Model Context Protocol (MCP) transforms AI from a compliance nightmare into a competitive advantage for financial services. By creating a secure control plane between AI systems and financial data, MCP enables what seemed impossible: giving AI powerful analytical capabilities while maintaining bulletproof governance. According to Bain & Company’s 2024 research, financial services firms see an average 20% productivity gain from AI automation¹. Platform engineers reduce integration time from months to weeks. Most institutions targeting 20% ROI see positive returns within 12 months². Discover how Daloopa MCP makes this possible →

Key Takeaways

- MCP creates a secure framework enabling AI agents to access financial systems with verified identities, granular permissions, and complete audit trails.

- Financial firms achieve 20% productivity gains through AI automation, with some organizations reporting 333% ROI over three years³.

- 95% of AI pilots historically failed without proper infrastructure—MCP solves this by providing built-in security and governance.

- Integration time drops from months to weeks with standardized context exchange protocols.

- ROI typically materializes within 12-18 months, with early wins from automation followed by transformational use cases.

- Compliance becomes automatic through cryptographic audit trails that satisfy Basel III, GDPR, and MiFID II requirements.

Understanding Model Context Protocol (MCP) in Finance

Picture a trading floor at 3 AM. An anomaly appears across seventeen portfolios simultaneously—correlation patterns that shouldn’t exist. In the old world, analysts wouldn’t spot this until morning reports. Today, an MCP-enabled AI catches it instantly, traces the source, documents its reasoning, and alerts the risk team—all while maintaining an audit trail that would make compliance smile.

That’s Model Context Protocol in finance: a secure framework that lets AI agents access financial systems using the same governance principles as human employees. Every AI gets an identity badge. Every action requires permission. Every decision creates a paper trail. It’s the missing infrastructure that makes enterprise AI work in finance.

From Siloed AI to Connected Intelligence

The break room coffee maker has been broken for three months, but no one’s surprised. That’s how financial institutions treat their AI pilots—nice ideas that never quite work in reality.

The journey looks depressingly familiar:

2020-2022: The Experimental Phase — Everyone built chatbots. They could tell you the weather and define “derivative,” but ask about your actual portfolio? Sorry, no access. These pilots lived in sandboxes, processing sample data and producing sample insights. According to MIT research reported by Fortune, approximately 95% of generative AI pilot programs fail to achieve rapid revenue acceleration⁴.

2023-2024: The Integration Nightmare — Brave souls tried connecting AI to real systems. Each integration was custom. Security teams demanded months of reviews. Compliance wanted kill switches everywhere. A simple question like “summarize our exposure to European banks” required six API integrations, three security reviews, and usually died in committee.

2025+: The MCP Revolution — Now imagine every AI agent working like a junior analyst: credentialed, monitored, and productive from day one. Integration takes weeks, not months. Security is built-in, not bolted-on. The same framework works for risk analysis, portfolio management, and regulatory reporting through model context protocol standards.

Traditional APIs hand over the keys to your kingdom. MCP creates a security checkpoint where every request is validated, every response is logged, and every AI agent operates within defined boundaries. The AI gets smarter while your data stays safer.

