What happens when a billion-dollar decision is based on bad data? Financial disasters, lost opportunities, and shaken investor confidence are only a few of the potential outcomes. In today’s high-stakes financial environment, accurate data is not a luxury—it is the foundation upon which reliable models and informed decision-making are built.

Every decision you make hinges on having credible, precise, and actionable data. By leveraging reliable financial data sources such as regulatory filings, company reports, and innovative financial data platforms, you can build models that withstand rigorous scrutiny and adapt swiftly to changing market dynamics. Trustworthy data sources for financial models are essential to ensuring the accuracy, consistency, and predictive power of your analyses.

In a world awash with information, you face the challenge of filtering vast amounts of data to identify only the most reliable sources. This guide provides actionable strategies to help you understand data quality, apply verification techniques, and stay ahead of evolving industry standards.

Adopting best practices—like analyzing historical trends, performing thorough sensitivity analyses, and implementing robust error-checking systems—will enhance your financial models’ reliability, precision, and transparency. The insights shared here will empower you to build confidence in your models and deliver insights that drive success.

Key Takeaways

- Reliable Financial Models Depend on Trustworthy Data: Utilize trustworthy data sources for financial models such as regulatory filings, company reports, and leading financial data platforms.

- Data Quality is Non-Negotiable: Accurate and timely data minimizes forecasting errors and supports robust risk management.

- Best Practices are Your Safeguard: Leverage historical trends, sensitivity testing, and systematic error-checking to strengthen your models.

The Importance of High-quality Financial Data

In financial modeling, reliable data provides the foundation for sound investment decisions, risk assessments, and strategic planning. Without dependable information, even the most sophisticated models can lead to flawed conclusions, potentially resulting in poor investment choices or misallocated resources.

Why Reliable Data Matters

Accurate data empowers you to assess performance, value investments correctly, and confidently predict future outcomes. For instance, consider an investment banking scenario. If your model is built on incomplete or outdated information, you risk mispricing assets and making investment decisions that could lead to billion-dollar losses.

Imagine a hypothetical situation where a bank’s valuation model underestimated a company’s risk because it relied on data that was not updated following a regulatory filing—this mistake could trigger a chain reaction of poor decisions and financial fallout.

When you base decisions on trustworthy data, you protect your investments and reinforce your reputation as a reliable decision-maker. Every dollar saved on mitigating errors contributes to a more resilient financial strategy.

Attributes of High-Quality Financial Data

Reliable, high-quality financial data exhibits several key characteristics:

- Consistency: Uniform reporting standards across periods ensure comparability and accuracy.

- Transparency: Traceable data collection methods and clear audit trails enhance trust.

- Timeliness: Frequent updates ensure that models reflect current realities and market conditions.

- Comprehensiveness: Data should provide a complete picture, including relevant historical and contextual information.

By prioritizing these attributes, financial professionals can mitigate risks, improve forecasts’ reliability, and strengthen their insights’ credibility.

