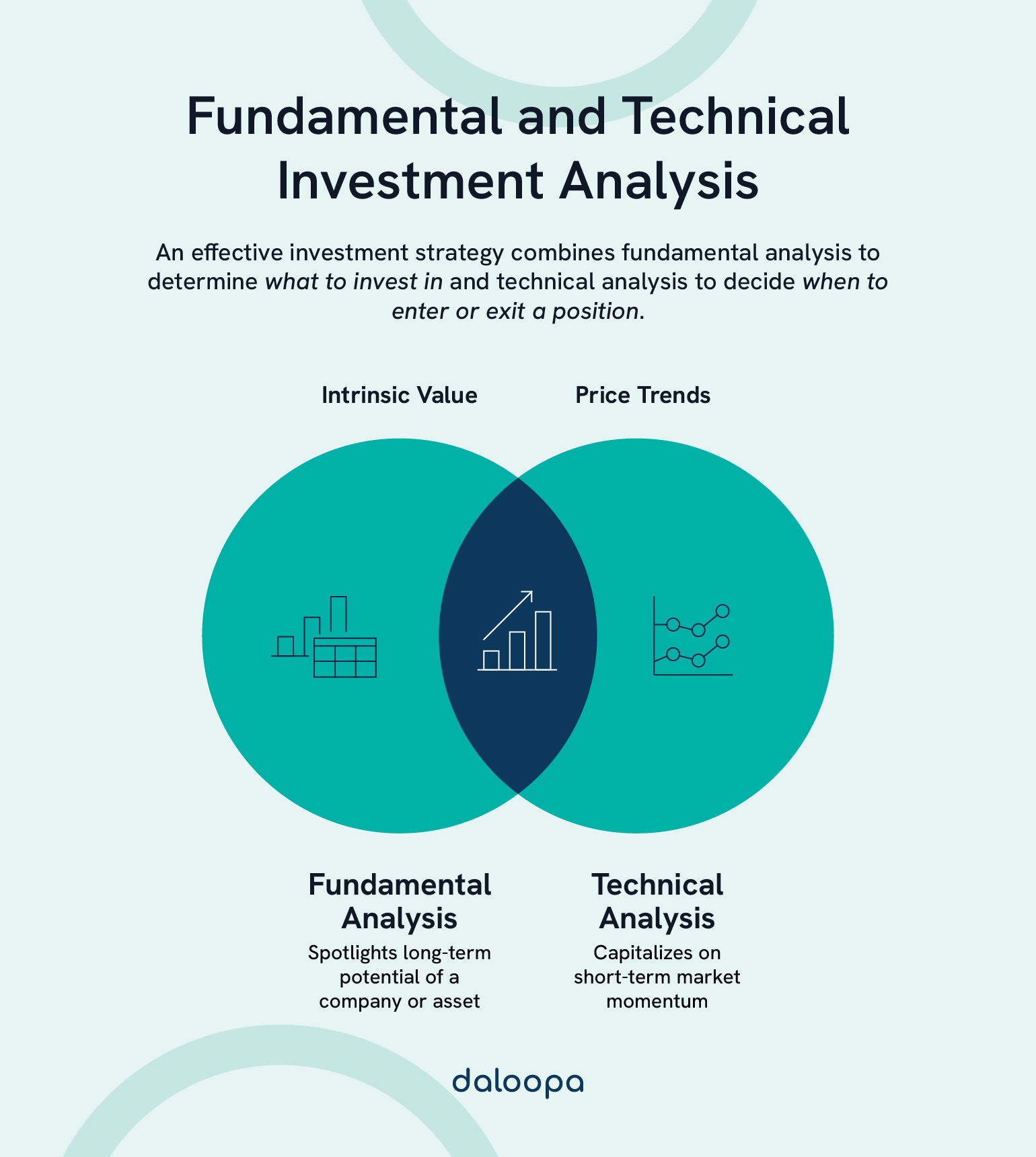

In today’s fast-moving markets, you can’t afford to navigate uncertainty by gut feel alone. You need a methodical framework that balances deep, data-driven insights into a company’s true worth with precise timing cues that capture market momentum. By mastering both fundamental analysis and technical analysis—and leveraging AI market research tools that automate and enrich your data inputs—you’ll reduce emotion-driven decisions, uncover hidden value in each sector, and enter or exit positions with confidence.

Key Takeaways

- Each analysis method plays a different, vital role in financial market research.

- Merging both approaches creates a more complete and adaptive investing strategy.

- Using structured fundamental analysis and technical analysis helps reduce emotional bias and reactive decisions.

Fundamental Analysis: A Deep Dive

Fundamental analysis evaluates a business’s true worth by digging into its financials and industry landscape. It involves hard data, like revenue and earnings, and softer context like leadership capability and market position.

Key Concepts and Tools

At its core, fundamental analysis strives to uncover a business’s intrinsic value by examining quantitative and qualitative data:

- Financial statements: Income statements map revenue to profit; balance sheets outline assets, liabilities, and equity; cash flow statements track the lifeblood of operations.

- Ratio analysis: Use metrics like P/E, debt‐to‐equity, and return on equity (ROE) to gauge valuation, leverage, and efficiency. For example, the P/E ratio divides a stock’s price by its earnings per share to show what investors pay per dollar of earnings.

- Macroeconomic context: Track GDP growth trends via the Bureau of Economic Analysis (BEA) and inflation via the Consumer Price Index (CPI) to understand the broader operating environment.

- Qualitative factors: Assess management quality, competitive moats, regulatory landscapes, and ESG risks through SEC filings and investor presentations.

These methods represent essential fundamental data analysis tools and techniques used by analysts today.