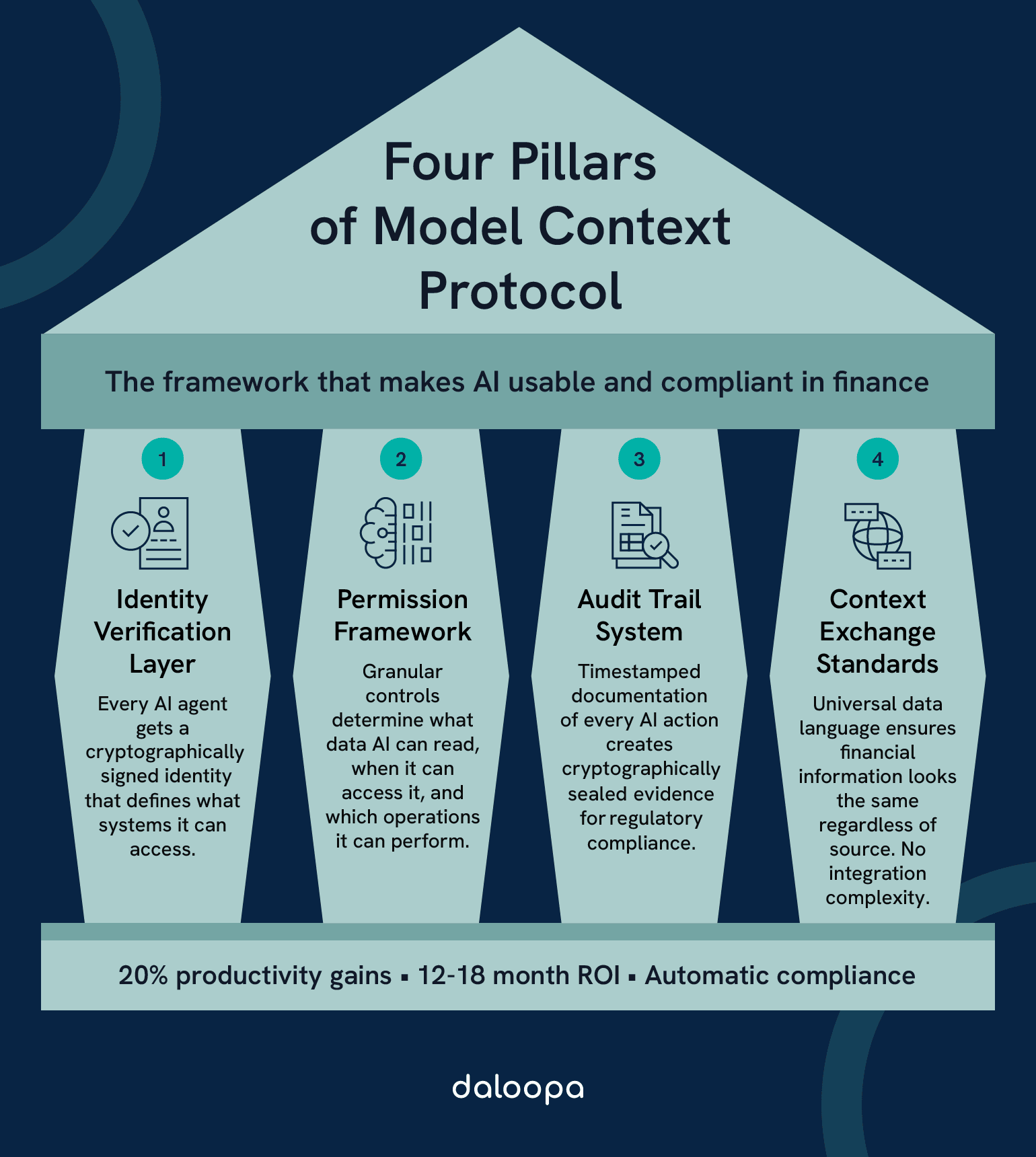

Four Pillars of Model Context Protocol

Four pillars hold up the entire MCP architecture. Remove any one, and the structure collapses back into the ungovernable mess of traditional AI integration.

Identity Verification Layer: Every AI agent starts life with a birth certificate—a cryptographically signed identity that says who it is, what it does, and who authorized it. Think employee badges for algorithms. The research assistant AI can’t suddenly access trading systems. The trading AI can’t peek at HR data. These aren’t suggestions; they’re cryptographic impossibilities.

Permission Framework: MCP gets granular here. An AI analyzing credit risk sees loan amounts and payment histories but never names or social security numbers. It can read Monday’s data on Tuesday but can’t change Monday’s data on Wednesday. Permissions are surgical—down to individual data fields, specific time windows, and particular operations.

