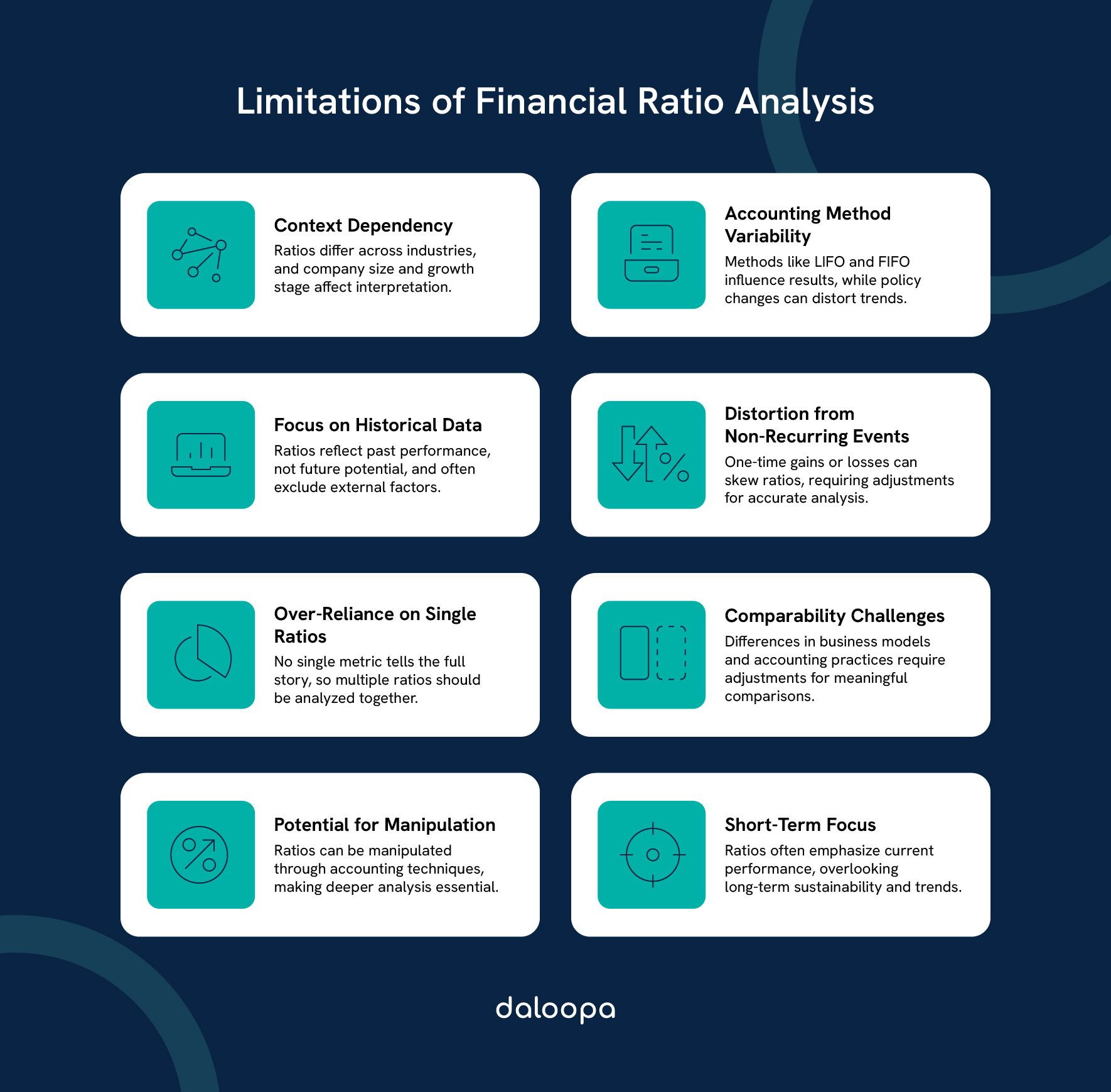

Financial ratios are valuable tools for assessing a company’s financial health–but they don’t always tell the full story. Relying solely on these metrics without understanding their context and inherent limitations can lead to flawed conclusions and misguided decisions.

There are significant pitfalls to look out for when analyzing financial ratios. One good example is making comparisons across different industries or companies with diverse business models. Each sector has distinct characteristics influencing financial metrics, and direct comparisons can be misleading. Additionally, the potential for financial statement manipulation can skew ratios and create a false sense of a company’s financial position.

