Most AI pilots in finance don’t fail from lack of ambition. They fail because one-off integrations snap with every upgrade, trapping teams in a cycle of rebuilds, wasted spend, and compliance risk that stalls AI before it delivers value.

Model Context Protocol (MCP) breaks that cycle. By standardizing AI-to-system communication, it replaces brittle connectors with a secure, reusable architecture—so you can build once, reuse everywhere, and scale AI across the finance stack with control and confidence.

Key Takeaways

- MCP standardizes AI connections so you don’t build custom integrations for every financial system.

- The design enables secure, reusable links between LLMs and enterprise finance infrastructure.

- Rollouts follow proven patterns that preserve compliance while accelerating AI deployment across finance.

Understanding MCP for Finance Operations

MCP defines a consistent protocol for connecting AI systems to financial data and tools, removing the need for bespoke adapters. Finance teams face distinct hurdles such as regulatory constraints and legacy platforms, so integrations must be secure, auditable, and durable.

The Model Context Protocol Foundation

Think of MCP as the communication layer between AI models and external systems. It regulates how contextual data moves between AI applications and financial databases, ERP suites, and regulatory repositories.

MCP runs lightweight servers that expose selectable capabilities to AI clients. Your finance applications can pull real-time accounting entries, transaction histories, and compliance records through standardized endpoints that are predictable and explicit. Instead of waiting days for reconciliations or audit prep, finance teams can surface validated data in hours.

The protocol uses a client–server model: AI systems request context from MCP servers; each server manages connections to specific finance tools such as SAP, Oracle Financials, or bespoke trading platforms, translating formats and permissions consistently.

Key MCP components for finance:

- Resource endpoints to fetch financial documents and reports.

- Tool interfaces to run transactions, checks, and calculations.

- Prompt templates to standardize how financial queries are expressed.

- Authentication layers to gate and log secure access to data.

Implement MCP once per system instead of coding per-app connectors. The result: a reusable integration pool that eliminates redundant builds, lowers ongoing IT spend, and speeds up finance initiatives that otherwise stall in pilot mode.

Finance-Specific AI Integration Challenges

Financial integrations must do more than “call an API.” They need complete auditability, role separation, and alignment with requirements like SOX and PCI DSS, all while maintaining system integrity under scrutiny.

Failure here doesn’t just break workflows. It exposes companies to failed audits, regulatory penalties, and reputational damage that can cost millions.

Critical integration requirements:

- Real-time compliance monitoring for AI-initiated operations.

- Granular permission controls around sensitive datasets.

- Transaction integrity across chained system interactions.

- Regulatory audit trails that capture inputs, outputs, and actors.

Legacy platforms bring proprietary formats and unique auth schemes. MCP addresses this with standardized adapters that translate to modern AI interfaces without forcing rip-and-replace upgrades. This allows finance teams to modernize workflows incrementally, without the massive capital outlays or downtime that rip-and-replace projects demand.

Data quality is non-negotiable when models touch financials. MCP implementations should validate accuracy and reconcile conflicts across multiple sources before any analysis or action proceeds. This means fewer reporting errors, cleaner reconciliations, and faster close cycles.

Finance also depends on contextual business rules and constraints. MCP lets AI access structured organizational knowledge and policies as context, avoiding brittle, hard-coded logic spread across apps. So you get AI outputs that align with internal policies from day one, rather than risky trial-and-error tuning.

Security expectations intensify in finance. MCP’s design emphasizes encrypted transport, authenticated endpoints, and controlled capabilities at every touchpoint where AI and finance systems meet.

MCP Architecture for Financial Systems

MCP supplies the foundation for consistent AI integrations across your finance stack. It establishes secure, reusable connections between AI agents and critical systems through lightweight servers and open, well-defined interfaces.

Core Components for Finance Operations

Your MCP implementation rests on three architectural layers that coordinate to deliver enterprise-grade outcomes.

- MCP servers: These sit between AI agents and financial systems. They handle authentication, data normalization, and protocol translation—no modifications to ERP or trading platforms required—so your core systems stay stable.

- Context management layers: They preserve session state and entitlements across finance applications. Configure role-based access once, align it with your compliance framework, and have those permissions propagate reliably.

- Resource notification systems: These stream real-time updates from market feeds, transaction processors, and risk platforms. Low latency matters for trading and payments; this pattern supports time-sensitive workloads.

