The SEC’s EDGAR system lets you download financial statements into Excel from SEC using structured data via XBRL downloads, Python scripts, or financial data Excel integrations—ready to plug into your analysis. Getting this data into spreadsheets quickly means you can build smarter models, develop your own metrics, and analyze multiple companies without middlemen or friction. Whether you’re new or experienced, these methods make access to high-quality data a lot easier.

Key Takeaways

- Extract structured financial data from SEC EDGAR in XBRL format.

- Automate downloads using Python or direct Excel queries.

- Build systems for repeatable, multi-company analysis using SEC EDGAR data retrieval tools.

Overview Of SEC Filings

The SEC’s EDGAR system centralizes all public company filings—mandatory disclosures that give you the raw data behind every headline. You can browse HTML, download PDFs, or download financial statements into Excel from SEC using machine‑readable XBRL tags. Because EDGAR remains free and uncensored, you’ll cut out subscription fees and access the same data as top‐tier hedge funds.

Types Of Financial Statements Available

- Form 10‑K (Annual Reports): Your deep dive—balance sheets, income statements, cash flows, footnotes, risk factors.

- Form 10‑Q (Quarterly Reports): Lighter, but still rich in YTD financials and MD&A commentary.

- Form 8‑K (Current Reports): Catch one‑off events like mergers, bankruptcies, or auditor changes.

Most filings embed XBRL tags, letting you download financial statements into Excel from SEC and pinpoint “Net Income” or “Total Assets” without guesswork.

Submission Timelines

- Large accelerated filers (public float ≥ $700 M) must file 10‑K within 60 days of year‑end and 10‑Q within 40 days of quarter‑end.

- Accelerated filers (public float ≥ $75 M but < $700 M) get 75 days for 10‑K and 40 days for 10‑Q.

