Market data management solutions are essential for financial analysts to make informed decisions. In today’s fast-paced financial markets, having accurate and timely market data is not just an advantage, it is a necessity. Effective market data management improves decision-making, enhances operational efficiency, and ensures regulatory compliance.

The challenge is not just in acquiring data, but also in integrating and analyzing it properly to come up with actionable insights. A sudden change in interest rates, for instance, requires quick attention and response. Advanced data management tools enable seamless integration of external data feeds, support complex financial models, and ensure compliance with the ever-evolving regulations. This approach to data handling allows us to respond rapidly to market changes and maintain a competitive edge.

As we explore the best practices for market data management, we will also highlight how better data utilization can improve client relations and service delivery. The goal is to provide a comprehensive overview of how financial analysts can maximize the value derived from market data management solutions, ensuring both accuracy and efficiency in financial analysis.

Key Takeaways

- Accurate market data is essential for informed decision-making.

- Advanced technologies in data processing allow for seamless integration and enhance operational efficiency.

- Best practices in data management significantly reduce financial data analysis challenges, improving client relations and service delivery.

The Importance of Accurate Market Data

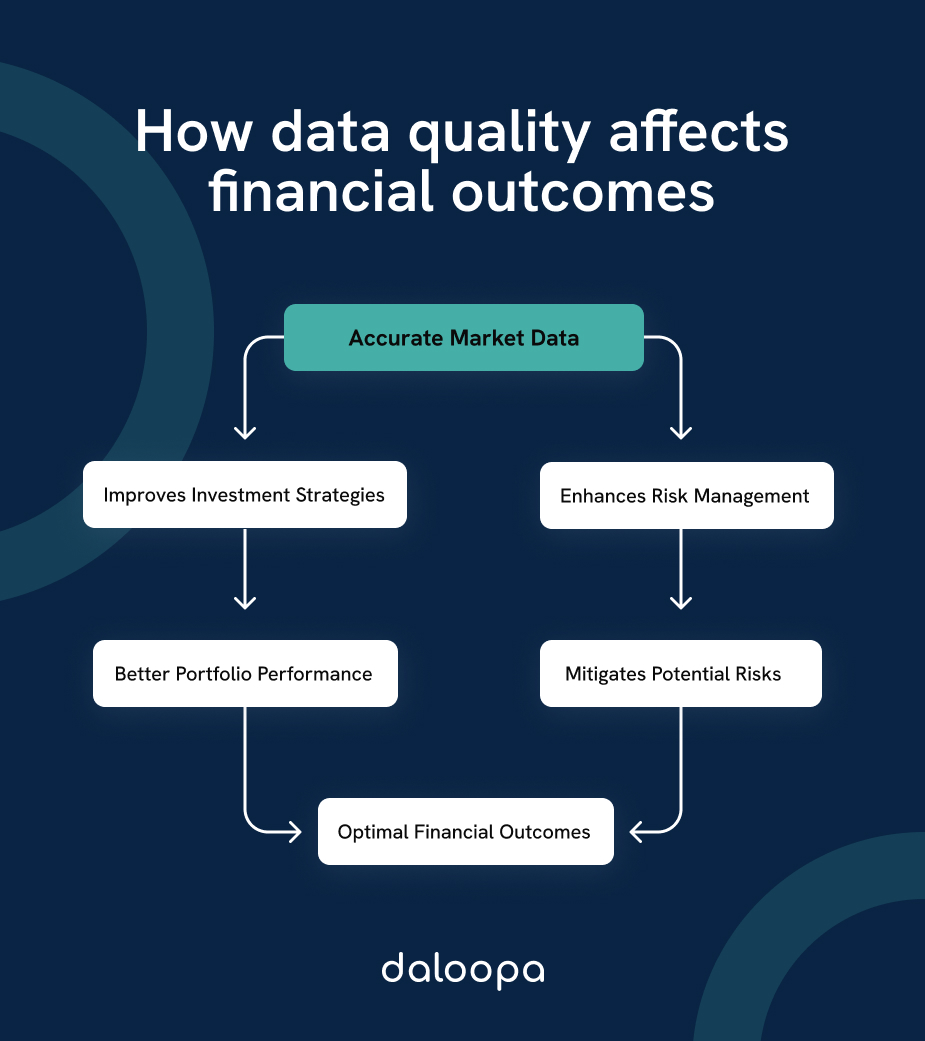

Accurate market data is important in assessing risks, managing investments, and making informed decisions. It impacts data quality and financial outcomes directly. There are many incidents where data inaccuracies caused a huge mess for big corporations. One good example is Uber’s commission miscalculation that saw them take a bigger cut from their drivers’ earnings than what is stipulated in their agreement.

Ensuring Data Quality

We must focus on maintaining data quality to make reliable decisions. Errors and inaccuracies can mislead, causing severe financial losses. Ensuring data quality involves validating, cleaning, and updating data regularly. We should utilize advanced analytic models to verify data accuracy.

Key Elements of Data Quality:

- Validation: Checking data against known benchmarks

- Cleaning: Removing errors and inconsistencies

- Updating: Keeping information current and relevant

Maintaining high data quality helps in predicting trends accurately and making sound financial decisions.

Impact on Financial Decisions

Accurate market data significantly influences our financial decisions. For example, investing based on erroneous data can lead to poor portfolio performance. In risk management, we rely on accurate data to assess potential risks.

Accurate data supports better investment strategies by providing clear insights into market movements. It also helps in financial services by offering precise information for client advisories.

When interpreting financial data, we must consider its accuracy to mitigate risks effectively. This approach ensures that our decisions are grounded in reality, leading to optimal outcomes.

