Accurate historical market capitalization data is vital for investors and analysts aiming to understand long-term trends and make informed decisions. Reliable data provides the foundation for evaluating company performance, identifying growth opportunities, and assessing economic conditions.

Whether a novice investor or a seasoned financial professional, the right tools can empower you to analyze historical market trends effectively.

This article explores the best sources for historical market capitalization data and how they can enhance investment strategies.

Key Takeaways

- Free tools like Yahoo Finance and Google Finance cater to casual investors with basic market cap data.

- Premium platforms like Daloopa offer comprehensive datasets for advanced analysis.

- Selecting the right source depends on specific research needs and available budget.

Understanding Market Capitalization

Historical market capitalization data offers insights into a company’s growth trajectory, enabling investors and analysts to evaluate trends, compare industry peers, and make data-driven decisions.

When seeking historical market capitalization data, consider the following factors:

- Accuracy: Ensures decisions are based on reliable numbers.

- Time Range: Determines how far back trends can be analyzed.

- Update Frequency: Reflects how current the information is.

- Adjustments: Accounts for stock splits, dividends, and other changes affecting historical data.

Reliable historical data reveals patterns that guide investment strategies and deepen understanding of broader economic movements. For instance, market cap fluctuations are influenced by:

- Economic conditions: Recessions or booms affect valuations across industries.

- Company performance: Revenue growth, profitability, and innovation drive changes.

- Investor sentiment: Market trends, news, and global events impact stock demand.

- Industry trends: Sector-specific shifts can dramatically alter market cap rankings.

By understanding historical market capitalization, investors can assess how companies adapt to changes, evaluate resilience, and identify opportunities in the broader financial landscape.

Free Online Tools for Historical Market Capitalization Data

Free online tools are excellent starting points for historical market cap research. Yahoo Finance and Google Finance are widely used platforms offering accessible data for many publicly traded companies. They are among the best sources for historical market capitalization data, providing novice investors with reliable insights to analyze historical market trends.

Yahoo Finance

Yahoo Finance is one of the best sources for historical market capitalization data. It covers stocks, ETFs, and indices from major exchanges such as NASDAQ and NYSE. Its intuitive stock screener allows users to filter equities based on specific criteria.

Steps to access historical market cap data:

- Search for the company ticker (e.g., AAPL, GOOG).

- Navigate to the “Historical Data” tab.

- Select the desired time range.

- Choose “Market Cap” from the metrics list.

- Export data in CSV format for further analysis.

Yahoo Finance also features interactive charts, making it easy to visualize market cap trends over time. Yahoo Finance provides an easy, efficient entry point for casual investors or students looking to explore past market behaviors.

Google Finance

Google Finance provides a straightforward interface for retrieving historical market cap data. Though less feature-rich than Yahoo Finance, it is ideal for quick lookups and basic analyses.

Notable features:

- Real-time stock prices

- Customizable historical charts

- News and company reports

Steps to find market cap information:

- Search for a stock ticker or company name.

- Access the “Historical” tab.

- Adjust the time frame as needed.

- Review market cap data in the chart.

Integration with Google Sheets allows seamless data export, making Google Finance a handy tool for further analysis. It’s particularly useful for investors seeking quick, actionable insights without requiring advanced tools.

Specialized Databases for In-Depth Analysis

For advanced research, professional investors rely on the best sources for historical market capitalization data and analytical tools.

