Jumping into stock investing without a framework can feel like trying to navigate unfamiliar terrain without a map. That’s where top-down fundamental analysis steps in—it gives you a structured way to look at the markets, starting wide with the economy and narrowing to specific companies. By linking economic data for fundamental analysis to actual market behavior, this method helps you avoid random picks. If you know how interest rates, inflation, or GDP trends are influencing different sectors, you’re better equipped to invest in the right places at the right time.

Key Takeaways

- Top-down fundamental analysis begins with macro trends and narrows to individual stock choices.

- Identifying the right sectors based on economic data for fundamental analysis can lead to smarter allocation.

- Clear checkpoints along the way help avoid emotional investing and boost confidence.

Understanding the Fundamental Analysis Top-Down Approach

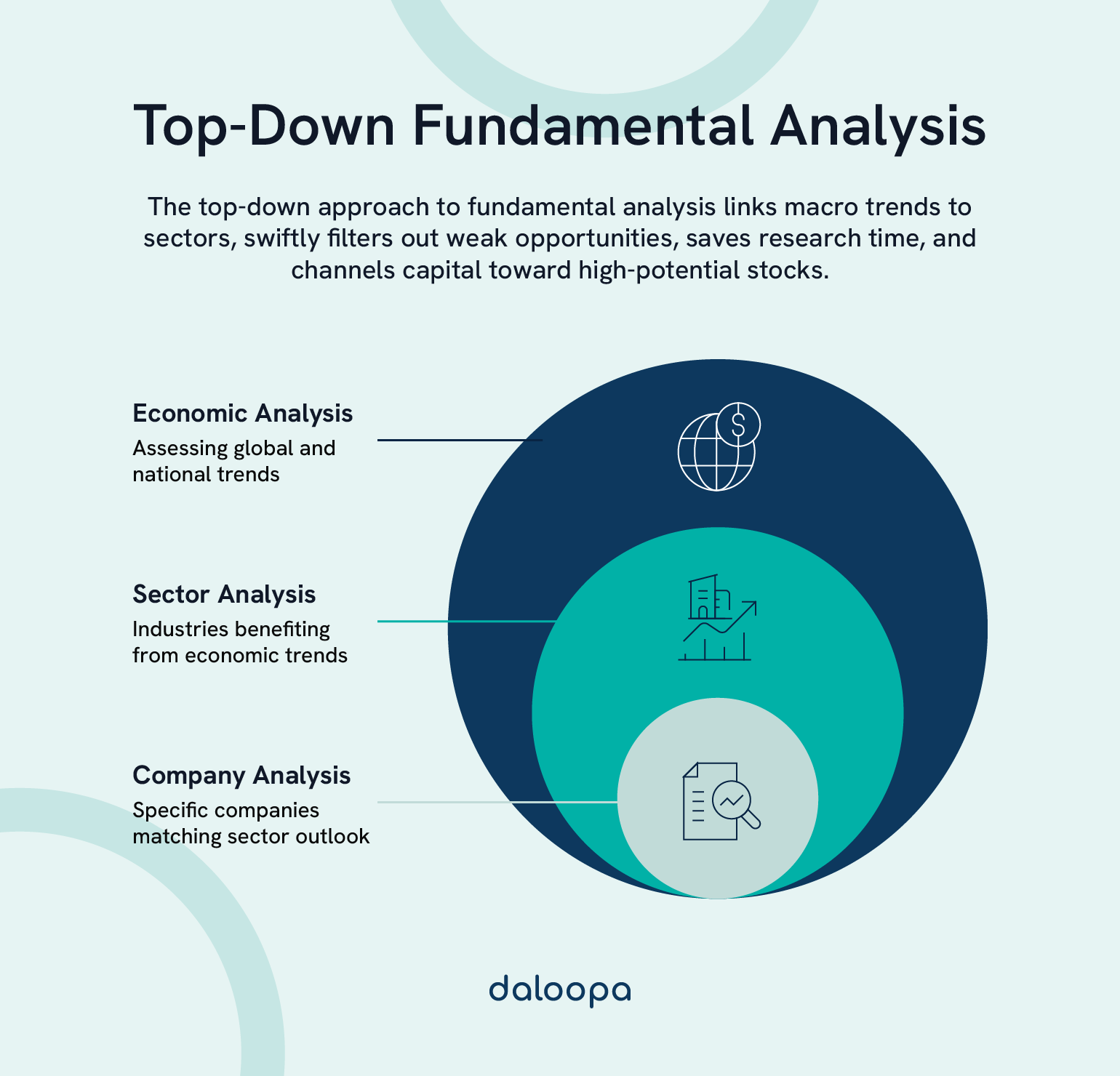

Top-down fundamental analysis acts like a funnel: you begin by assessing broad macroeconomic indicators, then zoom into sectors positioned to benefit, and finally select individual stocks with strong fundamentals that match the economic backdrop.

The “economy → sector → stock” roadmap ensures you’re allocating research time and capital where the odds favor outperformance, while sidelining areas facing headwinds.

Key components include:

- Economic Analysis: Real GDP, CPI, PPI, interest rates

- Sector Analysis: Valuation multiples, regulatory catalysts, innovation curves

- Company Analysis: Financial statements in fundamental analysis, cash flow profiles, and management quality

By regularly updating each layer—whether the Fed raises rates or a new fiscal package passes—you adapt your investment lens to current conditions and avoid static, emotion-driven decisions. The fundamental analysis top-down approach thrives on fresh, relevant data guiding each step.

Step 1: Analyzing Macroeconomic Indicators

Strong investment decisions begin with a clear grasp of the economic landscape, using authoritative data for fundamental analysis releases to guide your sector allocations.

Key Economic Indicators

- Real GDP Growth: According to the BEA advance estimate, real GDP fell 0.3% in Q1 2025 (Jan–Mar), reversing a 2.4% gain in Q4 2024.