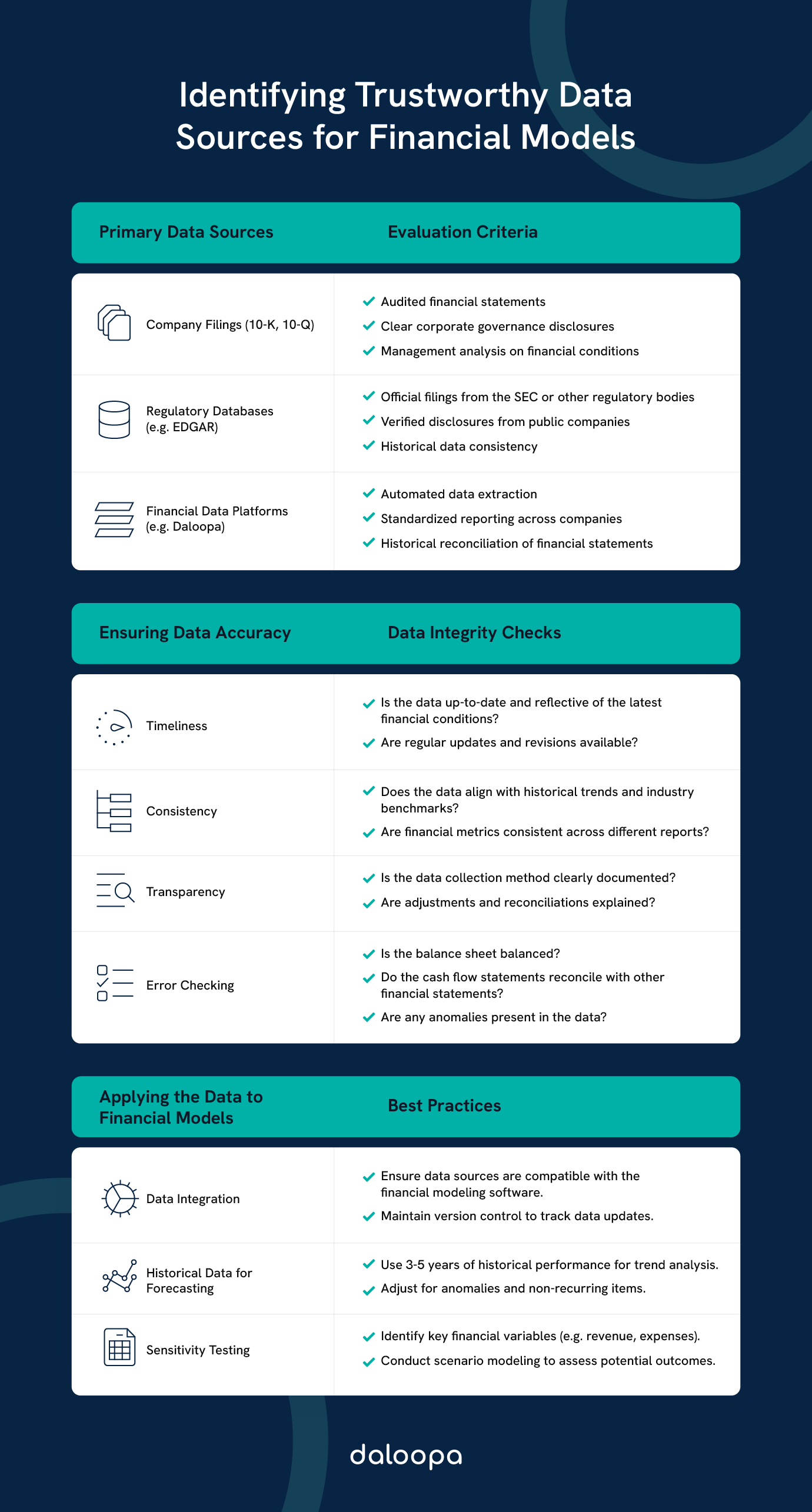

Primary Trustworthy Data Sources for Financial Models

Robust financial models rely on high-quality financial data sourced from trustworthy platforms. The following are three primary categories of data sources essential for building accurate and reliable models.

Company Filings: 10-K and 10-Q Reports

Company filings, including 10-K and 10-Q reports, are among the most valuable resources for financial analysts. Filed with the Securities and Exchange Commission (SEC), these documents provide detailed, standardized insights into a company’s financial performance, operations, and risks.

The Value of 10-K Reports

10-K reports, filed annually, contain:

- Audited financial statements, ensuring accuracy and reliability.

- Management’s discussion and analysis (MD&A) offers insights into operational strategies and market challenges.

- Disclosures on risk factors provide a clear picture of potential vulnerabilities.

- Corporate governance information, shedding light on a company’s leadership and decision-making processes.

The Role of 10-Q Reports

10-Q reports filed quarterly to serve as updates between annual filings. These reports include:

- Unaudited financial statements, which provide timely snapshots of company performance.

- Management commentary on financial conditions, offering valuable context for interpreting results.

- Disclosures about significant market risks and operational developments.

By analyzing these filings, financial professionals gain access to standardized, verifiable data that forms the backbone of accurate models.

Regulatory Databases: EDGAR and SEDAR

Centralized regulatory databases simplify access to corporate filings, making them indispensable tools and reliable financial data sources for analysts.

