Excel remains an indispensable tool for businesses navigating the complexities of financial forecasting. Businesses can create precise financial projections that drive strategic planning and resource allocation by leveraging Excel’s forecasting models and advanced features. By understanding the tools and techniques for financial forecasting in Excel, businesses can maximize the software’s potential to deliver actionable insights.

Excel’s accessibility and adaptability make it a preferred platform for businesses of all sizes. From basic trend analysis to complex, multi-variable models, mastering its capabilities equips organizations to predict market trends effectively and refine their financial strategies.

Key Takeaways

- Excel provides accessible tools for crafting accurate financial forecasts.

- Advanced features like FORECAST.ETS improves prediction reliability.

- Linking financial statements ensures holistic business planning.

Excel as a Tool for Financial Forecasting

Excel offers a comprehensive platform for financial forecasting, equipped with features that cater to a wide range of business needs. Its versatility makes it a go-to choice for financial analysts, business managers, and entrepreneurs aiming to gain clarity in their financial planning.

Excel simplifies complex calculations with built-in functions such as NPV, IRR, and PMT, which streamline cash flow and investment analyses. These functions reduce manual errors and enable users to focus on higher-level strategic considerations.

The tools and techniques for financial forecasting in Excel include advanced algorithms like the FORECAST.ETS function which predicts future values based on historical data, providing users with the tools needed to prepare for market fluctuations. Businesses can rely on these tools and techniques for financial forecasting in Excel to enhance decision-making and adapt to changing financial environments effectively.

Key tools for financial forecasting in Excel include:

- Data Tables: Sensitivity analysis for understanding variable impacts.

- Scenario Manager: Exploring multiple “what-if” scenarios for contingency planning.

- Goal Seek: Reverse-engineering targets to match specific goals.

- Solver: Optimizing problem-solving with constraints.

By linking spreadsheets, Excel allows seamless integration of income statements, balance sheets, and cash flow projections. Dynamic referencing through INDEX and MATCH functions enhances flexibility, ensuring updated financial forecasting models in Excel with minimal repetitive tasks.

Collaborative features enable real-time updates and shared access, ensuring forecast accuracy across teams. For example, a sales team can dynamically update inventory models, fostering improved department decision-making.

The video below provides a clear demonstration of how to streamline financial forecasting workflows and enhance accuracy using Daloopa’s Excel Plugin.

Key Financial Forecasting Models in Excel

Excel provides essential tools for deriving insights from historical data, including moving averages, exponential smoothing, and linear regression. Each technique offers unique advantages depending on business needs and data complexity.

Moving Averages

Moving averages smooth fluctuations in time series data, highlighting underlying trends. In Excel, you calculate moving averages using the AVERAGE function or the advanced FORECAST.ETS feature.

Steps for a simple moving average:

- Select historical data.

- Use =AVERAGE(A1:A3) for a 3-period moving average.

- Drag the formula to extend across other periods.

For a weighted average, assign different weights to data points:

- Example: =SUM(A1*0.5, A2*0.3, A3*0.2)

While effective for stable trends, moving averages may lag during rapid changes. Combining this model with advanced forecasting tools like exponential smoothing may yield better results for businesses with volatile sales patterns. Excel financial planning tools like these provide businesses with the precision and adaptability needed to make informed decisions based on historical data.

Exponential Smoothing

Exponential smoothing gives more weight to recent data, making it suitable for volatile environments. Excel’s FORECAST.ETS function automates this technique, ensuring faster and more accurate predictions.

Steps to use exponential smoothing:

- Select a cell for the forecast.

- Input =FORECAST.ETS(target_date, values, timeline).

For additional customization, FORECAST.ETS.STAT provides control over forecasting parameters, ideal for rapidly shifting markets. These parameters allow businesses to fine-tune their forecasts, ensuring higher precision and adaptability to nuanced changes. For example, a fashion retailer could use exponential smoothing to adapt to fast-changing trends by focusing on recent sales data while planning new inventory.