Data Management Technologies in Finance

To stay competitive, financial analysts rely heavily on advanced data management technologies. Our focus here includes tools for deep data analytics and the implementation of cloud-based solutions for more efficient data handling and processing.

Data Analytics Platforms

Data analytics platforms form the backbone of financial analysis. Technologies such as Apache Spark and Hadoop enable us to process large datasets quickly and efficiently. Apache Spark demonstrates exceptional speed and processing capabilities. These tools help in extracting valuable insights from vast amounts of financial data.

Machine learning algorithms are often integrated into these platforms to predict market trends and assess risks more accurately. Using these predictive models, financial analysts can make better-informed decisions, enhancing investment strategies and risk management.

Additionally, customizable dashboards and reporting tools allow for real-time data visualization, making it easier to track key performance indicators (KPIs). These features transform raw data into actionable insights, enabling timely and precise decision-making in the highly volatile finance sector.

Cloud-Based Solutions

Cloud-based solutions offer scalable and flexible data management options. Services such as AWS, Google Cloud, and Azure provide powerful cloud infrastructure for storing and processing financial data. These platforms support real-time data processing, which is crucial for activities like high-frequency trading and risk assessment.

With cloud-based data management, financial institutions can ensure data security and compliance with regulations like GDPR and CCPA. Moreover, these services facilitate collaboration among global teams by providing centralized access to data and analytical tools.

Integration with AI and machine learning technologies enhances the capability to predict financial outcomes and automate routine data processing tasks. This reduces human error, lowers operational costs, and improves the overall efficiency of financial data management.

Regulatory Compliance and Governance

The financial services industry must navigate a complex web of regulatory and governance requirements to manage market data effectively. Financial institutions are custodians of large amounts of personal data and are required to adhere to strict and ever-evolving data protection laws.

We take a look at the importance of adhering to legal requirements and establishing strong data governance frameworks.

Adhering to Legal Requirements

Regulatory compliance in the financial services industry involves meeting specific legal mandates to protect market integrity and customer interests. These regulations are often issued by bodies such as the SEC, FCA, and other regional financial authorities.

Financial analysts need to ensure they remain updated with changing regulations. Non-compliance can result in fines, legal action, and reputational damage. Key areas include:

- Customer data protection

- Anti-money laundering (AML) protocols

- Reporting and transparency mandates

Addressing these legal requirements necessitates robust internal policies and training to ensure that all team members understand their responsibilities.

