Imagine reviewing a startup’s financials only to uncover a hidden flaw that turns a promising opportunity into a costly mistake. Mastering a three-statement model is an academic exercise and the cornerstone of accurate financial forecasting and strategic decision-making.

In today’s fast-paced markets, a robust model can differentiate between seizing a lucrative investment and falling prey to financial miscalculations. This step-by-step guide to building a three-statement model for advanced users ensures precision, structure, and an in-depth understanding of the interdependencies between financial statements. Whether you are an investor, analyst, or CFO, the ability to dynamically link the income statement, balance sheet, and cash flow statement is critical. Following the best practices for financial modeling ensures accuracy, consistency, and reliability in your projections.

Key Takeaways

- A comprehensive three-statement model relies on dynamic financial models to connect financial statements with dynamic formulas and manages circular references.

- Using historical data for forecasting forms the backbone of reliable financial projections.

- This step-by-step guide to building a three-statement model for advanced users includes error checks, scenario analysis, and clear documentation, which makes it a useful tool for financial decision-making.

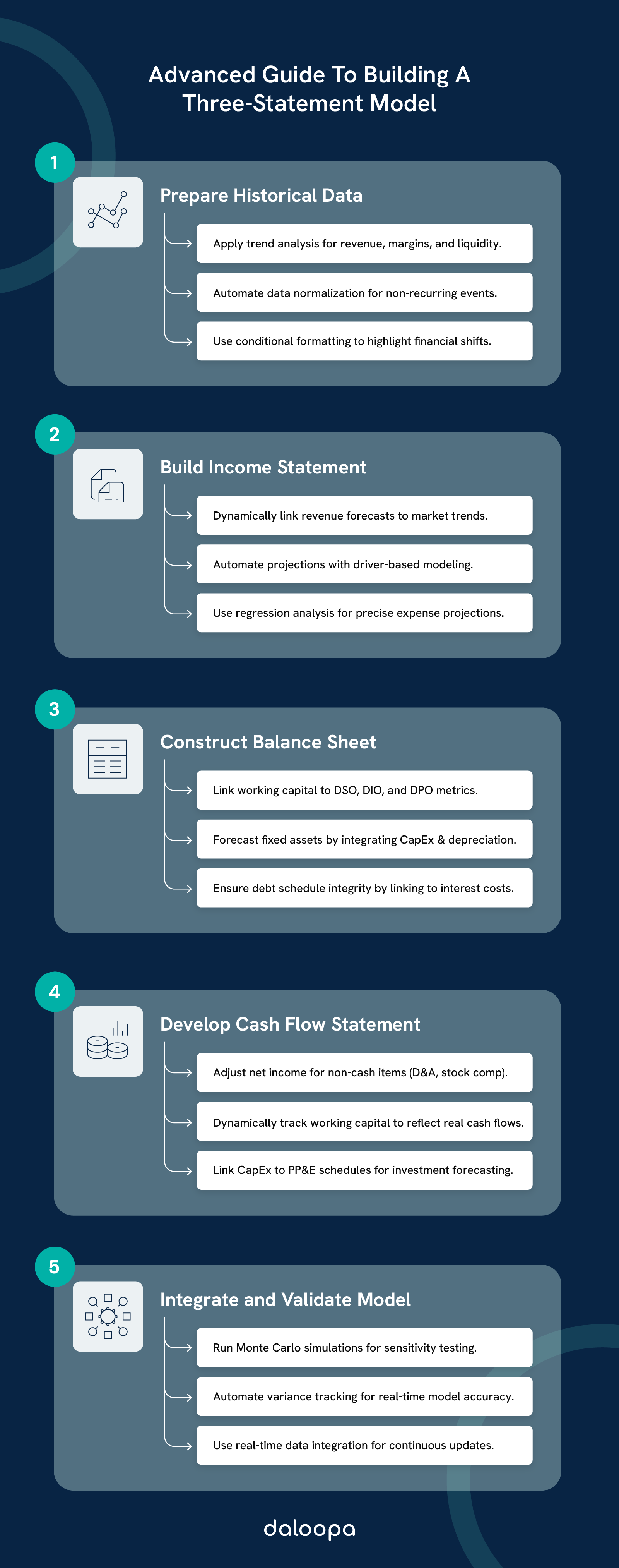

Step 1: Preparing Historical Data

A reliable three-statement model starts with properly organized historical data. Past financial performance provides the framework for forecasting and reveals patterns that shape future projections.