Real example: A portfolio optimization AI can see position sizes and calculate new allocations but cannot execute trades. It can access market data from approved vendors but cannot scrape unauthorized websites. Every boundary is explicit, enforceable, and auditable.

Audit Trail System: At 2:47 PM, AI Agent RISK-007 accessed 1,247 derivative positions, applied Monte Carlo simulation using parameters from config_file_238, and flagged 17 positions for review with confidence scores ranging from 0.72 to 0.94. Every step, timestamped. Every decision, documented. Every data point, traceable.

These aren’t just logs—they’re cryptographically sealed evidence chains that stand up in regulatory examinations. When an examiner asks “Why did the AI make this recommendation?”, you show them exactly what data it saw, what logic it applied, and what confidence level it assigned.

Context Exchange Standards: Instead of every system speaking its own dialect, MCP establishes a universal language for financial data. A “trade” looks the same whether it comes from your OMS, your risk system, or Bloomberg. This standardization significantly reduces integration complexity and eliminates the translation errors plaguing traditional integrations.

The recent $13M strategic investment in Daloopa validates this standardized approach to financial AI infrastructure⁵.

Transformative Applications in Financial Analysis

Stop thinking about AI as a threat to control. Start thinking about it as thousands of tireless analysts who never forget a detail, never miss a pattern, and always show their work. See how Daloopa MCP enables this transformation →

Portfolio Management Revolution with MCP

Real-Time Portfolio Intelligence

The head of equities at a $50B fund opens her dashboard Monday morning. Over the weekend, her MCP-enabled AI analyzed every position across 47 portfolios, compared them against 10,000 market scenarios, and identified 23 opportunities for tax-loss harvesting, 12 correlation breaks needing attention, and one rebalancing strategy that could save 30 basis points.

Each recommendation comes with a story. Not just “sell this, buy that,” but complete context: what changed in the market microstructure, how peer portfolios are positioned, the confidence interval, and exactly which data points drove the recommendation. The AI shows its homework better than any human analyst.

MCP-enabled systems process thousands of positions continuously, identifying patterns humans would need weeks to spot. Unlike black-box algorithms, every insight is explainable, traceable, and actionable.

Risk-Adjusted Optimization

The numbers tell the story:

| What Changes | Before MCP | With MCP |

| Analysis Frequency | Quarterly fire drills | Continuous monitoring |

| Scenario Testing | 20 scenarios if you’re lucky | Unlimited scenarios, fully documented |

| Rebalancing Time | 2-3 days of spreadsheet warfare | 15-30 minutes of validated recommendations |

| Audit Documentation | Scrambling before regulators arrive | Auto-generated, always ready |

| Decision Accuracy | Good but variable | Consistently high with confidence scores |

Scenario Analysis with Full Traceability

When the Fed hints at rate changes, every portfolio manager asks the same question: “How does this affect us?” MCP-enabled AI runs thousands of scenarios in minutes. Each scenario documents its assumptions, shows its math, and maintains perfect lineage from input to conclusion.

A compliance officer can click any recommendation and see the entire decision tree. No black boxes. No mysterious algorithms. Just transparent, traceable logic that stands up to scrutiny.

Dive into technical implementation →

Risk Assessment Transformation

Risk isn’t about avoiding danger—it’s about understanding it. MCP transforms risk assessment from periodic snapshots to continuous monitoring.

Fraud Detection at Scale

A transaction flows through at 11:47 PM. Amount: normal. Merchant: recognized. Location: expected. The MCP-enabled AI notices something subtle—this card typically makes 17 transactions on Tuesdays, never just one. The spending pattern breaks a three-year trend. The AI flags it with medium confidence, documents its reasoning, and the fraud team investigates.

That’s the power of MCP: analyzing millions of data points while explaining every decision. The AI never sees the cardholder’s name or full card number—tokenized data only. Privacy preserved. Fraud prevented. Compliance maintained.

