Have you ever wondered how financial analysts predict market movements with surgical precision? Or how compliance officers ensure they never miss a critical deadline? The SEC EDGAR database is their secret weapon—a vast repository of financial information paired with a robust API that transforms raw data into actionable insights.

Accessing the SEC EDGAR database through its API simplifies data retrieval processes. Analysts can efficiently gather publicly traded companies’ financial statements, risk disclosures, and other critical information. This guide to SEC EDGAR API and database will show you how to effectively leverage these tools for real-time access to financial data.

Key Takeaways

- The SEC EDGAR API provides programmatic access to millions of corporate filings, offering unparalleled data retrieval capabilities.

- Automated processes and real-time updates enhance efficiency for financial analysis and compliance tasks.

- Integration with modern technologies ensures seamless functionality within existing systems.

Importance for Data Analysts and Compliance Officers

The SEC EDGAR API and database are indispensable tools for data analysts and compliance officers in the financial industry. These resources offer several key advantages.

A Wealth of Data at Your Fingertips

In the world of finance, data is power. The SEC EDGAR API grants instant access to millions of financial records, allowing professionals to stay ahead in rapidly evolving markets. When analyzing financial data with SEC API, including balance sheets, income statements, or cash flow summaries, EDGAR’s structured database ensures that critical data is just a query away.

For example, longitudinal study researchers can compare historical filings across industries to understand market trends and corporate behaviors. Compliance officers benefit from centralized disclosure data, ensuring they can promptly identify and address regulatory risks.

Real-Time Access for Informed Decisions

The SEC EDGAR API enables real-time data retrieval, ensuring users have the latest insights at their fingertips. During earnings season, analysts can instantly access newly filed 10-K or 10-Q forms, allowing them to adjust investment strategies in response to emerging trends.

Automation further enhances productivity by:

- Establishing live data feeds for real-time dashboards.

- Creating alerts for filings containing specific keywords like “litigation” or “acquisition.”

- Generating compliance reports with minimal manual input.

These automation capabilities reduce the lag between data availability and actionable insights, ensuring timely decisions.

Ensuring Consistency and Precision

The standardized format of SEC EDGAR filings simplifies comparisons across companies and industries. For example, comparing operating costs between competitors becomes straightforward when data follows consistent formatting. This uniformity reduces manual adjustments, allowing analysts to focus on high-value tasks.

For compliance officers, EDGAR’s comprehensive view of filing timelines prevents costly errors. Automated tools built around the API can cross-reference deadlines with regulatory mandates, flagging potential issues before they escalate.

Enhancing Strategic Planning

Strategic planners use EDGAR filings to gain competitive intelligence. Companies can uncover market entry strategies by analyzing competitors’ financial disclosures or identifying R&D investment patterns. For instance, a hypothetical analysis of capital expenditures in filings could highlight emerging opportunities for market expansion.

Exploring the SEC EDGAR API

The SEC EDGAR API provides robust tools for accessing and analyzing financial data. This guide to SEC EDGAR API and database explores key endpoints and technical structures to facilitate data extraction and integration.

Key Endpoints and Their Functions

The SEC EDGAR API includes several critical endpoints:

- Filing Query API: Allows users to search filings using parameters like company name, CIK, form type, and date range. For example, this endpoint can track a competitor’s financial disclosures during earnings season.

- RSS Feed: Provides real-time updates on newly submitted documents.

- PDF Generator API: Converts HTML filings into PDF format for easier viewing and analysis.

- Company Facts API: Returns structured financial statements, enabling detailed analyses of balance sheets and revenue trends.

The Full-Text Search API adds depth by allowing keyword-specific searches. For instance, users can locate terms like “debt restructuring” or “climate risk” within filings, helping identify emerging risks or opportunities. This feature is invaluable when analyzing financial data with SEC API, enabling more precise and targeted insights.

Technical Structures and Data Formats

JSON, a lightweight data-interchange format, underpins the EDGAR API’s responses, making it compatible with modern programming languages like Python, JavaScript, and Ruby. The RESTful architecture further simplifies integration, with endpoints supporting HTTP methods such as GET.

Metadata fields like cik, accessionNumber, and formType provide structure to retrieved data, ensuring precision. Users can extract targeted datasets by leveraging pagination and sorting features without overwhelming their systems. For instance, sorting filings by date can help compliance teams focus on the most recent submissions first.

