In today’s high-stakes corporate finance environment, even a small error can lead to costly miscalculations and missed opportunities. AI financial modeling tools have advanced far beyond basic spreadsheet calculations, providing modern technical advisors with advanced strategies and techniques to face an increasingly complex financial landscape.

Today, leveraging sophisticated software platforms, integrating artificial intelligence, and automating routine tasks are not luxuries—they are essential for precision, efficiency, and strategic decision-making.

Financial modeling now demands an agile mindset that blends robust technology with core modeling principles.

In this article, we explore corporate financial modeling strategies and tools for technical advisors, discuss the pitfalls of outdated methods, and examine how emerging AI-driven modeling techniques can transform your financial planning process.

Key Takeaways

- Enhanced Accuracy: Advanced financial modeling software can reduce forecast errors significantly compared to conventional Excel-based approaches.

- Real-Time Insights: Modern platforms allow dynamic scenario analysis and automated data validation, leading to faster, more informed decisions.

- AI-Driven Intelligence: Integrating AI-driven modeling techniques into financial forecasting not only automates repetitive tasks but also uncovers deep insights from complex data sets.

Challenges of Traditional Excel-Based Financial Modeling

Traditional Excel-based financial models have long been the backbone of corporate analysis. However, relying solely on manual spreadsheet calculations exposes organizations to several inherent risks:

The Pitfalls of Manual Data Sourcing and Error-Prone Excel Models

Manual data entry in Excel increases the likelihood of errors—mistyped numbers, broken links, or misapplied formulas can cascade into significant forecasting mistakes. Research has shown that even a 1% error rate at the cell level can compound rapidly in large spreadsheets, leading to erroneous valuations and risk assessments.

Version control issues further complicate matters, as multiple team members editing a single model often introduce inconsistencies. In today’s fast-paced market, these inefficiencies not only slow down decision-making but also undermine the trust in financial reports.

Time-Consuming Data Integration

Integrating historical data into Excel models typically requires manual effort. Analysts spend countless hours gathering, cleaning, and updating data, leaving less time for critical analysis and strategic insight. This is why modern financial planning software is becoming a necessity for companies aiming to streamline their corporate financial modeling strategies and tools for technical advisors.