Financial analysis and risk management incudes adhering to various international standards and frameworks.

Data Governance Frameworks

Effective data governance involves implementing a structured framework that ensures data quality, integrity, and availability. This framework assists in meeting regulatory compliance and optimizing data management processes.

Components of a robust data governance framework include:

- Policies and procedures for data handling

- Roles and responsibilities for data management

- Technologies for data protection and integrity

A well-defined framework not only aids in compliance but also enhances decision-making by ensuring that data is accurate and reliable.

Utilizing tools like ontology and semantic technology can greatly enhance data transparency and regulatory compliance. Proper data governance is crucial in minimizing risks and maximizing the use of market data.

Ensuring data is handled with care and according to best practices protects organizations from potential liability issues while maintaining trust with stakeholders.

Operational Efficiency in Data Handling

Optimizing data handling can help financial analysts streamline operations and enhance decision-making. Key strategies include leveraging automation and AI, as well as improving data workflows to maximize efficiency and accuracy.

Automation and AI

Automation and artificial intelligence (AI) play a pivotal role in enhancing operational efficiency. By integrating AI-powered tools, we can significantly reduce manual data entry and processing time. This not only speeds up data handling but also minimizes errors.

For instance, automated data collection from various sources ensures that we have timely and accurate information without human intervention. Additionally, machine learning algorithms can identify patterns and anomalies faster than any human analyst, providing valuable insights for strategic decisions.

Employing chatbots for customer queries and automated reporting systems further enhances efficiency. These tools enable us to focus on high-value tasks and leave repetitive work to machines. Leveraging AI also helps in predictive analytics, providing foresight into potential market trends.

Improving Data Workflows

Improving data workflows involves streamlining processes from data collection to analysis. The first step is to standardize data formats across different sources, ensuring consistency and reliability. This can be achieved through data normalization techniques and using unified data models.

We can also implement cloud-based data management systems to centralize data storage and access. This ensures that all team members have real-time access to the same information, reducing inconsistencies and delays.

Data integration tools can automate the merging of data from multiple sources, saving time and reducing the risk of errors. Establishing clear protocols for data validation and cleaning ensures that our datasets are accurate and complete.

Finally, investing in robust data governance frameworks helps us maintain high standards of data quality and security. This includes regular audits, encryption, and access control measures to protect sensitive information and ensure compliance with regulations.

Integrating External Data Feeds

Integrating external data feeds enables financial analysts to enhance the accuracy and timeliness of their analyses. This section discusses connectivity via APIs and how diverse datasets are managed.

APIs and Connectivity

We utilize APIs to streamline the integration of various external data feeds. APIs allow us to automatically pull in financial instrument data, including real-time market prices and historical data. This connectivity reduces manual data entry and minimizes the risk of errors.

By setting up secure and efficient API connections, we can ensure that our data sources remain up-to-date. This constant data flow is vital for real-time analytics and quick decision-making. In financial markets, having the latest data can be a game-changer, especially in volatile conditions.

While API integration helps streamline processes and enhance functionality, it is not without challenges. We have to think about scalability issues, security concerns, rate limits, etc. Understanding and dealing with these API integration challenges ensures a seamless and successful integration.

Managing Diverse Datasets

Managing diverse datasets involves harmonizing information from multiple sources, each with its own format. We integrate data from stock exchanges, economic statistics, and proprietary financial platforms. This diversity enhances our analytical depth.

To handle these varying datasets, we employ data normalization techniques. This ensures that all incoming data conforms to a standard format, making it easier to process and analyze. Additionally, we use sophisticated tools to merge, clean, and validate the data, ensuring high-quality inputs for our financial models.

Tools for Advanced Data Analysis

Advanced data analysis tools offer powerful capabilities for making predictions, performing financial modeling, and assessing risk. They leverage algorithms and sophisticated methods to enhance the accuracy and efficiency of data interpretation.

