In the July 2023 CFA Institute survey, 55% of investment professionals reported incorporating unstructured data in their workflows, and 64% tapped alternative data sources. If you haven’t integrated AI tools for equity research into your process, you risk missing insights that peers already leverage.

Today’s financial landscape demands faster, smarter decisions. That’s where AI tools for equity research become critical. They transform hours of manual processing into minutes of automated equity research insights—especially when applying complex equity research valuation methods.

The following six solutions rise above mere tech flair—they actually streamline the work, especially when accuracy is non-negotiable for institutional analysts looking for advanced equity research software and equity research valuation methods.

1. Daloopa

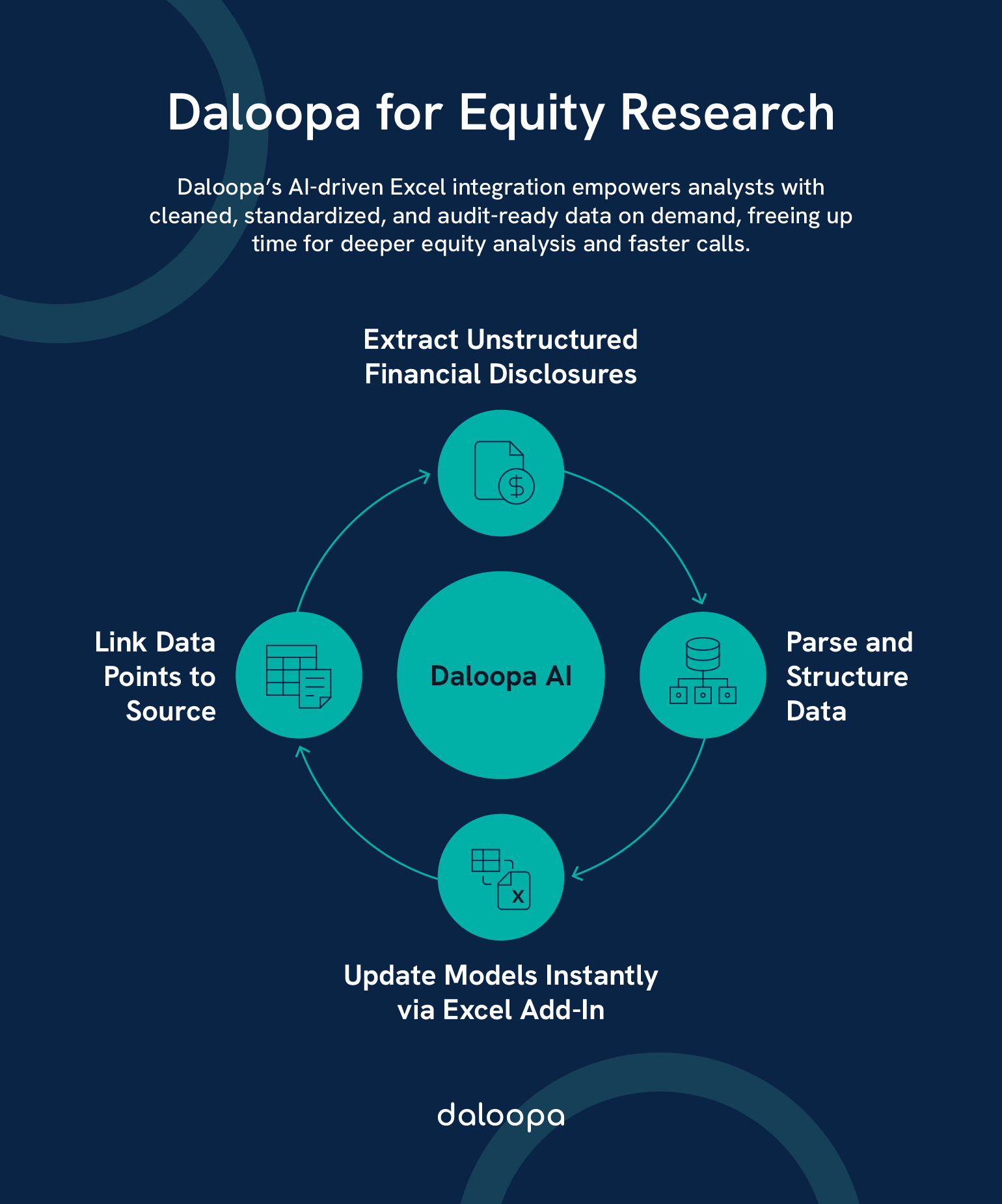

Daloopa carves out its niche by transforming unstructured financial disclosures—earnings releases, SEC filings, and investor reports—into clean, structured datasets you can plug directly into your models.

Daloopa’s AI-powered Excel add‑in alone saves analysts hours every quarter by updating models with a single click. As firms scale, Daloopa’s machine‑learning engine continuously refines its parsing logic, reducing data‑cleanup tickets and letting you redeploy analyst bandwidth to high‑value tasks. It fits naturally into existing modeling tools and spreadsheets. It’s especially helpful for tracking granular line items, footnotes, and non-obvious financial disclosures that can make or break analysis, all while fitting neatly into modern equity research software environments.

Key Features

- On-demand data extraction

- Automated model updates

- Uniform output formats

- Built-in quality control

- API connectivity

Use Cases

- Earnings Season Crunch: Replace days of copy‑paste with a 30‑minute model refresh, thanks to advanced AI tools for equity research.

- Footnote & KPI Tracking: Automatically capture segmented disclosures and non‑obvious metrics for deeper insights.

- Financial Audits & Compliance: Maintain SOC 2 and GDPR audit trails through accurate source links.

Ideal Users

Institutional equity analysts and financial modeling teams who need fully auditable, high‑accuracy fundamental datasets without disrupting existing Excel‑ or Python‑based workflows.

2. FinChat

