Hedge funds continue to evolve in response to shifting financial markets, with multi-strategy hedge funds standing out for their ability to diversify across multiple investment approaches within a single portfolio. Skilled portfolio managers play a crucial role, dynamically reallocating capital across asset classes to optimize performance and mitigate volatility.

This article explores the key aspects of multi-strategy hedge funds, focusing on performance, risk management, and emerging trends.

Key Takeaways

- Multi-strategy hedge funds diversify investments across various strategies for enhanced risk management.

- Skilled portfolio managers must perfect their ability to allocate capital in multi-strategy funds.

- The growth of hedge funds reflects evolving financial trends and investor demands.

The Evolution of Hedge Funds: A Focus on Multi-Strategy Adaptability

Hedge funds have undergone significant transformation, shifting from niche investments to key players in global finance. Multi-strategy hedge funds, in particular, have proven their resilience and adaptability in navigating various market environments, including times of extreme volatility.

From Niche Investment to Financial Powerhouses

Initially catering to a small, wealthy clientele, hedge funds were designed to provide alternative strategies outside traditional investments. By the late 20th century, their success in delivering superior returns, especially during volatile markets, attracted institutional investors such as pension funds and endowments, signaling the growing influence of hedge funds in mainstream financial markets, marked by a substantial increase in assets under management (AUM).