- Inflation Metrics: The CPI rose 2.4% over the 12 months ending March 2025, with “core” CPI (ex-food and energy) up 2.8%—important trends for assessing consumer purchasing power.

- Producer Prices: PPI final demand declined 0.4% in March 2025, signaling potential margin pressures ahead.

- Interest Rates: Central bank decisions drive borrowing costs; a rising Fed funds rate typically cools growth-sensitive sectors like housing and autos.

Global Economic Trends

- Trade Balances & FX: Widening U.S. trade deficits can weigh on GDP while dollar strength erodes multinational revenue in local currencies.

- Commodity Cycles: A surge in oil prices benefits energy producers but strains consumer budgets—an essential net-impact calculation for portfolios.

- Fiscal Policy: Infrastructure bills or tax reforms create winners (e.g., construction equipment makers) and losers (e.g., heavily taxed tech firms).

- Technological Shifts: Automation and AI adoption reshape labor markets and unlock new productivity gains in services and manufacturing.

These are foundational in the top-down fundamental analysis playbook, allowing you to narrow the field before drilling into company-level insights.

Step 2: Sector And Industry Analysis

After mapping broad trends, the next step in your fundamental analysis top-down approach is to identify which sectors stand to outperform or underperform under current economic conditions.

Identifying Promising Sectors

- Growth phases tend to favor Technology and Consumer Discretionary, while downturns elevate Healthcare and Utilities.

- Compare sector P/E ratios to historical averages to spot overextended valuations or unloved areas.

- Track capital expenditure trends—rising capex often foreshadows sector strength.

- Evaluate regulatory headwinds: new emissions rules may weigh on autos but boost renewables.

Industry Trends And Dynamics

Within each sector, some industries shine more than others:

- Market Structure: A fragmented industry may present consolidation opportunities; semiconductors, for instance, remain dominated by TSMC and Intel, where high R&D costs and IP moats deter new entrants.

- M&A Activity: Frequent acquisitions signal maturity; smaller chipmakers getting bought hints at scarcity of greenfield opportunities.