The open protocol sustains interoperability across AI models and software vendors. That flexibility not only avoids vendor lock-in but also ensures governance and security rules apply uniformly, reducing the risk of fragmented compliance or costly renegotiations with suppliers.

Integration Patterns With Financial ERP Systems

Three proven patterns help you deploy MCP alongside existing finance infrastructure without disrupting core operations. Each of these patterns minimizes disruption and accelerates ROI, a key factor for CFOs who demand measurable payback on AI investments.

Event-driven integration: Links MCP servers to ERP systems via your API gateways. Streaming platforms keep AI agents and finance data synchronized, enabling timely decisions and faster exception handling. For example, invoice exceptions can be flagged in near real time instead of days later, cutting processing cycles and late-payment penalties.

Federated access control: Ties into identity systems so AI interactions respect finance rules. Centralize policies; distribute capability. Business units gain flexibility while oversight remains strong. This prevents the classic compliance nightmare of “shadow AI” projects, keeping risk officers confident while still giving teams agility.

Microservices orchestration: Packages MCP servers as containers in your DevOps pipeline. Ship incrementally, roll back cleanly, and maintain AI integrations as code across environments and compliance zones. This translates to lower failure risk during rollouts, faster recovery when issues arise, and clearer evidence of control for regulators.

Implementation Strategy and Roadmap

A successful MCP rollout starts with a clear view of your current landscape, then proceeds through staged deployments that minimize risk and maximize learning. You end up with standardized integrations that don’t disturb day-to-day operations.

Assessment and Planning Phase

Begin with a full audit of existing AI integrations and enterprise systems. Capture every connector, endpoint, and data flow to understand complexity and fragility—not just where, but how and why data moves.

This gives you visibility into risk you can quantify in terms of wasted spend, compliance gaps, and operational delays.

Infrastructure analysis:

- Map all LLM links to ERPs, databases, and internal tools.

- Identify security weak points in today’s point-to-point connections.

- Catalog compliance duties across subsidiaries and business lines.

This baseline shows where MCP can replace brittle connectors with standardized, governed channels that are measurable and maintainable.

Prioritize stakeholder alignment. Bring platform and data engineers in early. Clarify MCP’s role, define success metrics, and identify needed infrastructure, from gateways to observability.

Set governance before you deploy. Decide who owns MCP server configs, access policies, and tool permissions; document change control and incident handling pathways from the start. Getting this right upfront avoids turf wars later and creates a clear line of accountability executives can trust.