Strengths and Limitations

Fundamental analysis anchors you in the “big picture,” pinpointing durable businesses trading below true worth. They shine in sectors like consumer staples, utility, and healthcare, where steady cash flows matter most.

However:

- Data gathering can be time‐intensive, though AI‐driven platforms now automate it in minutes.

- Market sentiment may shift prices before accounts catch up.

- Small-cap firms often lack clean disclosures, adding uncertainty.

Technical Analysis: An In-Depth Exploration

This method uses charts and statistics to spot trade setups. Instead of measuring value, technical analysis looks for movement patterns and momentum that hint at likely price behavior.

Key Concepts and Tools

Technical analysis offers a complementary lens by decoding price and volume patterns:

- Moving averages: The 50- and 200-day averages smooth noise and reveal trend direction; crossovers (e.g., “golden cross”) often signal momentum shifts.

- Volume analysis: Spikes in volume confirm conviction—an up-move on high volume suggests institutional support, whereas light volume rallies can be false breakouts.

- Chart formations: Visual patterns like head-and-shoulders or double tops narrate buyer/seller battles—imagine a rally stalling at a “shoulder” before a steep decline.

- Momentum oscillators: Tools such as RSI or Stochastic highlight overbought/oversold extremes, guiding you when a move has run too far.

- Candlestick patterns: Singles like hammers or engulfing bars offer early hints of sentiment shifts, especially when confirmed by trend and volume.

Strengths and Limitations

Technical analysis setups excel at fine-tuning your entries and exits, critical in fast-moving sectors such as semiconductors or biotech.

Short-term traders especially benefit. Day and swing traders rely on technical analysis to flag entry and exit moments.

But it’s not flawless:

- They can misfire in choppy markets or during low-liquidity sessions.

- No single indicator suffices; you need a toolkit and clear rules.

- Sudden news can override any pattern.

Comparative Analysis: Fundamental vs Technical

Both fundamental analysis and technical analysis help assess opportunity, but from very different angles. Knowing when and how to use them in tandem can improve decision-making and reduce blind spots.

Where Each Excels

- Fundamental analysis wins for long-term conviction: they spotlight companies with strong balance sheets, consistent free cash flow, and economic moats.

- Technical analysis shines in timing: they help traders capitalize on short-term momentum and mean reversion.

Investors with a multi-year outlook often prefer the depth of fundamental analysis. Active traders lean into the agility of technical analysis to find immediate openings.

Blending Both Approaches

What if the fundamentals are screaming “buy” but the charts haven’t cooperated? In that case, let fundamentals guide your watchlist while technical triggers determine your actual execution. For instance, you might queue a purchase in a dividend heavyweight when its 20-DMA dips 3% below the 50-DMA, ensuring you buy into a proven company at a temporary technical discount. This hybrid reduces the risk of chasing overheated rallies and smooths out drawdowns from premature entries.

Practical Application and Strategy Development

To build a strategy that lasts, you need structure. Merging fundamental analysis and technical analysis with risk control makes for a more consistent, disciplined investing process.

Building a Balanced Investment Strategy

- Define your framework: Write down your objectives (income vs. growth), time horizon, and maximum acceptable drawdown.

- Data sourcing: Automate downloads of SEC 10-K/10-Q filings and macro releases via AI financial market research tools to ensure accuracy and auditability.

- Sector allocation: Tilt your weightings based on how each sector historically responds to economic cycles (e.g., rotate into financials when Fed rate cuts loom).

- Position sizing: Instead of a flat 1–2%, adjust size by each stock’s 30-day volatility—smaller sizes for high-beta names, larger for stable blue chips.

- Entry/exit rules: Combine a fundamental “buy” list with technical entry triggers (e.g., RSI < 30 plus 10-DMA support).

- Review cadence: Schedule monthly “health checks” comparing your portfolio’s sector exposures, P/E averages, and technical breadth versus benchmarks.

Maintaining Discipline

- Journaling: Record every trade’s rationale, outcome, and any deviations from your rules.

- Audit logs: Use linked data sheets that hyperlink back to original filings, making every number traceable.

Consistency in applying your criteria—without deviation during high-pressure situations—is what separates guesswork from disciplined investing. Stick to the process even when the market tests your patience.

Case Studies and Real-World Examples

In March 2020, the U.S. stock market experienced a significant downturn due to the COVID-19 pandemic. The Dow Jones Industrial Average (DJIA) plunged approximately 26% over four trading days. Technical analysts observed that key support levels, including the 200-day moving average, were breached rapidly, indicating panic selling. Traditional support levels, which had held firm during previous corrections, failed quickly.

From a fundamental standpoint, sectors such as natural gas, food, healthcare, and software stocks earned high positive returns, whereas equity values in petroleum, real estate, entertainment, and hospitality sectors fell dramatically.

Another case: Tesla in 2020–2021. Tesla’s stock experienced explosive growth, rising from approximately $300 to over $1,200. Technical analysis revealed strong support and resistance levels, with the 50-day and 200-day moving averages serving as key indicators for entry and exit points.

Fundamentally, Tesla achieved consistent profitability and was included in the S&P 500 index, factors that contributed to increased investor confidence and institutional adoption.

What made these wins work?

- Pre-defined decision rules

- Steady position sizing

- Consistent strategy review

- Strong risk controls

Many traders log everything in a journal—entries, exits, results, and the thinking behind each decision. This habit promotes ongoing strategy refinement and sharpens execution.

Elevate Your Fundamental Analysis and Technical Analysis with Daloopa’s AI-driven Platform

Seamlessly extract every footnote, KPI, and macro release into Excel, and focus on insights instead of manual “monkey work”. Empower your research with advanced fundamental data analysis tools and techniques, hone your timing, and make every decision auditable and defensible with Daloopa. Create your free account today.