In today’s fast-paced financial environment, one missed opportunity can cost millions. Financial professionals face intense pressure to interpret complex data rapidly and make decisions directly impacting a company’s bottom line. Custom dashboard software empowers these professionals by consolidating vast datasets into clear, actionable insights—all in real-time.

This article examines how advanced custom dashboard software for financial professionals reduces manual work and transforms financial reporting, analysis, and presentations so that you can focus on strategy instead of tedious data entry.

Key Takeaways

- Real-time insights from custom dashboards enhance financial decision-making.

- Personalized interfaces streamline key metric tracking for finance professionals.

- Seamless integration with existing systems simplifies data analysis and management.

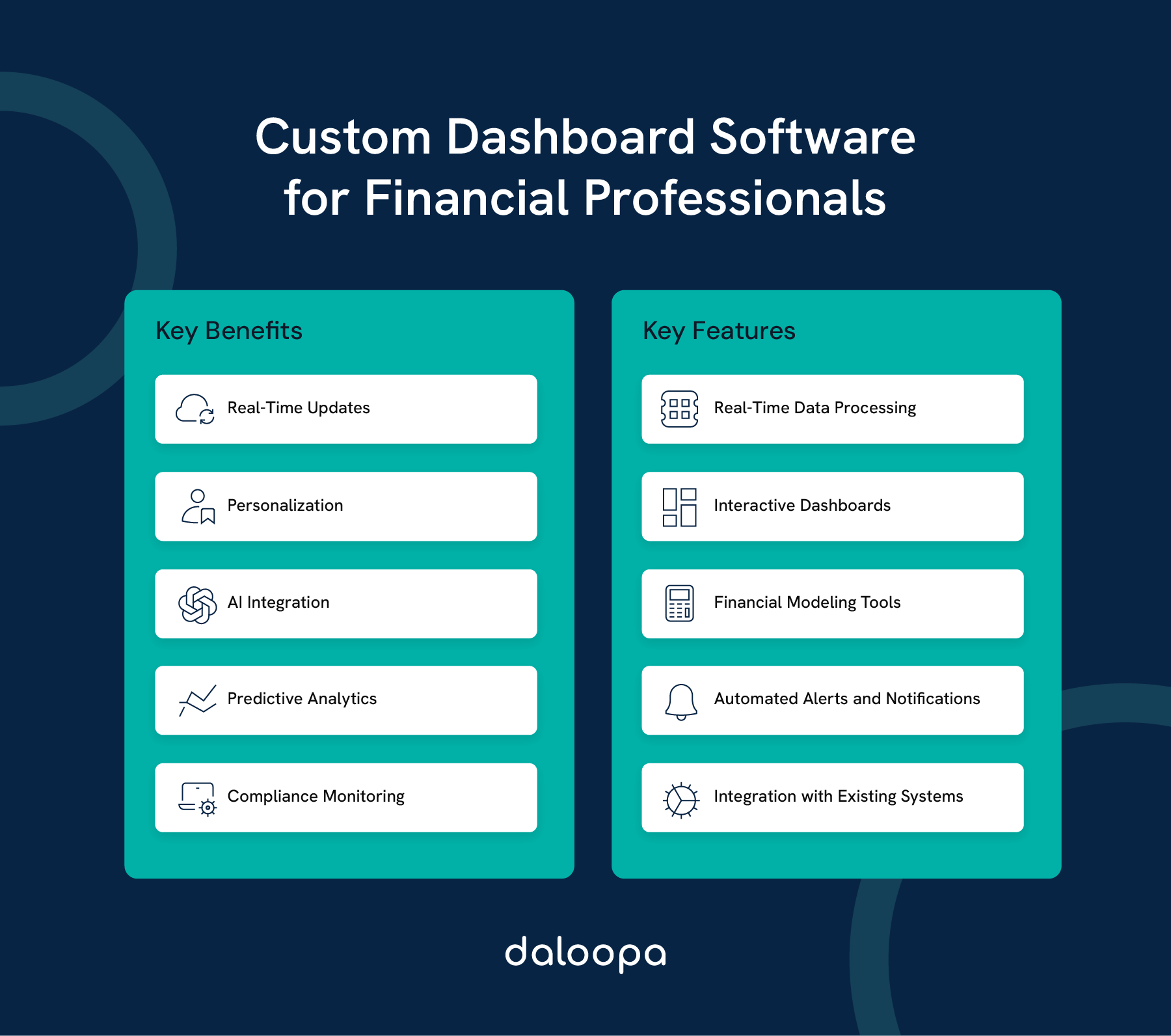

Benefits of Custom Dashboard Software

Custom dashboard software for financial professionals offers transformative advantages for financial professionals, redefining how data is analyzed, interpreted, and acted upon. These tools improve decision-making by converting complex financial data into clear, visually engaging formats. By enhancing the clarity of data, financial professionals gain the ability to make faster and more precise decisions, which is invaluable in a high-stakes environment.