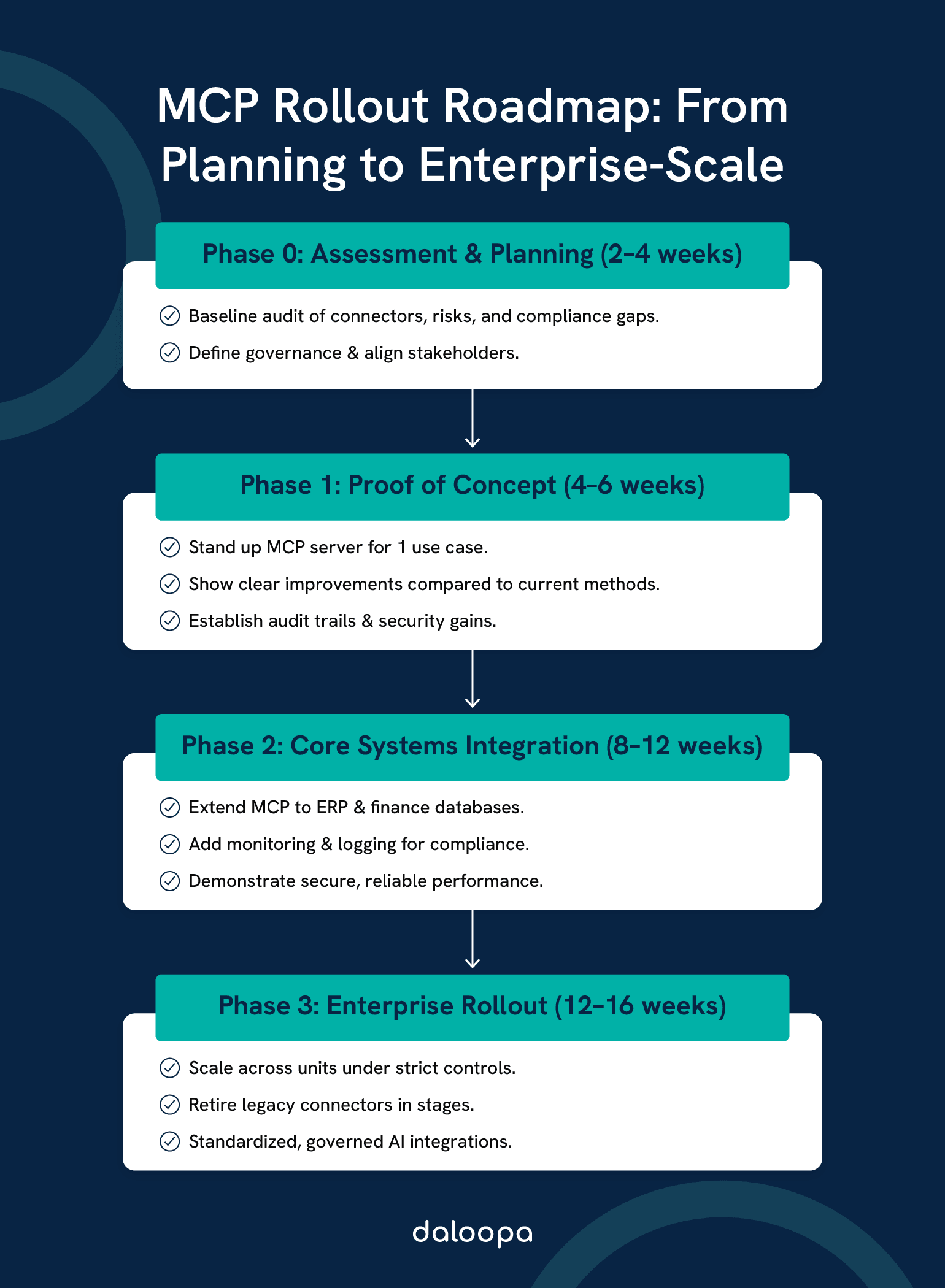

Phased Implementation Approach

Choose a pilot that is high-value but low-risk, then expand. This validates fit, builds internal skill, and creates reference patterns others can follow.

Phase 1: Proof of Concept (4–6 weeks)

Stand up MCP servers for one targeted use case—e.g., financial data retrieval or document processing—and show measurable security and maintainability gains versus today’s approach. Example: invoice processing times drop from days to hours while maintaining full audit trails.

Phase 2: Core Systems Integration (8–12 weeks)

Extend to mission-critical ERP connections and internal databases. Add comprehensive logging and monitoring to track latency, failures, and access patterns.

Phase 3: Enterprise Rollout (12–16 weeks)

Scale to additional units under strict governance. Retire legacy connectors in waves to avoid outages, with rollback plans and performance checkpoints.

Instrument each phase with performance and compliance checks. Gate progression on test results so reliability stays front-and-center. This structured approach reassures risk officers that MCP adoption strengthens, rather than jeopardizes, financial controls.

Finance-Specific Use Cases and Patterns

MCP supports repeatable AI patterns across finance, from AP workflows to real-time analysis. No more one-off connectors. You gain consistency, control, and speed while meeting audit and security expectations.

Accounts Payable Automation

MCP reshapes invoice processing into an AI-assisted flow that plugs directly into ERP platforms like SAP or Oracle—no per-vendor API builds, no brittle parsing presuppositions, no hidden side-effects.

Key automation capabilities include:

- Invoice data extraction and validation.

- Three-way match confirmation.

- Exception routing and resolution.

- Vendor payment scheduling and status.

MCP’s security model confines sensitive payment data within governed boundaries while AI performs checks and assists reviews. So payment cycles speed up while compliance confidence goes up. Because the pattern is standardized, you can deploy it across subsidiaries without re-integration.

Fraud detection becomes a first-class element. Algorithms flag unusual patterns or risky changes (like bank account switches), shrinking manual review queues while preserving the tight controls auditors demand.

Pre-built MCP servers cover common accounting tasks. They connect to financial institutions’ systems through authenticated channels and capture comprehensive logs. That’s full traceability for compliance teams and fewer gray areas for finance leaders to defend.

Financial Analysis and Reporting

MCP streamlines analysis by giving AI standardized access to multiple datasets at once. Analysts can assemble reports that combine ledger data, market feeds, and operational metrics through a single, consistent interface.

Real-time analysis capabilities include:

- Cash-flow forecasting with rolling updates.

