Every investor relations team knows the feeling: chasing data across spreadsheets, double-checking numbers at midnight, and scrambling to answer questions you already saw coming. The market moves fast but traditional workflows keep lagging behind. It’s exhausting, and it leaves little room for the strategic storytelling your stakeholders actually value.

Direct IR data integration changes that by connecting your existing IR systems to AI platforms that ensure data moves automatically, insights surface predictively, and communications become real-time and context-aware. The result? An IR function that shifts from reactive to proactive, delivering tailored insight at scale while staying firmly within regulatory guardrails.

Key Takeaways

- AI integration automates manual data handling and ends slow, error-prone aggregation that drains IR capacity.

- Predictive analytics turns historical results into forward-looking signals that guide executives and boards.

- Real-time engagement becomes practical through AI systems that deliver personalized, context-aware updates.

Current Market Landscape for IR Technology Integration

The market for IR technology is changing quickly as specialized AI tools mature and adoption pressures increase. Regulators are updating disclosure expectations while early adopters build advantages with faster workflows and richer stakeholder engagement.

Key Players in the IR-Specific AI Solutions Market

Established financial technology vendors are extending into disclosure automation with AI features. Q4, Workiva, and Donnelley Financial Solutions embed language models and analytics into their platforms to streamline filings and communications.

Platform categories:

- Disclosure Management: Automated SEC filing preparation paired with controls for regulatory compliance.

- Analytics Solutions: Real-time sentiment analysis and investor interaction tracking across channels.

- Communication Tools: AI-assisted earnings call transcription and automated investor outreach workflows.

Newer specialists focus only on AI-driven IR capabilities, including natural language processing for earnings materials and predictive models for investor sentiment and research coverage signals.

Choose technology based on whether you need an all-in-one platform or targeted AI features. Broad enterprise platforms fit complex environments and integrate widely with finance and legal teams.

Large implementations often require 6–12 months for configuration, data mapping, and control alignment, especially when disclosure calendars, templates, and review gates are unique to your organization.

Adoption Rates Across Different Market Capitalizations and Industries

Large-cap companies lead adoption, with roughly 40% using some level of automated disclosure technology in 2025. Mid-caps follow at about 25%, while small-caps sit near 12%.

Adoption by market cap:

- Large-cap ($10B+): 40% adoption rate

- Mid-cap ($2B–$10B): 25% adoption rate

- Small-cap (<$2B): 12% adoption rate

Technology and financial services firms move fastest. Healthcare and industrials advance more cautiously because of cross-border rules, clinical timelines, and complex supply chains that shape disclosures.

Regulatory complexity affects deployment speed. Technology companies often reach production in 3–6 months, while heavily regulated sectors plan for 12–18 months to align governance and validation.

Smaller teams see clear efficiency upside yet face budget and staffing limits. Cloud delivery is lowering barriers; subscription models help, though integration and change management still require investment.

Regulatory Considerations Driving Technological Transformation

SEC Regulation Fair Disclosure creates both opportunity and constraint. Systems must support broad, consistent disclosure and maintain controls that prevent selective dissemination during rapid news cycles.

Regulatory drivers:

- Real-time Disclosure: Faster filing expectations increase demand for automation and auditability.

- Data Accuracy: Higher scrutiny encourages AI-assisted validation tied back to source documents.

- Audit Trails: Complete logs of content, approvals, and data lineage become table stakes.

AI-generated materials require strong governance. Maintain documented processes that keep people in the loop for review, sign-off, and distribution, especially around earnings and guidance.

Global rules add complexity for multinationals. For instance, the European AI Act will influence controls, record-keeping, and transparency across markets beginning in 2026 for many organizations.

Regulatory uncertainty naturally slows high-risk use cases. Many teams start with automation of administrative work, then expand to content drafting as oversight frameworks mature.

Competitive Advantages Gained by Early Adopters of Integrated IR-AI Systems

Early adopters report 30–50% faster earnings prep through automated compilation, formatting, and consistency checks. Time saved shifts staff focus toward analysis, messaging, and investor meetings.