Linear Regression

Linear regression identifies relationships between variables to project future values. Excel simplifies this with the FORECAST.LINEAR function, offering clarity for businesses looking to understand causative links between data points.

Steps for linear regression:

- Organize data with X values (e.g., dates) and Y values (e.g., sales).

- Use =FORECAST.LINEAR(X_value, known_Ys, known_Xs).

For detailed analysis, use Excel’s Data Analysis ToolPak:

- Navigate to Data > Data Analysis > Regression.

- Input Y and X ranges.

- Specify the output range.

Linear regression works best with data showing a consistent trend, particularly in industries like manufacturing or logistics, where demand patterns often correlate with external factors such as seasonal cycles or macroeconomic conditions. When combined with other forecasting models, linear regression provides layered insights that enhance accuracy.

Advanced Excel Tools for Financial Forecasting

Excel’s advanced tools, like FORECAST.ETS and Forecast Sheets elevate forecasting accuracy by incorporating complex patterns and trends. These Excel financial planning tools simplify calculations and enhance data visualization, making communicating insights easier.

Using FORECAST.ETS Function

FORECAST.ETS applies triple exponential smoothing, accommodating seasonality and irregularities in financial data. The function calculates predictions and confidence intervals by selecting a target date, historical values, and timelines.

Combining this function with conditional formatting can help identify significant deviations, enhancing data interpretation. For example, businesses can flag deviations of 10% or more to investigate and mitigate risks proactively.

Steps to Implement:

- Select historical data.

- Input =FORECAST.ETS(target_date, values, timeline).

- Use FORECAST.ETS.STAT for fine-tuning predictions.

Creating Forecast Sheets

Forecast Sheets simplify presenting and analyzing financial data by generating a dedicated worksheet with interactive charts and predictions.

Steps for creating a Forecast Sheet:

- Select the data range.

- Go to the Data tab and choose “Forecast Sheet.”

- Adjust parameters like seasonality and confidence intervals.

Customize elements like seasonality and confidence intervals to refine visual outputs. Forecast Sheets also provide options to adjust the timeline length, making it possible to focus on specific periods of interest, such as quarterly or annual forecasts. Including annotations in these sheets can also help stakeholders quickly grasp key takeaways.

The clarity and precision offered by Forecast Sheets make them ideal for stakeholder presentations, particularly when communicating complex financial trends. Regular updates to these sheets ensure that forecasts remain relevant and actionable. For example, a finance team could prepare quarterly revenue forecasts and use interactive charts to visualize potential outcomes, aiding in budget allocations.