FinChat excels when you need conversational, on‑demand insights from large text corpora. Its NLP core parses both numeric tables and narrative passages—earnings call transcripts, research notes, and newswire copy—to deliver context‑aware summaries using advanced AI for equity research.

FinChat’s edge lies in its focus on language nuance—its entity recognition engine differentiates between GAAP versus non‑GAAP references, footnote risk factors, and executive tone shifts, offering deeper granularity than rule‑based parsers typically found in traditional equity research software.

Key Features

- Real-time financial parsing

- Market trend sentiment scoring

- Smart filters for opportunity screening

- Natural language query handling

Use Cases

- Earnings Transcript Deep‑Dive: Summarize risks and opportunities from call transcripts in seconds.

- Interactive Screening: For example, “Find U.S. tech stocks exhibiting increasing insider buying alongside strong positive social sentiment.”

- VanEck Deployment: VanEck cut analyst preparation time from 30 hours to 30 minutes using FinChat.

Ideal Users

Buy‑side and sell‑side analysts who prefer conversational interfaces and need high‑quality, cited answers without jumping between multiple data terminals.

3. AlphaSense

AlphaSense powers deep document search across thousands of pages in seconds, combining semantic search with customizable alerts to keep you apprised of critical updates.

By cross‑referencing regulatory filings with media sentiment, AlphaSense gives you a holistic vantage that outpaces siloed search methods and saves hours of manual filtering.

Key Features

- Semantic search across SEC filings, conference calls, and industry news

- Real‑time alerts on thematic triggers

- Tone‑shift detection to flag narrative changes in transcripts

- Analyst‑curated dashboards for sector tracking

Use Cases

- Regulatory Monitoring: Stay on top of 10‑K/10‑Q changes with Black‑lining and QoQ diff alerts.

- Thematic Research: Track sector themes (e.g., ESG, supply chain) across filings and news in one pane.

- Competitive Intelligence: Blend private internal docs with external sources for unified research.

Ideal Users

Corporate strategy, competitive‑intelligence teams, and institutional analysts who need a single “search bar” across all structured and unstructured content.

4. StockInsights AI

StockInsights AI caters to traders and researchers hungry for breadth and speed. It blends multi‑timeframe pattern detection with sentiment analysis across headlines, social media, and analyst reports.

