Fundamental analysis forms the bedrock of sound investment strategies, allowing us to assess a company’s intrinsic value. The most essential data for fundamental analysis comes from financial statements, such as balance sheets, income statements, and cash flow statements. Public sources, such as the Securities and Exchange Commission (SEC) and financial news platforms, provide valuable data, while financial data APIs offer real-time updates for deeper analysis. Combining fundamental data with technical analysis enhances decision-making by balancing long-term and short-term perspectives, ensuring informed investment choices through accurate, relevant, and timely data.

Key takeaways:

- Fundamental analysis relies heavily on financial statements.

- Publicly available data and financial data APIs are crucial resources.

- Integrating fundamental and technical analysis strengthens investment decisions.

Sources of data for fundamental analysis

Finding quality data helps us perform effective fundamental analysis. Reliable and accurate data significantly impacts the outcomes of your analysis and investment decisions.

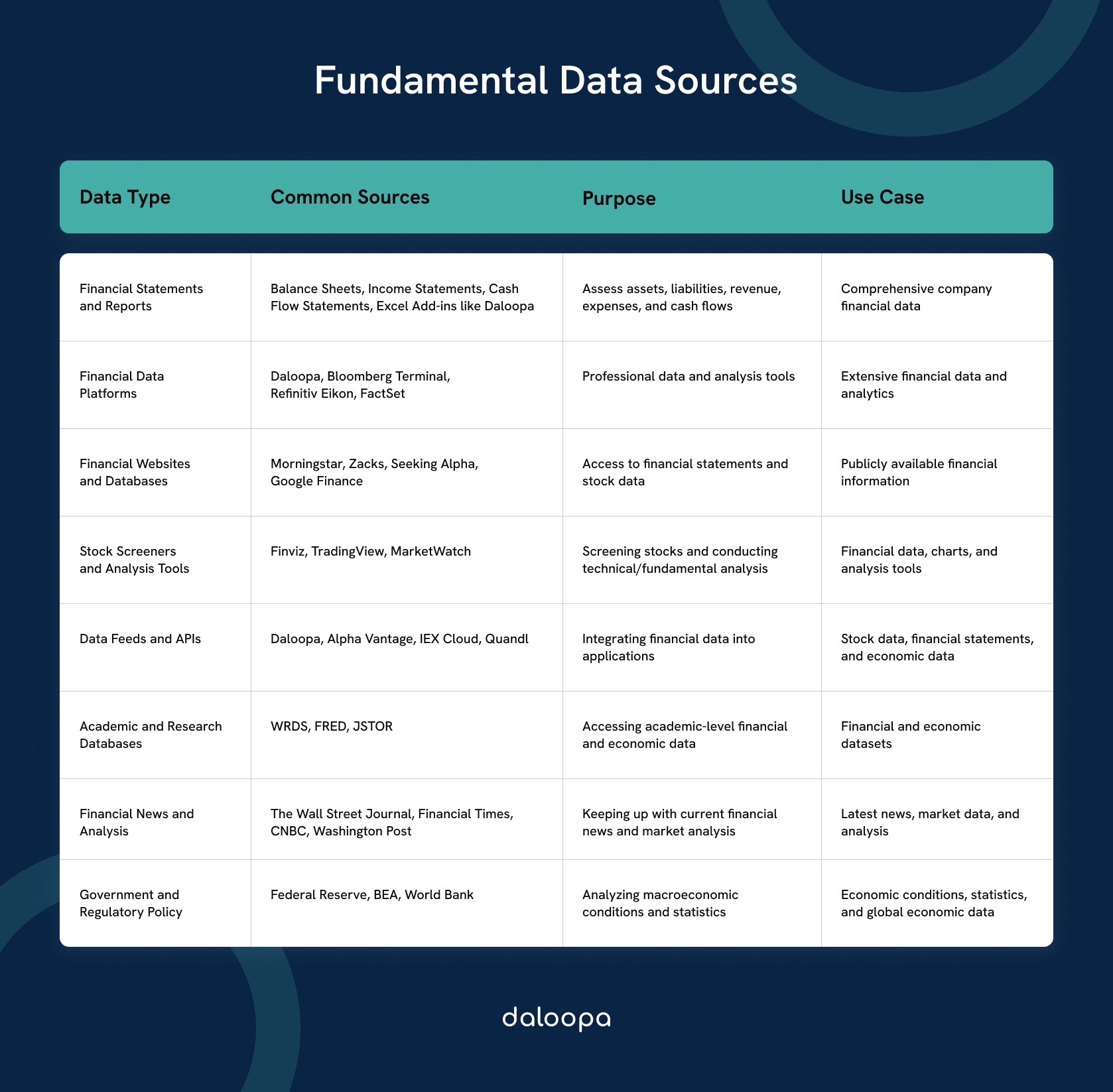

Overview of different sources

Public financial statements provide a strong source of information for a fundamental analysis. Companies publish these documents, which include income statements, balance sheets, and cash flow statements. These documents provide comprehensive insights into a company’s financial health.

Regulatory filings such as 10-K and 10-Q reports are also filed with the SEC. These filings offer detailed information about a company’s financial performance and institutional structure.

Financial news websites and financial data platforms such as Bloomberg and Reuters offer real-time financial data, analyst reports, and market trends, aiding timely and informed decisions.

Importance of reliable and accurate data

The reliability and accuracy of data make or break an analysis. Trustworthy data ensures we analyze a company’s true financial health, avoiding misguided decisions based on flawed figures.

Accurate data helps forecast future performance effectively. It reduces the risk of basing investment decisions on incorrect information, thus preserving capital and potential returns.

We must use multiple sources to validate the data. Cross-referencing between public financial statements, regulatory filings, and financial data platforms ensures the correctness of our fundamental analysis. This multi-source approach strengthens the analysis, providing a comprehensive view.

Financial statements

Understanding financial statements is crucial for fundamental analysis.

Explanation of financial statements (balance sheet, income statement, cash flow statement)