- Non‑accelerated filers have 90 days for 10‑K and 45 days for 10‑Q

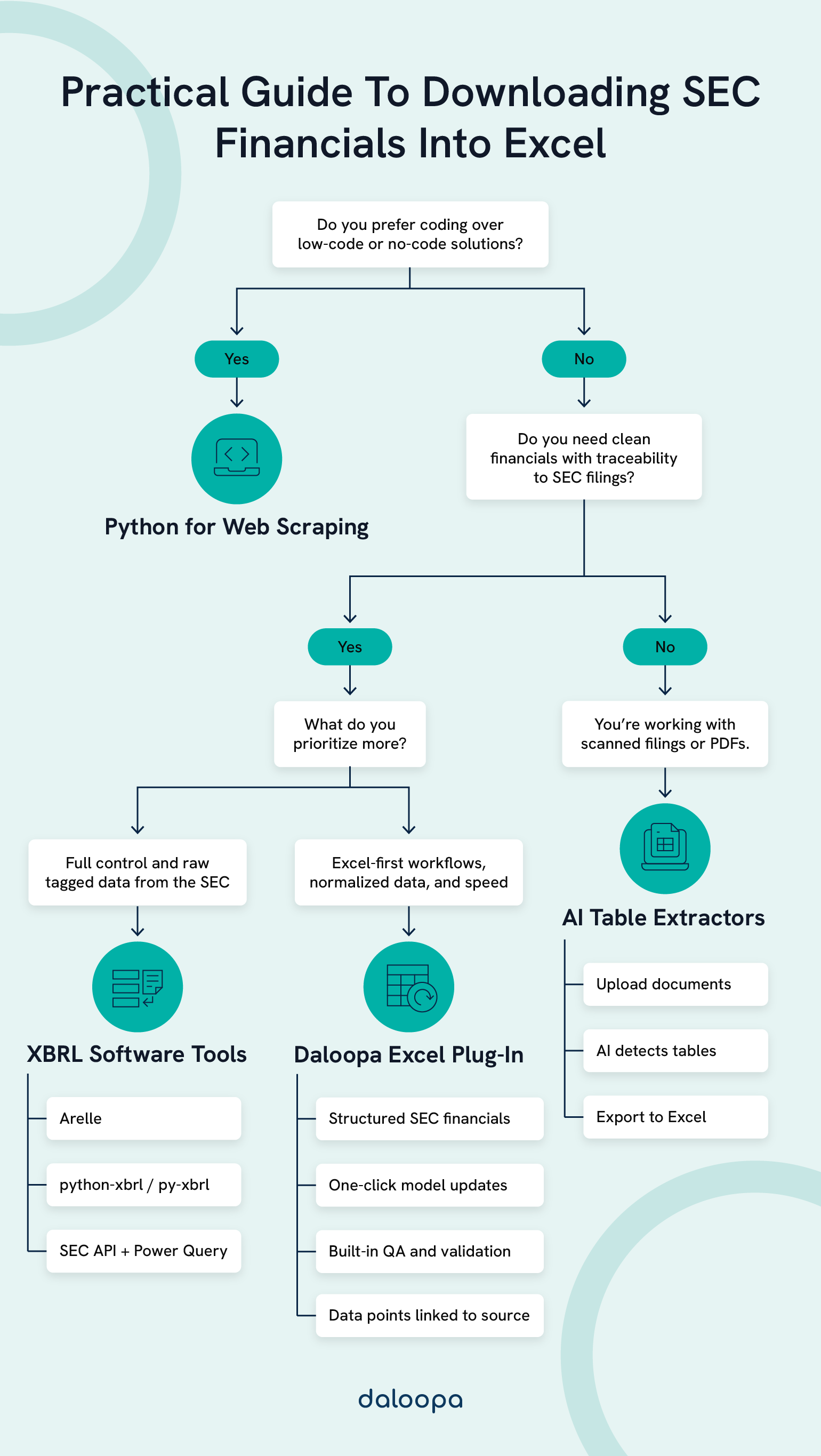

Methods To Download Financial Statements

The extraction process can be fully automated, thanks to standardized data and SEC EDGAR data retrieval tools that convert raw reports into usable spreadsheets for real-time financial insight.

Using Python For Web Scraping

When you want full control or custom logic, Python stands ready:

pip install requests beautifulsoup4 pandas python-xbrl py-xbrl

You can use this code to install five essential Python libraries that facilitate web data extraction and enable processing of XBRL documents into standardized formats like JSON or with HTTP APIs.

Follow these steps:

- Fetch the company’s CIK index page.

- Scrape the filings list (HTML‑parsing with BeautifulSoup).

- Download the XBRL instance or financial HTML.

- Parse tables into pandas and export to Excel.

- Schedule as a cron job for weekly or daily refresh

Leveraging XBRL Tools

Open‑source XBRL parsers help you bypass HTML entirely:

- Arelle: World’s only free XBRL platform, with GUI, CLI, Python API, and robust validation

- python‑xbrl / py‑xbrl: Simple libraries to parse instance docs into JSON or objects (Requires Python >= 2.6 or >= 3.3)

These SEC EDGAR data retrieval tools read XBRL tags natively, so “Revenues” or “EPS” land in cells with minimal cleanup.

AI-Powered Document Extractors

For PDF‑only filings or scanned docs, AI services like Daloopa detect tables and preserve layout. With direct Excel plug-ins and financial data Excel integration, they spare you hours of manual copying, and feed directly into Power Query or Python pipelines.

Download Financial Statements Into Excel From SEC: Step-By-Step Guide

Getting financial statements from the SEC into Excel isn’t hard—it just requires a little navigation and a few smart steps. Download financial statements into Excel from SEC reliably with this process:

Accessing The SEC Website

Let’s say you wanted to download financial statements for Apple:

- Use EDGAR Search Tools. SEC’s company search page consolidates filing lookup, CIK lookup, and API documentation in one place.

- Search by company name or ticker. Type “Apple” or “AAPL,” and press Enter—this returns Apple Inc. along with its CIK.

- Retrieve the CIK. On Apple’s landing page under “Company Information”, you’ll see CIK 0000320193—you’ll use this 10‑digit key in API URLs and for filtering XBRL downloads.

