examine key performance indicators to assess operational strength and growth potential.

Expanding Research Depth

Satellite imagery, web scraping, and even app usage trends provide unique angles for your analysis. For example, tracking foot traffic outside a retailer’s locations through alternative datasets might reveal discrepancies between market assumptions and reality. By integrating unconventional insights, you can bolster your investment thesis with evidence others might miss.

Investment Banking Modeling Prep & Model Example

Preparing for investment banking modeling interviews requires mastering essential concepts and techniques. Let’s explore investment banking modeling prep & model examples to equip you with the tools and knowledge needed to stand out in this competitive industry.

Key Techniques

Financial modeling starts with historical data collection from financial statements. Focus on revenue growth, margins, and working capital.

Develop projections using scenario analysis, creating base, upside, and downside cases. Ensure flexibility through dynamic inputs and incorporate valuation methods like DCF or comparables, accurately calculating WACC and terminal values.

Enhancing Your Investment Banking Models

- Use Automation Tools: Build macros or templates in Excel to streamline repetitive tasks, improving efficiency during interviews.

- Stress-Test Assumptions: Introduce variables for worst-case scenarios, such as interest rate hikes or supply chain disruptions.

- Highlight Value Drivers: Break down the metrics with the highest impact on valuation, such as customer retention or gross margin trends.

Advanced Investment Banking Modeling Techniques

Consider incorporating sensitivity analyses and Monte Carlo simulations to demonstrate risk management sophistication. Highlight your ability to model scenarios that quantify potential outcomes, strengthening your thesis.

Crafting a Differentiated Thesis

An actionable investment thesis sets you apart. Here’s how to create one.

Persuasive Arguments

Begin with a concise thesis statement emphasizing why the stock is mispriced. Highlight your unique perspective using data to support claims. For example:

- Competitive pricing advantage

- Market expansion opportunities

- Margin improvements

Link the thesis to the fund’s strategy and provide quantifiable targets.

Addressing Risks

Anticipate objections by identifying risks and mitigation strategies.

| Strengths | Weaknesses | Mitigants |

| Strong margins | High debt levels | Debt repayment plan |

| Market leadership | Cyclical demand | Product diversification |

Discuss monitoring mechanisms to adjust your approach if circumstances change.

Building a Narrative

Structure your thesis as a story, moving from the big picture to specifics. For instance, start by framing the broader market trends before narrowing down to how the target company is positioned to capitalize on them. A narrative structure helps interviewers follow your reasoning and reinforces your ability to think strategically.

Hedge Fund Case Study Interview Prep Strategies

Success in case study interviews stems from meticulous hedge fund case study interview prep and practice.

Understanding the Format

Expect multiple interview rounds, including:

- Behavioral questions

- Technical assessments

- Case study presentations

- Group discussions

Some firms assign take-home case studies, offering more time to analyze and prepare.

Practicing Mock Interviews

Mock interviews build confidence. Tips include:

- Practice with peers or mentors

- Record yourself for self-assessment

- Seek constructive feedback

Prepare concise, clear answers and align responses with the fund’s philosophy. Master explaining financial concepts in simple terms.

Demonstrating Hedge Fund Expertise

To stand out, showcase your analytical, creative, and strategic thinking.

Competitive Edge

Present a thesis backed by rigorous research, macro trends, and unique insights. Use alternative data sources or proprietary methods to uncover hidden value.

Demonstrate financial modeling mastery by discussing key assumptions and risk sensitivity. Address potential downsides with hedging strategies, showing balanced judgment.

Highlight how your thesis complements broader portfolio strategies, aligning with hedge fund practices like long/short equity or arbitrage.

Long-Term Interview Success

Prepare for post-interview follow-ups, such as additional pitches or deeper dives into your analysis. Maintain your own database of ideas and stay updated on market trends. Continuous learning and iterative improvement can keep you ahead in the competitive hedge fund landscape.

Developing an Analytical Mindset

Successful hedge fund analysts constantly refine their ability to interpret data and spot trends. Cultivate habits like reading industry white papers, listening to earnings calls, and engaging with thought leaders. These practices keep your knowledge sharp and your insights relevant.

Transform Your Hedge Fund Case Study Interview Prep with Precision Data

Simplify your hedge fund case study interview prep with Daloopa. Leverage AI-powered solutions to build precise, auditable financial models effortlessly. From real-time updates during earnings seasons to streamlined data validation linked directly to original sources, Daloopa accelerates your analysis and helps you craft winning investment theses.

Ready to excel? Use our hedge fund case study interview guide as your go-to resource. Take it further by preparing with tools trusted by top analysts worldwide. Request a demo today to see how Daloopa enhances your workflow and sets you apart.