Credit Risk Evaluation

Lending decisions can’t hide behind algorithms. Regulators demand explanations. MCP delivers:

- Application denied: debt-to-income ratio of 47% (threshold: 43%), recent credit inquiries (7 in 30 days), payment history showing 3 late payments in past 12 months

- Confidence level: 0.89 based on 10,000 similar historical cases

- Alternative recommendation: Approve with 2% rate increase or require co-signer

Every decision is defensible because every factor is documented.

Market Risk Monitoring

Traditional systems catch obvious problems. MCP catches the subtle ones. An energy company’s bonds suddenly correlate with cryptocurrency prices. A supplier three layers deep in your supply chain just had its credit downgraded. These signals matter, but finding them requires analyzing millions of connections continuously.

Regulatory Reporting Excellence

Compliance teams live in fear of the next examination. MCP turns fear into confidence.

Automated Compliance Documentation

Remember when SOX compliance meant armies of consultants? MCP handles modern regulatory requirements with elegant automation:

- Data lineage tracking: Every number traces back to its source system, timestamp, and validation rules.

- Decision justification: AI recommendations include regulatory citations and compliance checkpoints.

- Exception handling: Anomalies trigger documented workflows with escalation paths and resolution tracking.

Real-Time Regulatory Monitoring

Regulations change faster than institutions can adapt. MCP-enabled systems monitor regulatory feeds, identify relevant changes, map requirements to current processes, and generate gap analysis with remediation plans.

When the Fed announces new stress testing requirements on Tuesday, your MCP system has already analyzed the impact by Wednesday morning.

Trading and Execution Optimization

Pre-Trade Analytics Revolution

Before MCP: Traders rely on yesterday’s analysis and gut instinct.

With MCP: Real-time analysis of market microstructure, liquidity pools, execution probability, and optimal timing strategies.

The AI doesn’t replace trader judgment—it amplifies it with data-driven insights that update continuously.

Post-Trade Analysis and TCA

Transaction cost analysis used to be a quarterly exercise in archaeology. MCP makes it real-time intelligence:

- Slippage analysis: Why did execution differ from expectation?

- Venue optimization: Which routes consistently underperform?

- Timing patterns: When do certain strategies work best?

Every insight feeds back into tomorrow’s trading decisions.

Enterprise-Grade Security Without Compromise

Security teams usually kill innovation. With MCP, they enable it.

Data Protection Architecture

End-to-End Encryption: Your data never travels naked. From database to AI to decision, everything moves in encrypted channels. Even if intercepted, the data remains useless to attackers.

Zero-Trust Principles: Every request is suspicious until proven legitimate. AI agents must authenticate for each session, justify each data request, and operate within time-boxed permissions. Trust nothing, verify everything.

Compliance by Design

Built-in Regulatory Mapping

MCP doesn’t just store data—it understands regulations:

- GDPR: Data minimization, right to explanation, privacy by design

- Basel III: Capital requirements, liquidity coverage, leverage ratios

- MiFID II: Best execution, transaction reporting, algorithmic trading rules

- SOC 2: Security controls, availability, confidentiality

Each requirement maps to specific MCP controls that enforce compliance automatically.

Continuous Compliance Validation

Traditional compliance: annual audits and crossed fingers.

MCP compliance: continuous monitoring and real-time validation.

The system knows its compliance posture every second of every day. When auditors arrive, you hand them a real-time dashboard, not a dusty binder.

Proven Enterprise Reliability

High Availability Design: MCP runs on battle-tested infrastructure with 99.99% uptime SLAs. Multiple availability zones, automatic failover, and self-healing systems ensure your AI never sleeps—even during maintenance windows.

Disaster Recovery: Complete system recovery in under 4 hours. Data recovery to any point in the last 30 days. These aren’t marketing promises—they’re contractual guarantees backed by proven recovery exercises.

The Financial Advantage of Daloopa MCP

Numbers tell stories. Here’s what MCP means for your bottom line.