Fundamentals of Multi-Strategy Funds

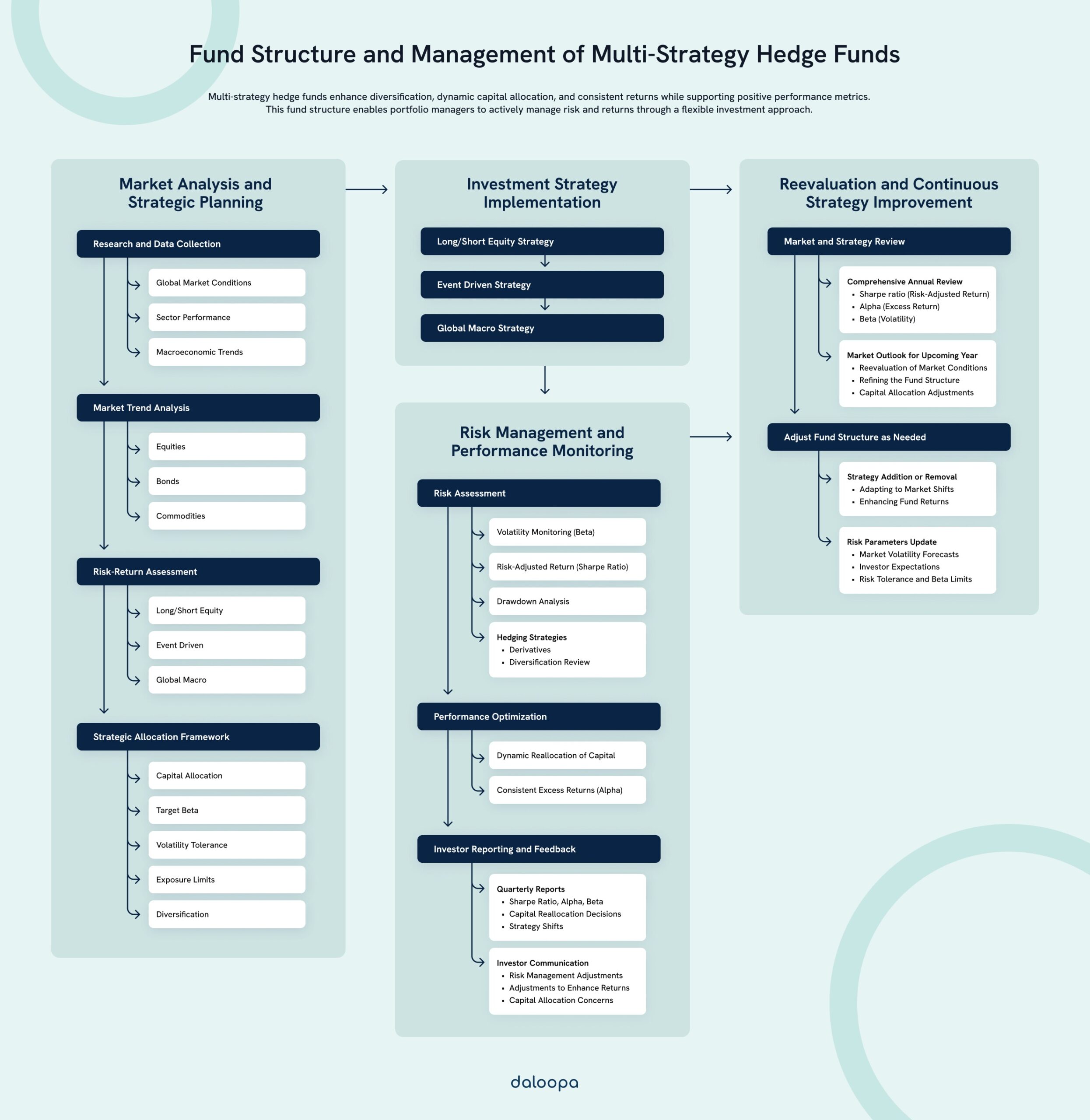

Multi-strategy hedge funds offer a unique, diversified investment framework by combining multiple strategies within a single portfolio, enabling fund managers to allocate capital across various asset classes and strategies, optimizing both risk management and return potential.

Key Investment Strategies in Multi-Strategy Hedge Funds

At the core of multi-strategy funds is a diverse range of investment approaches, including:

- Long/Short Equity: Long/short equity strategies involve taking long positions in undervalued stocks and short positions in overvalued ones, seeking to generate returns from both rising and falling equity markets.

- Global Macro: Focused on broad economic trends, global macro strategies leverage movements in interest rates, currencies, and commodities to capitalize on global market shifts.

- Event-Driven Strategies: Event-driven strategies profit from corporate events like mergers, acquisitions, or restructurings by anticipating how such events affect asset prices.

Each strategy operates independently within the broader portfolio but contributes to a common goal: maximizing risk-adjusted returns while diversifying exposure.

Capital Allocation and Portfolio Rebalancing

Multi-strategy hedge funds employ dynamic capital allocation, adjusting resources based on market conditions and the relative attractiveness of each strategy. Managers continuously evaluate the risk-return profile of each investment approach and shift capital toward those with the highest potential. For example, during periods of equity market volatility, capital might be reallocated from long/short equity strategies to more stable global macro or event-driven strategies.

Rebalancing within multi-strategy funds can occur frequently—sometimes daily or weekly—depending on market shifts or risk exposures. Managers also use leverage selectively to amplify returns or hedge positions to reduce downside risk.

Historical Success and Strategy Correlations

Research shows that blending strategies like long/short equity and global macro can reduce portfolio volatility due to their low correlation. For instance, during the 2008 financial crisis, many multi-strategy funds mitigated losses by reducing exposure to equities while increasing positions in bonds and currencies through global macro strategies. Similarly, during the COVID-19 market volatility, event-driven strategies capitalized on disruptions in sectors like technology and healthcare.

Advantages Over Single-Strategy Funds

Compared to single-strategy hedge funds, multi-strategy funds offer significant diversification benefits. By spreading risk across multiple strategies and asset classes, these funds are less exposed to the performance of any one particular market or sector.

Multi-strategy funds are better equipped to respond to market volatility, making them attractive to institutional investors seeking steady, risk-adjusted performance over the long term. The flexibility to capitalize on a wide range of market opportunities positions multi-strategy hedge funds as valuable tools in navigating today’s complex and uncertain financial landscape.

Assessing Performance and Risk in Multi-Strategy Hedge Funds

Multi-strategy hedge funds utilize sophisticated risk management frameworks to ensure consistent performance across varying market conditions. A thorough understanding of how these funds assess risk and return benefits professional analysts, especially in an environment where capital preservation and performance optimization are paramount.

Comprehensive Risk Management Frameworks

Risk management in multi-strategy hedge funds involves a range of methodologies aimed at identifying, quantifying, and mitigating risk. One key tool is Value-at-Risk (VaR), which estimates the potential loss in portfolio value over a given time frame with a specified confidence level. For instance, a 5% VaR of $10 million suggests a 5% chance the fund will lose $10 million or more in a given period. While VaR helps to quantify risk, it is supplemented by stress testing and scenario analysis, which simulate extreme market conditions, such as during the 2008 financial crisis or the COVID-19 pandemic. These tools allow funds to assess how their portfolios perform under adverse market conditions and adjust their exposures accordingly.