- Automated variance analysis across periods and entities.

- Risk metric calculations with shared definitions.

- Prep for regulatory filings with source-linked figures.

Context management keeps AI aligned with your chart of accounts, fiscal calendars, and policies. That cuts setup effort when connecting to financial services platforms and reduces misclassification errors.

Fintech data gets simpler to consume. MCP handles auth, schema alignment, and response normalization so models can focus on analysis rather than plumbing and brittle transforms.

Your AI applications can query Bloomberg terminals, internal warehouses, and cloud analytics through consistent calls, reducing the matrix of APIs to maintain while improving data lineage and timeliness.

The Daloopa MCP: Verifiable Financial Data for AI

Daloopa’s MCP supplies verified financial data with a clear chain of custody from original documents. That’s the piece regulators and audit committees care most about: provable trust.

The server extracts structured data from SEC filings, earnings materials, and financial statements while preserving links back to sources. Models receive normalized data with embedded verification metadata to support downstream controls.

The platform covers 5,000 tickers with 5-10x more data points than competing fundamental data providers, capturing both Non GAAP metrics and company guidance. This comprehensive coverage reduces AI hallucination risks and enables more sophisticated analytical prompts. The system maintains a >99% accuracy rate, ensuring outputs meet finance team reliability standards.

Data verification features include:

- Source document linking for every value.

- Extraction confidence scores for review.

- Historical revision tracking over time.

- Cross-validation across multiple sources.

The MCP server supports four key financial analysis use cases: benchmarking across industries, due diligence research, inflection point tracking in quarterly performance, and complex financial modeling including DCF valuations and three-statement projections.

This reduces the common problem where AI applications fall under scrutiny because inputs can’t be verified. Risk teams gain trust because every figure carries provenance.

DeFi workflows benefit, too, as traditional finance and decentralized systems intersect. Daloopa’s approach shows how verified data can support both financial institutions and blockchain-oriented services without special-case code.

Governance and Compliance Framework

MCP requires enterprise-grade security controls and automated compliance checks so finance data remains protected end-to-end. The framework supports broad AI use while preserving accountability and traceability.

Financial Data Security Controls

Your MCP deployment should implement defense in depth for sensitive data at every stage of AI processing. Role-based access gates capabilities; authentication verifies identity before any call proceeds.

Encrypt data at rest and in transit. Use AES-256 encryption for storage and TLS 1.3 for connections between MCP components and ERP systems so eavesdropping and tampering attempts are blocked.

Access control matrices clarify permissions by role:

| Role | Data Access | System Permissions | Audit Rights |

| Finance Admin | Full financial data | Configure MCP settings | Complete audit logs |

| Analyst | Read-only reports | Query permissions | Limited audit access |

| Auditor | Transaction records | View-only access | Full audit trail |

Enterprise governance depends on audit trails that capture who did what, when, and why. Log every AI interaction with immutable timestamps and correlate entries across systems.

Data masking reduces exposure of personal or sensitive identifiers. Configure MCP to redact fields like account numbers or SSNs before content reaches language models or cache layers. This limits insider threat vectors and reduces GDPR exposure when personal data is involved.

Regulatory Compliance Integration

Bake automated compliance checks into the path. Align with SOX, PCI-DSS, and GDPR requirements by verifying data scope, purpose, and authorization at request time rather than after the fact.

GDPR compliance requires consent tracking and deletion flows. Incorporate consent state in context; expose erasure requests that cascade to underlying systems while keeping compliance evidence.

Policy-aware monitors flag violations when AI attempts to access restricted datasets or exceed quotas. Route real-time alerts to compliance teams so issues are contained quickly and documented. Without this, violations can slip through until auditors catch them. By then, the damage is reputational and financial.

Retention policies should purge expired data on schedule while preserving mandated logs for the required period. Automate the cleanup to reduce manual steps and audit exposure. This reduces the chance of fines from data over-retention, a common GDPR trigger.

Integrate with existing compliance platforms to generate reports of AI usage, data flows, and control checks. Keep human review in the loop so authorized personnel approve or reject AI-generated recommendations before execution.

Performance Optimization and Monitoring

Strong MCP implementations pair clear metrics with ongoing tuning. Measure what matters, analyze trends, and adjust configurations so finance workloads run quickly and predictably.

