You’ve been burned by hype stocks. Now you want a method grounded in facts, not guesses. Through close examination of metrics like earnings growth, margins, and operational advantages, fundamental analysis helps investors better grasp a company’s real financial position, not just its public perception. With the right data at your fingertips, you can move past headlines and noise, modeling financial performance at a more detailed and informed level. Still, understanding the pros and cons of fundamental analysis will help ensure you use it effectively and avoid common pitfalls.

Key Takeaways

- Fundamental analysis offers a clear structure for evaluating intrinsic value based on real financial data.

- By focusing on underlying business drivers rather than short-term market fluctuations, it offers deeper insight into the long-term potential of a business.

- The strategy prioritizes evidence over emotion, leading to better-informed investing decisions.

Historical Context and Evolution of Fundamental Analysis

- 1934: Securities Exchange Act & Standardized Disclosures

After the 1929 crash, the U.S. Congress passed the Securities Exchange Act of 1934, establishing the SEC and requiring companies to file standardized reports like 10-Qs and 10-Ks prepared in accordance with Generally Accepted Accounting Principles (GAAP). This provided investors with reliable, comparable financial data and laid the foundation for modern fundamental analysis. - 1950s–1960s: Multiples & Sector Analysis

The post-war boom saw analysts popularize the price-to-earnings (P/E) ratio as a quick way to compare valuations. Comparing P/E ratios across companies became a fundamental tool for identifying value. At the same time, sector rotation strategies emerged, reflecting the influence of economic cycles on company performance. - 1970s: Integrating Macroeconomic Data

As stagflation gripped the U.S. economy, analysts began layering inflation metrics and real interest rates into valuation models. The seminal research by Fama and French highlighted how macro factors such as market risk, size, and value characteristics could explain differences in returns, broadening the scope of fundamental analysis. - 1980s: Surge of Quantitative Models

Advances in computing allowed for the development of multi-factor models that combined financial ratios—such as P/B, EV/EBITDA, and ROE—with economic indicators. Quantitative analysis became a key part of fundamental investing, as statistical methods were used to test the predictive power of various metrics. - 1990s–2000s: Real-Time Data & Automation

With the rise of the internet and financial terminals like Bloomberg, analysts gained immediate access to streaming data, historical financials, and digital filings. Automated modeling tools further increased the speed and accuracy of fundamental analysis, enabling more timely and comprehensive evaluations.

Today, platforms such as Daloopa feed clean, auditable historical fundamentals and GAAP to non-GAAP reconciliations directly into Excel, saving you hours during earnings season. These tools are essential for efficiently applying both fundamental analysis techniques and valuation methods.