The balance sheet provides a snapshot of a company’s financial position at a specific time. It shows assets, liabilities, and shareholders’ equity. Assets are what the company owns, liabilities are what it owes, and equity represents owners’ claims after settling liabilities.

The income statement reports a company’s financial performance over a specific period, detailing revenues, expenses, and profits. Key metrics include gross profit, operating income, and net income. The income statement helps us evaluate a company’s profitability and operating efficiency.

The cash flow statement tracks the flow of cash in and out of the business over time. It includes three sections: operating activities, investing activities, and financing activities. We use the cash flow statement to understand a company’s liquidity and ability to generate cash to fund operations, pay debts, and invest in growth.

How to access company financial statements

Public companies must file their company financial statements with regulatory bodies like the SEC in the US. These documents can be found on the SEC’s EDGAR database.

Financial statements also appear on a company’s investor relations website, often under sections like “Financial Information” or “Annual Reports.” Investors additionally utilize financial analysis tools and software that aggregate and present financial data from multiple companies. These tools often offer additional insights and metrics that aid in comprehensive analyses.

Publicly available data

Publicly available data allows us to conduct thorough fundamental analyses and gain valuable insights into a company’s financial health and market position.

Overview of publicly available data sources

One of the primary sources of publicly available data involves company filings, such as annual reports (10-K), quarterly reports (10-Q), and other filings submitted to regulatory bodies like the SEC. These documents provide detailed financial statements, management discussions, and other critical information.

Another key source includes market data from stock exchanges. We access price histories, trading volumes, and other market metrics through services provided by NASDAQ, NYSE, and others. Financial news websites and databases such as Yahoo Finance and Google Finance also offer an array of financial metrics and performance data.

Other options include public records and industry reports. Sources such as government databases, industry associations, and research firms publish relevant data that aids in comprehensive analysis.

How to access and utilize publicly available data for fundamental analysis

The SEC’s EDGAR database contains a downloadable copy of most company filings. Financial news websites, like Bloomberg and Reuters, provide easy access to market data and financial metrics. Some even allow data extraction into spreadsheets for further analysis.