Additionally, multi-strategy funds often employ liquidity risk management, ensuring they maintain sufficient liquidity to meet investor redemptions or take advantage of emerging opportunities without disrupting the portfolio. By actively monitoring liquidity, funds can balance between long-term strategies like global macro and shorter-term event-driven strategies.

Performance Metrics and Risk-Adjusted Returns

Several metrics are used to evaluate the performance of multi-strategy hedge funds, with a focus on risk-adjusted returns.

- Sharpe Ratio: The Sharpe ratio metric measures a fund’s risk-adjusted return by comparing the excess return (returns above the risk-free rate) to its volatility. A higher Sharpe ratio indicates that the fund delivers better returns per unit of risk. In periods of market stress, such as the 2008 crisis, multi-strategy funds with high Sharpe ratios demonstrated their ability to maintain performance while controlling risk, unlike many single-strategy funds that were more exposed to market downturns.

- Alpha: Alpha measures the fund’s ability to outperform its benchmark, indicating how much value the fund managers add through active management. A positive alpha shows that the fund generated returns above what would be expected given its risk profile (represented by beta). Historical data from multi-strategy funds shows a tendency to generate positive alpha, particularly in volatile markets, as fund managers can shift capital between strategies like long/short equity and fixed-income arbitrage to exploit emerging opportunities.

- Beta: Beta measures the correlation of the fund’s returns with the broader market. A beta of 1 suggests that the fund’s performance moves in line with the market, while a beta below 1 indicates less sensitivity to market swings. Multi-strategy funds tend to maintain a lower beta by diversifying across asset classes and strategies, which helps to smooth out volatility and protect against market downturns. During the COVID-19 market turmoil, many multi-strategy funds maintained lower beta, reducing their exposure to equity market shocks.

Comparative Performance During Key Market Events

Empirical data shows that multi-strategy hedge funds often outperform single-strategy funds during periods of market volatility.

Reports such as those from the Hedge Fund Research (HFR) index further highlight the historical resilience of multi-strategy funds. For example, the HFRI Fund Weighted Composite Index showed that multi-strategy funds experienced lower drawdowns during the 2008 crisis and the pandemic compared to their single-strategy counterparts.

Investment Strategies and Asset Classes

Multi-strategy hedge funds deploy a range of sophisticated investment strategies, each tailored to exploit specific market inefficiencies and macroeconomic trends.

Long/Short Equity Strategies

Long/Short Equity strategies involve taking long positions in undervalued stocks while shorting overvalued ones, aiming to generate returns from both rising and falling prices. The balance between long and short exposure is continuously adjusted based on market conditions, including interest rates and volatility regimes. For example, when interest rates rise, funds may reduce exposure to sectors sensitive to borrowing costs, such as real estate or consumer discretionary, while increasing positions in financials, which tend to benefit from higher rates.

Sector preferences often vary across funds, with some focusing on technology and healthcare, where innovation creates inefficiencies, while others might emphasize energy or industrials, where commodity price movements play a larger role. Long/Short funds also apply leverage and hedging techniques to enhance returns and protect against market downturns. For instance, during periods of increased volatility, managers may increase short positions to hedge broader market risks, preserving capital while still seeking alpha through stock-specific trades.

Event-Driven and Merger Arbitrage Strategies

Event-driven strategies capitalize on price movements triggered by corporate actions such as mergers, acquisitions, and restructurings. These funds actively adjust their exposure based on legal, regulatory, and economic developments that may influence deal outcomes. For example, when volatility spikes, the spread between target and acquirer prices widens, offering higher potential returns for Merger Arbitrage positions, though at increased risk.

In a typical Merger Arbitrage scenario, a fund may go long on a company’s acquired stock while shorting the acquirer’s stock. This strategy hinges on accurately forecasting deal completion, which requires close monitoring of regulatory approval processes, shareholder votes, and market sentiment. Global sector allocations can vary: during periods of heightened regulatory scrutiny, U.S. or European deals may see reduced activity, while opportunities in emerging markets could rise as deal flow in those regions increases.

Funds may also employ additional event-driven tactics like distressed investing, where they take positions in companies undergoing bankruptcy or restructuring, profiting from the anticipated recovery or liquidation value of the assets.