Measurable benefits:

- Time Savings: Up to 40% faster SEC filing preparation.

- Accuracy Improvements: Around 60% fewer manual errors in drafts and tables.

- Response Speed: Near-instant routing and handling of investor inquiries.

Richer analytics support proactive outreach. With sentiment and engagement signals, teams can address concerns before they appear in trading patterns or analyst notes.

Automated transcription and topic analysis of calls highlight what investors care about most, helping refine messages and follow-ups by segment.

Cost benefits grow as models learn your disclosure style and terminology. Many programs reach payback within 18–24 months through reduced external spend and leaner internal cycles.

The Technical Foundation: How IR-AI Integration Works

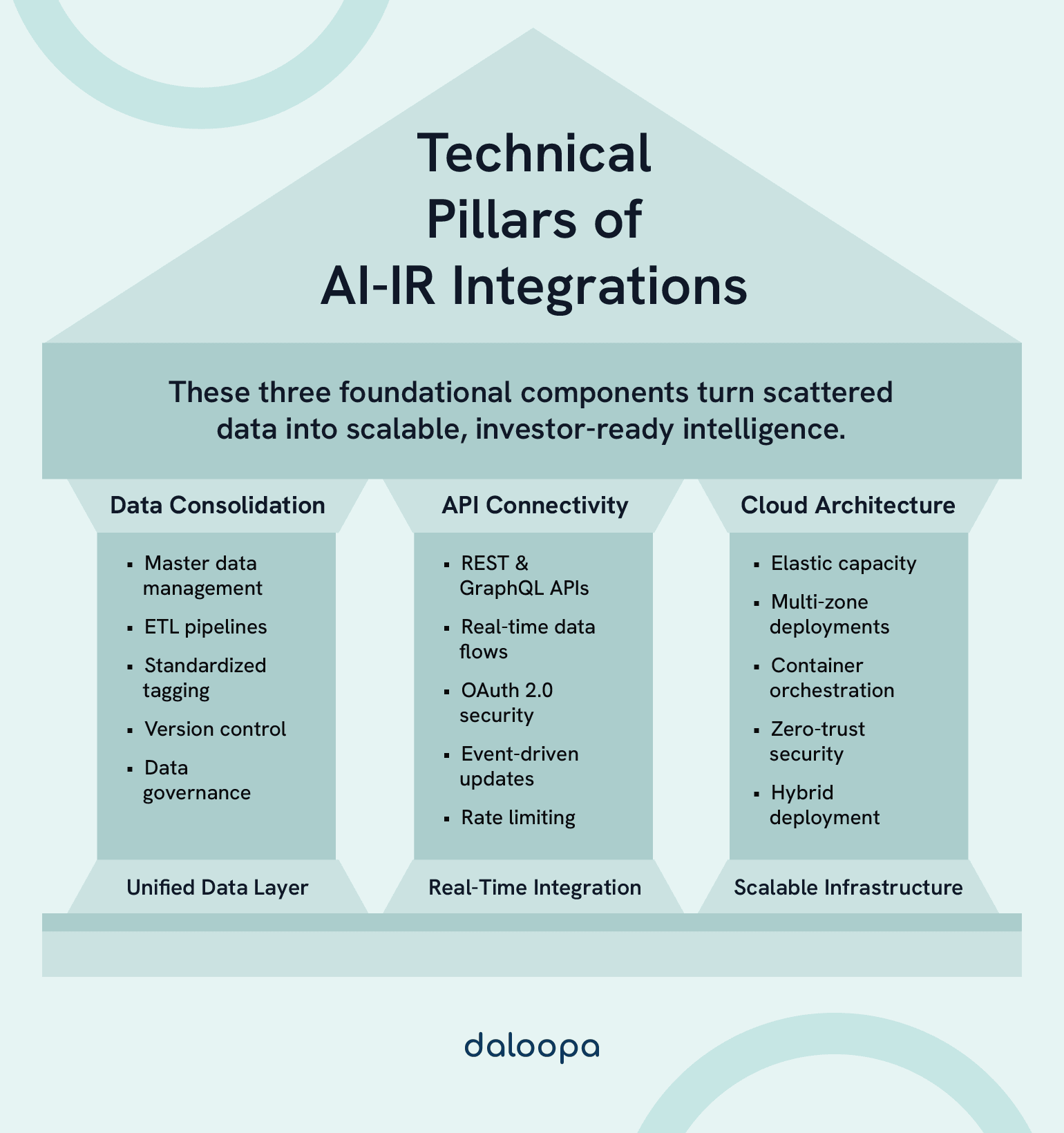

Modern IR-AI programs rest on three pillars: a unified data layer that removes silos, API connectivity that keeps information current, and cloud architecture that scales securely during peak periods.

Connecting the Dots: A Framework for Data Consolidation

IR data lives across finance systems, CRMs, transcripts, and filings. A unified data layer lets AI access consistent, reconciled information across these sources.

Start with standardization. Define schemas that convert disparate inputs into machine-readable formats. Align ERP metrics with press-release narratives and investor deck figures to ensure one version of the truth.

This alignment reduces one of the biggest credibility risks: contradictory numbers in different channels, which analysts often flag immediately.

Key consolidation components include:

- Master data management (MDM) for entity and instrument resolution.

- ETL pipelines for cleansing, normalization, and enrichment.

- Standardized tagging for financial concepts and KPIs.

- Version control and document lineage for disclosure artifacts.

Plan for structured data (metrics, dates, percentages) and unstructured content (commentary, Q&A, regulatory text). This dual approach lets AI understand numbers and context together.

Data governance underpins all of it. Track lineage from insight back to the precise source—supporting reviews, auditor requests, and regulator questions.

Daloopa’s MCP was designed with this in mind: providing clear data lineage, source links, and compliance-ready audit trails that regulators and auditors can follow in seconds. Instead of wrestling with scattered spreadsheets or unverifiable extracts, teams can point directly to the source behind every figure. That transparency doesn’t just reduce audit risk. It builds confidence in the insights IR delivers.