Quantified Business Value

Productivity Metrics That Matter

According to BCG’s 2025 research, the median reported ROI from AI in finance functions is 10%, with many organizations targeting 20%⁶. However, organizations implementing comprehensive AI infrastructure like MCP see substantially higher returns.

Financial analysts typically see 20-30% productivity improvements through AI automation. This translates to:

- 8-12 hours saved weekly per analyst

- 50% reduction in report generation time

- 75% faster data reconciliation

- 90% reduction in manual data entry

Error Reduction Impact

Human error in financial services isn’t just embarrassing—it’s expensive. StarCompliance reports that North American financial institutions face an average penalty of $2.5 million per compliance incident⁷. MCP reduces errors through:

- Automated validation preventing data entry mistakes

- Consistent application of business rules

- Real-time exception handling

- Complete audit trails for every decision

Implementation Case Examples

Global Investment Bank: From Chaos to Control

Challenge: 50+ AI pilots with zero production deployments

Solution: Daloopa MCP unified framework

Timeline: 6 months from pilot to production

Results after one year:

- 40% reduction in operational risk incidents

- 60% faster regulatory report generation

- $12M annual cost savings

- 4 new AI-driven products launched

Regional Credit Union: Digital Transformation

Challenge: Legacy systems, limited IT resources

Solution: Cloud-based MCP implementation

Timeline: 3 months to first production use case

Results after six months:

- 70% reduction in loan processing time

- 50% improvement in fraud detection accuracy

- 30% increase in customer satisfaction scores

- ROI positive in month 5

Total Cost of Ownership

Year 1 Investment

- Platform licensing: Variable based on scale

- Implementation services: 20-30% of license cost

- Training and change management: 10-15% of license cost

- Infrastructure upgrades: Depends on current state

Ongoing Costs

- Annual platform fees: Predictable SaaS model

- Minimal additional headcount required

- Reduced compliance consulting fees

- Lower operational risk insurance premiums

According to AscentRegtech research, firms spend almost $15 million on the consequences of non-compliance—2.71 times higher than maintaining compliance⁸. MCP’s automated compliance features directly address this cost differential.

Implementation Strategy for 2025 and Beyond

Success requires more than technology—it requires transformation.

Building Your MCP Foundation

Phase 1: Assessment (Weeks 1-4)

Start with brutal honesty. Where do AI pilots go to die in your organization? Common graveyards include:

- Data quality issues

- Security concerns

- Regulatory uncertainty

- Cultural resistance

Map these challenges to MCP solutions. Build your business case with real numbers, not wishful thinking.

Phase 2: Pilot Selection (Weeks 5-8)

Choose your first use case wisely. The ideal pilot is:

- Painful enough that people want it solved

- Simple enough to deliver in 90 days

- Valuable enough to justify expansion

- Visible enough to build momentum

Most successful pilots focus on automation of routine tasks where errors are costly and compliance is critical.

Phase 3: Implementation (Weeks 9-20)

This is where MCP shines. While traditional AI projects bog down in integration complexity, MCP provides:

- Pre-built connectors for major financial systems

- Standardized security frameworks

- Compliance templates for common use cases

- Proven implementation playbooks

Stakeholder Alignment Strategies

For the C-Suite: Focus on competitive advantage. Your competitors are already implementing AI infrastructure. The question isn’t whether to adopt MCP, but how quickly you can deploy it.

For Risk and Compliance: MCP doesn’t bypass controls—it strengthens them. Every AI action is more auditable than human decisions. Show them the audit trails, the permission frameworks, the regulatory mapping.

For IT and Security: MCP reduces integration complexity while improving security posture. One framework to govern all AI initiatives beats managing dozens of point solutions.

For End Users: Don’t talk about AI replacing them. Talk about AI eliminating the boring parts of their jobs. MCP means less manual data entry, fewer spreadsheet errors, more time for actual analysis.

