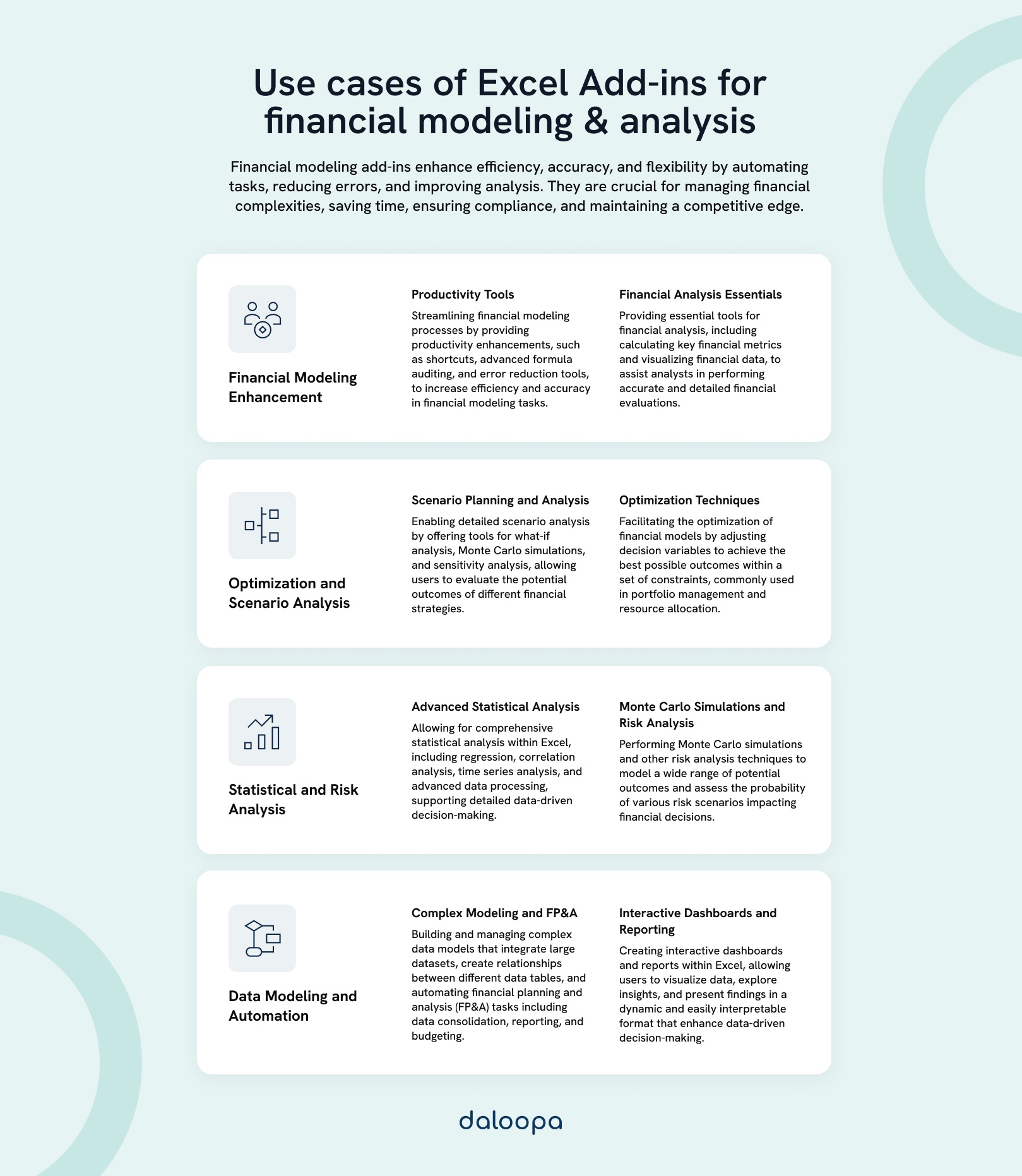

In the fast-paced world of finance, the ability to create accurate, dynamic, and insightful financial models is a critical skill. While Excel remains the go-to tool for financial professionals, its native capabilities can be significantly enhanced through specialized add-ins. These powerful extensions transform Excel into a more sophisticated platform for financial modeling and analysis, enabling analysts to work more efficiently, produce more robust models, and generate deeper insights.

