In today’s dynamic financial landscape, reliable data access plays a vital role in making precise and informed decisions. Data vendors across the USA provide comprehensive tools and insights to empower financial professionals, but choosing the right one can be daunting. Identifying the top financial data providers in the USA and evaluating their offerings can significantly enhance financial strategies and provide an edge in a competitive market.

Access to high-quality financial data is non-negotiable for professionals. Several leading data vendors in the USA for financial analysis stand out for their comprehensive offerings and innovative features.

1. Daloopa

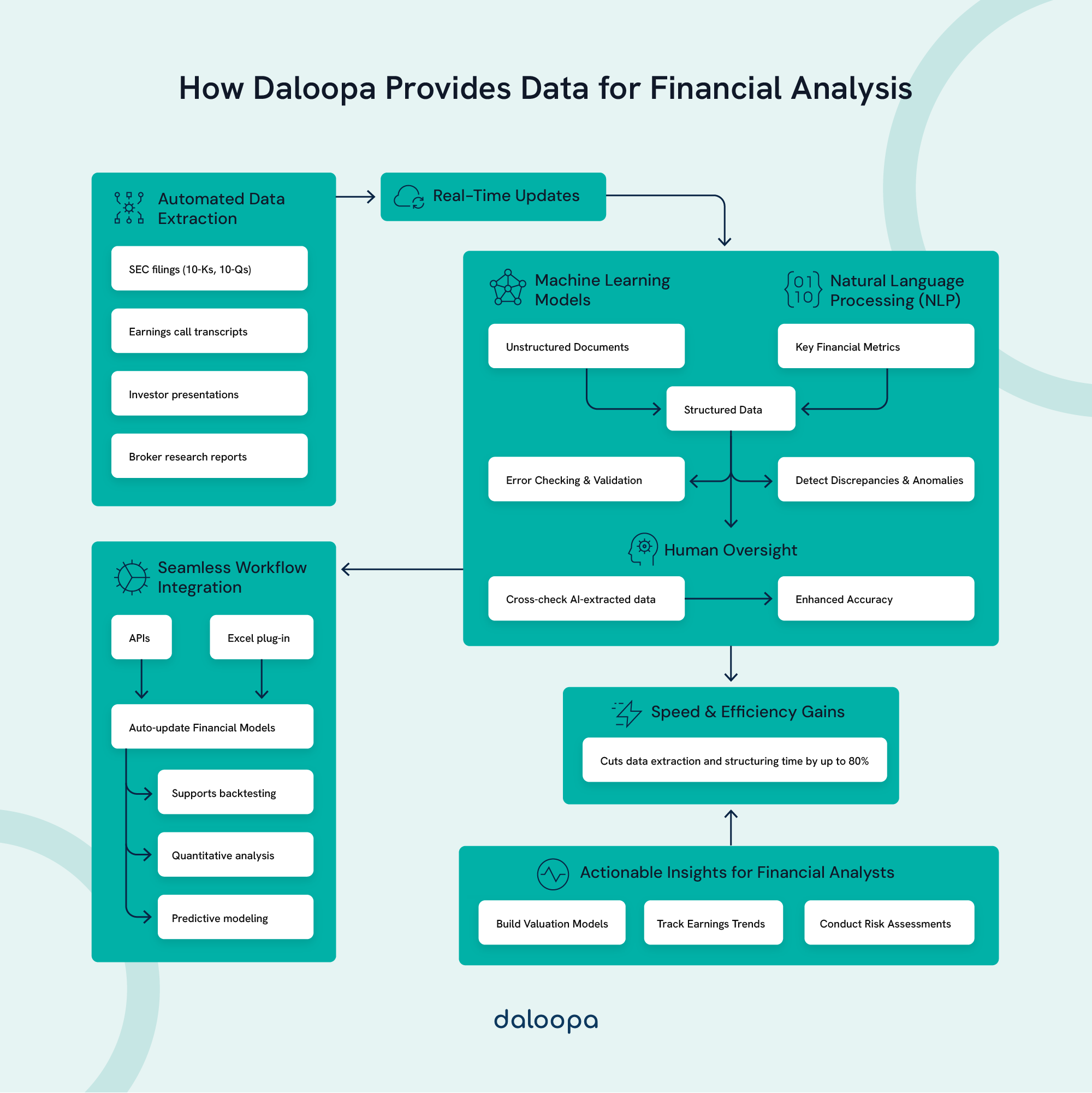

Daloopa leads the pack as an AI-powered financial data vendor that transforms unstructured information into comprehensive, auditable datasets for analysts. It stands out among data vendors in the USA for financial analysis, providing accurate and reliable insights for informed decision-making.