Daloopa

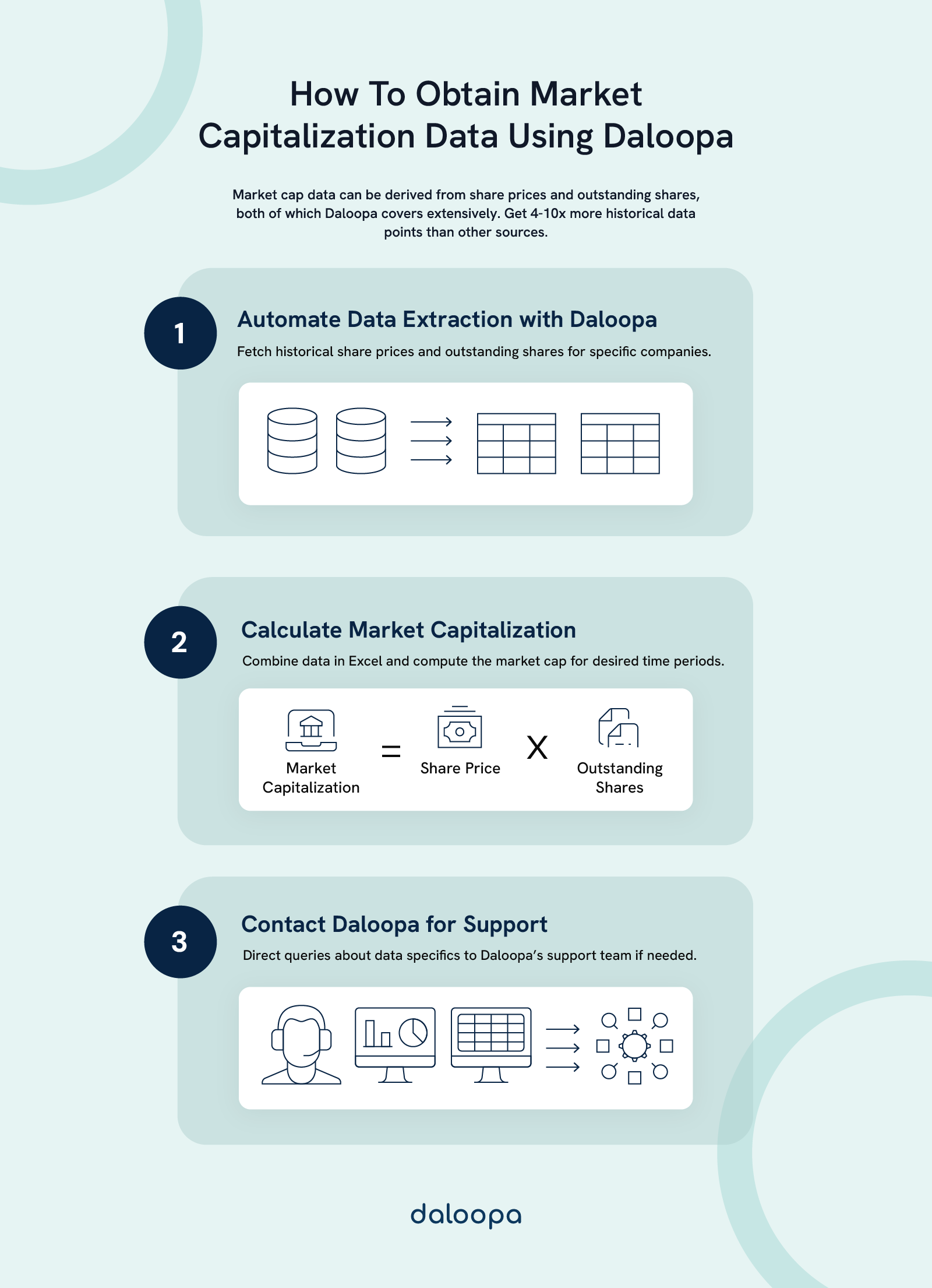

Daloopa’s advanced data processing and automated tools simplify financial analysis. By using AI-powered systems, it ensures accuracy and efficiency in gathering historical market cap data.

Key Features of Daloopa:

- AI-driven automation for data collection and processing.

- Ensures accuracy with advanced reconciliation techniques.

- Seamlessly integrates with Excel and other analytics tools.

- Ideal for in-depth financial modeling and large-scale research projects.

Daloopa provides an excellent solution for analysts seeking streamlined workflows that integrate with existing systems, enhancing productivity.

Bloomberg Terminal

Bloomberg Terminal provides detailed market cap information for global stocks, indices, and other securities, often dating back decades.

Key features include:

- Advanced filtering and sorting tools

- Data export options (CSV, Excel)

- API integration for automated analysis

Thomson Reuters Eikon

Eikon’s reporting and visualization tools enable users to create custom charts, enhancing their ability to track current and historical market trends. The platform’s accessibility and in-depth data coverage make it an excellent choice for researchers and analysts needing extensive datasets.

Key features include:

- Comprehensive global market coverage.

- Advanced charting and data visualization tools.

- Integration with third-party analytics software.

- Real-time news and insights for contextual analysis.

Why Historical Market Capitalization Data Matters

Historical market capitalization data is a cornerstone for investors and analysts seeking to understand past market dynamics. It sheds light on trends, company valuations, and economic changes that shape informed investment strategies.

Aiding Investment Decisions

Investors use historical market capitalization data to evaluate a company’s growth trajectory compared to industry benchmarks. Analyzing these historical market trends can help identify undervalued stocks or overvalued sectors. Historical data also plays a critical role in backtesting investment strategies, enabling investors to refine their approaches based on past outcomes.

Market cap data enhances understanding of key financial ratios like price-to-sales, crucial for assessing value and potential growth. Additionally, examining long-term historical market trends clarifies how macroeconomic cycles impact industries and company valuations.

Building Robust Portfolios

For new investors, historical market capitalization data offers valuable context for understanding stock prices and assessing risk. It helps illustrate how external factors influence valuations, fostering smarter portfolio diversification strategies.

Beyond individual companies, historical market capitalization data paints a broader picture of market behavior. It highlights cyclical trends, sectoral shifts, and the effects of major economic events, helping investors build robust, future-proof portfolios.

Long-term Trend Analysis

It allows seasoned analysts to spot patterns that could repeat under similar economic conditions, providing a framework for anticipating market shifts. Additionally, it offers clues into how companies weather crises, adapt to regulatory changes, or capitalize on emerging opportunities, further enriching an investor’s perspective.

Choosing the Right Source for Your Needs

The best sources for historical market capitalization data depend on your specific requirements. Balancing accessibility, data quality, and budget is crucial.

Balancing Accessibility and Depth

Free platforms like Yahoo Finance are ideal for casual analysis, but paid services like Bloomberg Terminal deliver superior depth and accuracy for professional needs. Determining your data scope—whether short-term or spanning decades—is key to choosing the right source.

Cross-Referencing for Reliability

Cross-referencing data from multiple platforms ensures reliability, especially for academic or professional research. While free tools are budget-friendly, premium datasets often justify their cost by offering unparalleled detail and credibility.

Selecting the right tools and sources for historical market capitalization data can elevate your financial insights and improve decision-making processes. Reliable sources are the foundation of robust, informed strategies that stand the test of time.

Perfect Your Historical Marketing Capitalization Data Standards

Ready to streamline your financial analysis and access accurate historical market capitalization data? Daloopa’s AI-powered tools offer unmatched precision and efficiency, integrating seamlessly with your existing workflows. Request a demo to discover how our advanced data solutions can transform your analysis and empower your decision-making.