You know the late nights: reconciling a stubborn spreadsheet, tracing a stray number back to some buried note in a 10-K, and feeling the clock—and your boss—closing in. Modern LLM-enabled workflows can reclaim those hours by feeding verified, auditable financial data into your models and tools so you stop babysitting formatting and start testing scenarios that move portfolios. For many teams, choosing the right LLM for financial data analysis is the first step to escaping this grind.

Key Takeaways

- Match LLMs to financial tasks such as data extraction, report building, and model validation rather than general-purpose use.

- Test models on your actual workflows and data to gauge accuracy and reliability.

- Focus on reducing repetitive tasks while protecting data integrity and ensuring automated outputs build trust.

Evaluating LLM Capabilities For Financial Use Cases

When you evaluate models, stop at features and ask: can this actually replace the tedious parts of my week without increasing audit risk? Concentrate on measurable capabilities: extraction quality, calculation accuracy, provenance (can I trace a number back to an original filing?), and how the model plugs into your stack. By choosing the right LLM for financial data analysis, analysts can reduce risk while speeding up output and fully realize the advantages of LLMs in finance.

Core Financial Analysis Tasks LLMs Can Enhance

- Data extraction and processing: You should expect an LLM pipeline to parse messy earnings decks, PDFs, and transcripts, tag the correct line items, and normalize formats so your model receives clean numbers. In practice, modern vendor pipelines reduce importing and cleaning from multiple hours to minutes by auto-mapping line items and inserting them into Excel templates.

- Report generation and summarization: For briefings and client notes, an LLM should synthesize the key metrics and highlight drivers of change (e.g., revenue by segment, one-time items, margin drivers) in a template you approve. Consistent language, linked sources, and the ability to regenerate when numbers update are among the advantages of LLMs in finance that save time.

- Trend analysis and pattern recognition: Use models to scan years of filings for recurring one-offs, margin trends, or shifts in working capital. A practical micro-case: upload 20 competitor 10-Ks and have the model flag debt/equity outliers and footnote language changes—then you validate only the flagged names instead of every line. Analysts who are choosing the right LLM for financial data analysis can use this to focus on insights rather than busy work.

Essential LLM Features For Financial Analysis

When evaluating tools for financial workflows, understanding the best LLMs for financial analysis helps you focus on features that truly improve accuracy, efficiency, and auditability.

- Mathematical precision: LLMs vary at chained arithmetic. Always add a numeric validator step (either a specialized numeric LLM or deterministic code) so DCF math, ratio roll-forwards, and multi-step calculations remain auditable.

- Domain-specific training data: Models trained with financial documents, regulatory text, and accounting language will better distinguish GAAP from non-GAAP and interpret footnotes correctly. If accuracy matters (it does), prioritize models or vendor stacks that emphasize finance training corpora.

- Provenance and connector support: You need APIs, Excel add-ins, and a way to instrument each data point with a source link. Systems that push structured, hyperlinked outputs into your workbook let you click through to the original EDGAR filing or transcript—critical for both trust and audits. With the best LLMs for financial analysis, these features come built-in.

