Digging through 10-Ks and Excel tabs isn’t investing—it’s a second job. That’s why today’s financial analysts depend on fundamental analysis software that automatically surfaces the ratios, trends, and red flags hiding in company filings. These tools transform tedious spreadsheet work into clarity—and free up your time for strategy, not data wrangling.

Key Takeaways

- Fundamental analysis software streamlines financial data collection and complex number crunching.

- These tools offer intuitive visuals and workflows for digging into company performance.

- They help investors focus on insight—not technical hurdles—to guide smarter portfolio decisions.

Understanding Fundamental Analysis Software

If you’ve ever tried valuing a company yourself, you know how time-consuming scraping SEC filings and building Excel models can be. Fundamental software automates data retrieval, ratio calculations, and dashboard creation—with some even pulling in macro indicators and sentiment data.

Definition and Purpose

Fundamental analysis software includes tools that ingest financial statements, market data, and non-financial disclosures (like investor presentations) to reveal a company’s true value. These platforms calculate P/E, ROE, debt ratios, and KPIs in real time—often linking each number back to its original source. That means you spend less time crunching numbers and more time interpreting results.

You, whether you’re a retail investor or analyst, can quickly screen stocks, benchmark peers, and model scenarios—all in one place—while minimizing spreadsheet errors.

Evolution of Fundamental Analysis Tools

At first, analysts relied on spreadsheets and manual ratio calculations. Then came platforms that scraped filings and created basic charts. Today, modern solutions do much more:

- Auto-scrape SEC filings and investor decks.

- Sophisticated visualizations for trends and benchmarks.

- Powerful screeners to uncover undervalued or high-momentum stocks.

- Mobile support so you’re always plugged in.

- On the cutting edge: sentiment analysis, satellite data and AI feeding quantitative models.

Comprehensive Analysis of Leading Platforms

Picking the right fundamental analysis tool depends on your workflow, goals, and risk tolerance.

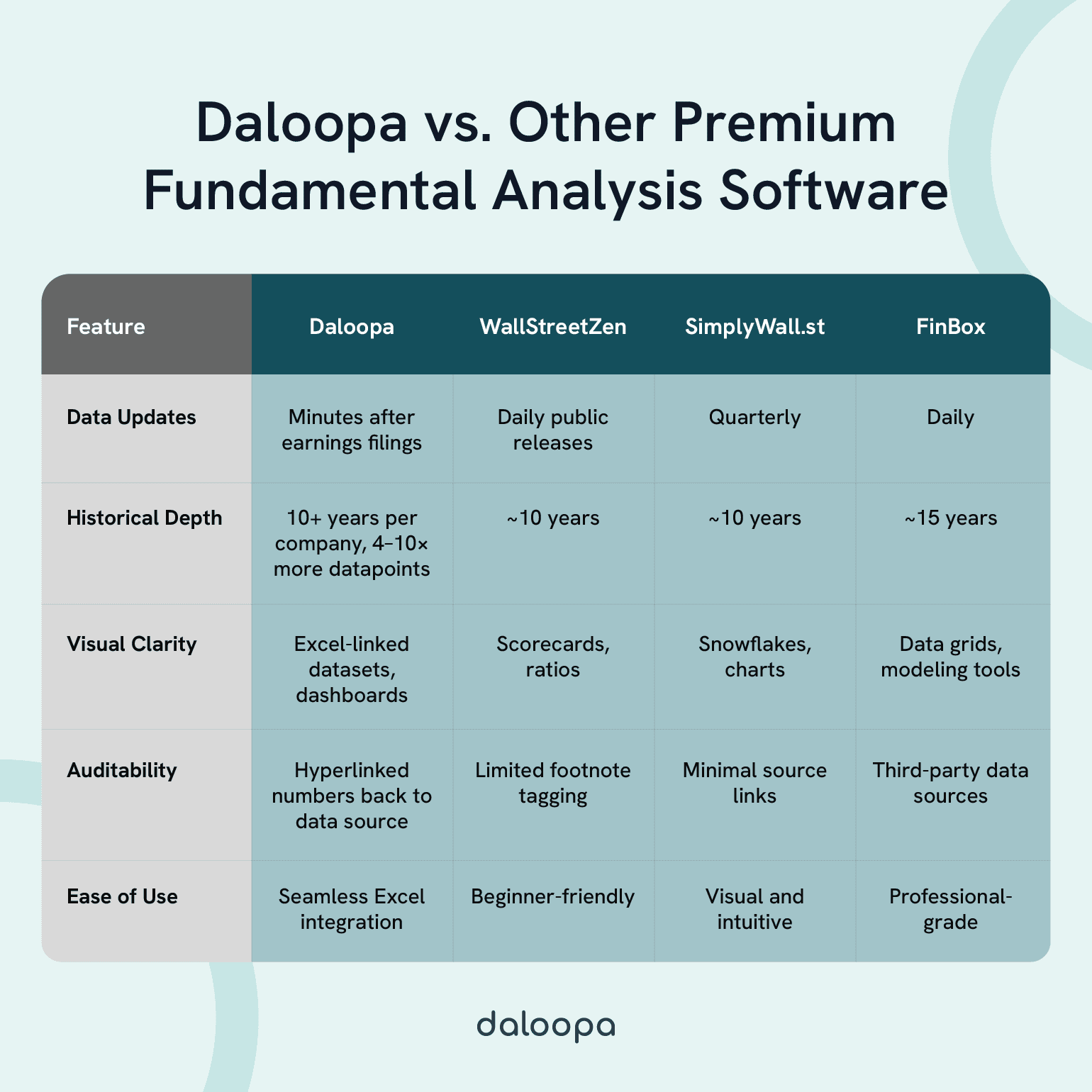

Premium Solutions Comparison

- Daloopa

Provides 4–10× more historical data than standard sources, extracts GAAP to Non-GAAP adjustments, KPIs, guidance, and more from SEC filings, filings supplements, footnotes, investor presentations . With one-click updates and hyperlink auditability, it automates what others leave for you to do manually. Plus, Daloopa’s new data disclosure feature flags data gaps in live models, making it one of the most robust automated financial modeling tools on the market. - WallStreetZen

