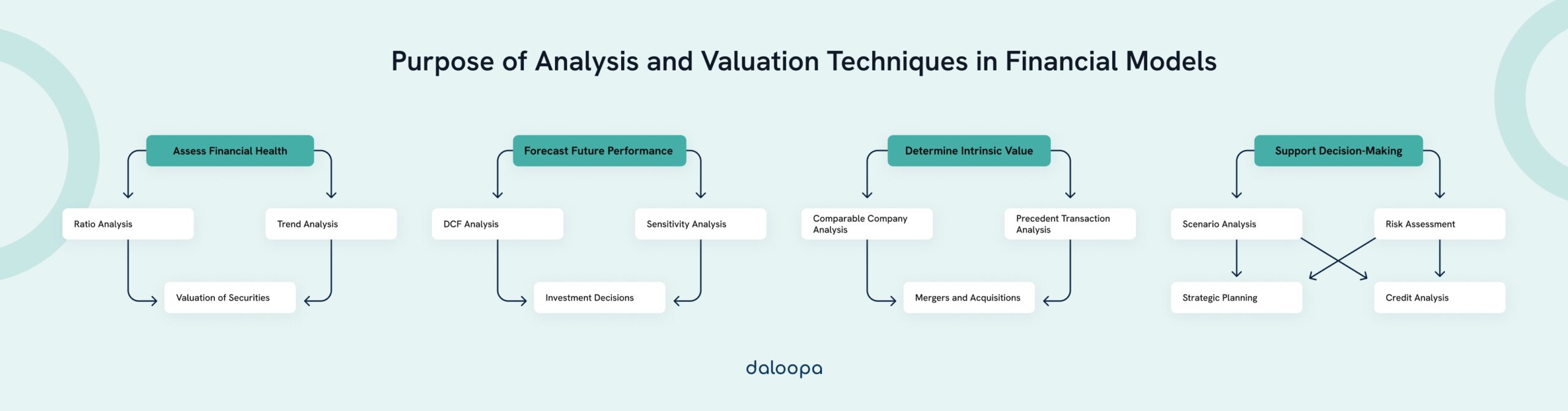

At the heart of financial models are the actual valuation and analysis techniques that are the ultimate end point for all the data we gather. Six of the most common types are below and should all be familiar.

- Three-Statement Models – A cornerstone of financial analysis is building integrated financial models that encompass the income statement, balance sheet, and cash flow statement. These models provide a comprehensive view of a company’s financial health and are essential for forecasting future performance. The process involves:

- Historical Data Entry: Input historical financial data for at least three to five years.

- Revenue Projections: Forecast future revenues based on historical growth rates, market trends, and business insights.

- Expense Projections: Estimate future expenses, considering fixed and variable costs, inflation rates, and operational changes.

- Balance Sheet Items: Forecast assets, liabilities, and equity components based on revenue projections and financial ratios.

- Cash Flow Statements: Derive cash flow projections from the income statement and balance sheet items, ensuring all three statements are interconnected.

- Historical Data Entry: Input historical financial data for at least three to five years.

- Discounted Cash Flow (DCF) Analysis: DCF analysis is a fundamental valuation method that estimates the present value of future cash flows using an appropriate discount rate. Here’s a step-by-step approach to building a DCF model:

- Step 1. Forecast Financial Statements: Use historical data to project revenues, expenses, and other key financial items for a forecast period (typically 5-10 years).

- Step 2. Calculate Free Cash Flow (FCF):

- EBIT (Earnings Before Interest and Taxes)

- Tax Adjustments: EBIT (1 – Tax Rate)

- Add Depreciation and Amortization

- Subtract Changes in Net Working Capital

- Subtract Capital Expenditures

- FCF Formula: FCF = EBIT (1 – Tax Rate) + Depreciation & Amortization – Change in Net Working Capital – Capital Expenditures

- Step 3. Determine Discount Rate (WACC): Calculate the Weighted Average Cost of Capital (WACC) using the formula: WACC = (E/V * Re) + (D/V * Rd * (1 – Tc))

- E = Market value of equity

- V = Total market value of equity and debt

- Re = Cost of equity

- D = Market value of debt

- Rd = Cost of debt

- Tc = Corporate tax rate

- Step 4. Calculate Terminal Value: Estimate the value beyond the forecast period using the Gordon Growth Model or Exit Multiple Method. Terminal Value Formula (Gordon Growth Model): TV = FCFn * (1 + g) / (r – g)

- FCFn = Free cash flow in the final forecast period

- g = Perpetual growth rate

- r = Discount rate (WACC)

- Step 5. Discount Cash Flows to Present Value: Use WACC to discount projected FCFs and terminal value. PV Formula: PV = FCF1 / (1 + WACC)^1 + FCF2 / (1 + WACC)^2 + … + TV / (1 + WACC)^n

- Step 6. Calculate Enterprise Value and Equity Value: Sum the present values of the forecasted FCFs and terminal value to get the enterprise value, then adjust for net debt to derive the equity value.

- Step 1. Forecast Financial Statements: Use historical data to project revenues, expenses, and other key financial items for a forecast period (typically 5-10 years).

- Comparable Company Analysis: Comps involve valuing a company based on the valuation multiples of similar publicly traded companies. Key steps include:

- Step 1. Identify Peer Group: Select a group of companies with similar business models, industry, size, and growth prospects.

- Step 2. Collect Financial Data: Gather key financial metrics such as revenue, EBITDA, and net income for the peer group.

- Step 3. Calculate Multiples: Compute valuation multiples like EV/EBITDA, P/E, and EV/Sales.

- Step 4. Apply Multiples: Apply the median or mean multiples to the target company’s financial metrics to estimate its valuation.

- Step 5. Regression Analysis: Regression Analysis evaluates relationships between variables to forecast future trends. Use Excel’s Data Analysis Toolpak for linear and multiple regression analysis.

- Step 6. Variance and Covariance Analysis: Variance and Covariance Analysis assess the variability and correlation between different financial metrics, helping in risk assessment and portfolio management.

- Step 1. Identify Peer Group: Select a group of companies with similar business models, industry, size, and growth prospects.

- Scenario Manager: You can leverage the Scenario Manager, or more advanced excel add-ins to evaluate different scenarios by changing multiple variables at once. Set up scenarios and switch between them to see the impact on your financial model.

- Monte Carlo Simulations: Monte Carlo Simulation assesses the impact of risk and uncertainty by simulating various scenarios. Use Excel add-ins or VBA to perform these simulations and analyze the distribution of possible outcomes.

- Precedent Transactions Analysis: Values a company based on the multiples paid in similar historical transactions. The process involves:

- Step 1. Identify Relevant Transactions: Select past transactions involving companies with similar characteristics.

- Step 2. Collect Transaction Data: Obtain details on transaction values, financial metrics, and multiples paid.

- Step 3. Calculate Multiples: Determine relevant multiples (e.g., EV/EBITDA, EV/Sales).

- Step 4. Apply Multiples: Use the median or mean multiples from past transactions to estimate the target company’s value.

- Step 1. Identify Relevant Transactions: Select past transactions involving companies with similar characteristics.

Looking to accelerate your financial analysis in Excel?

Daloopa’s AI can optimize your existing process. Excel expertise is indispensable for analyzing a company’s performance, projecting financial outcomes, and developing valuation models, as it converts complex datasets into straightforward results. Ensure you’re comfortable with the core techniques before delving into advanced modeling. AI can aid in financial analysis, but a solid grasp of the basics is necessary to create the kind of work colleagues respect.