Are you still relying on outdated spreadsheets? Today’s fast-paced markets demand financial analysts and investment professionals to harness the power of data-driven insights with speed and accuracy. Modern investment modeling software has reshaped how teams approach portfolio optimization, risk management, and performance analysis.

These platforms combine advanced analytics, real-time collaboration, and automated data extraction—cutting down on time-consuming manual inputs and reducing errors. Choosing the top investment modeling software for financial analysts helps ensure precision and enhances productivity.

Financial institutions that once depended on traditional spreadsheets now see the immense benefits of specialized software. These tools automate calculations, provide built-in audit trails, and integrate seamlessly with existing financial systems, ensuring compliance and precision.

In an era where every second counts, firms still using old methods risk falling behind competitors leveraging advanced, AI-powered forecasting tools and cloud-based financial software, like those developed by Daloopa.

Key Takeaways

- Modern investment modeling tools automate analysis and improve financial decision-making.

- Leading platforms provide seamless integration with existing financial systems while ensuring regulatory compliance.

- Choosing the right software enhances productivity and reduces the risk of analytical errors.

5 Top Investment Modeling Software Options

The most effective financial modeling tools combine advanced analytics with user-friendly interfaces, enabling financial professionals to handle complex calculations, forecasting, and scenario planning easily. Below, we explore some of the top investment modeling software for financial analysts.