Gathering and Structuring Financial Statements

A reliable three-statement model starts with properly organized historical data. Begin by collecting 3–5 years of audited financial statements from SEC filings, company reports, or investor presentations. Import the data into a standardized spreadsheet with a consistent timeline across columns. Create separate worksheets for the income, balance, and cash flow statements to ensure clarity and precision.

- Key Recommendations:

- Label each worksheet clearly and maintain uniform formatting. Use conditional formatting to highlight key figures like revenue spikes or expense surges.

- Standardize line items to allow for easy comparison across periods, and note any changes in accounting policies or business operations that could affect comparability.

Analyzing Historical Performance

Examine essential performance metrics such as revenue growth, operating margins, and working capital ratios. Calculate operational efficiency indicators like days sales outstanding (DSO), inventory turnover, and cash conversion cycles. These metrics offer insights into liquidity and operational efficiency.

- Actionable Checklist:

- Calculate revenue growth and operating margins.

- Determine DSO, Days Inventory Outstanding (DIO), and Days Payable Outstanding (DPO).

- Highlight any non-recurring events or seasonal patterns.

- What Can Go Wrong?

Failing to adjust for one-time events or changes in accounting standards can lead to skewed historical trends, resulting in inaccurate projections.

Step 2: Building the Income Statement

The income statement is the engine of your dynamic financial models, charting revenue generation, expenses, and profitability. A precise income statement requires accurate revenue forecasts and a clear understanding of cost structures.

Forecasting Revenue and Expenses

Begin your revenue forecast using historical averages, adjusted for current market trends, competitive positioning, and expansion strategies. Break down operating expenses into fixed and variable costs. Fixed costs like rent and salaries remain steady, whereas variable costs align with revenue changes.

- Key Expense Categories:

- Cost of Goods Sold (COGS): Generally ranges between 40–60% of revenue.

- Operating Expenses: Itemize marketing, administrative costs, and R&D individually.

- Depreciation & Amortization: Link these to fixed and intangible asset schedules for precise calculation.

- Actionable Framework:

Create a “Revenue and Expense Forecast Checklist” that includes:- Baseline revenue growth assumptions.

- Identification of fixed versus variable costs.

- A review of planned capital expenditures.

- What Can Go Wrong?

Overly simplistic assumptions or failure to adjust for market conditions can lead to unrealistic projections. Always cross-check your revenue growth assumptions with industry benchmarks.

Estimating Interest and Taxes

Link interest expense directly to your debt schedule on the balance sheet and adjust tax estimates based on pre-tax income and effective tax rates. This ensures consistency across the model.

- Actionable Tip: Build a mini-framework or checklist for tax calculations:

- Determine pre-tax income.

- Apply the effective tax rate.

- Adjust for deferred taxes and permanent differences.

Step 3: Constructing the Balance Sheet

The balance sheet offers a snapshot of a company’s financial position by detailing its assets, liabilities, and equity. It provides the structural balance that links profitability with liquidity and capital structure.

Forecasting Assets and Liabilities

Calculate key components like accounts receivable, inventory, and accounts payable for effective working capital management based on operational metrics (e.g., DSO, DIO, DPO).

- Actionable Checklist:

- Accounts Receivable: Link directly to revenue using DSO.

- Inventory: Base your forecast on Days Inventory Outstanding.

- Accounts Payable: Align with COGS assumptions using Days Payable Outstanding.

- Fixed Assets:

Project PP&E by incorporating planned capital expenditures (CapEx) and subtracting scheduled depreciation. This projection should factor in expansion plans or asset replacement cycles.