Python libraries like sec-edgar are invaluable for developers. These libraries abstract much of the API’s complexity, allowing high-level queries that retrieve data with just a few lines of code.

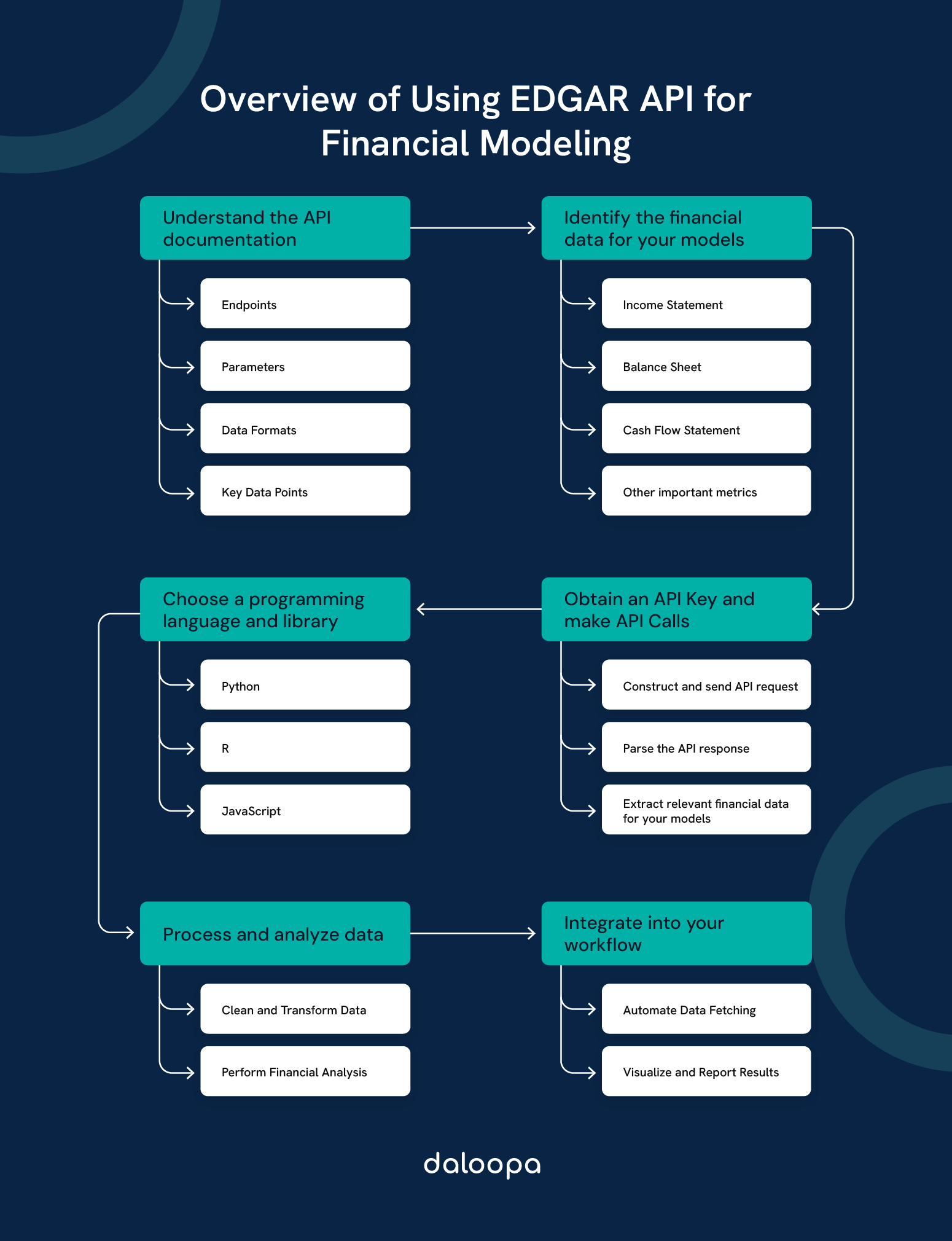

Accessing and Utilizing SEC Data

Proper setup and strategic integration are essential to maximizing the SEC EDGAR API’s potential. Here’s how to get started.

Obtaining an API Key and Setting Up Access

Users must register for an API key through the SEC platform to access the SEC EDGAR API. Embedding this key in API requests ensures authentication and access.