After gathering the data, the fundamental analysis involves examining financial statements to assess profitability, liquidity, and solvency. We calculate ratios such as the Price-to-Earnings (P/E) ratio, Debt-to-Equity ratio, and Return on Equity (ROE) to understand valuation and financial performance.

Additionally, analyzing trends in revenue, expenses, and profit margins over time highlight growth potential and operational efficiency. We effectively organize and interpret this data using software tools and spreadsheets for informed investment decisions.

Historical data

Historical data provides a basis for evaluating a company’s past performance.

Importance of historical data in fundamental analysis

Historical data allows us to assess a company’s performance trends over time, informing more accurate predictions. We can identify revenue growth, profit margins, and expenses by examining past financial statements. Understanding these metrics helps in evaluating the company’s stability and growth potential.

Historical data also provides insight into management effectiveness and company resilience during economic downturns. It allows us to perform a comparative analysis with industry peers, highlighting competitive advantages or weaknesses.

How to analyze historical data for investment decision-making

To analyze historical data effectively, start by reviewing key financial ratios such as Price-to-Earnings (P/E), Return on Equity (ROE), and Debt-to-Equity (D/E). These ratios can help us understand the company’s valuation, profitability, and financial health.

Use this data to build financial models and project future performance based on historical trends. We must understand market conditions during the periods analyzed, as external factors significantly impact performance.

We make informed investment decisions when scrutinizing historical data and tailoring our strategies to align with the company’s long-term growth potential and market positioning.

Data APIs

Data APIs help with accessing a wealth of financial information for fundamental analyses. They provide streamlined access to raw data crucial for informed decision-making in finance.

Overview of data APIs and their role in fundamental analysis

Data APIs serve as gateways to a broad range of financial data, including stock prices, company financials, and market indexes. These interfaces help us easily retrieve and integrate data into our analytic models and software.

Financial analysts rely on APIs for real-time and historical data, vital for tracking market trends and evaluating asset performance. We use APIs to automate data gathering, minimize manual errors and significantly speed up the analytical process.

How to access and utilize data APIs for fundamental analysis

Accessing data APIs typically involves registering for an API key from data providers, allowing us to authenticate and make requests for data securely.

Utilizing these APIs involves sending HTTP requests to specific endpoints to fetch the required data. For example, JSON or CSV formatted data can be retrieved by querying these endpoints, which we can then integrate into our financial models or databases.

Many APIs offer free access with limitations on the number of requests, while premium versions provide more extensive access. Proper implementation ensures that we leverage the full potential of these data resources for comprehensive fundamental analyses.

Factors to consider in data selection for fundamental analysis

Selecting the right data for fundamental analysis ensures accuracy and reliability in our investment decisions.

Importance of reliable and accurate data

When conducting fundamental analysis, poor-quality data leads to incorrect conclusions and poor investment decisions. We must prioritize reliable and verified data.

Reputation of data sources

Sources like financial statements from reputable companies, government publications, and well-known financial news websites provide more credible data. Platforms such as academic publications and industry reports also produce value.

Data quality and coverage

We need to assess the quality and coverage of the data. High-quality data is precise, up-to-date, and encompasses all necessary variables. For instance, data mining approaches to stock returns consider multiple fundamental signals for better prediction.

Specific factors to consider:

- Consistency: Data should be consistently updated and accurate.

- Scope: The data should cover the necessary geographical and sectoral information.

- Detail: More detailed data allows for deeper analysis.

Key takeaways:

- Reputation and Quality: Look for reputable sources that provide high-quality, up-to-date information.

- Coverage: Ensure the data covers all relevant areas, including the required sectors and regions.

- Accuracy: Select verified and accurate data to make informed investment decisions.

Enhance Your Financial Analysis with Daloopa

Unlock the full potential of your financial analysis with our advanced platform. Designed for professionals who demand accuracy and efficiency, Daloopa streamlines the process of gathering, analyzing, and managing financial data. Whether you’re handling complex financial statements or seeking real-time insights, Daloopa offers the tools you need to make informed, data-driven decisions. Create your free account today!