Open source financial data offers accessible, cost-effective resources for in-depth analysis, broadening opportunities for innovative financial modeling. However, data quality and reliability vary in each situation, raising accuracy concerns. Effective management and data security also require specialized tools and expertise.

Key Takeaways

- Accessible and low-cost

- Potential issues with data quality

- Requires specialized tools for management and security

Fundamentals of Open Source Financial Data

Open source financial data transformed trading, risk assessment, and portfolio management workflows by providing transparent and accessible datasets. Community-driven improvements ensure these data sources stay relevant and adaptable to changing market needs.

Understanding Open Data in Financial Workflows

Open data refers to freely available, adaptable, and shareable datasets. open source financial data allows real-time access to stock prices, trading volumes, and market indices. For risk assessment, analysts use open economic indicators or macroeconomic datasets to forecast potential market shifts. In portfolio management, open data helps optimize asset allocation by providing historical price data and financial ratios.

Widely used open source financial data platforms include Quandl, which offers datasets covering everything from commodities to cryptocurrencies, and Yahoo Finance, a go-to source for real-time market data and historical price tracking. These platforms integrate with open source tools like R and Python libraries, enabling deeper financial analysis and model development.

For example, books and resources on financial data analysis provide insights into leveraging these tools to create sophisticated models, from Monte Carlo simulations in risk analysis to machine learning applications in portfolio management.

Importance of Transparency and Accessibility

Transparency in financial data ensures equal access to information, reducing information asymmetry and fostering fairer markets. Open source financial data enables clearer detection of issues like market manipulation. For instance, with open trading volume data access, analysts identify unusual activity that may signal manipulation, ensuring a more transparent market environment.

Accessibility lowers the barriers for analysts and researchers. open source platforms like Quandl and Yahoo Finance provide real-time data that can be analyzed without hefty licensing fees. Tools like Python libraries and TensorFlow democratize sophisticated techniques like algorithmic trading and anomaly detection, allowing a wider audience to participate in financial innovation ensuring more informed, data-driven decisions across trading, risk assessment, and portfolio management.

The Role of Community in Open Source Projects

Community involvement drives innovation and sustainability in open source financial data. Professionals—including developers, analysts, and researchers—collaborate to enhance and maintain datasets, ensuring their accuracy and relevance for real-world financial applications supporting continuous improvements, with regular updates that reflect evolving market conditions and regulatory requirements.

In practical terms, engagement ranges from contributing code to improving documentation or developing new analytical tools. For example, investment banking analysts benefit from community-driven insights by leveraging widely used financial datasets such as those from Quandl, which aggregate community-contributed datasets across various markets. The community also plays a key role in identifying and resolving issues with data reliability, integration challenges, and security risks, strengthening the robustness of open source tools, and helping organizations address specific challenges, such as integrating open source solutions into proprietary systems or meeting regulatory compliance.

For instance, open source projects like PostgreSQL and Spark, used in high-frequency trading environments, continue to evolve through community collaboration, allowing them to handle large-scale data operations effectively.

Real-world success stories from financial institutions, such as hedge funds or trading firms that utilize open source technologies, illustrate the impact of community-driven projects. By sharing knowledge and resources, the open source community provides analysts with both scalable and adaptable tools to their unique financial workflows, ultimately enhancing the quality and transparency of financial data analysis.