- Filter for “Interactive Data.” In the filings list, select the “Interactive Data” filter to surface XBRL‑tagged documents instead of HTML or PDF.

- Download the XBRL instance. Click the most recent 10‑K (or 10‑Q) → “Documents” → the .xml link (often labeled “EX-101.INS”) to grab the tagged data file locally.

Using The SEC Filing Search API

- Build your API URL. To retrieve all structured financial statement data for a specific company using the SEC EDGAR Facts API, construct an API endpoint by combining the base path for company facts with the company’s unique 10-digit Central Index Key (CIK).

- Include a User‑Agent header. Per SEC fair‑access rules, set User-Agent: YourName your.email@domain.com in your HTTP client—browsers may be blocked without it.

- Fetch via browser or script. Paste the URL into Power Query’s Web/API connector or call it in Python/requests to retrieve a JSON payload of every tagged fact (revenues, EPS, assets, etc.)

- Inspect the JSON structure. Open the file in a text editor or let Power Query auto‑detect tables—fields nest under facts → reporting periods → val for values

- Save locally or load on‑the‑fly. You can store the .json as a file or pass the URL directly into Power Query for dynamic pulls every refresh cycle.

Troubleshooting: If Power Query returns a blank or error, confirm your URL and headers, or try switching between the Web Page vs. Web API connector—some SEC endpoints require the JSON‑specific connector

Converting Data Into Excel Format

Steps for financial data Excel integration with Power Query:

- Launch Power Query: In Excel, go to Data → Get Data → From Web (or From Other Sources → From Web (Advanced) for custom headers).

- Enter your API or file URL: Paste the companyfacts JSON endpoint or local .xml path, then select Connect.

- Choose authentication: Use Anonymous for public XBRL/JSON; only apply credentials if you host behind a gateway.

- Parse and expand records: In the Power Query editor, click the Record or List icons to drill into facts.Statements or data nodes—then hit To Table and Expand.

- Transform types and filter: Set columns like val to Decimal Number, turn end into Date, and filter for a specific form type or period.

- Close & Load. When your query returns a clean table, click Close & Load to populate your worksheet. On subsequent opens, just click Refresh.

Automation And Workflow Optimization

Automation takes this from a one-time task to a repeatable system. Whether you’re watching 3 companies or 300, setting up a workflow can shave hours off your process.

Creating Excel Macros And Power Queries

Once you finalize cleaning steps in Power Query, record an Excel Macro to automate formatting:

- Remove blank rows/columns

- Apply number formatting

- Insert PivotTables or charts

Embed that macro in your workbook so you can run Alt+F8 and watch Excel reshape your data, all without lifting a finger.

Building An Automation Workflow

Map your flow:

- Trigger: New filing appears (watch SEC RSS feed).

- Ingest: Power Query or Python script pulls JSON/XML.

- Validate: Use simple checksum formulas (e.g., Assets = Liabilities + Equity) to catch anomalies.

- Report: Write to a central workbook or database.

- Alert: Send an email if numbers deviate beyond thresholds.

Lock in validation rules to ensure clean data every run—so when you arrive Monday, your models are audit‑ready.

Using Daloopa’s Excel Plug-In

If you’d rather skip the plumbing, Daloopa’s AI‑powered Excel plug-in delivers:

- One‑click pulls of 10‑K, 10‑Q, and 8‑K line items

- Uniform tags across years and companies

- Template saving for forecasts, comps, or peer analysis

- Built‑in validation to flag missing or inconsistent values

You pick the fields—revenue, EPS, operating cash flow—and Daloopa inserts live formulas that update on demand. Every cell links back to its SEC source, so you never doubt your numbers.

Ready To Put Your SEC Data On Autopilot?

With the ability to download financial statements into Excel from SEC using tools like Daloopa for SEC EDGAR API Excel integration, you can shift from wrangling data to making smarter decisions. Empower your spreadsheets by utilizing our AI‑driven Excel add‑in to automate your pulls, audit with confidence, and free yourself from manual drudgery. Request a demo to see how Daloopa can help you extract, validate, and model your next set of filings.