The first step to understanding a company’s financial health is finding and analyzing its historical financial statements. These documents are essential for making informed decisions. If accurate, they provide a clear view of past performance and facilitate reliable forecasting and strategic planning.

Historical financial statements include key components such as the balance sheet, income statement, and cash flow statement. Each one reveals crucial information about a company’s assets, liabilities, revenue streams, and cash flow. By examining these records, we can identify trends, spot potential issues early, and get valuable insights for future growth.

Accessing the historical financial statements of a business often involves making a request through official channels or databases. It is also important to ensure that the statements are accurate and reliable. This article will cover the importance of accurate historical financial statements, how to access them, and how to analyze and use the data.

Key Takeaways

- Historical financial records are essential for understanding a company’s financial health.

- Key components like balance sheets and income statements offer diverse insights.

- Ensuring accuracy in these statements is critical for sound decision-making.

What Are Historical Financial Statements?

Historical financial statements are reports that reflect a company’s financial performance over a specified period in the past. These documents provide a comprehensive view of a company’s financial health and operational efficiency.

The main types of historical financial statements include:

- Balance sheets: provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a specific point in time.

- Income statements: shows a company’s revenues and expenses over a specific period and highlights net profits or losses.

- Cash flow statements: outlines cash inflows and outflows from operating, investing, and financing activities.

- Statements of shareholders’ equity: indicates changes in equity over time.

These statements can be quarterly, annual, or multi-year reports. Quarterly statements reflect three months of financial activity, providing more frequent updates. Annual statements present a full year’s financial data, offering a broader view. Multi-year reports include data over several years, allowing us to identify long-term trends and patterns.

Choosing the right period depends on what we wish to analyze—for instance, short-term performance or long-term financial stability.

Historical financial statements offer insight into financial activities that impact the company’s liquidity, profitability, and overall financial health such as:

- Revenue generation: indicating how well the company generates income.

- Expense management: showing costs and their control level.

- Investment activities: reflecting acquisitions and investments.

- Debt management: detailing how debts are managed and repaid.

The Role of Financial Statements in Decision Making

Financial statements play a critical role in making informed business decisions.

They provide stakeholders with a comprehensive view of a company’s financial health. Investors use these statements to make decisions about buying or selling stock, while lenders evaluate credit worthiness.

Managers rely on historical financial data to gauge performance against benchmarks and competitors. Accurate historical financials facilitate effective budgeting and forecasting, helping us allocate resources efficiently.

Moreover, these statements are indispensable for strategic planning. By analyzing financial trends, businesses can set realistic goals and develop plans that align with their financial capabilities.