Daloopa was founded in New York in 2019. The platform automatically extracts, normalizes, and updates key financial data points from over 5,000 public companies. Daloopa’s solution enables analysts to build and update financial models in real-time with just a few clicks.

Key features include:

- Automation of Data Extraction: Daloopa’s AI-driven technology cuts down manual “monkey work” by automating the extraction of financial statements (e.g., 10-Ks, 10-Qs, earnings transcripts).

- Real-Time Updates: The platform updates key data points within minutes of an earnings release, ensuring that your models reflect the most current information.

- Auditability and Transparency: Every data point is hyperlinked to its source document, giving analysts instant verification capability.

- Comprehensive Historical Data: With more than a decade of historical data per company, Daloopa allows for robust trend analysis and accurate forecasting.

- Seamless Integration: Whether via Excel add-ins or downloadable datasheets, Daloopa integrates directly into your existing workflow, updating your models with one click.

Daloopa’s solution speeds up routine tasks and helps analysts focus on generating insights and ideas that drive alpha. Its customer-centric approach and flexibility make it the ideal partner for financial professionals looking to reduce errors and save valuable time.

2. S&P Global

S&P Global remains a cornerstone of financial market intelligence, delivering extensive datasets across various asset classes. Based in New York City, the vendor has continuously evolved to cover detailed ESG insights, commodity analyses, and in-depth credit ratings.

Key strengths include:

- Broad Data Coverage: S&P Global provides historical and current market data, including indices, benchmarks, and credit ratings. This depth of information supports rigorous risk management and portfolio optimization.

- Integration Capabilities: Its seamless integration with analytical tools helps asset managers incorporate real-time high-quality financial data into complex financial models.

- Industry Expertise: S&P Global’s long-standing reputation and comprehensive coverage of global markets make it a trusted resource for institutional investors.

For example, a large asset management firm might use S&P Global’s indices to benchmark portfolio performance against industry standards—a concrete example of the value these datasets can provide in driving strategic decisions.

3. FactSet

FactSet offers integrated high-quality financial data and analytics tailored to buy and sell-side professionals. Their headquarters are in Norwalk, Connecticut. Focusing on speed and accuracy, FactSet aggregates real-time data from multiple sources, enabling detailed company and portfolio analyses.

Highlights of FactSet include:

- Integrated Data and Analytics: FactSet combines historical data, real-time quotes, and in-depth financial metrics into a single platform.

- User-Friendly Workstations: The FactSet Workstation offers customizable dashboards, screening tools, and modeling capabilities that streamline complex analyses.

- High Client Retention: With an impressive client retention rate exceeding 95% and a user base of nearly 190,000 professionals, FactSet is a proven partner in financial research.

For instance, an equity research team might use FactSet to analyze comparable companies by pulling high-quality financial data and market multiples directly into their valuation models. This concrete use case underscores the platform’s capacity to drive informed investment decisions.

4. Bloomberg

Started out of New York in 1981, Bloomberg remains one of the most recognized names in financial data. As one of the top data vendors in the USA for financial analysis, their Bloomberg Terminal provides a comprehensive suite of tools that deliver real-time market data, news, and advanced analytics for traders and analysts.

Key features include:

- Real-Time Market Data: Bloomberg’s terminals offer immediate access to live quotes, trading volumes, and breaking news—vital for high-frequency trading and rapid decision-making.

- Customizable Dashboards: Users can create personalized watchlists and set up real-time alerts to monitor specific securities or market events.

- Robust Analytics: With tools for portfolio management, risk assessment, and predictive modeling, Bloomberg supports a wide array of financial activities.