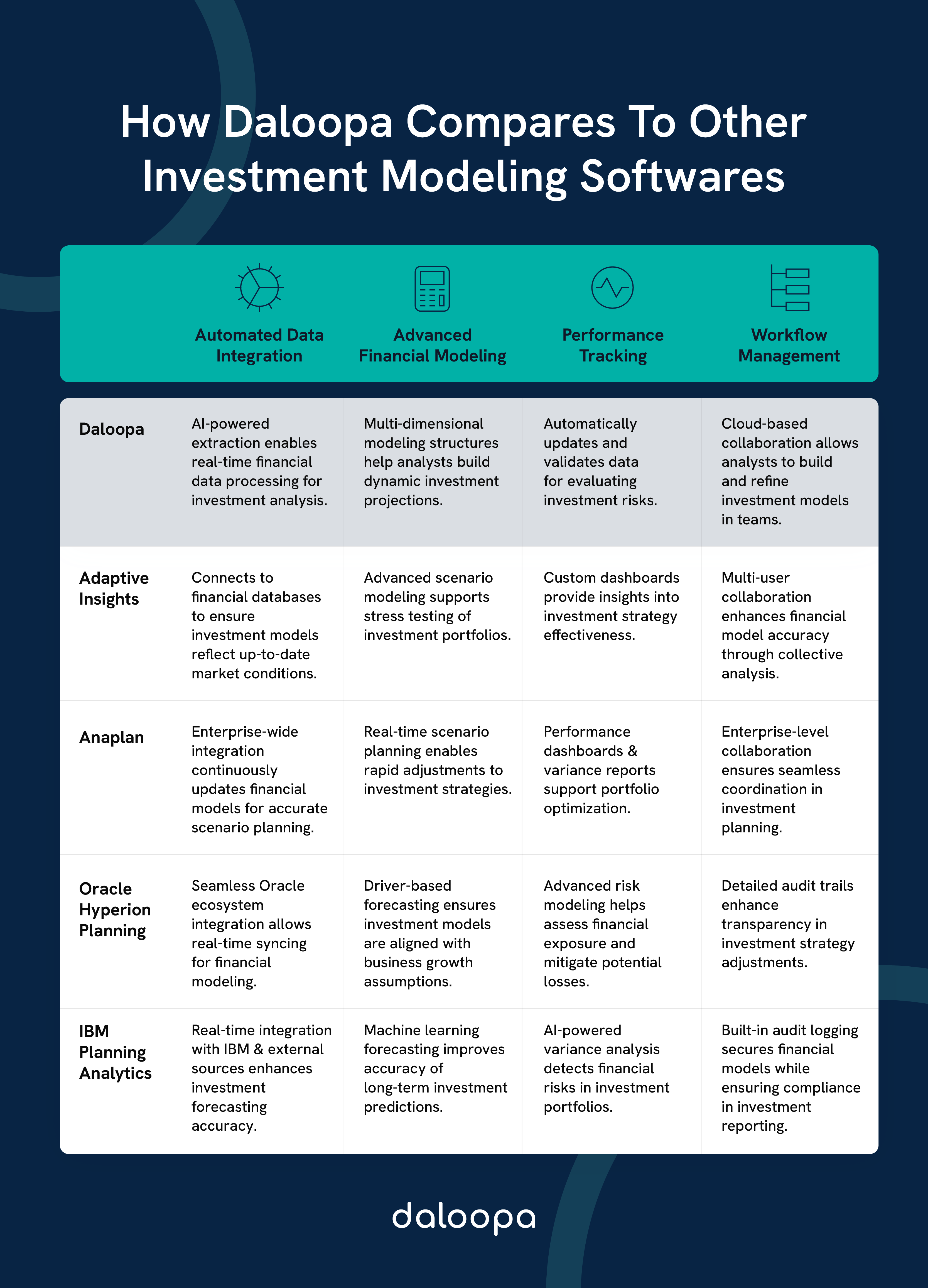

Daloopa

Daloopa stands out for its powerful data extraction and financial modeling capabilities. The platform automates the collection and processing of financial data from sources such as SEC filings and earnings reports, significantly reducing manual efforts and minimizing error propagation.

Key features include:

- AI-powered data extraction: Daloopa leverages artificial intelligence to automatically capture and validate financial information.

- Customizable financial models: Analysts can tailor models to industry-specific needs, ensuring the outputs are as relevant as possible.

- Real-time tracking of financial metrics: Stay ahead with instant access to updated financial data.

- Automated quality control: The system verifies data accuracy to ensure reliable outputs.

Daloopa is considered one of the top investment modeling software for financial analysts today. Its integration with leading data providers means you can access extensive market insights and company financials seamlessly. Its automated validation system minimizes errors, enabling financial teams to shift their focus from manual data entry to strategic decision-making. In today’s competitive market, this means fewer costly mistakes and more time spent on generating actionable investment insights.

Adaptive Insights

Adaptive Insights offers a comprehensive suite of financial planning tools in a cloud-based environment, making it ideal for scenario modeling and rolling forecasts. Its intuitive dashboard and interactive reporting features provide dynamic visualizations that support informed decision-making.

Core capabilities include:

- Driver-based financial planning: Build models that directly link operational drivers to financial outcomes.

- Integrated P&L, balance sheet, and cash flow modeling: Ensure all critical statements align and reflect the financial position.

- Interactive dashboards: Visualize real-time performance data to identify trends and anomalies quickly.

- Automated variance analysis: Quickly pinpoint and address deviations from forecasts.

The platform’s real-time collaboration features eliminate the frustration of version control issues often plaguing Excel spreadsheets. Financial teams can now collaborate on a single, centralized model, ensuring consistency and reducing the risk of errors from manual adjustments.

Anaplan

Anaplan is designed for enterprise-scale financial modeling and connected planning. Its proprietary Hyperblock technology allows for efficient, real-time calculations across massive datasets, making it a favorite among large investment teams.

Strategic advantages include:

- Real-time scenario modeling: Quickly simulate various market conditions and adjust strategies on the fly.

- Multi-dimensional financial analysis: Dive deep into complex data sets to uncover hidden trends.

- Predictive analytics integration (leveraging AI-powered forecasting tools): Enhance forecasting precision with AI-driven predictions.

- Role-based security: Ensure that sensitive data is protected through granular access controls.

Anaplan’s adaptable structure allows users to build custom workflows that maintain calculation accuracy even when large teams are involved. The platform’s flexibility in responding to market changes is invaluable for companies adapting swiftly to external shocks and evolving risk profiles.

Oracle Hyperion Planning

Oracle Hyperion Planning is an enterprise-grade solution that provides robust financial consolidation, forecasting, and planning capabilities. It integrates deeply with other Oracle products, offering strong security and comprehensive reporting tools.

Key features include:

- Advanced allocation modeling: Manage complex consolidations and multi-currency transactions with ease.

- Predictive planning tools: Use AI-enhanced forecasting to identify potential risks and opportunities.

- Web-based interface: Access and update financial models from anywhere, ensuring continuous workflow.

- Workflow automation: Streamline planning and reporting processes to reduce manual labor and errors.

Hyperion excels in handling complex business rules and offers detailed variance analysis tools to monitor trends over time. Its granular access controls provide the level of security required for large organizations, making it a trusted option for financial institutions with significant regulatory obligations.

IBM Planning Analytics

IBM Planning Analytics combines robust financial modeling with advanced analytics and AI-powered forecasting tools. It is designed to seamlessly integrate data from various sources and offer self-service analytics, making it highly scalable for enterprises.