Accessing a Company’s Financial Statements

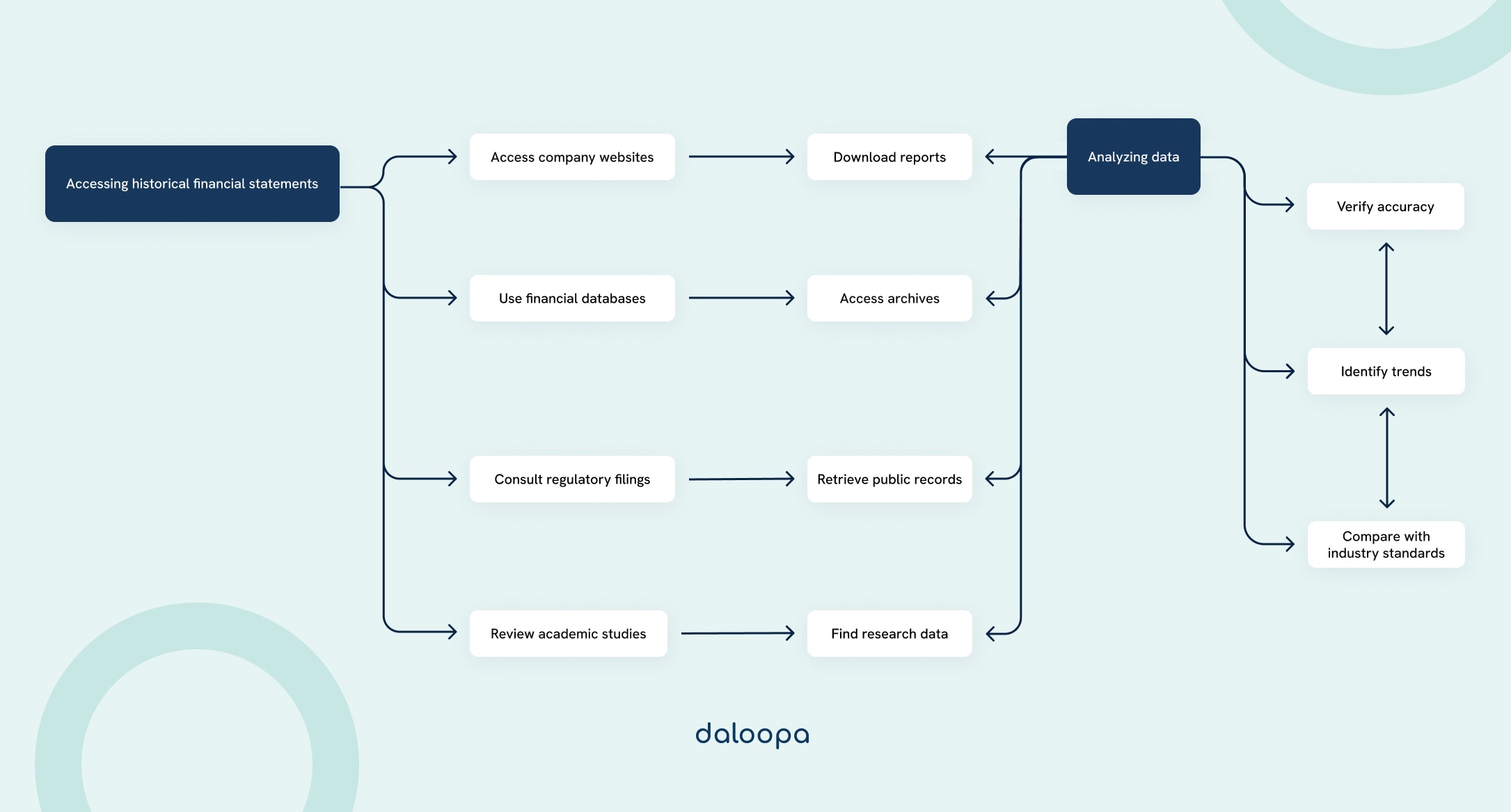

You need to first access the historical financial statements of a firm in order to analyze its past financial performance and determine trends. We can obtain these records through the following methods and sources:

- Company websites: often provide downloadable reports.

- Financial databases: platforms like Bloomberg and Reuters offer extensive archives.

- Regulatory filings: SEC’s EDGAR database provides public access in the U.S.

- Academic studies and reports: research libraries and publications like the Lippincott Library often include historical data.

These sources offer reliable information that can be used for accurate financial analysis.

Analyzing and Using the Data in Historical Financial Statements

Accurate historical financial statements are crucial for making sound business decisions. They enable us to evaluate past performance, forecast future trends, and make informed strategic choices.

Here are a few ways in which financial statements help businesses make informed decisions.

Performance Analysis

Businesses can use their financial statements to assess performance over time. Comparing different periods helps identify growth patterns, evaluate the impact of strategic decisions, and adjust future strategies. This comprehensive analysis provides insights into the company’s financial health and operational efficiency.

Identifying Trends and Patterns in Financial Performance

Historical financial data allows us to spot trends and recurring patterns. By examining revenue, expenses, and profit margins over multiple periods, companies can predict future financial outcomes. Recognizing these patterns is crucial to anticipate market changes and prepare robust business strategies.

Profit Margin Assessment

Analyzing historical profit margins helps businesses understand their profitability. Monitoring changes in profit margins over time can reveal operational efficiencies or inefficiencies. Companies use this data to strategize on cost management, pricing, and investment to improve future profitability.