Pros of Open Source Financial Data for Analysis

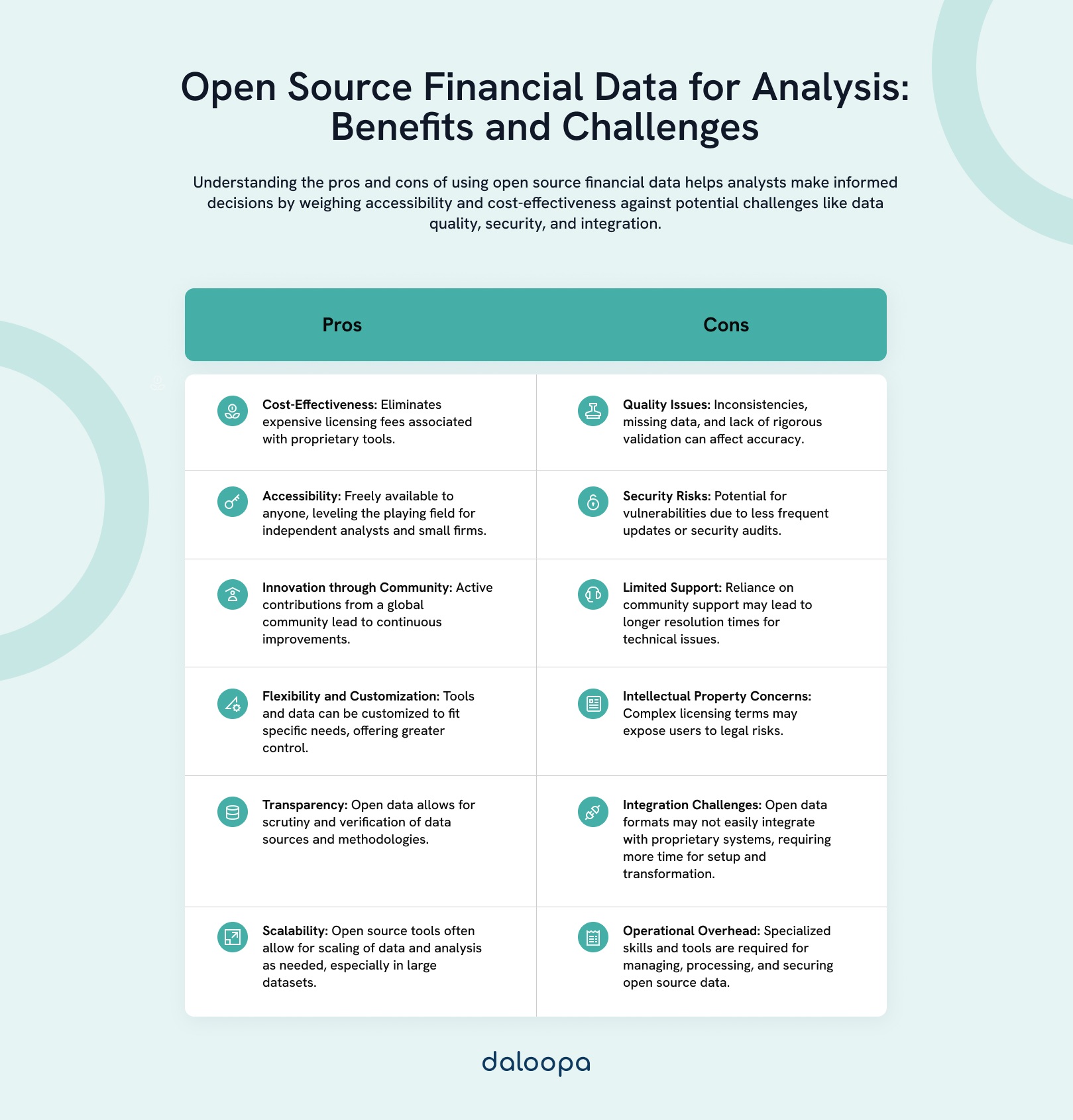

Open source financial data offers several advantages for investment banking analysts, including cost savings, greater accessibility, community-driven innovation, and flexibility in customization, leading to more efficient and accurate data-driven financial analysis.

Cost-Effectiveness

One of the most significant advantages of open source financial data involves reducing costs. Proprietary financial data platforms often come with high licensing fees. Analysts can access robust datasets without these financial constraints by using open source solutions, such as Quandl or Yahoo Finance.

For instance, Quandl provides free access to data on commodities, market indices, and economic indicators, allowing analysts to allocate budgets toward other critical areas like research and development or strategic initiatives.

Additionally, open source platforms like PostgreSQL and Python libraries, which offer powerful data analytics capabilities, are cost-effective alternatives to proprietary software like Bloomberg or Refinitiv, reducing costs but also providing similar functionalities and empowering analysts with high-quality resources to perform complex financial modeling and analysis.

Accessibility and Availability

Open source financial data democratizes access to valuable information, leveling the playing field for analysts across different sectors. Unlike proprietary datasets, open source financial data allows a broader range of participants to engage in sophisticated financial analysis because it is free.

For example, free tools like TensorFlow, widely used in the financial sector for machine learning and large-scale data processing, enable analysts to handle complex datasets, such as historical trading volumes or real-time stock price movements, fostering innovation and collaboration across the financial community, promoting more in-depth research, better risk management, and the development of advanced predictive models.