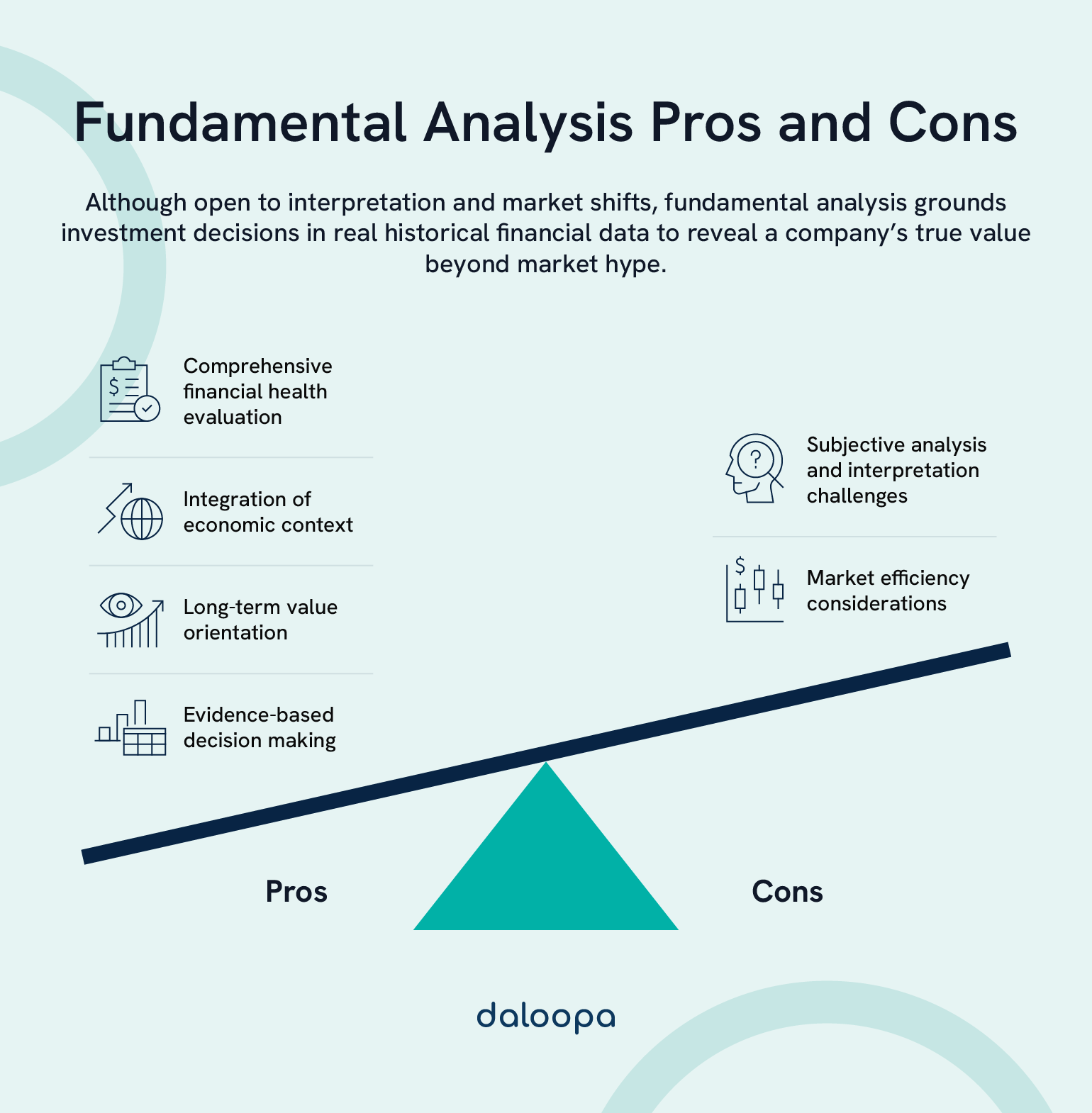

Advantages of Fundamental Analysis

Fundamental analysis equips you to look beneath price swings and evaluate the real drivers of value. When you consistently apply these methods, you stand to gain.

Comprehensive Company Evaluation

- Income Statement Dissection

You examine line items: revenue by segment, cost of goods sold (COGS), SG&A, R&D spend, and operating profit. By observing trends—accelerating revenue growth or expanding gross margins—you can infer whether a business is scaling efficiently or facing margin erosion. - Balance Sheet & Capital Structure

You evaluate debt maturities, covenant thresholds, and liquidity ratios. A conservative debt-to-equity ratio (e.g., below 1.0) often signals financial flexibility, letting the company invest through downturns without immediate refinancing risks. - Cash Flow Reality Check

Free cash flow (FCF) analysis adjusts for one-off expenses, working-capital swings, and capex requirements. Firms that consistently generate positive FCF can reward shareholders with dividends or share buybacks, or reinvest in growth.

With this granular lens, you can flag warning signs—like deteriorating working capital cycles or recurring one-time charges—before general market sentiment reacts. This is why many analysts rely on fundamental valuation methods to derive more accurate long-term value estimates, focusing on a company’s intrinsic worth rather than short-term market movements.

Long-Term Value Orientation

You gain a strategic vantage by focusing on durable competitive advantages rather than short-lived market fads. In periods when “momentum” names dominate headlines, you might find gems trading at deep discounts to true value.

By holding companies with durable moats—such as patents, network effects, or entrenched distribution channels—you can better weather cyclical downturns and benefit when sentiment rebounds. Historically, value-oriented portfolios have often outperformed growth-focused peers over long horizons, though this advantage can be cyclical. This underscores the importance of weighing the pros and cons of fundamental analysis when constructing long-term portfolio strategies.