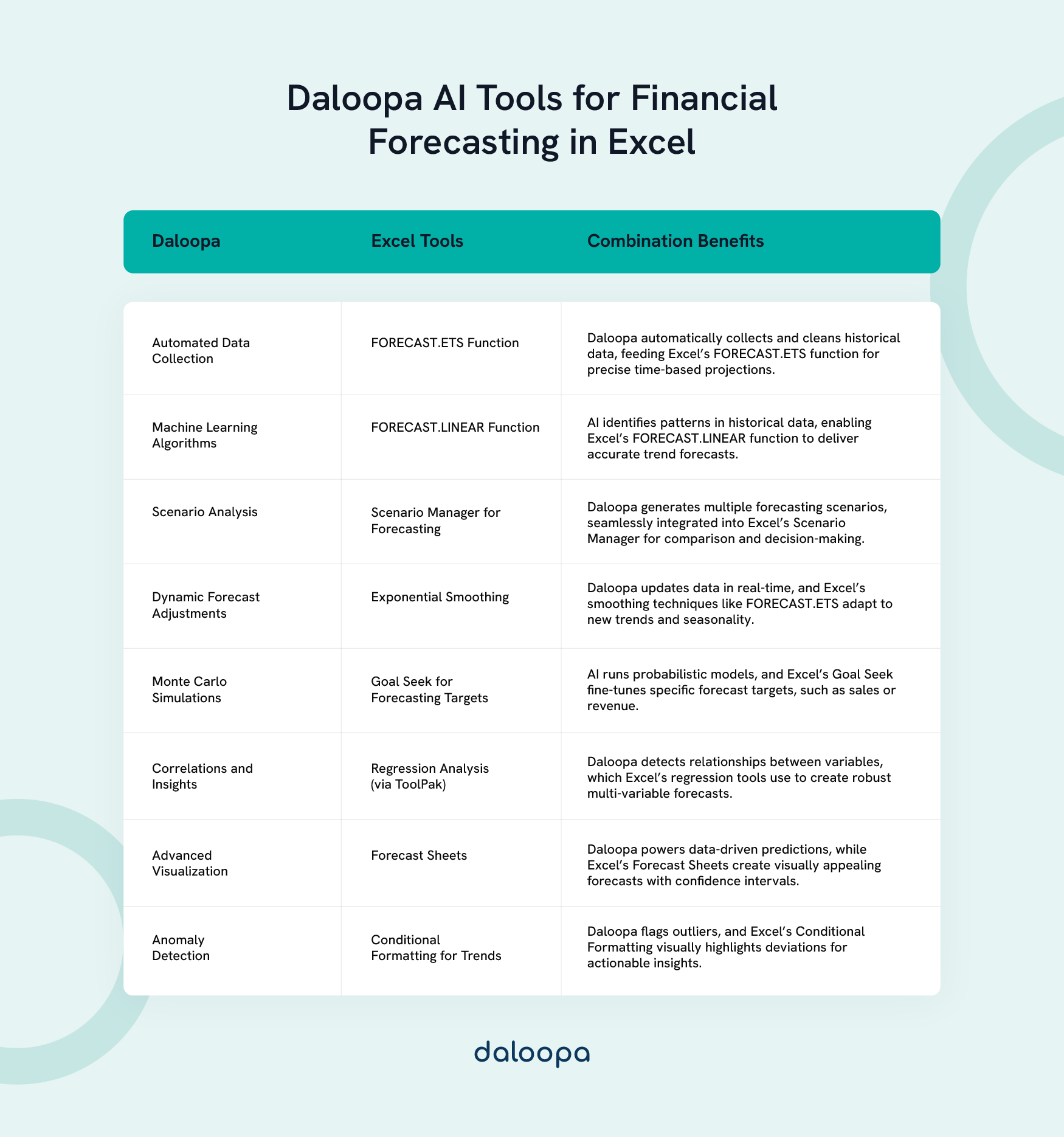

Using Daloopa’s AI Tools for Financial Forecasting in Excel

Daloopa’s AI-driven tools amplify Excel’s forecasting capabilities by automating data tasks and enhancing model accuracy. Their advanced technology seamlessly integrates into workflows, reducing manual labor and increasing efficiency.

Integrating Daloopa with Excel

Daloopa integrates seamlessly with Excel through its dedicated ribbon. It enables direct data import, advanced modeling, and machine learning algorithms, enhancing existing workflows.

Businesses can build robust hybrid models by combining Daloopa’s functions with Excel formulas, allowing for greater flexibility in financial modeling and adapting to the unique needs of various industries. The tool’s ability to work across different data formats and sources ensures compatibility with diverse datasets.

As explained in this video tutorial, Daloopa’s Excel plugin allows you to add updated numbers directly into your financial forecasting models in Excel using the exact same formatting, rather than needing to reformat everything yourself manually.

Automating Data Collection and Cleaning

Daloopa automates data extraction from financial sources like SEC filings and market reports. Its AI tools clean and standardize this data, saving time and reducing errors. Custom cleaning rules align the process with specific modeling needs, freeing time for strategic analysis.

The ability to eliminate inconsistencies and ensure uniformity across datasets significantly improves forecast reliability, making it easier to identify actionable insights. Automated alerts for anomalies further enhance data integrity, helping businesses address discrepancies before they impact forecasts.