Real-Time Updates

One of the most significant benefits of custom dashboards is their ability to provide real-time updates. As financial markets shift rapidly, having instant access to updated metrics is crucial. Custom dashboards ensure that finance teams can react to market fluctuations, track volatile asset performance, and adjust strategies without delays.

For example, an investment portfolio manager can track live price movements of stocks, monitor risk exposure, and reallocate assets within seconds—all from a single dashboard.

Personalization

Financial professionals perform vastly different roles—from CFOs focused on high-level cash flow trends to analysts tracking minute expense details. Custom dashboard software for financial professionals offers highly customizable interfaces, enabling users to view the metrics most relevant to their responsibilities.

A CFO can quickly review comprehensive cash flow and profitability trends, while a financial analyst might concentrate on predictive models and variance analyses. This role-specific customization enhances productivity and collaboration by ensuring that every team member accesses only the most relevant data.

AI Integration and Predictive Analytics

Modern dashboards integrate artificial intelligence and machine learning to drive predictive analytics. These tools not only track historical performance but also forecast future trends. For instance, an AI-powered financial dashboard might predict potential cost overruns in real time and recommend corrective actions before they become critical.

With features such as anomaly detection and one-click updates, financial teams can eliminate tedious manual data extraction and focus on strategic analysis. In practice, many leading firms already use AI-powered financial dashboard like Daloopa to enhance accuracy and reduce errors in financial models.

Enhanced Compliance Monitoring

Regulatory requirements constantly evolve, and financial professionals must ensure their data stays compliant. Custom dashboards equipped with compliance monitoring features automatically flag discrepancies and changes in key regulatory metrics. This proactive alert system reduces the risk of non-compliance and saves time during audits.

For example, by monitoring cash flow ratios and reconciliation discrepancies, a hypothetical accounting team can detect issues early and maintain a high standard of regulatory adherence.

Key Features of Dashboard Software

Custom dashboard software for financial professionals provides various features designed to enhance financial analysis and decision-making. Central to this is data visualization, which transforms complex numbers into easy-to-read charts and graphs. However, the power of these dashboards goes far beyond visualization alone.

Real-Time Data Processing

By combining real-time data processing and automated updates into one cohesive feature, AI-powered financial dashboards ensure that financial data reflects the latest market conditions. Whether tracking key performance indicators (KPIs) or updating financial forecasts, dashboards deliver up-to-the-minute accuracy and speed.

Interactive Dashboards and Drill-Down Features

Interactive dashboards empower users to explore data at various levels of detail. Users can click on a high-level metric to “drill down” into the underlying data for a deeper analysis. For instance, a financial manager can start with an overview of quarterly revenue and then drill down to view regional performance details. This interactivity simplifies complex analyses and fosters informed decision-making.

Financial Modeling Tools

Many dashboards include built-in financial modeling tools that allow professionals to simulate scenarios and forecast outcomes. These tools facilitate what-if analyses, helping users gauge the impact of changes in market conditions or business strategies on overall performance. By integrating these capabilities directly into the dashboard, financial teams reduce reliance on separate spreadsheets and manual calculations.

Automated Alerts and Notifications

Financial professionals can set thresholds for key performance indicators and receive notifications when these metrics deviate from expected ranges. For instance, an automated alert for declining liquidity ratios allows timely corrective actions, preventing larger financial challenges.

Seamless Integration with Existing Systems

Seamless integration with existing financial systems is another vital feature. Dashboards pull data from diverse sources into one cohesive platform, simplifying workflows and improving accuracy. For instance, a dashboard might integrate data from accounting platforms like QuickBooks, market data feeds, and even proprietary databases, creating a centralized view of financial health.