Community-Driven Innovation and Flexibility

The open source model thrives on community engagement, which leads to continuous innovation and improvement. Platforms like GitHub allow developers and analysts to collaborate on financial tools, share insights, and refine data analytics frameworks, making them more adaptable and relevant for real-world applications.

Open source financial tools offer extensive flexibility for customization. Analysts modify datasets or algorithms to fit specific financial workflows, such as trading algorithms, portfolio optimization, or risk assessments.

For example, investment banking analysts customize Python-based financial libraries like Pandas or NumPy to handle large datasets, automate processes, or integrate open source tools with proprietary systems in high-frequency trading environments.

Innovation Through Community Engagement

Open source financial projects thrive on community-driven collaboration, leading to impactful innovations in the financial industry. Large banks and FinTech firms have increasingly contributed to open source projects, providing real-world applications and improvements in financial data analysis.

For instance, JPMorgan has open sourced its Python-based trading analytics tool, Athena, which is now widely used for data analysis and risk management across the industry. It enhances the tool itself and allows other financial institutions to build on the platform, creating tailored solutions for their unique workflows.

Collaborative initiatives such as FINOS (the Fintech Open Source Foundation) have brought together major players like Goldman Sachs and Morgan Stanley to advance open source tools in finance. FINOS projects, including financial data models and trading platforms, drove innovation by allowing banks and analysts to collectively share best practices and improve key technologies.

By participating in these open source communities, investment banking professionals can stay at the forefront of emerging technologies, such as machine learning in trading algorithms or blockchain for secure transactions.

Community engagement fosters the development of specialized tools that proprietary software may not offer, ensuring financial analysts can leverage cutting-edge solutions to optimize data-driven decision-making.

Flexibility and Customization

One of the most significant advantages of open source data involves the ability to customize tools and datasets to meet specific needs. Proprietary software often lacks such flexibility, limiting users to predefined functionalities. With open source options, you can control modifications and adapt tools to suit our unique analytical requirements.

This flexibility enhances operational efficiency, allowing you to streamline workflows and integrate various technologies seamlessly. Custom scripts or plugins address unique challenges, paving the way for bespoke solutions that drive better decision-making and more precise financial analysis.

Cons of Open Source Financial Data for Analysis

There are several drawbacks to consider when using open source financial data for analysis, ranging from potential quality issues and security risks to intellectual property and integration challenges.

Quality Issues and Limited Support

While open source financial data offers accessibility, it often lacks the rigorous quality controls of proprietary data, leading to inconsistencies or outdated information. To mitigate these risks, investment analysts adopt several best practices to verify the integrity of open source datasets:

- Cross-Referencing Data Sources: One effective strategy is cross-referencing open source data with trusted proprietary sources. For example, analysts can validate market prices or trading volumes by comparing open source datasets from platforms like Quandl with data from Bloomberg or Refinitiv.

- Use of Data Provenance Tools: Ensuring data provenance—tracking the origin and history of datasets—can also improve reliability. Tools like Apache Kafka and blockchain-based solutions can help establish a clear audit trail, verifying that financial data is unaltered and trustworthy.

- Third-Party Audits and Certifications: Some third-party services, such as TruSet, specialize in validating financial data, providing peer-reviewed datasets, and offering certification processes to ensure the accuracy and consistency of data. Relying on such third-party certifications can add an extra layer of confidence when working with open source financial data.

- Automated Data Quality Checks: Analysts can implement automated quality control checks using open source tools like Python’s Pandas library. These checks identify outliers, missing entries, or anomalies within datasets, ensuring any errors are detected early in the analysis process.

While open source financial data may lack dedicated support teams, relying on community contributions and third-party services can help address issues efficiently. Investing in tools that ensure data quality and engaging with certified providers can significantly reduce the risks of using open source financial data.

Security Risks in Open Source Financial Data

While open source financial data offers numerous advantages, it comes with significant security concerns, particularly for large financial institutions. Since the data is freely available, it may be more vulnerable to tampering or manipulation by malicious actors.

Analysts must be vigilant, as open source platforms may not undergo the same rigorous security audits as proprietary systems, increasing the risk of data tampering, which could lead to inaccurate financial models or compromised trading strategies.

Many firms adopt robust internal security measures to mitigate these risks, such as employing blockchain technology to ensure data integrity and immutability. Additionally, third-party platforms like OpenZeppelin offer security audits for open source projects, ensuring code integrity and minimizing vulnerabilities.