Predictive Modeling and Algorithms

Predictive modeling utilizes historical data and algorithms to forecast future outcomes. These tools are essential for making data-driven predictions. For instance, they help financial analysts predict market trends and economic conditions.

We often use machine learning algorithms like regression analysis, decision trees, and neural networks in this process. These techniques improve our predictions’ accuracy, enabling better decision-making.

Specific algorithms, such as time series analysis, are crucial in identifying patterns over time. They allow us to build robust models for forecasting stock prices, credit risks, and other financial metrics. By utilizing these tools, we can more effectively manage and mitigate potential risks in the financial sector.

Investment and Financial Modeling

Investment and financial modeling tools are indispensable for planning and strategy development in finance. These tools include software for scenario analysis, portfolio optimization, and valuation models. They enable us to create detailed financial simulations and test various investment strategies.

For instance, Monte Carlo simulations allow us to visualize the potential outcomes of investment decisions under different market conditions. This helps in understanding the range of possible returns and risks.

Another critical tool is the use of discounted cash flow (DCF) models, which evaluate the present value of expected future cash flows. These models assist in making informed investment decisions by analyzing a company’s intrinsic value. By integrating these tools into our analysis, we can enhance our financial modeling capabilities and improve investment strategies effectively.

Client Relations and Service Delivery

Effective client relations and robust service delivery are crucial to managing market data, providing analysts with both reliable insights and adequate support mechanisms. Here are essential aspects to consider for enhancing customer insights and establishing a solid support infrastructure.

Enhancing Customer Insights

We need accurate and actionable insights to understand our customers better. Leveraging customer relationship management (CRM) systems allows us to analyze customer behaviors and preferences. This system can transform raw data into valuable information, enabling better service customization.

For instance, CRM analytics helps identify high-value customers and their service needs. Tracking transactions and interactions provides a clearer picture of customer preferences. Additionally, real-time data analysis allows for timely responses to customer needs, improving overall satisfaction.

Investing in advanced analytics tools can help unlock deeper insights. These tools can predict future trends and customer needs, guiding our strategic decisions. The ultimate goal is to build stronger, more personalized relationships with our clients, ensuring long-term loyalty and retention.

Best Data Management Practices for Financial Analysts

Financial analysts can optimize their performance by focusing on effective reporting strategies and utilizing key performance metrics.

Effective Reporting Strategies

Effective reporting helps stakeholders make informed decisions. We should prioritize clear and concise reports, using visual aids such as charts and graphs to highlight key data points. Utilizing tools like Excel and Tableau improves the visualization of complex data sets.

Reports must be tailored to the audience, ensuring they address the specific needs of different stakeholders. For instance, executives might prefer high-level summaries, whereas operational teams may need detailed analyses. Regular updates and maintaining accuracy are vital to building trust and reliability in our reports.

We should also incorporate historical data comparisons to provide context and identify trends. This practice aids in making investment recommendations and long-term strategic planning.

Utilizing Key Performance Metrics

Key Performance Indicators (KPIs) are essential to gauge the financial health of an organization. We should focus on metrics such as Return on Investment (ROI), Earnings Before Interest and Taxes (EBIT), and Debt-to-Equity Ratio. These metrics offer insights into profitability, operational efficiency, and financial stability.

It’s important to track these KPIs consistently to spot deviations early and adjust strategies accordingly. Using dashboards that update in real time can enhance our ability to monitor these metrics effectively.

Incorporating KPIs into our financial analyses allows us to make data-driven investment recommendations, aligning financial goals with broader business objectives. This alignment ensures that all efforts are focused on achieving the desired financial outcomes.

Are You Maximizing Your Market Data Management Potential?

Are you fully leveraging the latest market data management solutions to drive informed decision-making? In the rapidly evolving landscape of finance, accurate and timely data isn’t just beneficial—it’s essential. Advanced tools and technologies not only streamline your data operations but also provide deeper insights into market trends and investor behavior, giving you a competitive edge. Unlock the full potential of your financial analysis by integrating these solutions into your workflow. Start by creating a free Daloopa account and experience how powerful data management can transform your financial strategies.