Key strengths include:

- Multi-dimensional analysis: Model intricate financial hierarchies and relationships efficiently.

- Automated data integration: Aggregate data from multiple systems to provide a single source of truth.

- Machine learning-based forecasting: Enhance prediction accuracy with continuous learning from historical data.

- Excel-based interface: Familiar functionality with powerful analytics capabilities.

The system’s ability to process real-time data and offer immediate insights means that financial teams can quickly pivot in response to market changes. Its scalability and ease of use firmly place IBM among the top investment modeling software solutions for financial analysts, making it crucial for organizations looking to implement cutting-edge technology without extensive training or disruption.

Comparative Analysis of Leading Software Solutions

Understanding the distinctions among the top investment modeling software for financial analysts investment modeling tools is essential for selecting the right solution for your organization. The choice between using Microsoft Excel and dedicated financial modeling software often comes down to efficiency, collaboration, and precision.

Microsoft Excel vs. Dedicated Financial Modeling Software

While Excel has been the go-to tool for decades due to its flexibility and extensive formula library, its limitations are becoming increasingly apparent:

- Version Control Nightmares: Multiple users editing the same spreadsheet can lead to errors and inconsistencies.

- Error-Prone Manual Inputs: Manual data entry is susceptible to mistakes, which can propagate and result in significant financial errors.

- Limited Automation: Excel lacks built-in automation and real-time collaboration, which modern software platforms provide effortlessly.

Dedicated financial modeling software offers clear advantages such as real-time collaboration, automated data validation, and industry-specific templates. That’s why dedicated platforms rank as the top investment modeling software for financial analysts over Excel:

- Real-Time Collaboration: Multiple team members can work simultaneously without risking version conflicts.

- Automated Data Validation: These platforms reduce human error by automating the data entry and validation process.

- Industry-Specific Templates: Built-in templates tailored for various industries minimize setup time and ensure compliance with regulatory standards.

Cloud-Based vs. On-Premise Solutions

Cloud-based financial modeling platforms provide instant accessibility and automatic updates, eliminating the need for extensive hardware investments. These solutions allow teams to collaborate remotely and ensure that models remain up to date.

On-premise solutions, on the other hand, offer greater control over security and customization. They function without constant internet access and often handle large datasets more efficiently.

Cloud-Based Solutions:

- Instant Accessibility: Access financial models anytime, anywhere, facilitating remote work and global collaboration.

- Automatic Updates: Cloud platforms regularly update software and security features without manual intervention.

- Lower Upfront Costs: Avoid substantial investments in hardware and benefit from scalable pricing models.

On-Premise Solutions:

- Greater Customization: More control over security settings and custom integrations.

- Enhanced Control: Suitable for organizations with strict data governance policies and regulatory requirements.

Choosing the Right Investment Modeling Software

Selecting the right financial modeling software depends on your organization’s unique needs. It is essential to ask these critical questions before committing to a platform:

- Will it scale with your team? Ensure the software can handle increasing data volumes and collaborative needs as your team grows.

- Does it integrate seamlessly with your existing systems? Compatibility with your current financial infrastructure is crucial.

- Will it eliminate inefficiencies that cost you money? Focus on tools that offer tangible improvements in forecasting precision and error reduction.

Key Features to Prioritize in Top Investment Modeling Software for Financial Analysts

- Real-Time Collaboration Tools: Essential for teams working in fast-paced environments.

- Seamless Data Integration: Look for platforms that automatically pull data from multiple sources.

- Robust Reporting and Visualization: Advanced analytics and intuitive dashboards are a must.

- Automated Workflow Capabilities: Reduce manual work and ensure consistency.

- User-Friendly Interface: Minimal training is required so that all team members can use the software effectively.

- Customer Support and Training Resources: Ensure the vendor provides adequate assistance during implementation and beyond.

Security and regulatory compliance are also critical. Ensure your chosen platform meets industry standards such as SEC, IFRS, GAAP, and data protection regulations.

Daloopa’s Role in Modern Investment Modeling

Ready to revolutionize your financial modeling and boost your team’s efficiency? Discover how Daloopa’s AI-powered platform can transform your investment analysis by automating data extraction and reducing errors.

Visit Daloopa today to request a demo and see firsthand how AI-powered forecasting tools and cloud-based financial software can help your organization achieve measurable results in forecasting accuracy and strategic planning. Join the ranks of forward-thinking firms that have already embraced the future of investment modeling.