Global Macro Strategies

Global Macro strategies take a top-down approach, driven by macroeconomic and geopolitical trends. These funds invest across asset classes such as equities, bonds, currencies, and commodities, seeking to profit from shifts in global economic conditions. Interest rate differentials between countries, yield curves, and inflation data are critical indicators for these strategies. For instance, if a country is expected to raise interest rates, a Global Macro fund might go long on that country’s currency while shorting bonds to capitalize on anticipated rate hikes.

Commodities are another important asset class for Global Macro funds, particularly in inflationary environments. For example, rising oil prices due to geopolitical tensions may lead to long positions in energy futures or energy-related stocks. Conversely, if inflation data indicates a slowing economy, the fund might shift exposure to safe-haven assets like gold or government bonds.

These funds are highly responsive to changing volatility regimes. During periods of low volatility, they might increase exposure to riskier assets like emerging market currencies or equities. However, when volatility spikes—such as during a geopolitical crisis—Global Macro funds typically rotate into defensive assets, including U.S. Treasuries or cash, while simultaneously shorting risk-sensitive assets like high-yield bonds or equity indices.

The Role of Portfolio Managers

In multi-strategy hedge funds, portfolio managers are pivotal in driving performance and aligning investments with the fund’s strategic objectives. Their responsibilities extend beyond simple oversight; they dynamically manage capital across multiple strategies, make key allocation decisions, and integrate various trading teams to ensure seamless execution.

Dynamic Capital Allocation and Strategy Management

Portfolio managers in multi-strategy hedge funds must continuously evaluate market conditions and adapt their allocations across different strategies. They actively monitor each strategy’s performance rather than adhering to static asset distribution, identifying shifts in risk/reward profiles driven by market volatility, interest rate changes, or macroeconomic developments. This ongoing analysis allows them to rebalance the portfolio dynamically, moving capital to areas with the highest potential for returns while mitigating downside risks.

Risk management frameworks, such as scenario analysis, stress testing, and Value-at-Risk (VaR) models, are integral to their decision-making processes. These tools help managers assess potential losses and ensure the portfolio maintains an appropriate risk-adjusted return profile. Furthermore, capital is reallocated based on real-time feedback from markets and performance metrics like alpha, beta, and the Sharpe ratio, ensuring that no single strategy overexposes the fund to specific market risks.

Governance Frameworks and Decision-Making Structures

Effective governance frameworks ensure portfolio managers can make informed, timely decisions while maintaining a cohesive investment approach. Multi-strategy hedge funds often implement tiered decision-making structures, where senior portfolio managers oversee capital allocation across strategies while individual strategy leads provide insights specific to their domains—be it Long/Short Equity, Global Macro, or Event-Driven approaches.

Key decisions, such as reallocation or tactical shifts in strategy, often undergo rigorous review by investment committees, ensuring alignment with the fund’s broader objectives. Additionally, the integration of quantitative models with human oversight enables portfolio managers to blend systematic approaches with discretionary insights, enhancing the fund’s agility.

Trading Team Integration and Coordination

Portfolio managers work closely with specialized trading teams that execute strategies within distinct asset classes or market segments. These teams, typically composed of analysts and traders with expertise in areas such as equities, fixed income, currencies, or derivatives, operate with a high degree of autonomy but are guided by the overall portfolio strategy set by the manager.

To achieve cohesive execution, portfolio managers facilitate regular communication between trading teams and ensure their actions align with broader fund goals. This collaboration involves frequent strategy updates, performance reviews, and risk assessments to maintain team transparency. Portfolio managers also foster a culture of collaboration and accountability, where diverse expertise is harnessed to maximize performance across all strategies.

Compensation Structures and Alignment with Investor Interests

Incentive structures play a crucial role in aligning the interests of portfolio managers with those of investors. Compensation is typically tied to fund performance, with performance-based incentives such as profit-sharing or bonuses linked to achieving predefined benchmarks. These structures ensure that portfolio managers are motivated to pursue strategies that generate returns and manage risk in a way consistent with investor objectives.

Many funds adopt a “high-water mark” approach, where bonuses are paid only when the fund surpasses its previous peak performance, preventing managers from being rewarded for recovering past losses. This structure incentivizes long-term value creation and discourages excessive risk-taking, ensuring portfolio managers prioritize sustainable growth over short-term gains.