Evaluating Liquidity Position

Historical financial statements provide insights into a company’s liquidity position. By examining historical ratios like the current ratio and quick ratio, businesses can assess their ability to meet short-term obligations. This evaluation helps in maintaining adequate liquidity to support day-to-day operations and avoid financial distress.

Industry Average Comparison

Comparing financial data to industry averages helps companies gauge their performance relative to competitors. This benchmark analysis involves looking at historical data to identify strengths and weaknesses. By understanding industry standards, businesses can strive to meet or exceed these benchmarks for better competitive positioning.

Assessing Resource Allocation

Historical financial data allows us to evaluate how resources were allocated in the past. By scrutinizing expenditures and investment patterns, businesses can determine if resources were utilized effectively. This assessment helps in optimizing resource allocation for future projects and investments, ensuring better returns and efficiency.

Importance of Accurate Historical Financial Statements

Inaccurate reports can lead to misguided decisions and erode trust with stakeholders. For example, the assessment of the financial statement accuracy for Russian companies highlights the need for stringent financial security standards.

Accurate historical financial statements are crucial because they:

- Ensure transparency: providing a clear picture of financial health.

- Enables precise trend analysis: correct historical data allows us to identify patterns and make projections based on reliable information.

- Facilitate decision-making: support effective internal decision-making processes. They provide a solid foundation to develop strategies for improvement and growth.

- Enhance credibility: helps build and maintain trust with investors and stakeholders.

- Support compliance: ensure compliance with regulatory standards. Accurate data helps prevent financial discrepancies, which could lead to legal issues or loss of credibility.

How to Ensure the Accuracy of Historical Financial Statements

To ensure the accuracy of historical financial statements, we need to verify compliance with accounting standards, identify potential errors, and employ effective accuracy-improvement techniques.

Understanding Accounting Standards

Accounting standards serve as benchmarks for financial reporting. They ensure that financial statements are accurate and comparable. To assess historical financial statements, we should first focus on understanding the relevant accounting standards in place at the time the statements were prepared.

Key accounting standards to review include:

- Generally Accepted Accounting Principles (GAAP) – widely used in the United States for consistency in financial reporting.

- International Financial Reporting Standards (IFRS) – adopted by many countries outside the United States, IFRS aims to bring global standardization.

- Local Accounting Standards – depending on the country, local standards might impact the way historical financial statements were prepared.

Thoroughly understanding these standards aids in detecting non-compliance and discrepancies.

Identifying Potential Errors and Inconsistencies

To ensure the accuracy of financial statements, identifying errors and inconsistencies is crucial. Some common areas to examine include:

- Revenue recognition: verify if revenues were recognized in the correct period.

- Expense matching: check if expenses match with corresponding revenues.

- Valuation of assets and liabilities: ensure proper valuation methods were used.

- Disclosure requirements: confirm that all necessary disclosures were made appropriately.

Use tools like comparative analysis or ratio analysis to spot deviations. For instance, comparing year-over-year ratios can highlight inconsistencies that need further investigation.

Techniques to Improve Accuracy

Employing certain techniques can significantly improve the accuracy of historical financial statements. These techniques include:

- Audit and reconciliation: performing regular audits and reconciling accounts ensures any discrepancies are caught early.

- Verification of supporting documents: cross-checking statements with invoices, receipts, and contracts can validate the accuracy.

- Technology and software: utilizing accounting software helps streamline the validation process, reducing human error.

- Professional judgment: consulting with accountants or auditing professionals can provide an additional layer of assurance.

Are You Confident in the Accuracy of Your Historical Financial Analysis?

As an investment banking analyst, your decisions are only as good as the data you rely on. Accurate historical financial statements are critical for making informed forecasts and strategic recommendations. But how certain are you that the data you are analyzing is accurate and comprehensive? Daloopa can help you access and verify historical financial data with unmatched precision. Start leveraging the power of accurate insights today by creating a free Daloopa account to enhance your financial analysis and decision-making.