Measuring Success

Leading Indicators (Months 1-3)

- Time to deploy first use case

- Number of data sources integrated

- User adoption rates

- System availability metrics

Lagging Indicators (Months 4-12)

- Hours saved through automation

- Error rates before/after

- Compliance incident reduction

- Measurable ROI

Transformation Indicators (Year 2+)

- New products enabled by MCP

- Competitive advantages gained

- Cultural shift toward AI adoption

- Strategic initiatives accelerated

Special Considerations for Fintech Companies

Fintechs move fast and break things—except when those things are financial systems. MCP lets fintechs maintain velocity while adding enterprise-grade governance.

Built for Modern Architecture

Cloud-Native Advantage: Fintechs born in the cloud have a natural advantage. MCP deploys natively on AWS, Azure, and GCP. No legacy infrastructure to navigate. No mainframe integration nightmares.

API Economy Integration: Modern fintechs are API-first, making MCP integration natural. Recent implementations show deployment in weeks rather than months, with one payment processor implementing MCP in just 4 weeks.

Rapid Product Development: Launching financial products typically requires extensive compliance review, risk assessment, and technical integration. With MCP, these processes happen in parallel. AI agents handle routine compliance checks, standard risk assessments, and technical validation. Product development cycles compress dramatically.

Scalability Without Complexity: Fintechs using Daloopa MCP scale differently. Customer onboarding uses AI-driven KYC/AML. Transaction monitoring employs real-time pattern analysis. Risk management includes continuous model validation. Regulatory reporting automates submission. The infrastructure supporting 1,000 customers scales to handle significant growth without fundamental changes.

See how fintechs innovate with Daloopa MCP →

Your Strategic Roadmap to MCP Success

Near-Term Opportunities (2025-2026)

Natural language becomes natural. Ask: “Are we compliant with the new Basel rules?” Get: “Yes, except for section 3.2.1 regarding operational risk buffers. Here’s what needs adjustment and the implementation plan.”

Cross-institutional protocols emerge. Banks share fraud patterns without sharing customer data. Risk signals propagate across the industry in seconds, not weeks.

Long-Term Vision (2027-2028)

Blockchain audit trails become standard. Every AI decision, immutably recorded across institutions. Quantum-resistant encryption arrives before quantum computers break current encryption. Your future self thanks your present self for implementing MCP’s upgradeable security architecture. Behavioral analytics catch the subtle stuff, not just wrong trades but pattern changes that precede public information.

Implementation Readiness Assessment

Key Success Factors

| Component | Your Score | What It Means |

| Cloud Infrastructure | ___/10 | Can you deploy services rapidly? |

| Data Governance | ___/10 | Is your data findable and usable? |

| Team Readiness | ___/10 | Will people embrace or resist? |

| Compliance Posture | ___/10 | Can you prove controls work? |

| Budget Reality | ___/10 | Is funding committed, not promised? |

Score 35+? Proceed. Under 35? Fix foundations first.

ROI Calculation Framework

Benefits (Annual):

- Analyst hours saved × $50-75/hour (based on U.S. Bureau of Labor Statistics data showing median financial analyst wage of $48.99/hour)⁹

- Errors prevented × potential loss per error

- Compliance violations avoided × average penalty cost

- Deals closed faster × Value × Win rate improvement

Costs (Annual):

- MCP platform + infrastructure

- Implementation + training

- Ongoing support

Organizations using comprehensive AI platforms report 333% ROI over three years according to Forrester’s Total Economic Impact study³.

Your Twelve-Month Implementation Journey

Foundation (Months 1-2): Build infrastructure like renovating while the bank stays open—careful, methodical, invisible to customers.

Adoption (Months 3-6): Launch pilots. Small wins build momentum. Success stories spread organically. Skeptics start asking questions instead of raising objections.

Scale (Months 7-12): Enterprise rollout. What seemed impossible in Month 1 feels inevitable by Month 12. The organization can’t imagine working without MCP.

Why MCP Is Your Competitive Edge

Financial institutions face an impossible choice—embrace AI and risk everything, or avoid AI and become irrelevant. Model context protocol eliminates this false dilemma.