While analyzing financial ratios capture past performance, they can’t predict how external factors like economic shifts or regulatory changes might affect future outcomes. By recognizing these limitations, you can move beyond the numbers and make more informed, well-rounded financial decisions.

Key Takeaways

- Financial ratios need contextual analysis to avoid misinterpretation.

- Comparing ratios across industries can yield misleading insights.

- A comprehensive financial analysis should include more than just ratios.

Understanding The Limitations Of Analyzing Financial Ratios

Financial ratios offer significant insights into a company’s financial performance, but they have their limitations. Understanding these limitations is necessary to avoid data misinterpretation and poor decision-making.

Contextual Variability In Financial Ratios

Industry norms and specific company factors play major roles in analyzing financial ratios. A ratio deemed healthy in one industry or sector could signal trouble in another. For instance, the inventory turnover ratio varies greatly from sector to sector. The inventory turnover ratio for a grocery store will differ markedly from that of a luxury car dealership.

Factors like company size, growth phase, and business model must also be considered. A startup’s financial metrics may differ vastly from those of an established corporation within the same industry. Financial health indicators may signal different meanings when looked at through the lens of these unique attributes.

Seasonal fluctuations can also affect ratios. A retailer’s current ratio might seem concerning if measured just after the holiday season when inventory levels are low, even though this could be normal for that period. Similarly, companies with cyclical businesses may exhibit fluctuations in profitability and efficiency that do not represent consistent performance.

Impact Of Accounting Policies On Analyzing Financial Ratios

Different accounting methods can result in variations in analyzing financial ratios, even among companies within the same sector. For example, the choice between LIFO (last-in, first-out) and FIFO (first-in, first-out) inventory valuation affects the cost of goods sold and, in turn, profitability ratios. FIFO usually shows a lower cost of goods sold, leading to a higher gross income, while LIFO shows a higher cost of goods sold and lower gross income.

Depreciation methods similarly impact financial metrics. Companies have different ways to spread the cost of their assets (like buildings and machines) over time. Two common methods are straight-line depreciation and accelerated depreciation. With straight-line, the cost is evenly spread out each year. With accelerated, more of the cost is spread out in the earlier years.

The method a company chooses can affect how much profit they show on paper. For example, accelerated depreciation can make profits look smaller in the early years, but larger later on. This can impact how investors and lenders view the company’s financial health, especially during tough economic times or when market demand changes.

Being mindful of these accounting choices is crucial when comparing companies or analyzing trends over time. Policy changes can create artificial improvements or declines in ratios, and understanding their implications is vital for meaningful analysis.

Short-Term Vs. Long-Term Financial Health

When analyzing financial ratios, it’s essential to differentiate between short-term performance and long-term viability. Financial ratios often depict a company’s current state but may not indicate long-term viability. For instance, the current ratio shows short-term liquidity but doesn’t account for future cash flows or long-term debt obligations. A company could exhibit strong liquidity ratios while facing significant long-term risks.

Conversely, a firm investing heavily in research and development or aggressive expansion might exhibit weaker short-term metrics due to increased expenses. This might suppress profitability ratios temporarily but pave the way for future growth and market leadership.

To gain a full perspective, both short-term and long-term indicators should be assessed. Analyzing trends and forecasting future performance is key to understanding a company’s financial trajectory. Combining historical data with predictive analysis can help paint a clearer picture of future stability.

Influence Of Non-Recurring Events

One-time events can distort financial ratios, creating a skewed view of a company’s financial status. Examples include:

- Asset sales

- Legal settlements

- Restructuring expenses

- Extraordinary gains or losses

A significant one-time gain, for example, could inflate profitability ratios, making a company appear more profitable than it truly is in regular operations. Similarly, an unexpected loss from a lawsuit or natural disaster could temporarily depress performance metrics without reflecting the ongoing state of the business.

Adjusting for these non-recurring items requires a detailed ratio analysis of financial statements and related notes. Recognizing and isolating such items helps ensure a more accurate assessment of the core business.

Over-Reliance On Single Ratios

No single ratio can capture the full picture of a company’s financial health. Overemphasizing one metric risks overlooking critical aspects of performance.

For instance, a strong current ratio might suggest good liquidity, but without considering the debt-to-equity ratio, significant leverage risks could be missed. Similarly, an excellent return on assets (ROA) might indicate effective asset utilization, but without examining revenue growth and cost management, broader trends could be overlooked.