Economic Context Integration

Blending macroeconomic analysis into your valuation process allows you to ask: Can this company preserve margins when inflation surges? How sensitive is its cost of capital to Federal Reserve rate hikes? You monitor:

- GDP Growth & Recession Risks: Before the 2008 financial crisis, housing starts and bank lending metrics signaled cracks in the system. Analysts who drilled into those data tracked systemic risks earlier than the broader market.

- Interest Rate Trajectory: When the Fed raised rates in 2023, high-growth tech names—whose valuations relied on steep discount rates—fell harder than value-oriented, cash-flow-generating businesses. You adjusted your DCF “WACC” inputs accordingly, reducing exposure to interest-rate-sensitive sectors.

- Policy & Regulation: You track how regulatory changes, like GDPR in Europe, affect tech firms’ ad revenues. Not all “growth” companies weather new compliance costs equally, so you factor rule changes into your baseline assumptions.

By aligning company-level forecasts with real-time macro indicators, you can stress-test your thesis. Whether using fundamental data analysis tools and techniques or macro overlays, clarity in assumptions matters. For instance, if GDP growth decelerates from 3% to 1%, will the firm’s organic revenue still expand? If not, your fair-value band shifts down by 10–20%.

Limitations of Fundamental Analysis

While fundamental analysis offers structure, it also carries inherent drawbacks. You must recognize these to avoid blind spots. To fully benefit, it’s crucial to weigh the pros and cons of fundamental analysis in real-world applications.

Time And Resource Intensity

Conducting high-quality fundamental research often requires:

- Hours of Financial Statement Review: You download the quarter’s 10-Q, reconcile line-items to management guidance, and model scenarios—easily 8–10 hours per company each quarter.

- Premium Data Subscriptions: Access to industry reports, sell-side consensus estimates, and ESG scores often comes with six-figure annual fees. Small teams or part-time investors may struggle to keep pace.

- Continuous Monitoring: Companies update guidance mid-quarter; new regulations emerge; geopolitical conflicts flare. If you don’t refresh your models weekly, your analysis can become outdated before you act.

These demands create a steep barrier for a retail investor juggling a day job. Unless you automate data collection via APIs or AI tools, you’ll constantly play catch-up, even with the best fundamental data analysis tools and techniques available.

Market Efficiency Considerations

In efficient markets, new information already reflects in price, leaving little upside from deep dives. Challenges include:

- Speed of Information Flow: Newswire services often disseminate earnings surprises within seconds. By the time you finish your 3-page memo, the stock might already gap up or down.

- Algorithmic Trading & Short-Term Noise: High-frequency trading algorithms react to order flow, not fundamentals. Flash crashes and “momentum” swings can override your carefully built DCF for days or weeks.

- Momentum & Sentiment Overlays: Even if a stock trades at 50% below its intrinsic value, broad market rotations (e.g., tech vs. value) can keep it depressed for extended periods. You may finally “buy” at a deep discount, only to watch the price slide lower because the entire sector is out of favor. This reality highlights a key limitation of fundamental analysis: valuation accuracy doesn’t always predict short-term market behavior.

In these situations, technical analysis can provide additional insight by focusing on price trends, momentum, and market psychology—areas where fundamental analysis is less effective.

Practical Application For Investors

When you commit to fundamental analysis, you commit to a process. Without disciplined steps, you risk analysis paralysis or emotional trading. But before fully embracing it, consider the pros and cons of fundamental analysis within the context of your investing goals and time constraints. Here’s how to build a systematic framework:

Effective Implementation Strategies

- Develop a Step-by-Step Workflow

- Gather Raw Data: Pull the latest 10-K, 10-Q, earnings transcripts, and industry reports. If you use Daloopa’s AI-powered platform, you can import historical metrics—revenue splits, non-GAAP adjustments, segment margins—directly into Excel within minutes.

- Isolate Key Ratios: Prioritize metrics that align with your fundamental analysis strategy. For a growth-bias, focus on revenue CAGR, gross margin expansion, and R&D intensity. For value plays, emphasize P/B, EV/EBITDA, and FCF yield.

- Build Base-Case, Bear-Case, Bull-Case Models: Create three scenarios for top-line, margins, and capex. In each scenario, modify discount rates, terminal growth rates, and reinvestment assumptions to see a range of intrinsic values.

- Construct a Customizable Checklist

- Financial Health: Is EBITDA margin above industry median? Is debt maturing within one year?