Financial Environment and Hedge Funds

Navigating the complexities of the financial environment is fundamental to the operation of hedge funds. Multi-strategy hedge funds, in particular, must remain agile and responsive to shifts in interest rates and macroeconomic trends. By employing diverse investment approaches, these funds can adjust their allocations to optimize performance in varying economic climates.

Interest Rates and Hedge Fund Strategies

Interest rates are a major driver in determining how hedge funds allocate capital across different strategies. During periods of low interest rates, borrowing becomes cheaper, allowing funds to leverage their positions more extensively. For instance, funds might increase their exposure to long/short equity strategies, using leverage to amplify returns.

Rising interest rates also pose challenges to debt-heavy strategies. Multi-strategy funds may reduce exposure to sectors like real estate or leveraged buyouts, where higher borrowing costs can cut into returns. To manage interest rate risk, funds frequently hedge their positions using derivatives like interest rate swaps or futures, allowing them to profit from volatility while protecting their portfolios.

Economic Trends Influencing Hedge Fund Strategies

Beyond interest rates, broader economic trends, such as inflation or central bank policies, significantly influence hedge fund strategy selection. During inflationary periods, for example, multi-strategy hedge funds often pivot towards commodities and inflation-protected securities. As inflation spikes, real assets like oil, gold, and agricultural products tend to appreciate, making commodity exposure an effective inflation hedge.

Investor Considerations: Institutional vs. Individual Investors

The nature of the investor base—whether institutional or individual—plays a significant role in shaping the operations and strategic flexibility of multi-strategy hedge funds.

Institutional Investors

Institutional investors, such as pension funds, endowments, and insurance companies, tend to have large capital allocations, providing them with leverage to negotiate better terms, such as lower fees or more favorable redemption rights. Institutions often have extensive resources for due diligence, enabling them to scrutinize fund performance, governance structures, and risk management practices.

In periods of rising interest rates or economic uncertainty, institutional investors may favor multi-strategy funds that emphasize macroeconomic hedging or equity market-neutral strategies.

Individual Investors

Individual investors, in contrast, often face higher minimum investment thresholds and have less negotiating power in terms of fees or liquidity provisions. However, they can still benefit from the risk diversification and adaptive strategies offered by multi-strategy funds. For individual investors, selecting a fund with transparent governance, clear risk management frameworks, and alignment of interests between managers and investors is essential.

Understanding the distinct needs and preferences of these two investor types informs how multi-strategy funds structure their offerings, allocate capital, and communicate performance results.

Assessing Assets Under Management (AUM)

Assets under management (AUM) have a significant impact on how hedge funds operate. Larger AUM allows for greater diversification across strategies, which can reduce risk by spreading exposure across multiple asset classes, sectors, and regions. However, managing a large AUM can also present challenges, such as reduced flexibility and agility in pursuing niche investment opportunities.

Smaller AUM funds, by contrast, can be more nimble, executing high-conviction trades and taking advantage of smaller market inefficiencies that might be inaccessible to larger funds. Yet, they may face greater volatility due to concentrated positions and a narrower range of strategies.

Evaluating the effectiveness of AUM management is essential for investors assessing the scalability and performance potential of a multi-strategy hedge fund.

Forward-Looking Trends in Multi-Strategy Investing

Technological advancements continue to reshape multi-strategy investing, particularly through the integration of artificial intelligence (AI) and machine learning (ML) in investment research and strategy execution.

Emerging Business Models

The evolution of business models in the hedge fund space is another key trend. Performance-based fee structures are becoming more common, aligning manager compensation with fund performance to foster long-term value creation.

By integrating AI technology and adopting flexible business models, multi-strategy hedge funds can better navigate the challenges posed by macroeconomic shifts and evolving investor expectations.

Enhance Your Multi-Strategy Hedge Fund Analysis with Daloopa

Daloopa’s AI-powered data extraction tools provide detailed insights into multi-strategy hedge funds, helping analysts track performance and assess risk across diverse investment strategies. With accurate, real-time data at your fingertips, Daloopa makes it easier to navigate the complexities of hedge fund evaluation.

Interested in learning more? Explore how our platform can support your investment analysis—request a demo at your convenience.