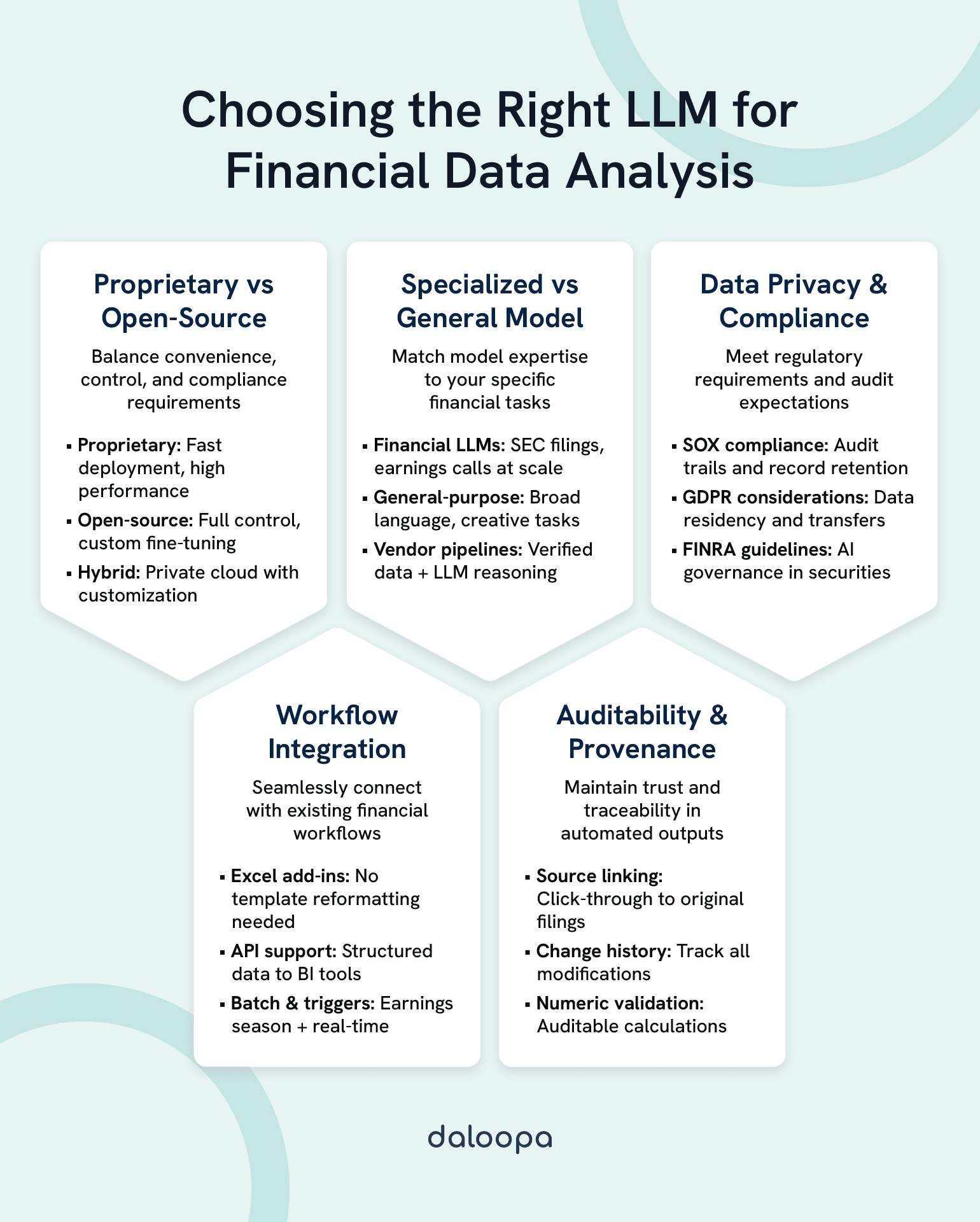

Selecting The Right LLM Architecture

You’ll choose between proprietary convenience and open-source control. Each path has tradeoffs in speed-to-value, customization, cost, and compliance.

Proprietary Vs. Open-Source Models

Proprietary models (e.g., managed APIs) deliver fast deployment and high-level performance out of the box. They save integration time but may limit how you log or store prompts and outputs. Open-source models give you full control: fine-tune them on your internal financial datasets, host them in approved regions, and enforce stricter audit logs—but you’ll need infrastructure and MLOps discipline.

If data residency or strong internal controls drive vendor selection, hosting an open model inside a private cloud or using hybrid architectures can satisfy those constraints while enabling customization. For many, choosing the right LLM for financial data analysis comes down to this balance between control and convenience.

Specialized Financial LLMs Vs. General-Purpose Models

Specialized financial LLMs and vendor pipelines that pair LLMs with verified financial data reduce the need for heavy fine-tuning. For example, platforms that attach a Model Context Protocol layer feed vetted, hyperlinked numbers to LLMs so you get accurate context with fewer hallucinations. If you must parse SEC filings, earnings calls, and footnotes at scale, prefer the specialized option.

General-purpose models shine when you need broad language abilities or creative summarization, but plan to wrap them with structured, auditable inputs for high-stakes finance work. Understanding these tradeoffs is part of choosing the right LLM for financial data analysis effectively.

Implementation Considerations

Rolling out an LLM in finance requires careful handling of privacy and integration. These two factors shape compliance outcomes and day-to-day efficiency.

Data Privacy And Compliance Requirements

Regulators expect records and audit trails. Section 802 and related SOX provisions require retention and the ability to reproduce audit-relevant records—so any automated pipeline must preserve original sources and change history. If your firm operates in Europe, GDPR imposes rules on processing personal data and cross-border transfers. FINRA and other industry supervisors also call out special expectations for AI governance in the securities industry. Build your data flows with regional residency, encryption, and documented data handling policies.

Practical checklist:

- Log every ingestion, prompt, and output with timestamps.

- Keep hyperlinked source pointers for every numeric value.

- Mask or remove personal data before feeding proprietary models when possible.

- Ensure vendor contracts include audit rights and clear data usage terms.

