Be ready for the Reddit IPO

Reddit filed an S-1 announcing its plan to list on the NYSE (Ticker: RDDT). Start your analysis today with Daloopa.

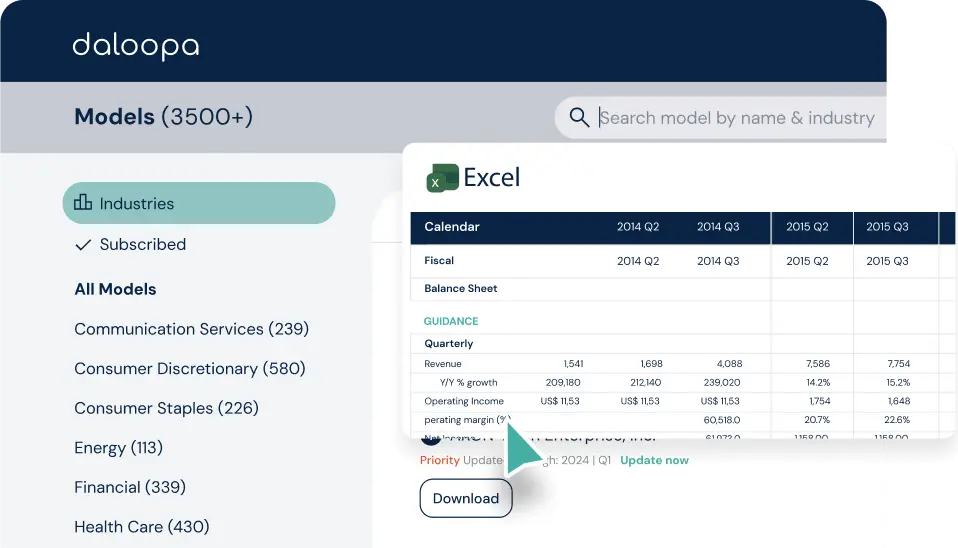

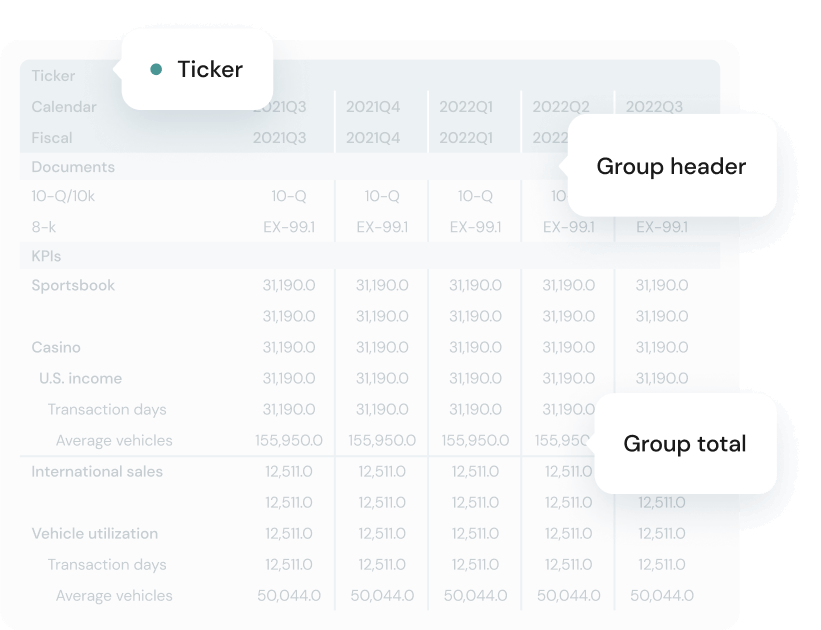

Daloopa provides all the publicly disclosed data -including guidance, debt, KPIs, segmental and geographical breakdowns – in one datasheet and shares updates within minutes of release.

Be one step ahead of the rest.