Intellectual Property and Licensing Concerns

Using open source financial data raises potential intellectual property challenges, particularly around complex licensing terms. Some data may come with specific usage restrictions, and failure to comply can result in legal disputes.

For instance, using open source datasets from sources like Yahoo Finance or Quandl for commercial purposes may require compliance with particular licensing agreements that vary across platforms.

Financial institutions must carefully review the licensing terms associated with any open source data they integrate. A best practice is to conduct a legal audit of data licenses before incorporating them into trading algorithms or risk models. Tools like FOSSA help automate license compliance checks, ensuring that analysts and institutions adhere to legal standards without slowing down analytical workflows.

Integration Challenges with Proprietary Systems

Integrating open source financial data into existing proprietary systems can present technical challenges, particularly in data formatting and infrastructure compatibility. open source datasets often use non-standard formats that require additional cleaning and transformation before being used effectively.

For example, data from platforms like Quandl may need to be harmonized with proprietary data systems such as Bloomberg or Refinitiv, adding time and complexity to the process.

One solution is to employ data integration tools such as Apache NiFi, which allows for seamless transformation and routing of diverse data sources into a unified pipeline. Financial institutions also frequently use APIs to bridge the gap between open source data and proprietary systems, enabling smoother workflows and reducing operational disruptions.

In high-frequency trading environments, where milliseconds matter, integrating open source financial data with proprietary systems requires scalable solutions that can handle vast volumes of data without causing latency. Specialized platforms like Kafka and Spark are often used to manage this process, ensuring that data flows smoothly across systems while maintaining speed and reliability.

Operational Considerations in Open Source Financial Analysis

Integrating open source financial data with proprietary systems like Bloomberg Terminal or Thomson Reuters Eikon requires a structured approach to ensure smooth interoperability. One major challenge is harmonizing diverse data formats, as open source datasets may not follow the standardized structures used by these platforms.

For instance, Bloomberg Terminal operates on a proprietary API, while open source data sources such as Quandl or Yahoo Finance may use different schema and protocols.

To address this, firms can utilize ETL (Extract, Transform, Load) tools like Apache NiFi or Talend to streamline the data integration process. These tools enable the extraction of raw data, transformation into standardized formats, and loading into existing proprietary systems for real-time analysis.

Leveraging APIs enables seamless data flow between platforms. For high-frequency trading environments, Apache Kafka and Spark can handle large volumes and speed up data transactions without causing significant latency.

Without proper processing, discrepancies between datasets could affect the reliability of financial models, particularly in trading or risk assessment workflows. Ensuring compatibility across different business intelligence tools—Tableau, Power BI, or Python-based solutions—ensures that the integrated data remains accurate and actionable for investment decision-making.

Compliance and Regulatory Awareness

When working with open source financial data, strict adherence to financial regulations like Dodd-Frank, Basel III, and GDPR is non-negotiable. For example, Dodd-Frank requires detailed record-keeping for financial transactions, and using open source data may complicate compliance if proper documentation and provenance are not maintained. Similarly, Basel III’s emphasis on risk management requires that financial models using open source data be audited to ensure their reliability and accuracy.

One key compliance consideration is ensuring data privacy under GDPR when using open source datasets that include personal or sensitive information. Data anonymization techniques, encryption, and documentation of data handling processes are essential to meet these requirements.

It’s important to ensure that all open source data is properly sourced and verifiable for regulatory reporting, especially under frameworks like SOX or MiFID II. Utilizing third-party certification services or audits of open source platforms can add a layer of trust and ensure that the data aligns with legal mandates.

Regular audits, coupled with robust documentation, help mitigate non-compliance risks and ensure that open source financial data can be used safely in regulated environments. Staying updated with regulatory changes and maintaining strong data governance policies are crucial for reducing legal exposure.

Scalability and Sustainability for Business Growth

As financial institutions expand their reliance on open source financial data, scalability becomes a pivotal concern. High-frequency trading environments, for instance, require systems capable of processing vast amounts of data in real time.

Cloud-based platforms such as Amazon Web Services (AWS) or Google Cloud provide the necessary infrastructure to scale processing capabilities dynamically, ensuring that performance remains unaffected by increasing data loads.