KPIs for Finance AI Operations

Response Time Metrics anchor your view of MCP health. Track round-trip latency between LLMs and ERPs; for real-time queries, aim for sub-200 ms where feasible and investigate sustained outliers. Delays here translate directly into analysts waiting hours instead of seconds to generate critical variance reports.

Watch context retrieval efficiency, that is, how fast MCP fetches relevant data. Define thresholds for database query time and cache hit rates to avoid I/O drag during peak cycles.

Throughput indicators show capacity limits. Measure concurrent transactions, payload sizes, and successful connection rates during close, forecast runs, and market opens.

| Metric | Target | Critical Threshold |

| API Response Time | <200ms | >500ms |

| Context Retrieval | <100ms | >300ms |

| Cache Hit Rate | >85% | <70% |

| Connection Success | >99.5% | <98% |

Track error rates across components—auth failures, validation errors, timeouts. Spikes often reveal misconfigurations, expired credentials, or schema drift. Left unchecked, these “small” failures snowball into compliance gaps or missed reconciliations.

Monitor resource utilization for MCP servers—CPU, memory, network—so you can tune concurrency and scaling before saturation affects users.

Continuous Improvement Framework

Use automated performance analysis to spot anomalies in latency and throughput. Correlate with deployment events and data volume changes to isolate causes quickly.

Create feedback loops from real user queries. Identify repeated patterns; pre-compute or cache common contexts to shrink response times where it counts.

Run monthly configuration reviews for MCP servers. Adjust connection pools, timeouts, and batching based on observed load rather than static assumptions.

Apply capacity planning from historical demand curves. Anticipate quarter-end spikes, earnings windows, and payroll cycles; scale ahead of need.

Leverage A/B testing for configuration tweaks. Trial changes with a subset of workloads, measure impact, then promote successful settings with change-managed rollouts.

Document what works. Maintain runbooks with tuning steps, dashboards, and escalation paths so teams can move fast when signals degrade.

Future-Proofing Finance AI Implementations

MCP lowers integration debt and gives you a stable base for new AI capabilities. With the right extension points and roadmap, your architecture adapts to shifting rules and rising expectations. This means avoiding costly rewrites every time regulations shift or a new AI vendor enters the market. MCP keeps investments relevant longer.

Extensibility Planning

Design for growth with modular connectors that keep business logic separate from transport concerns. That way, you can add models or controls without refactoring upstream systems.

Introduce abstraction layers between MCP servers and core finance platforms. This lets teams swap model providers, add controls, or support new schemas by configuration or plugin without multimillion-dollar replatforming costs.

Key extension strategies:

- Plugin architectures to add data sources and compliance checks.

- Version-controlled schemas to manage evolving structures.

- Configurable authentication supporting multiple protocols.

- Dynamic resource discovery for newly MCP-enabled tools.

Document extension APIs early. Finance organizations often need custom audit artifacts or risk measures; clear contracts shorten delivery time and reduce back-and-forth.

Plan for multi-tenant cases where units demand isolation. MCP servers should enforce separate data boundaries while central governance oversees standards and monitoring.

Advanced Capabilities Roadmap

Prioritize real-time risk assessment and regulatory automation as foundational. Both need strong context handling, which MCP provides through structured interfaces and predictable flows.

Phase 1 capabilities: Automated transaction categorization and baseline fraud checks. These deliver immediate value and establish patterns for broader adoption.

Phase 2 developments:

- Predictive cash-flow models trained on historical patterns.

- Automated compliance reporting across jurisdictions.

- Dynamic pricing models for financial products.

- Advanced anomaly detection that correlates multiple feeds.

Phase 3 integrations: Touch blockchain verification and IoT-linked finance data. MCP’s extensible design accommodates these additions without protocol changes or risky shortcuts.

Reserve 30% of development capacity for emerging tech and regulatory shifts. AI moves fast; with MCP in place, you can evaluate and adopt new capabilities without re-architecting core integrations.

Building Durable AI Foundations in Finance

AI won’t transform finance if every upgrade demands a rebuild. That’s why MCP matters. It standardizes how AI connects to your systems, turning fragile point-to-point fixes into a reusable integration layer. The payoff isn’t just technical. It’s lower integration debt, shorter audit cycles, faster deployments, and future-proof investments that adapt to shifting rules and new AI capabilities. Finance leaders who move first gain a lasting edge: AI that scales without stalling.

Want to stop rebuilding integrations every quarter? Standardize your AI-to-finance workflows with Daloopa MCP. Reach out to us today and get audit-ready financial data directly into your LLMs.