API Connectivity and Real-Time Data Flows

Reliable APIs keep data fresh during volatile periods like earnings. Architecture should preserve integrity as updates flow to AI engines and back to disclosure and communications systems.

REST and GraphQL APIs form the backbone. REST suits standard exchanges. GraphQL efficiently retrieves complex, related objects when building dashboards or narrative summaries.

Plan for bidirectional movement. Source data moves into analysis, while generated insights, summaries, and checks flow back into CMS, email, IR websites, and CRM activities.

Authentication and rate limiting protect sensitive information. Use OAuth 2.0 with scopes for least-privilege access, and apply rate controls that maintain stability under load.

Adopt webhooks for event-driven updates. When new figures post, triggers kick off parsing, validation, and drafting, cutting latency between close and communication.

The Role of Cloud Architecture

Cloud infrastructure provides the headroom modern AI needs for language models and forecasting. Elastic capacity supports spikes without a permanent hardware footprint.

Multi-zone deployments raise reliability during critical windows, with failover across regions to keep investor channels up during filings and calls.

Container orchestration with Kubernetes adds elasticity. As traffic and workloads surge, the platform scales model serving and data processing automatically.

Security design must protect data and satisfy regulators. Zero-trust networking, encryption in transit and at rest, and exhaustive logs cover both protection and proof.

Hybrid patterns keep the most sensitive data on-prem while using cloud compute for heavy AI tasks. This model balances performance, cost, and control.

For risk-sensitive teams, hybrid rollouts are often the best first step: sensitive disclosure drafts stay in controlled environments, while AI handles lighter but time-consuming work such as transcript summarization or investor sentiment tagging. This balance demonstrates compliance strength to regulators while showing boards a clear path toward efficiency and credibility gains.

AI in Action: Core Capabilities That Transform IR

AI changes investor relations through three capabilities: natural language processing that automates complex drafting with controls, predictive analytics that anticipates behavior and interest, and visualization that turns raw data into interactive, decision-ready views.