Reddit IPO Schedule

Filing Date

Reddit initially filed for its IPO in December 2021, delayed due to market conditions, and refiled for an IPO in early 2024.

Roadshow Dates

Specific dates for the roadshow weren’t disclosed, but it likely took place in the weeks leading up to the IPO in March 2024.

Pricing Date

The final IPO price was set at $34 per share on March 20, 2024.

Listing Date

Reddit’s shares began trading on the NYSE under ticker RDDT on March 21, 2024.

Closing Date

The IPO closed around March 25, 2024.

Additional Information

Underwriters

Major underwriters included Morgan Stanley, Goldman Sachs, J.P. Morgan, and BofA Securities.

Use of Proceeds

The IPO raised $519 million for Reddit, which is expected to be used for general corporate purposes, potential acquisitions, and investments in technology infrastructure.

Major Shareholders

Key stakeholders include CEO Steve Huffman, Tencent, and OpenAI CEO Sam Altman.

Valuation

Reddit’s IPO initially valued the company at $6.5 billion, based on the $34 per share pricing. However, after shares surged to $50.44 on the first day of trading, Reddit’s market cap jumped to $9.5 billion.

Oversubscription

Reddit’s IPO was oversubscribed by four to five times, reflecting strong demand from investors, which helped drive the stock price up by 70% during its debut trading session.

RDDT Valuation & Financials

Valuation Metrics

Pre-IPO Valuation

Reddit was valued at $6.5 billion when it priced shares at $34. After trading began, Reddit’s market cap rose to $9.5 billion.

Price-to-Earnings (P/E) Ratio

Reddit is still not profitable and reported a net loss of $90.8 million for 2023, so no P/E ratio is available.

Enterprise Value

While specific enterprise value metrics weren’t disclosed, the IPO valuation of $6.5 billion serves as a starting point for future calculations.

Financial Statements

Revenue

For 2023, Reddit’s revenue was $804 million, up 21% from 2022, largely driven by advertising.

Net Income

The company reported a net loss of $90.8 million for 2023, an improvement from its $158.6 million loss in 2022.

Cash Flow and EBITDA

Detailed figures weren’t provided, but Reddit is focusing on revenue growth and financial stabilization.

Reddit IPO Prospectus

Link to SEC Filings

Reddit’s S-1 filing can be found here.

Summary of Prospectus Key Points

- IPO Date: March 21, 2024

- Ticker Symbol: RDDT

- Share Price: $34 per share

- Oversubscription: The IPO was oversubscribed by 4-5 times, indicating high investor interest.

- User Participation: Nearly 2 million shares were set aside for Reddit users and moderators through a direct share program.

Reddit Market Cap

- As of September 2024, Reddit’s market capitalization is approximately $9.5 billion. This figure comes after a successful IPO, where the stock was initially priced at $34 per share, but surged to $50.44 on the first day of trading, reflecting strong investor demand and high market interest.

- The post-IPO market cap is a significant increase from the initial $6.5 billion valuation, indicating robust performance in the public market despite some ongoing challenges.

Reddit Stock Price

Reddit’s stock (RDDT) debuted on the New York Stock Exchange on March 21, 2024, with an IPO price of $34 per share. The stock surged by 70% on the first day, reaching a high of $57.80 before closing at $50.44, giving Reddit a market cap of $9.5 billion.

As of September 26, 2024, Reddit’s stock is trading at $66.375, showing a strong year-to-date increase of 31.59%. The 52-week range is $37.35 to $78.08, reflecting significant investor interest and steady growth since its IPO.

Interested in other companies?

Create a free account to get access to five more free models for free.

About Daloopa

We believe that AI technology can improve clarity and efficiency for investors and financial markets.

Daloopa was formed in 2019, inspired by our founders’ personal experience at Point72, a NYC- based/short equiy hedge. Accurate data is central to all investment decisions and can influence speed and confidence for decision-makers. We believe that institutional finance has an opportunity to embrace tech-driven accuracy and speed.