A development environment typically includes:

- Libraries for API calls and data manipulation, such as requests.

- Visualization tools like matplotlib to highlight trends in retrieved data.

- Database systems for storing and indexing large datasets.

Strategies for Real-Time Data Integration

Polling systems can automate queries to the EDGAR API, ensuring users receive updates on new filings as they are submitted. For instance, a script written in Python could query the API hourly, reducing manual oversight.

Caching frequently accessed data in systems like Redis improves performance and reduces API call volumes. This approach ensures data relevance while maintaining efficiency.

For collaborative teams, shared databases aggregate API responses, creating a centralized repository accessible across departments. This setup supports seamless collaboration and ensures data consistency.

Analyzing Financial Statements with SEC EDGAR

The SEC EDGAR API provides rich financial data for analysis. Users can retrieve company-specific information and explore various filing types to gain actionable insights. Analyzing financial data with SEC API enables users to extract key metrics from these filings, offering valuable perspectives for decision-making.

Company-Specific SEC EDGAR Data Retrieval

Filings such as Form 10-K or 10-Q are treasure troves of financial information. Analysts can pinpoint relevant documents using the API’s query parameters without wading through extraneous data. Extracted XBRL data can then be transformed into datasets for further processing. SEC EDGAR data retrieval makes it easier to identify and extract valuable insights from complex filings. With accurate SEC EDGAR data retrieval, users can ensure they’re working with the most up-to-date and precise financial information.

Cross-company comparisons become easier with EDGAR’s standardized formats. For example, comparing profitability ratios between competitors in the same sector becomes straightforward when balance sheets and income statements follow a consistent structure.

Understanding Filing Types and Dates

Different filing types serve distinct purposes. For instance:

- Form 8-K: Highlights material events, providing early warnings of significant developments.

- Form 13F: Reveals institutional investment strategies, offering insights into market trends.

By tracking the cadence of filings, users can identify patterns. For instance, frequent insider transactions might signal strategic shifts, offering a predictive edge in market analysis.

Advanced Usage and Best Practices

The SEC EDGAR API offers advanced capabilities for data extraction and analysis. Adopting best practices ensures optimal performance and compliance.

Handling Large Data Sets and Archive Files

When analyzing financial data with SEC API, such as historical trends, working with large datasets becomes inevitable. Pagination reduces memory load, allowing analysts to process data in manageable chunks. Additionally, multi-threading accelerates parsing by distributing tasks across multiple processors.

Compressed formats like GZIP can reduce disk usage for long-term storage of retrieved filings. Automated archival systems can periodically download filings, ensuring data continuity even if API endpoints experience downtime.

Ensuring Data Accuracy and Compliance

Accuracy remains paramount. By validating API responses against checksum hashes provided by the SEC, users can detect data corruption early. Logging API interactions further enhances auditability, enabling teams to backtrack and verify past queries.

Compliance concerns are addressed by adhering to rate limits and monitoring SEC’s API guidelines changes. Regularly consulting the API documentation ensures practices remain aligned with regulatory requirements.

Examples and Practical Applications

Examples highlight the transformative power of the SEC EDGAR API data retrieval, while emerging trends point toward even greater potential.

Hypothetical Example of SEC EDGAR API Utilization

A hedge fund leverages EDGAR data to build models that analyze debt ratios and litigation risks, producing strategies that outperform traditional benchmarks by integrating real-time insights into their decision-making processes.

Lessons Learned and Future Trends

Emerging technologies like machine learning promise transformative applications. Algorithms capable of summarizing lengthy 10-K filings or predicting market anomalies are becoming a reality.

Natural language processing (NLP) tools could soon enable sentiment scoring, helping users gauge optimism or risk embedded in filings. These advancements will enhance EDGAR’s utility for analysts and compliance teams alike.

This guide to SEC EDGAR API and database equips you with the knowledge to access and analyze critical financial data efficiently. Utilize the insights and tools from this guide to enhance your data integration and compliance processes.

Simplify Your Life with Daloopa

Transform your financial data analysis with Daloopa. Our advanced AI-driven platform enhances workflows by automating repetitive tasks, improving data accuracy, and seamlessly integrating with tools like the SEC EDGAR API. Empower your team with dynamic dashboards, real-time insights, and predictive analytics tailored to your needs.

Discover how Daloopa can revolutionize your data strategy today by scheduling a demo.