- EDGAR (Electronic Data Gathering, Analysis, and Retrieval): Maintained by the SEC, EDGAR houses comprehensive filings from U.S. public companies, including financial statements, annual reports, and disclosures. The database also includes filings from foreign companies trading on U.S. exchanges.

- SEDAR (System for Electronic Document Analysis and Retrieval): Canada’s equivalent to EDGAR, SEDAR, provides filings from Canadian public companies, mutual funds, and investment entities. It is an essential resource for analysts focusing on North American markets.

- EDINET (Electronic Disclosure for Investors’ NETwork)

EDINET is Japan’s electronic disclosure system that facilitates public access to corporate filings under Japanese disclosure regulations. It functions similarly to EDGAR by providing investors and analysts with a reliable source of detailed financial and operational data from Japanese companies. - Companies House

Companies House is the official registry for companies in the United Kingdom. It serves as a central repository for statutory filings, including annual accounts and financial statements, enabling public access to a wide range of corporate information essential for informed decision-making. - ASIC Registers and the ASX Platform

In Australia, the Australian Securities and Investments Commission (ASIC) and the Australian Securities Exchange (ASX) provide access to corporate filings through various public registers and platforms. These systems offer comprehensive company information and disclosure documents that help maintain transparency in Australian corporate reporting. - MCA21 Portal

The MCA21 portal, operated by India’s Ministry of Corporate Affairs (MCA), aggregates filings from public companies, including annual returns and financial statements. This system promotes transparency and efficient access to corporate disclosures, ensuring that investors and analysts in India can make well-informed decisions.

These databases provide free, centralized access to reliable, high-quality financial data, saving time and ensuring accuracy.

Financial Data Platforms: Daloopa

Modern financial data platforms are revolutionizing the way analysts gather and process information. One of the leading platforms in this space is Daloopa. Daloopa automates financial data extraction from SEC filings, investor presentations, and other critical trustworthy data sources for financial models so that you can focus more on analysis and less on data collection. Here’s why Daloopa stands out:

- Complete and Comprehensive Data: Daloopa collects every data point disclosed by over 5,000 companies, covering more than 10 years of historical financials, KPIs, and adjustments. This level of detail is crucial for building models that reflect a company’s performance.

- Accurate and Auditable: Every number in Daloopa’s database is hyperlinked to its source document, offering one-click verification. This auditable trail ensures you have complete confidence in the data you’re using.

- Ready When You Are: Daloopa is built for speed. Key data points are updated within minutes of earnings releases, and full updates are completed within 90 minutes on average. Whether building a new model or updating an existing one during earnings season, Daloopa helps you save valuable time.

- Flexible Data Delivery: Daloopa can deliver data via downloadable Excel sheets or through a direct data feed into your financial model, ensuring it fits seamlessly into your workflow.

By integrating platforms like Daloopa into your data-sourcing strategy, you gain access to reliable financial data sources, improving efficiency and elevating the overall quality and reliability of your financial models.

Check out this video to give you an idea of how Daloopa models work:

Best Practices for Ensuring Data Accuracy

Accurate data is critical for building reliable financial models. Adopting best practices with reliable financial data sources ensures precision, minimizes errors, and improves model performance.

Using Historical Data for Forecasting

Historical data serves as a solid foundation for forecasting. Analyzing trends over 3–5 years can help identify patterns, inform assumptions, and improve the reliability of projections. When using historical data:

- Adjust for anomalies such as one-time events or accounting changes.

- Compare company performance to industry benchmarks.

- Factor in macroeconomic trends to align forecasts with broader market conditions.

Combining historical insights with forward-looking guidance enhances financial models’ overall accuracy and relevance.

Conducting Sensitivity Testing

Sensitivity testing allows you to understand how changes in key variables affect your model’s outcomes. By adjusting factors such as revenue growth rates, operating margins, or interest expenses, you can observe the impact on metrics like cash flow and net income. For example, you might create several scenarios—best-case, worst-case, and most likely—and use Excel or specialized financial modeling software to calculate the resulting changes in your forecasts.

Here’s a step-by-step approach:

- Identify Key Variables: Focus on factors that impact your model most.

- Set Realistic Ranges: Define a range of values for each variable based on historical performance and industry benchmarks.