Natural Language Processing for IR Communications

NLP handles time-intensive communication with precision. Advanced models draft earnings summaries, power transcripts, and assemble regulatory materials while maintaining consistent tone and formatting.

Document generation capabilities:

- Automated earnings synopses produced directly from validated financials.

- Real-time translation of technical disclosures for global audiences.

- Press releases checked against regulatory rules with embedded controls.

At scale, AI responds to investor questions with financial fluency. Systems watch sentiment in research and media, then alert IR when narratives shift around your company.

Models learn your voice. They adapt to prior filings, press language, and board materials so drafts align with brand and stay within disclosure boundaries.

Predictive Analytics for Investor Behavior

Predictive models examine trading patterns, earnings reactions, and sentiment to estimate how investor segments may respond to updates. That visibility supports stronger planning and outreach.

Key behavioral predictions:

- Volume inflections ahead of earnings or guidance events.

- Institutional interest changes tied to sector and factor trends.

- Analyst rating moves following metric changes or commentary.

Algorithms reveal which metrics matter most to different groups. With that map, you can highlight the drivers that consistently influence engagement and valuation.

Timing improves as well. Schedule messages for windows when target investors are most responsive, balancing reach with volatility risk.

Predictive analytics doesn’t just streamline outreach. It strengthens credibility with analysts by showing you anticipate their questions, and it reassures boards that communication plans are tied to hard market signals, not gut feel.

For predictive analytics to be credible in IR, the underlying data must be both deep and clean. That’s where Daloopa stands out, delivering the most complete, accurate, and up-to-date dataset directly to your LLMs. This ensures your AI models don’t just predict market behavior, they do it with a foundation analysts can trust.

Data Visualization and Interactive Reporting

Interactive dashboards turn static reports into narratives that flex to each stakeholder’s priorities. Investors can move from high-level trends to operational detail without losing context.

Visualization capabilities:

| Feature | Benefit | Use Case |

| Dynamic charts | Real-time updates | Live earnings presentations |

| Scenario modeling | What-if analysis | Strategic planning discussions |

| Mobile dashboards | On-demand access | Board meeting preparation |

Guide the story with annotations that explain variance, one-offs, and run-rate effects. Clear context reduces follow-up emails and helps leaders prepare for tough questions.

Unify sources in one view. Blend financials with ESG metrics, peer comparisons, and guidance so stakeholders see performance, risk, and outlook together.

Implementation Strategies and Change Management

Success comes from a phased rollout with measurable outcomes and a workforce plan that pairs automation with human judgment where it counts most.

Phased Integration and ROI Measurement

Begin with pilots focused on repetitive tasks. Target call transcription, structured data intake, and templated responses to build baseline metrics and confidence. Choosing the right first pilot is critical: for a mid-cap firm, the safest entry point is often automating transcript drafting and Q&A tagging, where compliance risk is low but efficiency gains are visible.

Phase 1: Foundation (Months 1–3)

- Stand up automated data collection and reconciliation.

- Ingest and normalize historical financial datasets.

- Configure monitoring and control checks for compliance.

Phase 2: Analytics Enhancement (Months 4–6)

- Deploy predictive models for investor behavior and coverage signals.

- Launch real-time sentiment tracking across research and media.

- Introduce automated report and draft generation.

Phase 3: Strategic Intelligence (Months 7–12)

- Activate engagement platforms that personalize investor outreach.

- Add predictive market and sector trend analysis to planning.

- Implement recommendation engines for messaging and timing.

Track ROI with response times, coverage accuracy, data-processing hours saved, and engagement depth. Many teams see 40–60% efficiency gains within six months of initial deployment.

Keep legal and finance embedded in reviews. Validate AI outputs before external distribution to maintain consistency, accuracy, and control adherence.

Empowering the Team: The Human-AI Partnership

IR roles shift from production to interpretation. Team members focus on narrative, relationships, and decisions while AI accelerates data and drafting.

This shift is often the biggest source of anxiety as many professionals quietly wonder if automation means replacement. But the reality is that AI extends your influence by freeing time for higher-value work boards and investors notice.

Core human responsibilities:

- Develop the strategic story and refine key messages.