Focuses on financial health with automated scores and clean visuals. Great if you need clear buy/sell signals—but don’t expect deep modeling flexibility. - SimplyWall.st

Uses a “snowflake” summary of fundamentals and visually richer dashboards. Better for investors who want snapshots rather than spreadsheets. - FinBox

Offers professional data feeds and full control over valuation modeling. Ideal if you build custom Excel or Python models and need raw materials.

Free and Freemium Alternatives

If you’re climbing the learning curve or watching costs, several fundamental analysis tools offer free access:

- Yahoo Finance

Offers basic ratios, light screeners, and charts. It’s functional, but lacks depth and audit trails. - Finviz (Free)

Gives fast filtering with P/E, EPS, dividend yield, plus real-time news. It’s ideal if you want speedy filters without logging in or distractions (strengthening the original: “speed-focused traders”)—but you’ll miss modeling and auditability. - Stock Rover (Free tier)

Includes five years of financials, screening tools, and basic portfolio tracking. Great for casual investors, but lacks instant sourcing or hyperlink verifiability.

Open-Source Options

If you’re technically inclined, open-source fundamental analysis tools provides full control:

- OpenBB Terminal

Brings financial APIs and data scrapers to a CLI environment. You can build Python workflows with full customization—but it demands time and tech skill. - GitHub toolkits (e.g., Fundamental Analysis in Python)

Parse filings and compute ratios for custom metrics. Ideal if you want control over every line—but expect manual upkeep and less convenience.

Essential Features Evaluation

Before choosing a tool, assess it using these criteria:

Data Quality

- Does the tool provide complete raw data from SEC filings and supplements?

- Can you access 10+ years of historical data?

- Is each number traceable back to its original filing?

Analysis Tools

- Are key ratios calculated automatically?

- Can you compare auditors side by side?

- Does it support building or customizing valuation models?

User Experience

- Is the UI intuitive?

- Can you generate reports or export data easily?

- Does it integrate with your current modeling tools (Excel, Python)?

Evaluating these elements can help you match the right tool to your investment approach—so you spend less time toggling tabs and more time making smart calls.

Case Scenarios & Emotional Resonance

The power of fundamental analysis isn’t just in clean data—it’s in what that data enables. Whether you’re managing institutional capital, running a lean buy-side shop, or building models in Excel at 2 a.m., the value of time, clarity, and confidence cannot be overstated. Below are examples of some real-world scenarios that show how Daloopa directly impacts the workflows, emotions, and outcomes of professional investors.

Scenario 1: The Buy-Side Equity Analyst with 30+ Coverage Universe

- Pain Point: You’re responsible for dozens of names across multiple sectors. Earnings season means 14-hour days, 10-Qs flooding your inbox, and model updates that are always a step behind your CIO’s questions.

- How Daloopa Helps: With Daloopa, one of today’s most advanced automated financial modeling tools, models update automatically within minutes of a filing. No more ctrl+F digging, no copy-pasting from PDFs, no waiting for your intern’s footnote interpretation. Whether it’s GAAP to non-GAAP reconciliation, KPIs from management commentary, or capex footnotes, every datapoint is pre-tagged and sourced.

- Emotional Shift: Stress turns to confidence. Instead of rushing to update numbers, you’re focused on writing the investment memo. You walk into your Monday meeting with clean models and sharper insights—two steps ahead of everyone in the room.

Scenario 2: The Associate at a Fundamental Hedge Fund Preparing for Investment Committee

- Pain Point: You’ve built a solid model, but your PM wants answers now. They ask where your EBITDA adjustment came from—and you’re frantically trying to track the footnote in the 10-K. You can’t afford to be wrong or slow.

- How Daloopa Helps: Every single line item in your model links directly back to the exact filing source. A click takes you from Excel to the footnote paragraph it came from. When the PM grills you, you’re calm—and fast.

- Emotional Shift: Imposter syndrome becomes professionalism. Instead of hoping you did it right, you know you did. Every answer is backed up—instantly.

Scenario 3: The Solo Analyst or Independent Researcher Competing Against Institutions

- Pain Point: You don’t have a team. You don’t have access to Bloomberg or CapIQ. But you’re trying to publish deep research and win the trust of sophisticated investors.

- How Daloopa Helps: Daloopa levels the field. You get the same raw data that institutional desks use, plus footnote-tagging, transcripts, and presentation parsing—delivered to your Excel in seconds. No more scrambling to backfill five years of KPIs or restated net income.

- Emotional Shift: Intimidation turns into credibility. You produce insights with the same rigor as billion-dollar shops—and your readers notice.

Ready to trade Excel drudgery for insight-driven impact?

Explore fundamental analysis software that’s built for investors who want to focus on alpha, not manual processes. Modern automated financial modeling tools like Daloopa streamline analysis from filing to forecast, automatically feeding your model with full history, audit links, and updates in minutes. Tap into deeper coverage, cleaner workflows, and faster decisions with a free Daloopa account or request a demo to discover how your models can be transformed.