Ensuring Balance Sheet Integrity

The balance sheet must always balance—assets should equal liabilities plus shareholders’ equity. Validate this balance by ensuring retained earnings adjust appropriately with net income and dividends.

- What to Do:

Regularly reconcile the debt schedule and verify that changes in retained earnings reflect net income minus dividends. - What Can Go Wrong?

Misaligned working capital metrics or incorrect equity adjustments can distort the financial position. Regular cross-checks are essential to maintain integrity.

Industry-Specific Considerations

Different industries adjust their balance sheet models according to unique operational characteristics:

- Tech Startups: Manage high cash burn and deferred revenue carefully.

- Retail: Focus on seasonal cash flow variations and inventory-heavy structures.

- Real Estate: Emphasize long-term debt management and asset depreciation.

Using these insights, tailor your balance sheet to reflect industry norms and challenges accurately.

Step 4: Develop the Cash Flow Statement

The cash flow statement clarifies the actual movement of cash, categorizing it into operating, investing, and financing activities. It is the ultimate test of a company’s liquidity and operational efficiency.

Linking Cash Flows to the Financial Statements

Start with net income and adjust for non-cash items like depreciation and amortization. Then, calculate changes in working capital to reflect the timing differences between accrual-based accounting and actual cash movements.

- Actionable Checklist:

- Operating Activities: Begin with net income, adjust for non-cash items, and account for working capital changes.

- Investing Activities: Include capital expenditures linked to PP&E forecasts.

- Financing Activities: Factor in debt repayments, interest expenses, and equity transactions.

- Pro Tip:

Use Excel’s conditional formatting to track cash inflows and outflows visually. - What Can Go Wrong?

Failing to adjust non-cash items properly or neglecting working capital changes can result in overstated or understated free cash flow. Precision is key to avoiding these pitfalls.

Step 5: Integrating and Validating the Model

Validation is critical to ensuring the model’s accuracy, reliability, and usability. Regular cross-checks prevent inconsistencies and improve financial decision-making.

Ensuring Model Accuracy

Cross-check key financial ratios against historical performance and industry benchmarks. Validate ratios such as:

- Debt-to-EBITDA

- Interest Coverage

- Working Capital Ratios

- Develop a “Model Audit Log” to track:

- Date of Change

- Person Responsible

- Specific Modifications Made

- Expected Impact on Projections

Utilizing the Model for Strategic Planning

Integrate scenario analysis into your dynamic financial models to test sensitivity to external changes. Adjust variables like revenue growth, working capital, capital expenditures, and debt refinancing scenarios. Dynamic dashboards can then translate these changes into actionable insights for decision-makers.

Consider WeWork’s IPO debacle in 2019, where unrealistic projections and insufficient sensitivity analysis led to financial distress. A robust scenario analysis could have highlighted potential cash flow challenges and guided more prudent decision-making.

Why Following Best Practices for Financial Modeling Matters

A step-by-step guide to building a three-statement model for advanced users is only as effective as the underlying principles that drive it. Implementing best practices for financial modeling ensures that your model remains robust, flexible, and insightful. Key principles include:

- Maintaining dynamic financial models that adapt to different scenarios.

- Ensuring transparency through clear documentation and error checks.

- Utilizing historical data effectively while incorporating real-time market trends.

Let Daloopa Make Things Easier for You

Building a three-statement model is more than a technical task—it is a dynamic process that requires continual refinement, cross-checking, and integration of real-world data. This step-by-step guide to building a three-statement model for advanced users ensures that each financial statement is constructed with precision, validated through actionable takeaways, and optimized for robust financial forecasting and strategic decision-making.

Are you ready to transform your financial modeling process? At Daloopa, we specialize in automating financial data extraction and streamlining complex modeling tasks. Request a demo today to discover how our solutions can help you extract, analyze, and validate financial data faster and more accurately. Empower your financial analysis and make confident decisions with cutting-edge tools for modern financial professionals.