- Supply Chain Resilience: On-shoring or diversified suppliers reduce risk—key in industries from autos to pharmaceuticals.

- Technology Adoption: You’ll track adoption curves; rapid digital transformation in financial services has created winners like cloud-native banks.

Each of these factors ties into the broader framework of top-down fundamental analysis, helping refine your final equity selections.

Step 3: Evaluating Individual Stocks

With sectors and industries prioritized, you drill into company-specific fundamentals to uncover asymmetric returns.

Company Fundamentals

- Income Statement: Trends in revenue growth and operating margins reveal operational strength.

- Balance Sheet: You’ll watch debt ratios and liquidity—healthy working capital and manageable leverage are defensive qualities.

- Cash Flow Analysis: Only free cash flow (FCF) that hits the bank matters; reconcile non-cash accounting items before trusting GAAP profits.

- Management Quality: Review strategic vision and capital allocation track record; a CEO with a proven M&A or restructuring success can tilt the scales.

Valuation Methods

- P/E and EV/EBITDA Comparisons: Benchmark against peer medians to spot value or potential overpayment.

- Discounted Cash Flow (DCF): Model future cash flows—assume prudent growth rates and discount with a rate that reflects company-specific risk.

- Industry-Specific Metrics: EV/EBITDA shines for capital-intensive firms; price-to-sales helps evaluate high-growth, unprofitable tech names.

- Relative Yield: For dividend payers, compare yields to sector averages while ensuring payout ratios remain sustainable.

At this stage, financial statements in fundamental analysis play a key role. You’re not just reading reports, you’re interpreting signals in the context of your earlier macro and sector findings.

Integrating The Top-Down Approach Into Investment Strategy

Analysis alone isn’t enough—you need a rules-based framework to translate insights into portfolio actions.

Building A Diversified Portfolio

- Sector Weighting: Tilt exposures to sectors exhibiting favorable macro signals (e.g., overweight industrials during post-inflation capex cycles).

- Correlation Management: Combine assets with low inter-sector correlation to smooth returns across cycles.

- Geographic Diversification: Blend developed-market and emerging-market allocations to capture different growth drivers.

- Rebalancing Discipline: Review allocations quarterly—and more frequently if economic indicators shift materially.

The top-down fundamental analysis process ensures that these portfolio decisions are backed by logic, not emotion.

Risk Management And Long-Term Investing

- Macro Risk Indicators: Monitor credit spreads, yield curve inversions, and sovereign debt metrics to gauge systemic risk.

- Liquidity Buffers: Maintain a cash cushion (5–10%) to take advantage of drawdowns and meet margin calls without forced selling.

- Position Sizing: Cap individual holdings to 5% of portfolio value to limit idiosyncratic shocks.

- Stress Testing: Use historical downturn scenarios—2008, 2020—to model portfolio drawdowns and adjust exposures.

Strategic Decision-Making

- Signal Prioritization: Pre-define which macro and sector indicators (e.g., PMI >50, CPI momentum) trigger tactical shifts.

- Decision Trees & Checklists: Build visual frameworks that map indicator thresholds to buy/sell actions, eliminating ad-hoc calls under pressure.

- Timing the Market: While timing remains challenging, aligning sector rotations with data-driven signals (e.g., rate-cut cycles) can enhance returns.

- Continuous Learning: Integrate new data, like Daloopa’s real-time earnings datasheets, into your process to refine assumptions and stay ahead.

Tools like Daloopa’s earnings trackers simplify how you apply top-down fundamental analysis in real time, especially when dealing with rapidly evolving financial statements in fundamental analysis.

Act on Your Analysis with AI-Powered Precision

Transform hours of manual data gathering into minutes of high-conviction analysis: leverage Daloopa’s AI-driven datasheets, hyperlinked to source filings for instant verification. Equip yourself with a dynamic, audit-ready toolkit that refreshes as earnings roll in—so you can focus on the strategic insights that drive returns using fundamental analysis top-down approach.

Explore how Daloopa can accelerate your top-down framework and unlock deeper, faster investment research today.