Sustainability also involves active participation in the maintenance of open source software. Financial firms can contribute to open source projects by submitting patches, participating in security audits, or funding development, ensuring the longevity and continuous improvement of these tools. Maintaining engagement with the broader open source community also keeps organizations ahead of emerging trends and security vulnerabilities.

To support both scalability and sustainability, leveraging open source databases like PostgreSQL, which can handle large datasets, and adopting modular architectures that allow for system upgrades without complete overhauls ensures operational efficiency as data demands grow. Sustainable practices also extend to regular updates and system patches to mitigate any potential security risks posed by the use of open source solutions.

Analytical Tools and Technologies for Open Source Finance

open source finance utilizes a diverse array of analytical tools and technologies tailored for effective data management, visualization, and large-scale processing. These tools facilitate the efficient handling, analysis, and interpretation of extensive financial datasets.

Databases and SQL

SQL databases, such as PostgreSQL and MySQL, play a foundational role in managing and querying structured financial data. PostgreSQL stands out for its robustness and advanced features, making it suitable for executing complex queries essential in financial analysis.

Investment banking analysts frequently leverage SQL to extract transaction data, conduct detailed audits, and generate comprehensive financial reports. For example, PostgreSQL’s integration capabilities with programming languages like Python and R enhance analytical capabilities by allowing for advanced statistical analysis and data manipulation, which can be critical for model validation and risk assessment.

Incorporating reputable data sources, such as Quandl or Yahoo Finance, into these databases can further strengthen the quality of financial models and reporting.

Data Visualization and Reporting Tools

Visualization tools are vital for interpreting complex financial data. Platforms like Metabase and Redash enable the creation of interactive dashboards and comprehensive reports, allowing analysts to visualize intricate datasets through graphs, charts, and tables.

Metabase’s user-friendly interface is particularly beneficial for team members lacking deep technical expertise, empowering them to explore and query data independently. Redash complements this by supporting diverse data sources and SQL integration, ensuring a seamless workflow. For instance, a financial institution might use these tools to track performance metrics in real time, fostering data-driven decision-making.

To ensure effective compliance and reporting, integrating visualization tools with data sourced from regulatory databases (such as those maintained by the SEC or MiFID II) can enhance transparency and accountability in financial reporting.

Big Data Solutions: Apache Ecosystem

Handling large-scale financial data necessitates robust solutions from the Apache ecosystem. Tools like Apache Spark and Apache Hadoop are crucial for managing high volumes of data.

Apache Spark facilitates real-time data processing, making it ideal for applications such as fraud detection and market analysis, where timely insights can significantly impact trading decisions. For instance, large banks often employ Spark for real-time risk assessment and anomaly detection in trading transactions.

Hadoop’s distributed storage capabilities are essential for archiving vast amounts of financial records securely, allowing for efficient retrieval and analysis. Furthermore, Apache Kafka manages real-time data feeds, which maintain the accuracy of live financial data streams.

When combined with machine learning frameworks, these tools enable predictive analytics, empowering analysts to derive actionable insights from historical data trends. KNIME enhances these capabilities by providing an intuitive interface for orchestrating complex data analysis workflows, making it easier for analysts to implement and modify their analytical processes.

Incorporating case studies that illustrate the successful application of these tools in major financial institutions could further validate their effectiveness in real-world scenarios, thereby enhancing the credibility of the discussion.

Security and Privacy in Open Source Finance

open source finance tools present significant opportunities for transparency and innovation, yet they also introduce critical concerns regarding data protection, cybersecurity, and the management of sensitive financial information.

Ensuring Data Protection and Privacy

In open source finance, robust data protection and privacy protocols are non-negotiable. Implementing advanced encryption techniques, such as AES (Advanced Encryption Standard) or RSA (Rivest-Shamir-Adleman), safeguards user data. These encryption methods ensure that sensitive information remains confidential during transmission and storage.

Additionally, establishing strict access controls is paramount. Role-based access control (RBAC) can help ensure that only authorized personnel have access to sensitive data. Employing multi-factor authentication (MFA) adds another layer of security, making unauthorized access significantly more difficult.

Adherence to regulatory frameworks, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), accounts for responsible data handling. Regular audits and vulnerability assessments can identify potential security gaps, enabling timely remediation. It’s advisable to use third-party tools or services specializing in penetration testing to assess the security posture of open source tools before implementation in sensitive financial environments.