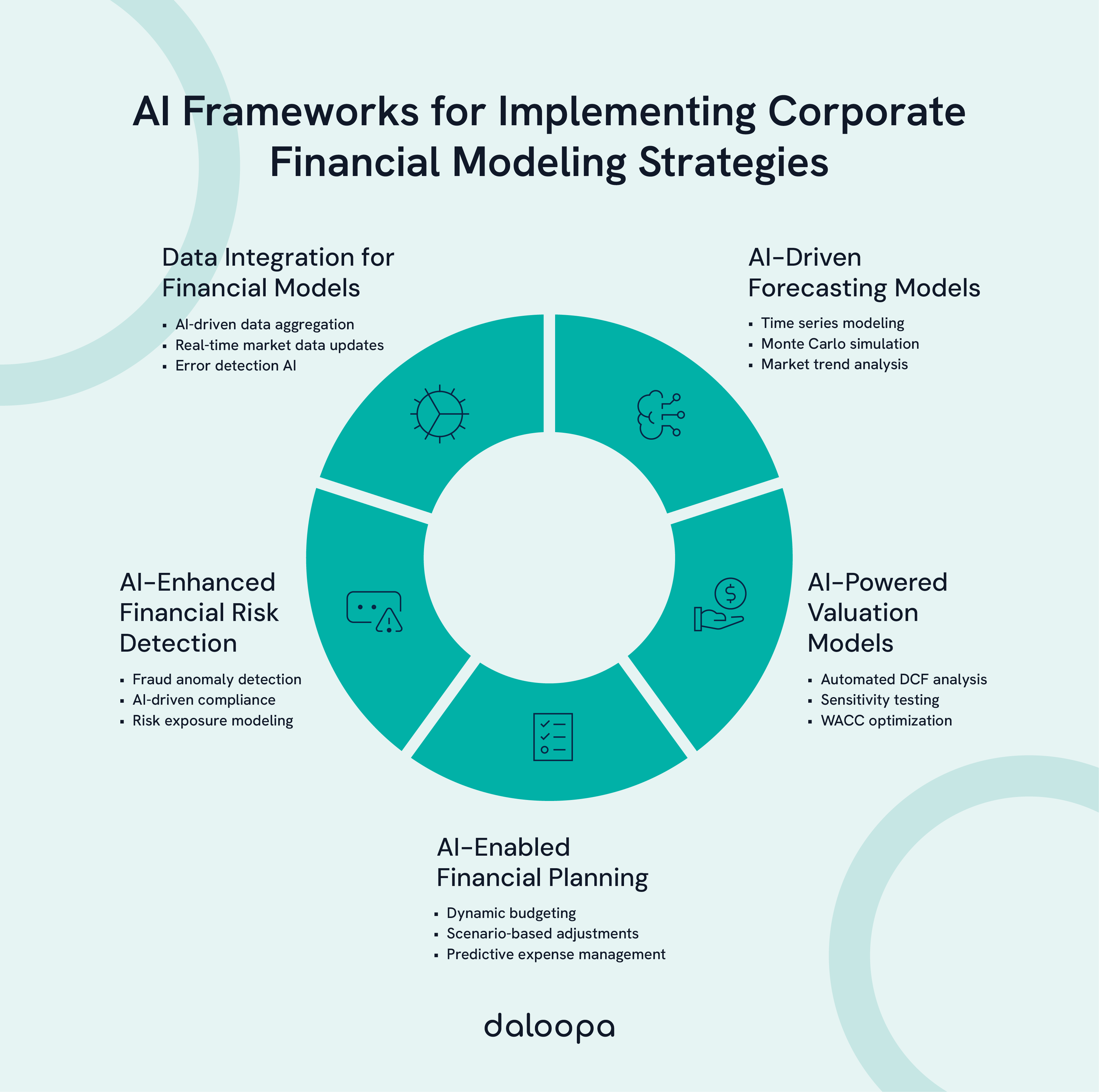

Harnessing Advanced AI-Driven Modeling Techniques

As the limitations of traditional Excel-based methods become increasingly apparent, advanced AI-driven financial modeling offers a transformative alternative. AI-powered platforms automate data collection, process vast datasets, and enhance forecasting precision by uncovering hidden correlations and market trends that manual models often miss.

Enhanced Forecasting and Scenario Analysis with Automated Data Integration

AI algorithms actively assess large volumes of financial and market data, integrating real-time inputs to update models continuously. For example, machine learning models can run thousands of Monte Carlo simulations to evaluate the impact of varying interest rates, inflation, and market dynamics simultaneously. By automating scenario analysis, these platforms empower your organization to adjust quickly in response to shifting economic conditions. Studies indicate that AI-enhanced forecasting can improve prediction accuracy by up to 90% compared to traditional methods, ensuring that your financial models remain robust even in volatile markets.

Moreover, integrating automated data feeds minimizes human error in data sourcing. Real-time market data, historical financials, and macroeconomic indicators all feed into a single, cohesive model—eliminating the need for manual updates and reducing the risk of miscalculations.

Valuation Models and DCF Analysis with Auditable Data

AI-driven platforms streamline valuation techniques such as Discounted Cash Flow (DCF) analysis by automating cash flow projections and weighted average cost of capital (WACC) calculations. These systems maintain an auditable trail of all inputs, allowing financial advisors to validate assumptions and methodologies quickly.

With built-in error-checking mechanisms, valuation models become more reliable, and sensitivity analyses can be conducted in real-time. Financial planning software further refines this process by integrating data sources seamlessly, ensuring that all financial projections are based on the most recent data.