- Competitive Moat: Does the firm hold at least one proprietary advantage—patent portfolio, network scale, or distribution exclusivity?

- Macro Alignment: Does the broader economic cycle support cyclicals or defensives? If recession probabilities exceed 50%

- Embed Margin of Safety

- Target Entry Price: Set your buy trigger at least 15–30% below your base-case intrinsic value to buffer forecasting errors. For instance, if your DCF yields $100, you’ll place a limit order at $70–$85.

- Position Sizing: Allocate no more than 3–5% of your portfolio to any one name, unless you possess exceptionally high conviction backed by multiple checklists.

- Ongoing Monitoring & Thesis Update

- Quarterly Reviews: After each earnings release, revisit your key assumptions. Did management hit guidance for revenue and margins? Did CapEx align with your three-year projection?

- Red-Flag Alerts: Use Google Alerts or Bloomberg news feeds for material events—M&A rumors, regulatory probes, or insider-trading scandals. If you spot an “unverifiable claim” (like rumored FDA approval), mark it for follow-up.

- Document & Reflect: Maintain a research memo with dated entries for every model change. After 12–18 months, review your “wins” and “misses” to refine your process and reduce hindsight bias.

Following these steps, you enforce consistency, minimize emotion, and approach each new opportunity with a proven framework. In each scenario, modify discount rates, terminal growth rates, and reinvestment assumptions to see a range of intrinsic values. This helps stress-test your assumptions using fundamental valuation methods.

Combining With Complementary Approaches

While it helps identify strong investment opportunities, integrating fundamental analysis with technical analysis can sharpen timing and optimize risk management:

- Technical Indicators for Timing

- Moving Averages: Use the 50-day and 200-day simple moving averages as trend filters. If a fundamentally sound stock trades above both, you may avoid catching a falling knife. Conversely, a pullback below those lines could signal an attractive entry (assuming fundamentals remain intact).

- Relative Strength Index (RSI): When RSI dips below 30 on a quality name, it might suggest oversold conditions—especially if earnings continue to beat consensus.

- Sentiment & Flow Analytics

- Put/Call Ratios & Option Skew: If you see abnormally high put volumes against calls for a fundamentally sound firm, you might interpret it as bearish sentiment—providing a potential discount entry after analyzing why.

- Short Interest Trends: A rising short interest could indicate a crowded trade. If fundamentals remain unchanged, a short squeeze becomes more probable.

- Alternative Data Overlays

- Web Traffic & Social Media Sentiment: Monitor unique website visits or app downloads for consumer-facing companies. If page views spike while consensus still lags, you spot trends ahead of official reports.

- Geolocation Data: For retail or auto manufacturers, foot-traffic trends at stores or parking lot counts can presage earnings beats or misses. By overlaying these indicators atop your fundamental model, you gain a “leading indicator” edge.

- Portfolio Construction & Risk Management

- Diversify Across Factors: Combine value, growth, momentum, and quality factors. If your fundamental picks align with a positive macro backdrop, overweight them—otherwise, hedge with cash or inversely correlated sectors.

- Dynamic Position Sizing: Increase allocation when conviction is high: a small-cap tech uptrend shows improving fundamentals, plus RSI above 50, plus positive alternative data—together, these trigger a 5% position. Reduce to 1–2% when uncertainty looms.

By fusing fundamental rigor with these technical methods, you fine-tune both entry and exit, minimize drawdowns, and ensure you’re not “all-in” on a thesis that falters for reasons beyond financial statements.

Improve Your Fundamental Analysis with Daloopa

Anchoring your decisions in a well-structured fundamental framework transforms investing from guesswork into a logical discipline. Understanding the pros and cons of fundamental analysis ensures you approach this method realistically, leveraging its depth while acknowledging its demands.

You’ll still face subjective judgments—different analysts will overlay their own assumptions on your models. Yet, armed with transparent audit trails, macro overlays, and complementary technical tools, you gain conviction in your positions rather than relying on crowd psychology or momentum chases.

Power your next model with Daloopa’s instant, auditable financial data—so every decision is driven by insight, not guesswork. Whether you’re applying fundamental valuation methods or leveraging advanced analysis tools, true precision begins with clean, reliable data.