Handling Sensitive Financial Information

When managing sensitive financial information, high standards of confidentiality and accountability are essential. Data anonymization techniques, including tokenization and data masking, can effectively minimize risks while preserving the integrity of datasets. For instance, tokenization replaces sensitive data with unique identifiers, allowing for data analysis without exposing confidential information.

User education is also vital in maintaining security. Financial analysts must be trained in best practices, such as creating strong, unique passwords and recognizing phishing attempts. open source tools should offer secure methods for data entry and storage, integrating built-in safeguards that guide users in maintaining security.

Addressing Cybersecurity in Open Source Tools

Cybersecurity threats are a significant concern for open source financial tools. Regular updates and patch management must be prioritized to mitigate vulnerabilities. Tools should be designed to integrate security patches seamlessly, ensuring minimal disruption to functionality. Analysts should monitor updates from the open source community closely, applying patches as soon as they are released.

Community engagement plays a pivotal role in enhancing cybersecurity within open source projects. Encouraging code reviews and the establishment of bug bounty programs can effectively identify and address potential security threats, enhancing the security of the software and fostering a culture of accountability among developers and users alike.

Network security measures, including firewalls and intrusion detection systems (IDS), should be implemented to guard against external threats. By combining advanced technological solutions with community vigilance and proactive measures, you can establish a robust cybersecurity framework that safeguards sensitive financial data in open source environments.

The Future of Open Source in Financial Analysis

As the landscape of financial analysis evolves, open source technologies are increasingly becoming integral to modern workflows.

Trends in Open Source Data Analysis

The growing adoption of open source tools such as Python and R, alongside blockchain technologies, facilitates democratized access to complex financial data analysis, enabling analysts to manipulate and visualize data more effectively.

In practical terms, integrating Python and R into financial workflows can significantly enhance data processing capabilities. For example, analysts can leverage libraries like Pandas for data manipulation or Matplotlib and Seaborn for advanced data visualization, enabling more sophisticated insights into market trends. Additionally, the application of machine learning algorithms using tools like scikit-learn can drive predictive analytics, aiding in more informed investment decisions.

Moreover, blockchain technologies offer transformative potential for trade settlement systems. By utilizing public blockchains, financial institutions can streamline settlement processes, reduce counterparty risks, and enhance transparency. For instance, blockchain can facilitate real-time transaction tracking, allowing all parties involved in a trade to access the same immutable record, which minimizes disputes and accelerates the settlement timeline.

Interplay with Proprietary Software

While the benefits of open source software are clear, its relationship with proprietary software remains complex. Many large financial institutions continue to rely on proprietary systems for their robust support and reliability. However, open source software can play a crucial role in complementing these proprietary solutions.

For example, financial institutions can utilize open source tools for prototyping and testing new models before integrating them into more extensive, proprietary platforms. This hybrid approach allows organizations to balance cost, performance, and innovation effectively. By using open source platforms for preliminary analyses, analysts can quickly iterate on their models and refine them based on real-world performance before committing to more expensive proprietary solutions.

Vision for a More Open Financial Ecosystem

Looking to the future, investment banking analysts foresee a financial ecosystem where open source shifts towards transparency and community collaboration can foster innovations in areas such as risk management, algorithmic trading, and portfolio management.

Public blockchains like Bitcoin and Ethereum are already demonstrating how decentralized technologies can reshape financial infrastructures. Their transparency features can significantly enhance the trustworthiness of transaction records, benefiting stakeholders across the board.

For instance, using blockchain for trade settlements can lead to instantaneous verifications and settlements, minimizing delays often associated with traditional systems.

The open source movement has the potential to democratize financial analytics further, leading to a more competitive market. By reducing costs and enabling broader access to sophisticated analytical tools, the collaborative nature of open source projects promotes continual improvement and innovation.

Financial institutions that embrace this shift are likely to reap the rewards of increased efficiency and enhanced decision-making capabilities, positioning themselves favorably in an ever-evolving market landscape.

Discover the Potential of open source Financial Data with Daloopa

Explore how Daloopa can enhance your financial analysis through accessible and cost-effective open source resources. Our platform provides high-quality datasets and specialized tools designed for effective data management and security.

Join a community of professionals embracing innovation and customization in financial modeling.

Interested in learning more? We invite you to try our demo to discover how Daloopa can support your journey toward informed, data-driven decisions. Learn more here.