Constructing Financial Models with Daloopa

Daloopa analyzes historical data to recommend appropriate forecasting techniques. Machine learning algorithms adjust forecasts based on new inputs, ensuring real-time accuracy. It also highlights variable correlations for creating comprehensive models, helping refine financial strategies.

The insights provided by Daloopa help businesses identify underlying trends, empowering them to make informed decisions that align with long-term objectives.

Performing Advanced Scenario Analysis

Daloopa enables detailed scenario analysis by identifying impactful factors. Its Monte Carlo simulation tools offer probabilistic forecasts, providing nuanced insights into risks and opportunities. These scenarios help quantify potential outcomes, supporting informed risk management.

By running multiple scenarios, businesses understand potential outcomes comprehensively, allowing for more robust strategic planning. Decision-makers can evaluate the implications of various strategies and prioritize actions based on detailed projections.

Enhancing Reporting and Visualization

Daloopa augments Excel’s reporting features by suggesting optimal visualizations and creating dynamic dashboards. Its natural language processing generates narrative summaries, making reports more accessible to stakeholders.

These interactive presentations not only improve communication but also help in aligning cross-functional teams around shared financial goals. Advanced visualization techniques, such as heatmaps and interactive timelines, add depth to reports, providing audiences with an engaging and informative experience.

Linking Financial Statements for Comprehensive Planning

Integrating financial statements allows businesses to align key metrics and assess their overall financial health, fostering a clearer understanding of operational impacts on broader financial objectives.

Integrating Balance Sheets and Cash Flow Projections

Start by linking opening balances from the balance sheet to the cash flow statement. Adjust projections for accounts receivable or inventory purchases to reflect their impact across both statements.

For example, an increase in inventory might reduce cash flow but signal higher anticipated sales, creating a complex but insightful relationship between financial statements. These insights help identify opportunities for optimizing working capital and balancing cash management strategies.

Utilizing Historical Data for Accurate Forecasting

Historical data forms the backbone of reliable forecasts. Steps for leveraging past financial statements include:

- Collect 3-5 years of data.

- Identify growth trends and seasonal patterns.

- Calculate efficiency ratios.

Using Excel financial planning tools like regression analysis and FORECAST.ETS ensures data-driven projections grounded in historical performance. Incorporating these insights fosters confidence among stakeholders, demonstrating thorough preparation and analytical rigor. Businesses can refine their methodologies and enhance future accuracy by comparing historical forecasts with actual results.

Mastering Financial Forecasting in Excel

Excel empowers businesses to create accurate and adaptable forecasts for navigating changing markets. Its simplicity and depth make it a critical asset for businesses aiming to stay ahead.

Building Confidence in Predictions

Confidence intervals and error metrics, such as MAE and RMSE, help assess forecast reliability. Excel financial planning tools like Data Tables facilitate risk modeling, offering a broader perspective on potential outcomes.

Proactively addressing these outcomes ensures businesses are better equipped to handle financial uncertainties, maintaining stability even in fluctuating markets. Incorporating scenario analysis further strengthens these forecasts by highlighting best- and worst-case scenarios.

Continuous Learning and Adaptation

Frequent updates using Excel’s dynamic range references align forecasts with current data. Statistical functions like MEDIAN and STDEV help refine financial forecasting models in Excel, ensuring predictions evolve with market conditions. Tools and techniques for financial forecasting in Excel play a pivotal role in helping businesses stay adaptable and improve the accuracy of their projections

Committing to continuous learning ensures that businesses remain agile and capable of adjusting strategies to meet both immediate challenges and long-term goals. With Excel at the core of financial forecasting, businesses can confidently embrace innovation and data-driven decision-making.

Use Daloopa for Easy Forecasting

Leverage the power of Daloopa’s AI to unlock deeper insights and elevate your financial forecasting in Excel. Automate workflows, improve accuracy and make informed decisions with confidence. Visit Daloopa to explore their cutting-edge tools and transform your financial planning today!