- Manage complex stakeholder relationships across channels.

- Oversee compliance, approvals, and disclosure precision.

- Lead crisis communications and sensitive issues.

AI-enhanced capabilities:

- Continuous analysis and anomaly detection across datasets.

- Automated handling of routine inquiries and scheduling.

- Ongoing sentiment and trend monitoring with alerts.

- Multilingual drafting and distribution support.

Train teams on prompts, validation, and synthesis. Build hybrid workflows where AI prepares drafts and humans refine, contextualize, and approve.

Change programs work best when leaders explain role evolution clearly and show how tools raise the team’s influence inside the organization.

The Future of AI in Investor Relations

AI will shift IR from responding to events to anticipating them. With real-time data integration and continuously learning models, reporting adapts as markets move and stakeholders ask new questions.

Daloopa’s Comprehensive IR Data Foundation

Data quality will continue to be a crucial part of AI-driven investor relations. While sophisticated models can process information at incredible speeds, they’re only as reliable as the underlying datasets they analyze. Daloopa provides the comprehensive financial database designed for modern IR workflows, structuring information to feed directly into LLMs, vector databases, and predictive models that power next-generation IR systems.

Daloopa maintains detailed financial datasets for leading public companies across all sectors, including:

- Tesla

- Amazon

- Nvidia

- ARM Holdings

- Super Micro Computer

- Airbnb

- Novo Nordisk

- Gilead Sciences

- Arista Networks

- Rivian Automotive

- Cloudflare

- Moderna

- Lucid Group

- Shopify

- Spotify Technology SA

- Twilio

- Marathon Digital

- Roblox

- Netflix

The consistent quality of our inputs provide a critical foundation for newer AI capabilities like natural language generation and predictive analytics. Clean, well-structured data produces more accurate outputs and reduces the risk of AI-generated content that contradicts actual financial performance.

Emerging Technologies Reshaping IR Data Integration

Natural language processing will analyze large volumes of analyst reports and research notes to surface common themes, outlier opinions, and early movements in sentiment.

Live sentiment tracking will raise early flags when concerns build, whether in notes, articles, or trading signals, so IR can respond before issues expand.

Predictive analytics will estimate investor actions more precisely, including which funds are likely to add or trim positions based on history and current factors.

Alternative data will feed directly into IR workflows. Social activity, supply chain signals, and even geospatial indicators will inform messaging, context, and guidance ranges.

Blockchain-based disclosure can add transparency and control. Smart contracts may trigger releases when quantified thresholds are crossed, reducing manual error and timing risk.

Voice intelligence will transcribe, tag, and summarize calls instantly, delivering tailored digests to analysts, directors, and employees right after events conclude.

Beyond Automation: Strategic Value Creation

AI will help shape stories, not just assemble them. Models will recommend framing based on what resonates with each segment, learning from past interactions and outcomes.

Dynamic storytelling platforms will tailor decks and sites to investor type. Institutional audiences will see deeper technical analysis while retail audiences get concise, visual explanations.

Timing optimization will consider volatility, competing news, and investor calendars to pick release windows with the strongest impact and lowest risk.

Relationship intelligence will capture interactions across meetings, emails, and events, building profiles that inform outreach strategy and follow-ups.

Forecasting will extend to capital needs and investor appetite. Teams will know which investors align with upcoming raises based on mandate, history, and current portfolio moves.

Message testing will run continuously, learning which approaches drive desired behaviors and adapting communications with each cycle.

The New Standard for Investor Relations

Investor relations is no longer about keeping pace, it’s about staying ahead. Direct IR data integration with AI eliminates the tradeoff between speed, accuracy, and strategy. Teams that embrace this shift gain time back for narrative, clarity for stakeholders, and confidence in every number shared.

That shift only works if the data fueling AI is complete, structured, and reliable. Daloopa delivers exactly that: granular financial data built for LLMs, vector embeddings, and predictive modeling. With cleaner inputs, your AI isn’t just faster; it’s smarter, context-aware, and aligned with the demands of modern IR. See how Daloopa can transform your IR workflow today.