By incorporating qualitative market conditions with quantitative metrics, AI-driven modeling techniques deliver a nuanced view of a company’s performance.

Leveraging Financial Planning Software

Modern financial planning software represents a quantum leap from traditional Excel-based methods, offering integrated solutions that encompass budgeting, forecasting, and strategic analysis.

Superior Data Accuracy and Real-Time Updates Versus Traditional Excel

Financial planning software eliminates human errors tied to manual data entry. These platforms directly pull financial information from ERP systems and accounting software, ensuring precision across all reports.

Real-time data integration keeps financial models current. As market conditions evolve, the software updates projections automatically, reducing reliance on outdated estimates.

Key benefits include:

- Version control: A centralized data repository eliminates discrepancies

- Audit trails: Every change is tracked, ensuring accountability

- Data validation: Automated checks highlight inconsistencies

- Collaboration features: Multiple users can work simultaneously without conflict

Dynamic Financial Modeling Tools

Modern platforms enable the construction of dynamic, interconnected three-statement models that automatically adjust as underlying variables change. Pre-built templates for cash flow projections, ratio analysis, and budget variance reporting simplify complex tasks and help standardize organizational outputs.

Interactive dashboards and sensitivity analysis tools provide clear visualizations of key metrics, making it easier to communicate financial performance to stakeholders and quickly identify trends.

For technical advisors, these dynamic tools not only enhance accuracy but also enable a deeper level of analysis. Instead of spending hours debugging a spreadsheet, you can now focus on strategic insights that drive profitability.

The Future of Corporate Financial Modeling Strategies and Tools for Technical Advisors

The evolution of data technologies and AI continues to shape the future of corporate financial modeling strategies and tools for technical advisors, offering new opportunities for deeper insights and improved decision-making.

Embracing Next-Generation Data Technologies for Superior Insights

Emerging technologies such as cloud computing, natural language processing (NLP), and blockchain are beginning to integrate with financial modeling platforms, paving the way for more comprehensive analyses.

Cloud-based tools facilitate collaborative workflows by allowing teams to work on the same models simultaneously from anywhere in the world.

Blockchain technology also offers promising benefits for corporate financial modeling strategies and tools for technical advisors by enhancing data security and traceability. In areas such as mergers and acquisitions or capital allocation, blockchain’s immutable ledger can validate the integrity of financial data, ensuring that every input is auditable and tamper-proof.

Critical Implementation Priorities

To successfully transition to advanced financial modeling, organizations must focus on several critical implementation priorities:

- Data Security and Compliance: Safeguard sensitive financial data by integrating robust cybersecurity measures and ensuring regulatory compliance.

- Model Validation Frameworks: Implement continuous testing and validation processes to guarantee that models remain accurate over time.

- Cross-Platform Compatibility: Ensure that your financial planning tools can integrate seamlessly with existing ERP, accounting, and data analytics systems.

- Automated Quality Control: Adopt AI-driven quality control mechanisms that monitor and correct errors in real-time.

- Continuous Model Optimization: Regularly update and refine your models using feedback loops and real-time data to maintain peak performance.

Ready to Accelerate Your Financial Modeling with Daloopa

In today’s competitive financial landscape, staying ahead means leveraging the best available technology. That’s where Daloopa comes in. Daloopa transforms your financial modeling process by eliminating the tedious manual work that traditional spreadsheets demand. Our innovative platform automatically collects and updates fundamental financial data, directly linking each data point to its source for one-click verification.

Investing in next-generation technologies is not just about keeping pace with the competition—it’s about setting the standard for excellence in financial analysis. Embrace the future of corporate financial modeling strategies and tools for technical advisors by integrating robust AI solutions, ensuring data accuracy, and fostering a culture of continuous improvement.

Ready to revolutionize your financial modeling process? Discover how Daloopa can help you eliminate manual data entry, accelerate model updates, and empower your team to focus on strategic insights.

Request a demo today and take the first step toward smarter, more efficient financial modeling.