Top Excel Add-Ins for Financial Modeling and Analysis

These tools are used for financial modeling, scenario analysis, and statistical analysis to support decision-making.

- Macabacus: Streamlines financial modeling with productivity enhancements.

- Functionality: Geared towards financial modeling, offering productivity enhancements, advanced formula auditing, error reduction tools, and robust shortcuts.

- Benefits: Enhances efficiency in financial modeling tasks by providing a suite of tools that streamline the modeling process, reducing the time spent on repetitive tasks.

- Example Use: Creating detailed financial models for a company using built-in templates for balance sheets, income statements, and cash flow statements, while leveraging shortcuts to quickly audit formulas and ensure accuracy.

- Monte Carlo Add-In: Performs Monte Carlo simulations for risk analysis.

- Functionality: Allows users to perform Monte Carlo simulations within Excel. This tool helps in risk analysis by simulating various outcomes based on different inputs and assumptions.

- Benefits: Provides a probabilistic approach to decision making, helping users understand potential risks and rewards by modeling a wide range of possible scenarios.

- Example Use: A financial planner could use the Monte Carlo Add-In to simulate retirement portfolio outcomes based on different investment returns and withdrawal rates, helping clients understand the likelihood of achieving their financial goals.

- Solver: Optimizes financial models by adjusting decision variables.

- Functionality: Used for optimization tasks. It helps find the best solution for problems involving multiple constraints and objectives, making it useful in financial modeling.

- Benefits: Adjusts the values in decision variables to achieve the desired outcome, adhering to set constraints. It is beneficial for performing scenario analysis, providing a range of possible outcomes based on different assumptions.

- Example Use: An investment manager might use Solver to optimize an investment portfolio, determining the best allocation of assets to maximize returns while minimizing risk.

- Model Analyzer: Provides tools for scenario and statistical analysis.

- Functionality: Provides multiple solutions for Excel modeling, including statistical analysis, what-if analysis (with tornado charts, spider charts, and sensitivity tables), scenario analysis, multiple goal seek, break-even analysis, and Monte Carlo simulations.

- Benefits: Centralizes input and output variables in spreadsheets, enabling sophisticated financial analysis and decision-making.

- Example Use: A financial analyst might use Model Analyzer to perform detailed scenario analysis and Monte Carlo simulations to evaluate the potential outcomes of different investment strategies.

- Analysis ToolPack: Allows advanced statistical analysis within Excel.

- Functionality: A Microsoft add-in that allows statistical analysis such as correlation analysis, descriptive statistics, and histograms.

- Benefits: Provided on every computer using Excel 2007 and later, both Mac and PC, enhancing the capability to perform advanced statistical analysis within Excel.

- Example Use: A statistician might use the Analysis ToolPack to perform correlation analysis and generate descriptive statistics for a large dataset.

- StatPlus: Offers comprehensive statistical analysis tools.

- Functionality: A statistical analysis package that works on both Mac and PC. It allows analysis of correlations, regressions, time series, and data processing, and creates statistical charts.

- Benefits: One of the few Excel add-ins for statistics that works on Mac, providing comprehensive statistical analysis tools.

- Example Use: A researcher might use StatPlus to analyze time series data and create regression models to understand trends and patterns in their data.

- Simtools: Enhances statistical analysis with Monte Carlo simulations.

- Functionality: Adds 32 statistical functions to perform Monte Carlo simulations and risk analysis in Excel spreadsheets.

- Benefits: Covers a range of functions for cumulative probability, correlations among random variables, decision analysis, regression analysis, and more, enhancing the capability for sophisticated statistical analysis.

- Example Use: A risk analyst might use Simtools to perform Monte Carlo simulations and assess the probability of different risk scenarios impacting their portfolio.

- XLSTAT: Provides tools for advanced statistical analysis.

- Functionality: An add-on with about 100 features for advanced statistical analysis, including linear and non-linear regressions, k-means clustering, and principal component analysis.

- Benefits: Highly compatible, working on both PC and Mac, and provides a wide range of tools for comprehensive statistical analysis.

- Example Use: A data scientist might use XLSTAT to perform principal component analysis and k-means clustering to identify patterns and relationships in their data.

- Analystix Tools: Includes essential tools for financial analysis and visualization.