How Financial Professionals Use Custom Dashboards

Custom dashboards empower financial professionals to turn raw data into actionable insights. These tools have revolutionized reporting, analysis, and presentations by offering real-time, visually appealing data at a glance.

Enhancing Financial Reporting

Dashboards simplify reporting by consolidating data from multiple sources into cohesive views. Financial analysts and CFOs rely on dashboards to track metrics such as profit margins, cash flow, and budget variances, often presented in engaging charts and graphs.

Interactive features allow users to dive deeper into specific metrics, which is invaluable for reconciliations and identifying discrepancies in financial statements. Tailored dashboards also ensure alignment with industry reporting standards, reducing compliance risks.

Streamlining Data Analysis

Financial analysts use custom dashboards to quickly process large datasets, uncovering trends and patterns that might go unnoticed. Advanced features like predictive modeling, scenario analysis, and automated KPI alerts make decision-making faster and more precise.

For example, dashboards can forecast performance, test investment strategies, and notify teams when metrics deviate from expectations. These capabilities enable professionals to operate with greater confidence and efficiency.

Improving Client Presentations

Custom dashboards have redefined how financial professionals communicate with clients and stakeholders. Advisors now use dynamic, interactive presentations instead of static slides. Real-time data visualizations, such as portfolio performance metrics and asset allocation graphs, make complex concepts easier for clients to grasp.

For CFOs presenting to boards or investors, dashboards provide instant access to in-depth data, enabling them to address questions effectively and enhance the overall quality of their presentations.

Integrating Custom Dashboard Software for Financial Professionals

Successful implementation of custom dashboard software hinges on seamless integration with existing systems and user-friendly customization options.

Compatibility With Existing Systems

Integration ensures that dashboards pull data directly from financial tools like QuickBooks, Xero, or Stripe. Real-time connections reduce manual data entry and errors while improving efficiency.

Custom dashboards can also connect with SQL databases for direct data access and import data from spreadsheets, preserving familiar workflows while enhancing visualization.

Ease of Use and Customization

User-friendly interfaces, such as drag-and-drop tools, simplify dashboard creation and modification. This minimizes the learning curve and ensures accessibility for all users.

Custom dashboards can be tailored to mirror existing reporting processes. Templates can resemble familiar spreadsheet layouts, easing the transition for teams. Additionally, flexibility in connecting multiple data sources allows users to consolidate and analyze information effectively.

Choosing the Right Dashboard Software for Financial Professionals

Selecting the ideal dashboard software involves evaluating financial software vendors, weighing costs, and ensuring robust security features.

Evaluating Financial Software Vendors

When assessing financial software vendors, focus on their experience in the financial sector and their track record with customization and integration. Look for providers that offer comprehensive demos, trial periods, and customer references.

Reliable vendors should provide ongoing support and training to help your team get the most out of the software. For example, vendors like Daloopa provide extensive tutorials and a dedicated support team to facilitate a smooth transition and rapid adoption.

Cost Considerations

Budget plays a significant role in software selection. Compare total ownership costs, including implementation, maintenance, and subscription fees, with the anticipated return on investment (ROI) derived from increased efficiency and reduced manual work.

Consider tiered pricing options that allow you to scale usage as your company grows. For instance, Daloopa offers a free plan, a Standard plan, and a Plus plan to cater to different organizational needs without compromising data quality or update speed.

Security Features

Financial data is highly sensitive, so robust security is non-negotiable. When choosing dashboard software, ensure the vendor implements advanced security measures, such as end-to-end encryption, multi-factor authentication, and role-based access controls.

Financial software vendors with certifications like SOC 2 Type 2 or ISO 27001 are committed to maintaining high-security standards. This is particularly important when dashboards integrate data from multiple sources, ensuring that every piece of information remains secure.

Ready to Transform Your Financial Workflow?

Stop spending countless hours on manual data updates and start making smarter, faster decisions with custom dashboard software for financial professionals. Experience the future of financial modeling with Daloopa—the AI-powered financial dashboard solution trusted by top investment firms. With real-time updates, comprehensive data coverage, and seamless Excel integration, Daloopa empowers you to eliminate the manual work and focus on generating high-impact insights.

Discover why leading analysts and portfolio managers rely on Daloopa to accelerate model workflows and drive alpha. Upgrade your financial operations today and embrace the power of better data.