5. Thomson Reuters (Refinitiv)

Thomson Reuters, now operating under the Refinitiv brand in New York, offers the Eikon platform—a direct competitor to Bloomberg’s Terminal. Refinitiv provides robust real-time data, news, and analytics that help financial professionals track market trends and conduct in-depth research.

Strengths of Refinitiv include:

- Customization and Flexibility: Eikon allows users to tailor their data feeds, dashboards, and alerts to their needs.

- Comprehensive Coverage: The platform covers various asset classes, including equities, fixed income, and commodities, and offers specialized ESG data.

- Integration with Trading Workflows: Refinitiv’s tools integrate seamlessly with existing systems, enabling streamlined operations and enhanced decision-making.

6. YCharts

Founded in Chicago, Illinois, YCharts is a rising star among financial data providers in the USA, offering an intuitive platform focused on investment research and analysis. Its strength lies in delivering comprehensive data visualization and screening tools that empower financial advisors and portfolio managers.

Key benefits of YCharts include:

- User-Friendly Interface: YCharts features an intuitive design allowing users to quickly create detailed charts and graphs for market trend analysis.

- Customizable Screeners: Analysts can build custom watchlists and filters to track stocks, ETFs, and mutual funds, tailoring research to specific investment strategies.

- Actionable Insights: The platform combines historical and real-time data, which enables users to make informed decisions based on robust analytics.

Key Considerations When Choosing a Data Vendor

Selecting the right data vendor is pivotal for financial professionals aiming to boost their analytical potential. When choosing data vendors in the USA for financial analysis, evaluate essential factors such as data quality, diversity, and system integration.

Data Quality and Reliability

The foundation of any financial analysis is accurate, up-to-date data. A vendor must deliver high-quality financial data that is both timely and thoroughly validated. Key features to look when looking for financial data providers in the USA include:

- Frequent Updates: Real-time or near real-time data updates minimize the risk of basing decisions on outdated information.

- Rigorous Data Cleansing: Vendors that employ automated error detection and cleansing processes can dramatically reduce inaccuracies.

- Transparent Methodologies: Look for data vendors in the USA for financial analysis that clearly explain their data sourcing and validation methods.

- Source Verification: Tools like Daloopa hyperlink each data point to its original source document, allowing one-click verification—a critical feature that builds trust in the data’s integrity.

For example, if an investment firm uses Daloopa to update its financial models, it can rest assured that every figure is accurate and can be quickly verified against original filings. This reliability minimizes the risk of costly errors in decision-making.

Variety and Scope of Data Offered

A robust vendor should offer a comprehensive array of data types covering all aspects of financial analysis. This includes:

- Market Data: Real-time prices, trading volumes, and historical pricing.

- Fundamental Data: Detailed company financials, ratios, and key performance indicators (KPIs).

- Alternative Data: Nontraditional datasets such as sentiment analysis, social media trends, and satellite imagery can offer additional insights.

- Regulatory Data: Information on compliance, corporate actions, and economic indicators.

The more diverse the data, the broader your analytical capabilities. For instance, combining traditional financial metrics with alternative data can help uncover hidden investment opportunities and manage risk more effectively.

Scalability and Integration Capabilities

As financial data volumes grow, the vendor’s solution must scale without sacrificing performance. Integration is equally important; the data should seamlessly feed into your existing systems and workflows. Look for:

- Flexible Delivery Methods: Options such as APIs, Excel add-ins, or cloud-based data feeds that ensure the data is accessible in the format you need.

- Seamless Integration: The ability to plug the data directly into analytical tools and financial models without extensive customization.

- Scalable Infrastructure: Financial data providers in the USA that invest in robust, cloud-based platforms can handle large datasets and high-frequency updates, ensuring consistent performance even as your data needs expand.

Daloopa, for example, not only automates data extraction but also offers both Excel downloads and direct data feeds, making it simple to integrate into any existing workflow.

Ready to Transform Your Financial Analysis?

Discover how Daloopa’s AI-powered financial modeling copilot can revolutionize your workflow—delivering complete, auditable, and real-time. As one of the leading data vendors in the USA for financial analysis, we empower you to make faster, more informed decisions.

Request a demo today and see how Daloopa helps top-performing analysts find more time for alpha-generating insights.