Its portfolio monitoring feature keeps you alerted to threshold breaches on key ratio shifts—ideal for risk teams tracking covenant compliance or sudden leverage changes.

Key Features

- Multi‑timeframe technical pattern recognition

- Sentiment and relevance scoring from market headlines

- Real‑time risk metrics and volatility signals

- Integrated backtesting engine for strategy proofing

Use Cases

- Rapid Due Diligence: Build thesis‑driven summaries on new coverage ideas in minutes.

- Continuous Disclosure Tracking: Never miss an 8‑K or MD&A update relevant to your watchlist.

Ideal Users

Value investors, risk teams, and hedge fund researchers who need breadth and speed in parsing public filings across multiple jurisdictions.

5. FinSphere

FinSphere blends conversation-based AI with live market feeds, letting users analyze data through natural dialogue instead of complex dashboards.

By embedding risk‑management alerts, FinSphere flags volatility spikes and unexpected correlation shifts, helping you nip portfolio drifts in the bud.

Its conversational UI reduces friction, especially for those who prefer asking questions over hunting through drop-down menus. That accessibility speeds up learning curves and reduces time to insight.

Key Features

- Real-time feed with NLP interaction

- On-the-fly stock evaluations

- Pattern recognition automation

- Strategy risk analysis

- Ongoing strategy optimization

Use Cases

- On‑Demand Analysis: Generate full equity reports or thematic deep dives via chat.

- Strategy Optimization: Iterate factor tilts and correlation analyses through conversational prompts.

Ideal Users

Quantitative research teams and data‑driven analysts who value a chat‑first interface backed by real‑time data and rigorous evaluation frameworks.

6. TipRanks

TipRanks synthesizes data from blogs, social media, insider filings, and analyst ratings into its proprietary Smart Score, ranking stocks on potential performance.

TipRanks Expert Center surfaces high‑probability ideas and vetting tools to help you fine‑tune position sizing around well‑backtested signals.

Key Features:

- Smart Score algorithm analyzing eight performance dimensions

- Analyst credibility scores based on historical accuracy

- Real‑time sentiment tracking from news and social chatter

- Browser plugins and mobile apps for on‑the‑go access

Use Cases

- Screening: Quickly filter for “Perfect 10” stocks that have historically outperformed the S&P 500.

- Analyst Benchmarking: Compare your own calls against ranked experts to spot overlooked ideas.

Ideal Users

Retail and institutional investors who want a data‑driven supplement to fundamental research via crowd‑sourced and machine‑learning‑driven signals.

Integrating AI Tools Into Investment Research

AI reshapes how you work, replacing tedious tasks with streamlined analysis and adding visual clarity to complex research workflows.

Portfolio Management And Risk Analysis

AI models learn from decades of historical data to help you:

- Construct balanced portfolios via mean‑variance optimization enhanced with ML‑derived risk factors.

- Simulate stress scenarios faster by running Monte Carlo analyses at hyperscale.

- Monitor exposures continuously, with automated alerts on tracking error breaches and sector concentration risks.

With embedded backtesting, you can trial strategies across different market regimes to make data‑driven allocation shifts.

Choosing The Right AI Tool For Your Needs

When evaluating platforms for your equity research software stack, ask yourself:

- Does it integrate seamlessly with your existing Excel models, Python scripts, or BI dashboards?

- Does it handle both numeric data from SEC filings and narrative context from earnings calls with equal precision?

- Does the vendor maintain SOC 2 Type 2 controls and comply with GDPR’s data‑processing requirements?

- Will it deliver split‑second market alerts when you need speed or deeper NLP insights when you need depth?

- Does it offer robust APIs and user‑defined schemas to tailor outputs to your proprietary models?

- Does the vendor provide responsive, market‑hours support and comprehensive training resources?

Let Daloopa Take It From Here

Unlock new levels of efficiency and insight by powering your equity research with structured, auditable financial data delivered at model speed through the most advanced AI tools for equity research. Discover how Daloopa’s AI‑driven platform can transform your equity research workflow. Request a demo and turn your next earnings season into an alpha‑generation opportunity.