- Functionality: Provides tools for financial analysis, including calculating CAGR, WACC, Black & Scholes formula, histogram building, and date arranging.

- Benefits: Includes essential tools for financial analysis and visualization, working on Excel 2010 and later on PC.

- Example Use: A financial analyst might use Analystix Tools to calculate the weighted average cost of capital (WACC) for a company and visualize the distribution of financial data using histograms.

- Power Pivot: Builds complex data models and interactive dashboards in Excel.

- Functionality: Extends Excel’s capabilities by allowing users to build more complex data models with millions of rows, far beyond the standard Excel limitations. It lets users create relationships between different data tables, crucial for comprehensive analysis.

- Benefits: Offers advanced data manipulation features like calculated columns and measures, enabling complex calculations and quick insights. It also provides robust data visualization options, allowing for the creation of interactive dashboards and reports within Excel.

- Example Use: A financial analyst could use Power Pivot to build a detailed data model that connects sales data, customer information, and product details, creating interactive dashboards to visualize sales performance and trends.

- Datarails: Automates Excel FP&A for accurate, efficient financial planning.

- Functionality: Financial planning and analysis (FP&A) software that connects with Excel.

- Benefits: Automates data consolidation, reporting, and analysis, improving accuracy and efficiency in financial planning.

- Example Use: Streamlining the budgeting process by consolidating financial data from multiple sources and generating comprehensive reports.

Key Advantages of Financial Modeling Add-Ins

- Enhanced Efficiency: Automate repetitive tasks and complex calculations, allowing analysts to focus on high-value activities.

- Improved Accuracy: Reduce errors in financial models through built-in error-checking and advanced formula auditing tools.

- Greater Flexibility: Easily perform scenario and sensitivity analyses with dynamic, interactive models.

- Advanced Visualization: Create more compelling and insightful visual representations of financial data and model outputs.

- Standardization: Implement consistent modeling practices across teams and organizations, improving collaboration and reducing errors.

Why Financial Professionals Need These Add-Ins

- Complexity of Modern Finance: As financial markets and instruments become increasingly complex, basic Excel functions often fall short. Add-ins provide the advanced capabilities needed to model sophisticated financial structures and scenarios.

- Time Pressure: In a fast-moving financial environment, the ability to quickly build, modify, and analyze models is crucial. Add-ins significantly reduce the time required for model development and analysis.

- Data Integration Challenges: Financial models often require inputs from various sources. Many add-ins offer seamless integration with external data sources, ensuring models are always up-to-date.

- Regulatory Compliance: With increasing scrutiny on financial models, add-ins can help ensure models meet regulatory standards for transparency, auditability, and risk management.

- Competitive Edge: Professionals who can leverage advanced modeling tools can provide more in-depth analysis and valuable insights, giving them a significant advantage in the field.

Maximizing the Impact of Financial Modeling Add-Ins

To fully leverage the power of these add-ins, financial professionals should:

- Align with Specific Needs: Choose add-ins that address the specific modeling challenges in your area of finance, whether it’s corporate finance, investment banking, or portfolio management.

- Invest in Training: Ensure that team members are well-versed in using these tools to maximize their potential and maintain consistency in modeling practices.

- Integrate with Existing Workflows: Select add-ins that can seamlessly integrate with your current financial software ecosystem and data sources.

- Prioritize Model Integrity: Use add-ins that offer robust model auditing and error-checking features to ensure the reliability of your financial models.

Stay Updated: Regularly update your add-ins and stay informed about new features to continually improve your modeling capabilities.

The Future of Financial Modeling

As the finance industry evolves, so too will the tools used for financial modeling and analysis. Machine learning and artificial intelligence are increasingly being incorporated into Excel add-ins, offering predictive analytics and automated model optimization. By embracing these advanced tools now, financial professionals can stay ahead of the curve and be prepared for the next generation of financial modeling.

Empowering Financial Decision-Making Through Advanced Modeling Tools

In an era where financial decisions are increasingly data-driven, Excel add-ins for financial modeling and analysis are indispensable tools for finance professionals. These add-ins not only enhance productivity and accuracy but also open up new possibilities for more sophisticated, dynamic, and insightful financial analysis. By leveraging the right combination of add-ins, analysts can transform Excel from a basic spreadsheet application into a powerful financial modeling platform, driving better financial decision-making and strategic insights across the organization.