The transformation delivers security without sacrificing capability, compliance without constraining innovation, automation without abandoning control, and measurable ROI within 12-18 months.

Three uncomfortable truths: Your competitors are already implementing AI infrastructure. Regulatory requirements will only get stricter. The talent you need expects AI-augmented workflows.

Frequently Asked Questions

Q: What is Model Context Protocol in finance? A: MCP is a secure control plane that enables AI agents to safely access financial systems with verified identities, granular permission controls, and complete audit trails. It solves the challenge of giving AI powerful analytical capabilities while maintaining enterprise-grade security and regulatory compliance.

Q: How does MCP ensure regulatory compliance? A: MCP provides built-in audit trails with cryptographic integrity, data lineage tracking showing exactly what data was used, and permission frameworks that enforce data minimization. These features directly map to requirements in Basel III, GDPR, SEC rules, and MiFID II, making compliance demonstration straightforward during examinations.

Q: What’s the typical ROI timeline for MCP implementation? A: According to industry research, most financial institutions targeting 20% ROI achieve positive returns within 12-18 months. Early wins come from automation of routine tasks (months 1-3), followed by accuracy improvements (months 4-6), and culminating in transformational use cases (months 7-12). Some organizations report significantly higher returns with comprehensive implementations.

Take Action Today

For Financial Analysts:

- List your three most painful manual processes.

- Calculate hours spent on data gathering versus analysis.

- Document one critical error from the last quarter.

- Build your MCP business case using these numbers.

For Platform Engineers:

- Audit your API gateway capabilities.

- Map identity provider integration points.

- Design permission models for your top use case.

- Schedule architecture review with security team.

Model Context Protocol represents the convergence of necessity and possibility in financial services. As AI transforms from experimental technology to operational necessity, MCP provides the missing infrastructure that makes enterprise deployment viable. The institutions implementing MCP today aren’t just solving technical challenges—they’re building sustainable competitive advantages that compound over time.

The question isn’t whether your institution needs AI-enabled financial analysis. The question is whether you’ll implement it with the security, compliance, and governance that MCP provides, or struggle with point solutions that never quite work in production. With 95% of AI pilots historically failing without proper infrastructure, and successful implementations showing 20% productivity gains with measurable ROI within 12-18 months, the path forward is clear.

Your competitors are already moving. The technology is proven. The framework exists. Model Context Protocol isn’t just about AI—it’s about the future of financial services.

Explore how Daloopa MCP accelerates your secure AI transformation. Join the institutions already seeing significant ROI from intelligent automation that works in production.

Transform Your Financial Analysis with Daloopa MCP →

Get Started Today:

Continue Learning:

- Why Gen AI Hasn’t Transformed Finance Yet—And How MCP Fixes It

- LLM Use Cases in Financial Analysis

- Daloopa API Integration Guide

- MCP Prompts Documentation

References

- Mehta, Bhavi, et al. “AI in Financial Services Survey Shows Productivity Gains Across the Board.” Bain & Company, July 2024.

- “How to Measure AI ROI in Financial Services for 2026 Budgets: Guide for CFOs.” Aveni, 13 Oct. 2025.

- Olson, Matthew. “AI ROI Calculator: From Generative to Agentic AI Success in 2025.” Writer, 22 Aug. 2025.

- Estrada, Sheryl. “MIT Report: 95% of Generative AI Pilots at Companies Are Failing.” Fortune, 18 Aug. 2025.

- “Daloopa Receives $13M Strategic Investment to Power the Next Generation of AI in Finance.” PR Newswire, 31 July 2025.

- “How to Get ROI from AI in the Finance Function.” BCG, 4 June 2025.

- Leonard, Lang. “The Global Cost of Non-Compliance in 2024.” StarCompliance, 14 Jan. 2025.

- “The Not So Hidden Costs of Compliance.” AscentRegtech, 27 Mar. 2025.

- “Financial Analysts.” U.S. Bureau of Labor Statistics, May 2024.