A balanced approach involves using multiple ratios across various categories:

- Liquidity (e.g., current and quick ratios)

- Profitability (e.g., gross margin, return on assets)

- Efficiency (e.g., inventory turnover, receivables turnover)

- Leverage (e.g., debt-to-equity, interest coverage)

Complementing these metrics with qualitative analysis such as market position, brand strength, and management expertise provides a richer understanding of company performance.

Comparative Financial Ratio Analysis Challenges

Comparing financial ratios between companies is complicated by differences in:

- Business models

- Accounting methods

- Size and growth stage

- Geographic location

- Product mix

Even within the same industry, these variables can render direct comparisons unreliable. A small, growing tech firm will have different metrics than a large, established competitor. Additionally, firms operating in different regulatory environments or with varying access to resources may show divergent financial results that are not directly comparable.

Ensuring meaningful comparisons may require adjustments for accounting differences, focusing on similar-sized peers, or applying industry-specific benchmarks. This added layer of diligence helps create more accurate financial ratio analyses and avoids skewed perceptions.

Potential For Manipulation

Ratios can be manipulated through accounting techniques or transaction timing, known as “window dressing” or “earnings management.” Common tactics include:

- Delaying expenses or accelerating revenue recognition

- Changing inventory valuation methods

- Classifying long-term debt as short-term to improve the current ratio

- Using off-balance-sheet financing to hide liabilities

A well-known example is the Enron scandal, where the company used loopholes to manipulate its financial statements, keeping significant liabilities off its balance sheet. This fraudulent manipulation skewed the analysis of financial statements, making Enron’s debt-to-equity ratio look much healthier than it actually was, misleading investors and analysts into thinking the company was more stable and profitable. This manipulation contributed to an artificially high stock price, which peaked at $90.75 per share but plummeted to under $1 when the fraud was exposed.

Thorough financial ratio analysis involving cash flow statements, footnotes, and multi-period comparisons can help identify potential manipulations. Analysts should remain cautious of sudden improvements in key ratios without substantive changes in operational performance.

A Balanced Approach To Financial Ratio Analysis

While financial ratio analysis is powerful, it should be approached with care. Evaluating multiple ratios collectively provides a fuller picture of a company’s financial standing.

Metrics like return on equity (ROE) and return on assets (ROA) reveal profitability but lack comprehensive context. A thorough analysis of financial statements, including the income statement and balance sheet clarifies the factors driving these ratios.

When analyzing financial ratios such as earnings per share (EPS), it’s important to consider elements like share buybacks that might artificially inflate results without actual business growth. Additionally, understanding whether earnings growth is driven by sustainable operational gains or temporary cost-cutting measures is essential.

Market value ratios like the price-to-earnings (P/E) ratio are useful for comparisons but need industry norms and economic conditions for context. High P/E ratios could indicate growth potential but also carry risk if market expectations are unmet.

Liquidity ratios are key for understanding short-term obligations but should be complemented with an analysis of liquid asset quality and cash flow. The composition of current assets and their convertibility to cash in times of need also matter.

Profitability ratios, such as gross profit margin, provide essential insights but require deeper exploration into cost structures and operational efficiency. Trends in these ratios may indicate shifts in competitive positioning or cost management.

Debt ratios assess financial risk and should include both short-term and long-term obligations, along with the company’s capacity to manage debt under varied economic conditions. Monitoring interest coverage and debt repayment timelines provides insight into potential vulnerabilities.

By analyzing financial ratios together and understanding their context, a more accurate assessment of a company’s financial health and performance can be achieved. Incorporating broader analysis ensures a complete view that helps mitigate risk and inform sound decision-making.

Analyzing Financial Ratios for Smarter Decisions

Analyzing financial ratios provides valuable insights into a company’s health but doesn’t always give the full picture. Without context, ratios can mislead and distort a company’s true financial standing, whether due to industry differences, accounting choices, or even manipulation tactics. By understanding these pitfalls and complementing ratios with additional analysis, investors, owners, and analysts can make better-informed, more comprehensive financial decisions.

Daloopa streamlines your financial ratio analysis by offering clarity and depth that go beyond surface-level metrics. Check out Daloopa today and enjoy automated, up-to-date, comprehensive insights, and reduce the risk of misleading conclusions for smarter, data-driven decisions.