- Run Simulations: Adjust each variable within the defined range and observe the effects on your model’s outputs.

- Visualize the Results: Use charts and graphs to present the sensitivity analysis, making it easier to communicate findings to stakeholders.

These steps help ensure that your model remains robust despite uncertainties, allowing you to prepare for various market conditions.

Implementing Error-Checking Systems

Automated error-checking maintains data integrity. Implement systems that routinely verify critical aspects of your models, such as ensuring that balance sheet cash flow statements reconcile with other financial statements and key ratios fall within expected ranges.

For instance, you can use built-in functions in Excel or custom scripts that cross-reference data from multiple sources to detect discrepancies early. Regular peer reviews and audits of your models further help catch any errors automated systems might miss. Adopting these measures creates a safety net that significantly reduces the risk of costly mistakes.

Evaluating the Quality of Data Sources

Assessing data quality is a critical step in building reliable financial models. This involves evaluating the accuracy, consistency, and credibility of data sources. Using reliable financial data sources ensures that models are based on trustworthy and verifiable information.

Verifying Accuracy and Reliability

Cross-reference data from multiple reports to confirm that your financial statements are accurate. For instance, compare figures from a company’s 10-K report with those in its 10-Q updates. If the numbers align and are updated promptly, you can be more confident in their reliability. Reputable and trustworthy data sources for financial models such as regulatory filings (e.g., EDGAR and SEDAR) and established financial data platforms (like Daloopa) are typically the most dependable.

In addition, pay attention to the audit trails provided by your data sources. If you can trace every number back to its original document, you are better positioned to verify the accuracy of the information and spot any potential discrepancies.

Leveraging Public Company Data

Public filings are among the most transparent and trustworthy data sources for financial modes. The information available in 10-K and 10-Q reports and data from platforms like EDGAR offers a high level of assurance because these documents must comply with regulatory standards.

Moreover, combining this data with insights from market-leading platforms such as Daloopa—which integrates and automates financial data extraction—ensures that your models are built on a foundation of comprehensive and reliable information.

By leveraging reliable financial data sources alongside public company data and modern automated tools, you enhance both the speed and the quality of your financial analysis, paving the way for more informed and timely decisions.

Building Confidence in Financial Models

Ultimately, confidence in your financial models arises from the interplay of reliable data, sound methodologies, and robust validation processes. Here’s how you can ensure that your models not only meet but exceed stakeholder expectations:

- Utilize Reliable Financial Data Sources: Use trustworthy data sources for financial models like EDGAR, SEDAR, and advanced platforms like Daloopa to gather your data. This minimizes the risk of inaccuracies that could undermine your models.

- Analyze Historical Trends: Leverage past performance to set realistic assumptions and identify trends. Adjust for any anomalies to maintain a true picture of performance.

- Run Sensitivity Tests: Evaluate how your models react to changes in key variables. This highlights potential risks and reinforces the model’s resilience in volatile markets.

- Implement Modular Designs: Build models that are flexible and easy to update. Modular designs enable quick adjustments when new data becomes available, ensuring your models remain current.

- Conduct Regular Audits: Regular internal and external reviews help validate your assumptions and data sources, boosting confidence in your analytical processes.

By integrating these strategies, you create financial models that are both robust and adaptive, providing actionable insights that drive better decision-making and foster investor trust.

Use Daloopa to Ensure Trustworthy Data Sources for Financial Models

Don’t let unreliable data derail your financial decisions. In today’s fast-paced financial world, having access to accurate, auditable, up-to-date, and trustworthy data sources for financial models and forecasts is non-negotiable. With solutions like Daloopa, you can automate data extraction from SEC filings, investor presentations, and more—allowing you to build and update models with unprecedented speed and accuracy.

Daloopa empowers you to reduce manual data collection, reduce errors, and focus on what truly matters: insightful analysis and strategic decision-making. Whether building new models, updating existing ones during earnings season, or creating industry benchmarks, Daloopa’s comprehensive data sheets and one-click updates ensure you always work with the best available information.

Ready to revolutionize your financial modeling process? Request a demo today and see how Daloopa can help you turn data into your most valuable asset.