The advantages of LLMs in finance are clear, but only if compliance and data privacy are respected.

Integration With Existing Financial Workflows

The low friction path is the one that plugs into your spreadsheets and data warehouses. Seek:

- Excel add-ins that retro-fit into your templates (no reformatting).

- APIs to deliver structured tables into BI tools and data lakes.

- Support for both batch updates (earnings season) and event triggers (press release ingestion).

These integrations are a major factor when choosing the right LLM for financial data analysis, ensuring it complements, rather than disrupts, existing workflows.

Practical Applications And Use Cases

LLMs paired with structured extraction transform three common analyst pain points: grunt ingestion, brittle forecasts, and low-latency decision support. With the best LLMs for financial analysis, these tasks become faster and less error-prone.

Automating Routine Financial Analysis Tasks

Imagine this workflow: a press release drops, your platform ingests the PDF and XBRL, maps line items to your model, then updates the sheets and highlights any variances over your prior quarter. What used to take 3–4 hours to import and clean can drop to under 15 minutes with plug-and-play add-ins and verified data feeds. That’s not theory—many teams report moving from multi-hour manual cycles to near-instant updates when they adopt one-click data updaters.

You can also automate anomaly detection: have the system flag unusual nonrecurring items or footnote language changes, and only human-review those exceptions.

Enhancing Financial Forecasting And Modeling

LLMs help by synthesizing qualitative signals (management tone, segment commentary) and combining them with historical series. You can auto-generate scenario tables and compare model outputs across multiple assumptions in seconds, allowing you to run Bayesian-style sensitivity checks and backtest quickly.

LLM-assisted model validation saves time: the model can cross-check assumptions against the historical record, flag inconsistencies, and point you to the exact paragraph in a filing that justifies or contradicts a forecast assumption. Here, the advantages of LLMs in finance are not just speed but higher confidence in forecasts.

Investment Analysis And Decision Support

Use LLMs for rapid screening—filter hundreds of filings for a handful that meet your investment thesis—and for concise, evidence-linked research memos. Client-facing chatbots powered by verified data let you respond in real time with audit-linked answers, improving client service without burning analyst hours. This type of efficiency is exactly why firms are focused on choosing the right LLM for financial data analysis now.

Measuring ROI And Performance

Your leadership will sign off only when you quantify benefits. Don’t argue in abstractions—show numbers.

Defining Success Metrics For LLM Implementation

Start with baseline measurements:

- Hours per company for ingestion, cleaning, and mapping.

- Time to generate a client brief or internal note.

- Error rate in manually transcribed figures (and number of restatements historically triggered by data errors).

Then track improvements: reduced hours, fewer reconciliation errors, faster delivery, and client satisfaction changes. Financial metrics to present to leadership include billable-hour efficiency and deliverable-turnaround improvements tied to revenue impact. Selecting the best LLMs for financial analysis ensures these improvements are maximized and measurable.

Daloopa and similar vendors provide before/after metrics showing substantial cycle time reductions during earnings season.

Continuous Improvement Strategies

Run weekly quality checks, monitor false positives from anomaly detectors, and collect analyst feedback on missed cases. Monthly, update prompts, expand training examples, and re-baseline metrics. Keep a quarterly governance review that includes an external audit of your data lineage and access controls.

Future-Proofing Your LLM Strategy

Financial technology changes quickly, so analysts need tools that adapt with regulations, data types, and new analysis methods. Planning for this keeps investments relevant longer.

Emerging Trends In Financial LLMs

- Specialized financial models and retrieval-augmented generation lower hallucination risk by combining vetted data with model reasoning.

- In-context learning reduces retraining needs by teaching models via examples in prompts.

- Multimodal processing brings charts, tables, and text under one analysis pipeline—useful for slide decks and PDF tables.

- Real-time pipelines move from batch refreshes to instant ingestion on press releases and filings.

By keeping an eye on these trends, firms make smarter decisions when choosing the right LLM for financial data analysis for the long term.

Building A Sustainable LLM Roadmap

Start with a small pilot (earnings updates or validation) to prove value. Add governance: documented data lineage, model change logs, and fallback procedures to other vendors if needed.

Budget for ongoing API costs, security reviews, and analyst training. Invest in internal skills so you own the prompts, templates, and audits rather than outsourcing them all.

Supercharge Your Financial Data Analysis With Daloopa

Turn hours of mechanical work into decisive insight: plug your models into a verified data pipeline, run one-click updates at every release, and let your analysis be the edge. Explore along with Daloopa’s MCP to map your first pilot from ingestion to audit-ready output.